Digital Process Automation Market Insights: 2031

The global digital process automation market size was valued at USD 12.4 billion in 2021, and is projected to reach USD 42.7 billion by 2031, growing at a CAGR of 13.2% from 2022 to 2031.

Increase in the integration of AI and machine learning in automation and surge in adoption of the low-code automation platform are driving the growth of the market. However, data security and privacy and lack of technical expertise limit the growth of this market. Conversely, surge in proliferation of robotic process automation (RPA) solutions in business practices are anticipated to provide numerous opportunities for the expansion of the digital process automation market during the forecast period.

The use of digital process automation is increasing as businesses are focused on digitizing their operations in order to become more customer centric and responsive both in terms of how they meet evolving customer demands and introduce new products to the market. As its operating model becomes digitized and intelligent with digital process automation industry, it also becomes possible to take more risks with product innovation.

The report focuses on growth prospects, restraints, and analysis of the global digital process automation market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global digital process automation market share.

Top Impacting Factors

Increase in the Integration of AI and Machine Learning in Automation

The adoption of AI is growing in the automation industry at an unprecedented rate for highly intense and repetitive tasks, as it helps users to reduce manpower and time. Further, automation has introduced a system of computers and machines and replaced a system that was built by combining man and machine, which is driving the adoption of digital process automation. In addition, the increased competition among vendors to have efficient, and product quality has also increased with the use of digital process automation.

Furthermore, an increase in the integration of such advanced technologies is offering superior capabilities at better licensing costs. As more and more players enter the market, the licensing cost is expected to decrease, which will further boost the adoption of IA, which in turn drives the digital process automation market growth during the forecast period.

In addition, the emergence of technology integrated with evolving AI technologies is enabling the creation of a digital workforce for end-to-end business automation. Moreover, the focus has shifted to enabling citizen developers across the organization to start automating tasks that organizations perform repeatedly as a part of their routine work. Easy drag-and-drop functionalities along with better tool capabilities increase adoption across business teams, allowing the IT teams to focus on providing the right infrastructure and managing reusable components across functions and departments. This add-on integration in automation is expected to drive market growth.

Surge in Adoption of the Low-code Automation Platform

Various automation solutions have been tailored by low-code automation platforms to automate repetitive, structured, and non-cognitive processes. In addition, automation enables businesses to focus on strategic value-add activities, customer experience, and leadership, while robots perform supporting tasks effectively and seamlessly. This has resulted in increased operational efficiency due to better optimization of resources drives the digital process automation market growth.

Furthermore, the increasing switch to digital technology is visible all around us, and it has become imperative for organizations to effectively align business strategies, not only as a response to this change but also to pave the way for digital transformation.

Segment Review

The global digital process automation industry is segmented into component, deployment mode, enterprise size, type, industry vertical, and region. Depending on the component, the digital process automation market is divided into solution, and services. By deployment mode, it is divided into on-premises and cloud. Based on enterprise size, it is categorized into large enterprises and small & medium-sized enterprises. Depending on the type, the market is divided into sales process automation, supply chain automation, claims automation, and marketing automation. Based on industry vertical, it is bifurcated into BFSI, IT & telecom, healthcare, retail, manufacturing, government, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

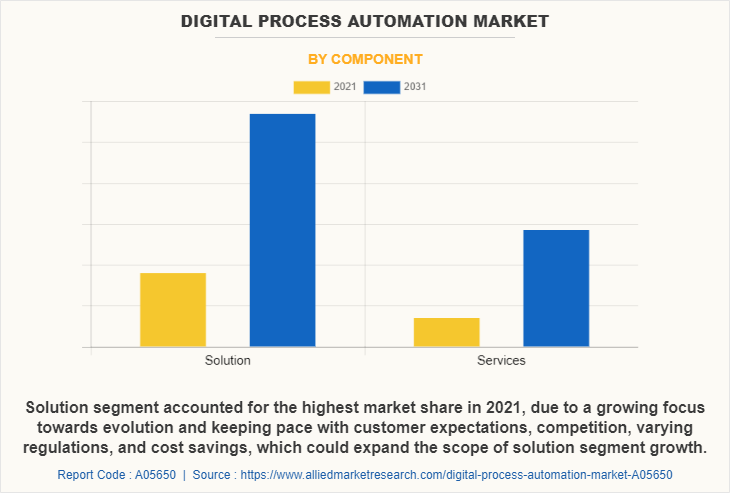

Depending on the component, the solution segment dominated the digital process market share in 2022 and is expected to continue this trend during the forecast period, owing to Surge in demand for the digital process automation solution as it lessens the time consumption to manage and monitor, while still maintaining enhanced security, governance, and availability. However, the service segment is expected to witness the highest growth in the upcoming years, owing to the adoption of digital process automation services certainly provides numerous benefits to industry verticals, and tools used for workflow automation.

