Digital Mortgage Software Market Research, 2032

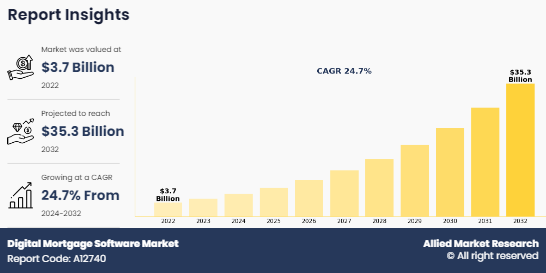

The global digital mortgage software market was valued at $3.7 billion in 2022, and is projected to reach $35.3 billion by 2032, growing at a CAGR of 24.7% from 2024 to 2032.

By leveraging advanced technologies such as artificial intelligence, machine learning, and data analytics, digital mortgage software enhances efficiency, reduces paperwork, minimizes errors, and improves customer experience. It allows borrowers to complete applications from the convenience of their homes, while lenders benefit from faster processing times and reduced operational costs. Some of the popular digital mortgage software are Blend, Roostify, and Ellie Mae’s Encompass. As the mortgage industry increasingly embraces digital transformation, these solutions are becoming essential tools for modernizing and optimizing mortgage processes.

Digital mortgage software refers to technology platforms that streamline the mortgage application and approval process by digitizing various steps involved in securing a mortgage. These platforms enable lenders, borrowers, and other stakeholders to manage the entire mortgage lifecycle online, from application to closing. Key features typically include online application forms, document upload & verification, automated underwriting, electronic signatures, and real-time tracking of application status.

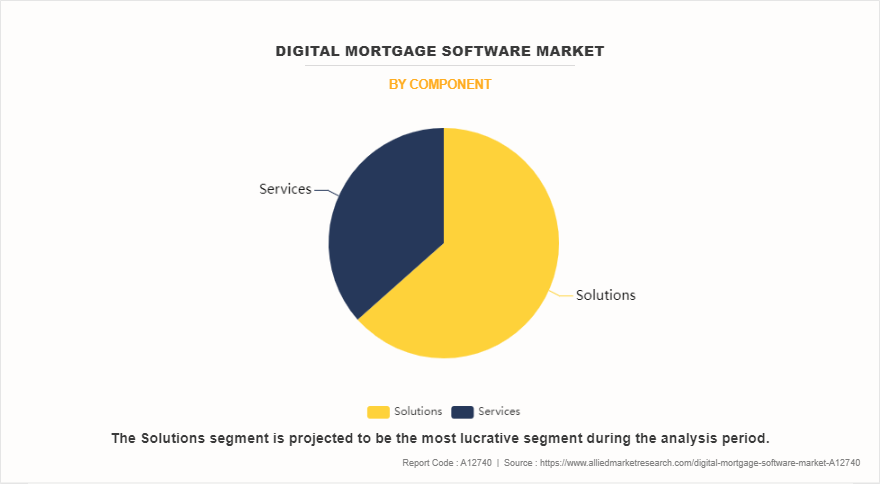

In terms of component, the software segment holds the highest digital mortgage software market share due to increasing various technological solutions designed to automate and streamline the mortgage process. However, the service segment is expected to grow at the highest rate during the digital mortgage software market forecast period, owing to the increasing complexity of mortgage automation software implementations. As mortgage solutions become more sophisticated with features like AI and machine learning, lenders require expert guidance to effectively deploy and utilize these technologies.

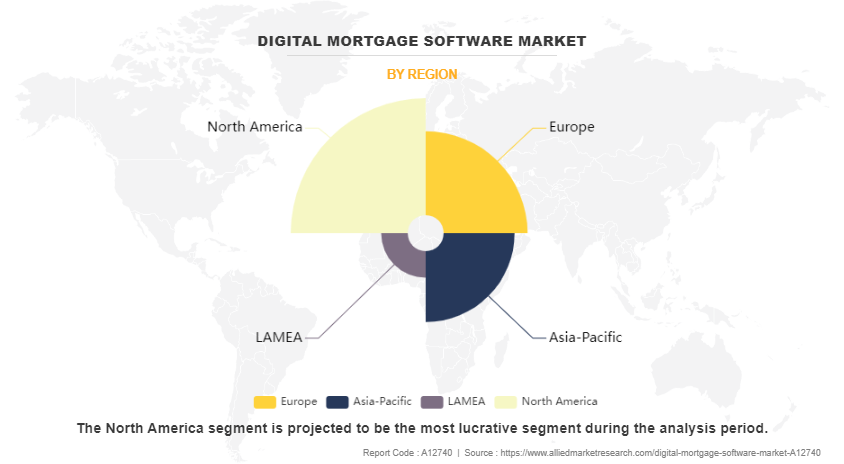

Region-wise, the digital mortgage software market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the presence of major digital lending providers across the North American countries is expected to drive digital mortgage software market growth in the region. The region has also been an early adopter of the latest and advanced technologies. However, Asia-Pacific is expected to witness significant growth during the forecast period. The growth is attributed to the increasing number of fintech companies in the region. The proliferation of smartphones and the increasing rate of internet access serve as positive indicators for the expansion of the local digital mortgage software market. Moreover, the surge in adoption of open banking across the countries, such as India and China, has created new opportunities for market growth.

The report focuses on growth prospects, restraints, and analysis of the global digital mortgage software market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global digital mortgage software market outlook.

Segment review

The digital mortgage software market is segmented based on component, deployment mode, enterprise size, application, end-user, and region. Based on component, the market is categorized into software and services. On the basis of deployment mode, the market is divided into on-premise and cloud. Based on enterprise size, the market is bifurcated into large enterprises and SMEs. By application, the market is classified into residential mortgage, commercial mortgage, and others. By end-user, it is classified into banks, credit unions, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in the digital mortgage software market are StreamLoan, Maxwell Lender Solutions Inc., ICE Mortgage Technology Inc, Salesforce Inc, nCino, Blend, CoreLogic, Blue Sage Solutions, Calyx Software, and Finastra. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Impact of government regulations on the global digital mortgage software market

All well-governed financial industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields, including IT. Organizations are adopting visual analytics to manage, store, and extract relevant and useful information from the data stored. For instance, California’s Online Protection Privacy Act provides explicit privacy rights and allows users to know how their information will be used in the future. Furthermore, cloud security regulations are strongly adhered to by almost all AI service providers to operate as global service providers. For instance, the U.S. security regulation is mandatory to be adhered to by a majority of players located in this country.

In addition, federal and state governments are improving their track plans for various Digitalization and technology-neutral regulations laws, which apply to data that are involved in their operations. For Instance, In April 2024, the Consumer Financial Protection Bureau (CFPB) in the U.S. issued new guidelines encouraging the use of digital documentation and electronic signatures in mortgage applications. This move aims to enhance the efficiency and security of the mortgage process by promoting the adoption of digital technologies. The CFPB's initiative is part of a broader effort to modernize financial services and ensure that consumers benefit from faster, more transparent transactions while maintaining high standards of data protection and compliance.

in April 2024, In Brazil, the Central Bank of Brazil (BACEN) launched an initiative to promote digital financial services, including digital mortgage platforms. This initiative includes guidelines for secure digital transactions, electronic signatures, and online verification processes to improve financial inclusion and accessibility. By fostering a supportive regulatory environment, BACEN aims to leverage technology to reach underserved populations and streamline financial services across the country.

Top Impacting Factors

Increase in demand for automation

The digital mortgage software market is significantly driven by the growing demand for automation in the mortgage process. Traditional mortgage processing involves a substantial amount of paperwork, manual verification, and a high risk of human error, making the entire process lengthy and cumbersome. Automation streamlines these processes by digitizing document management, automating data entry, and facilitating faster approvals. For instance, in May 2023, Temenos launched a fully integrated front-to-back, mortgage solution with a smart decision engine powered by Explainable AI, helping lenders to deliver a personalized digital mortgage experience while reducing their costs and time to close. This solution enhances productivity and reduces delinquencies for the lenders through automation and intuitive workflows to make quick and prudent decisions, using AI to provide affordability assessments that are transparent and explainable, these factors are likely to contribute to the increased installation of the digital mortgage software offerings, globally.

Integration of AI and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies into digital mortgage software is another crucial driver, owing to AI and ML enhance the capabilities of these systems by providing advanced analytics, predictive modeling, and risk assessment tools. For Instance, Blend, a digital lending platform, uses AI to analyze borrower data and predict loan performance, enabling lenders to make more informed decisions. AI-powered chatbots and virtual assistants also improve customer service by providing instant responses to queries and assisting borrowers through the application process. These technologies help in identifying fraud, assessing creditworthiness more accurately, and offering personalized loan products, thus making the mortgage process more secure and efficient in digital mortgage software options. The ability of AI and ML to transform raw data into actionable insights is propelling the growth of the digital mortgage software market.