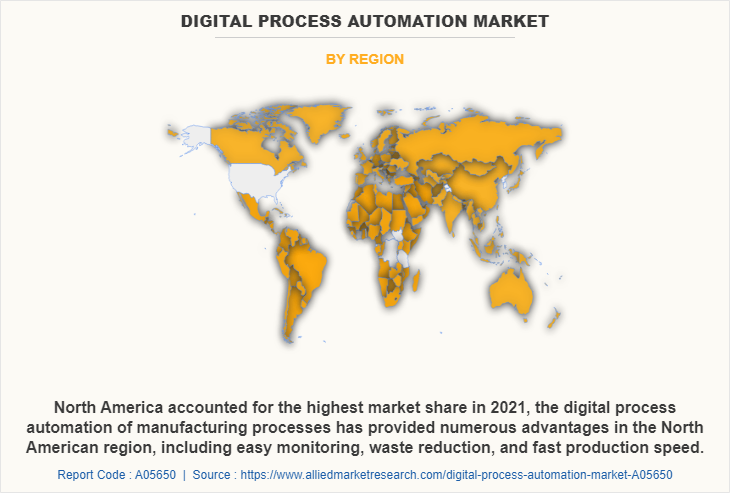

Region wise, the digital process automation market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the new advances in automation using industry specific AI and ML. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the supportive government initiatives in the manufacturing sector, an increase in adoption of digitalization solutions and advancement in technologies.

The global digital process automation market is dominated by key players such as Appian, Cognizant, SS&C Technologies, Inc., IBM Corporation, Infosys Limited, LTIMindtree Limited, Open Text Corporation, Oracle Corporation, Software AG, and Pegasystems Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Digital Capabilities:

A Digital process automation is often referred to as the next generation or evolution of business process management (BPM). BPM were to drive costs down and make employees more productive by improving processes generally found in back offices. However, digital process automation goals are more focused on customer experiences, digital transformation, and innovation. Basic back-end integration, collaboration tools, and cloud-based architecture are the primary supporting technologies that businesses use to manage processes and automation efforts in an organization. Increasingly, robust and real-time analytics are being deployed and used with digital process automation. Innovations with artificial intelligence (AI) and machine learning (ML) are crucial for continuous improvement, an important factor for digital process automation.

In addition to automation, the primary drivers for this growth will be the low code development that puts the power of automation accessible to everyone. Digital transformation demands automation of hundreds, if not thousands, of operational processes. Low-code application development platforms allow business to go from concepting an idea to building a fully working business application in minutes.

End-User Adoption:

The logical successor to Business Process Management, Digital Process Automation (or DPA) is similarly concerned with ensuring the effectiveness and efficiency of business processes but takes the idea further by focusing on external users including customers, vendors, etc. This includes Mobile-first interfaces, process transparency for users, offloading customer tasks to automation, triggered reminders and notifications, easy collaboration and rapid user response with adaptation.

In addition, any process that involves a trigger, data collection, information routing, and activity tracking can be digitally automated. Digital process automation services are used in IT/IS services, finance, sales, new product request, employee onboarding, employee offboarding, procurement process, capital approvals and vendor management.

Moreover, digital process automation of manufacturing processes offers various benefits, such as effortless monitoring, reduction of waste, and production speed. This technology provides customers an improved quality with standardization and dependable products within time and at a much lower cost. The aforementioned factors can significantly improve the maintenance, health, and safety features, which in turn, are reinforcing market growth among end-users.