Restraints

High Implementation Costs

One of the significant restraints in the digital mortgage software market is the high cost of implementation. Developing and integrating sophisticated software systems require substantial investment in terms of technology, infrastructure, and training. Small and medium-sized mortgage lenders may find it challenging to afford these initial costs. Additionally, the maintenance and upgrading of these systems also require ongoing financial commitment. For instance, implementing a comprehensive digital mortgage platform like Ellie Mae's Encompass can involve not only software licensing fees but also costs associated with customization, integration with existing systems, and employee training. These high costs can be a deterrent for many lenders, especially those with limited financial resources, slowing down the adoption of digital mortgage solutions.

Opportunity

Expansion into emerging markets

The expansion into emerging markets presents a significant opportunity for the digital mortgage software market. Many developing countries are experiencing rapid growth in their financial sectors and increasing demand for home loans. However, the mortgage processes in some regions are often manual and inefficient, providing a ripe opportunity for digital transformation. For instance, in countries like India and Brazil, where the users are expanding, there is a growing demand for more accessible and faster mortgage services. Companies like Infosys Finacle are already making strides in these markets by offering digital banking solutions that include mortgage processing capabilities. By leveraging the increasing internet penetration and mobile usage in these regions, digital mortgage software providers may tap into a large and underserved market. Moreover, the adoption of digital solutions can help streamline mortgage processes, reduce costs, and increase accessibility for potential homeowners in these emerging markets by offering digital mortgage software solutions, such factors are driving the growth of the global digital mortgage software industry.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital mortgage software market analysis from 2022 to 2032 to identify the prevailing digital mortgage software market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the digital mortgage software market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global digital mortgage software market trends, key players, market segments, application areas, and market growth strategies.

Digital Mortgage Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 35.3 billion |

| Growth Rate | CAGR of 24.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Blend Labs, Inc., Finastra, nCino Opco, Inc., CoreLogic, Blue Sage Solutions, LLC, ICE Mortgage Technology, Inc, Salesforce, Inc., Calyx Technology, Inc., Maxwell Financial Labs, Inc, StreamLoan.io |

Analyst Review

A digital mortgage platform represents a software system for mortgage origination that is hosted in the cloud. A cloud-hosted software system for mortgage origination is known as a digital mortgage platform. Some of the main features are a mortgage application and document intake gateway for borrowers, a cloud-based archive of all applications and documents, systems for team-based responsibilities and permissions, and the ability to link with other software and systems.

The global digital mortgage software market is expected to register high growth due to high investments from a variety of businesses, as well as a big client base. In addition, improved customer experience, technology developments, fewer operating costs, and greater regulatory compliance are expected to increase digital mortgage software market share and revenue as a whole. Thus, the increase in adoption of digital mortgage software, owing to its benefits, is one of the most significant factors expected to drive the growth of the market. Various companies have established alliances to increase their capabilities with the surge in demand for digital mortgage software. For instance, in March 2024, Sutherland, a leading digital transformation technology and services company that drives experience-led transformation for global leaders across industries, partnered with Vaultedge Software, an AI driven document automation platform that simplifies mortgage processing for lenders & servicers. This partnership allowed Sutherland and Vaultedge to drive end to end digital transformation for the entire mortgage operation lifecycle spanning across - origination, servicing, and capital market transactions.

In addition, various companies have expanded their current product portfolio with increased diversification among customers, growth in investment across the globe, and rise in demand for digital mortgage software. For instance, in May 2024, Suffolk Building Society partnered with UK-based fintech Finova, integrating the Apprivo originations banking platform and enhanced digital mortgage services. This alliance promises efficiency and improved customer experience.

Moreover, with the increase in competition, major market players have started acquisition of companies to expand their market penetration and reach. In January 2022, BeSmartee acquired FlashSpread to support both business and consumer lending, with the goal of making the whole loan process simple, quick, and transparent.

The Digital mortgage software Market is estimated to grow at a CAGR of 24.7% from 2024 to 2032.

The Digital mortgage software Market is projected to reach $35.2 billion by 2032.

The Digital mortgage software Market is expected to witness notable growth due to increase in demand for automation and integration of AI and Machine learning boosts the growth of the global digital mortgage software market. In addition, the growing popularity of online and mobile banking is positively impacting the growth of the digital mortgage software market.

The key players profiled in the report include StreamLoan, Maxwell Lender Solutions Inc., ICE Mortgage Technology Inc, Salesforce Inc, nCino, Blend, CoreLogic, Blue Sage Solutions, Calyx Software, and Finastra.

The key growth strategies of Digital mortgage software Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...