Government Initiatives:

Governments of many countries support end-users to improve technologies such as artificial intelligence and machine learning across a range of vertical, including manufacturing sector, owing to the growing adoption of digital process automation technology, which led to the formation of federal data privacy law protecting personal information, thus, resulted in the growth in the technologies that offer secure featured services. Furthermore, growing concerns for privacy regarding automation solutions raise unique privacy concerns owing to their ability to capture huge amounts of data. This has introduced legislation to set federal data privacy and security standards that protect consumer data online.

Furthermore, the leadership at the executive level of the United States government continues to encourage and clear a path for the use of digital process automation. More than 30 government agencies in US are currently using digital process automation to reduce their backlogs, eliminate compliance issues, improve throughput, and save precious taxpayer dollars. In addition to liberating government employees from the mundane, repetitive, and boring manual work, digital process automation allows them to better serve citizens.

Moreover, the Indian government is also taking initiatives to forester market innovation in digital process automation. For instance, in December 2021, the cases of AI and ML in the government of India currently include biometric identification, facial recognition, criminal investigation, crowd and traffic management, management of natural resources digitally and digital agriculture. The Indo-US Science and Technology Forum (IUSSTF) launched its flagship program, the US-India artificial intelligence initiative. The activity brings together key stakeholders from India and the USA to foster AI innovation by sharing idea and provide better digital process automation solutions and experiences, identifying new opportunities in the digital process automation market. Hence, all such developmental efforts and strategic initiatives are expected to create market growth opportunities.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global digital process automation market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global digital process automation trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Digital Process Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 42.7 billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 412 |

| By Component |

|

| By Business Function |

|

| By Organization Size |

|

| By Deployment Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | SS&C Technologies, Inc., Pegasystems Inc., Infosys Limited, software ag, Oracle Corporation, IBM Corporation, Appian, Open Text Corporation, Cognizant, LTIMindtree Limited |

Analyst Review

Digital process automation uses digital technology such as AI and ML to perform a process or accomplish a workflow or function. The growth in digital process automation is due to the rising need for different businesses to automate their processes as part of extensive digital transformation initiatives, the higher the demand for process automation throughout the world, the greater the demand for business management solutions. Furthermore, businesses have been gathering information through AI to decide what processes can be automated and enhance the output. Such factors increased the demand for digital process automation services.

Key players in the digital process automation market are Appian, Cognizant, SS&C Technologies, Inc., IBM Corporation, Infosys Limited, LTIMindtree Limited, Open Text Corporation, Oracle Corporation, Software AG, and Pegasystems Inc. With the growth in demand for digital process automation solutions, various companies have launched various solutions to provide enhanced services. For instance, in June 2020, Infosys launched an all-new, SAP-based digital process automation-based personalized medicine solution for the pharmaceutical industry. This Solution enables pharma companies to digitally transform their processes and drive stronger business outcomes. The modular solution uses advanced analytics to manage individual patient treatment lifecycles from enrollment and scheduling to post-medical treatments. It uses IoT and blockchain to manage critical cold chains and outcome-based invoicing. Such factors have helped to grow the digital process automation market.

In addition, there is a surge in demand for automation with industrial AI and ML to complete missions with minimal human intervention with the help of innovations. Many key players collaborated to provide better and enhanced digital process automation services. For instance, in May 2022, Pegasystems Inc., a software company partnered with Google Cloud to assist joint clients in accelerating their digital transformations by leveraging Pega's low-code enterprise software on Google cloud's highly scalable cloud services. Pega focuses on Pega cloud apps accessible on Google cloud as a fully hosted and managed-as-a-service solution as part of the partnership. Pega and Google Cloud together solves industry-specific use cases, conduct collaborative go-to-market operations, and deliver Pega Infinity apps to the Google Cloud Marketplace. Such collaborations have helped to grow the digital process automation market.

The digital process automation market is projected to reach $42.68 billion by 2031.

The digital process automation market is estimated to grow at a CAGR of 13.2% from 2022 to 2031.

The key players profiled in the report include Appian, Cognizant, SS&C Technologies, Inc., IBM Corporation, Infosys Limited, LTIMindtree Limited, Open Text Corporation, Oracle Corporation, Software AG, and Pegasystems Inc.

Asia Pacific is expected to witness significant growth during the forecast period

Increase in the integration of AI and Machine learning in Automation, and surge in adoption of the low-code automation platform contribute toward the growth of the market.

Loading Table Of Content...