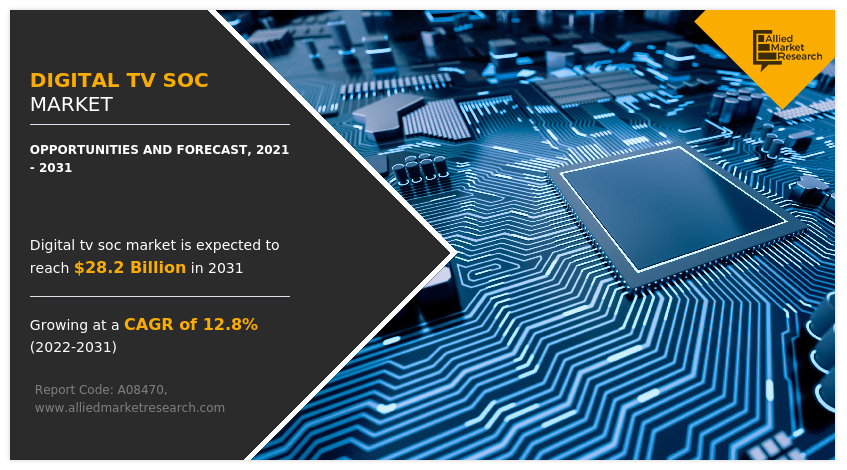

Digital TV SoC Market Statistics - 2031

The global digital TV SoC market was valued at $8.6 billion in 2021 and is projected to reach $28.2 billion by 2031, growing at a CAGR of 12.8% from 2022 to 2031. A digital TV System on a chip is an advanced microchip equipped with the necessary electronic circuits and parts for a digital display solution, such as High-Definition Television (HDTV) and Ultra-High-Definition Television (UHDTV), on a single integrated circuit (IC). Further, the next generation 4K and 8K TV SoCs offer premium refresh rates and incorporate a suite of advanced technologies that make media truly stand out. Most of the components of digital television are contained within integrated circuits. This may include tools for handling radio frequency, mixed signals, and digital signals.

In addition, they are put together on a single substrate. Furthermore, SoCs use significantly less energy and take up much less space than multi-chip architectures with equivalent capability. The majority of intricately connected computer systems are built to improve performance and save power usage.

The global digital TV SoC market is expected to witness notable growth during the forecast period, owing to the surge in demand for smart and power-efficient electronic devices. Moreover, an increase in disposable income in developing economies majorly drives the digital TV SoC market outlook. Furthermore, integration with advanced technologies is projected to shape the future of manufacturing industries by standardizing the processes.

However, the high initial cost of design & development, and maintenance is one of the prime factors that restrain the digital TV SoC market growth. Further, the rise in demand for compact and scalable ICs in the global electronic industry is projected to provide a lucrative opportunity to expand the digital TV SoC market during the forecast period.

Segment Overview

The digital TV social market is segmented into Application, End User, and Region.

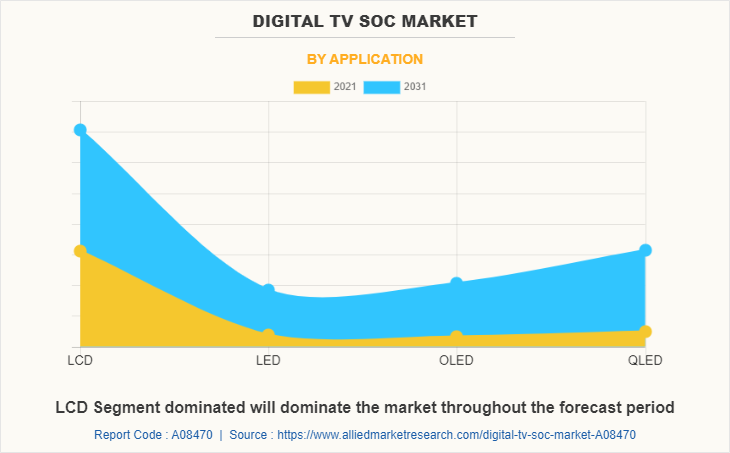

By application, the digital TV SoC market is segmented into LED, LCD, OLED, and QLED. In 2021, the OLED segment dominated the digital TV SoC market share in terms of revenue and is expected to follow the same trend during the forecast period. However, the other segment is expected to emerge as the fastest-growing segment of the market during the forecast period 2022-2031.

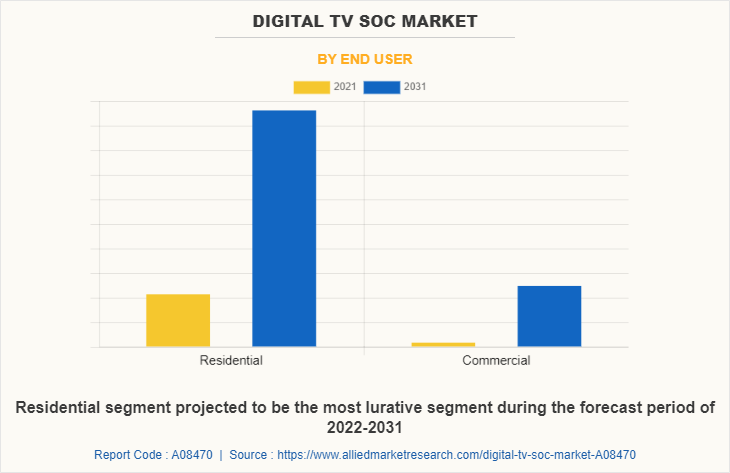

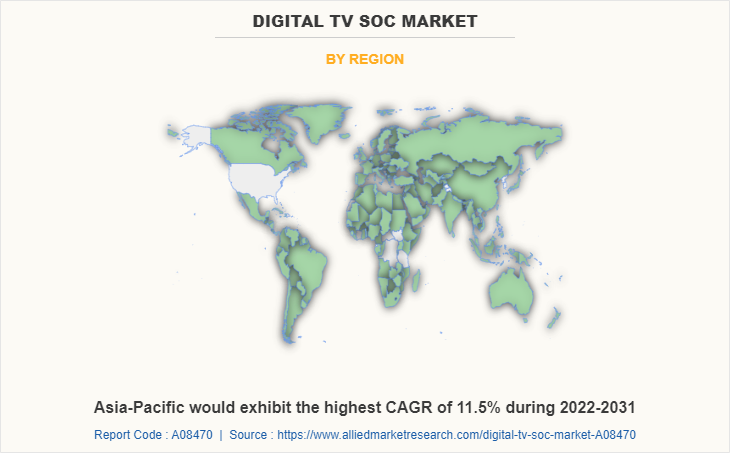

By end user, the digital TV SoC market size is classified into residential and commercial. The residential segment dominated the market in 2021 in terms of revenue and is expected to dominate the market during the forecast period. Region-wise, the digital TV SoC market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific, specifically China, remains a significant participant in the digital TV SoC market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced digital TV solutions, driving the growth of the digital TV SoC industry in the Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major global digital TV SoC market players that have been provided in the report include Intel Corporation, Samsung Electronics Co. Ltd., Qualcomm Incorporated, Toshiba Corporation, NXP Semiconductors, Broadcom Inc., STMicroelectronics N.V., Apple Inc., MediaTek Inc., and Taiwan Semiconductor Manufacturing Co. Ltd.

Country Analysis

Country-wise, the U.S. acquired a prime share in the digital TV SoC market in the North American region and is expected to grow at a high CAGR of XX% during the forecast period of 2022-2031. The U.S. holds a dominant position in the digital TV SoC market, owing to the presence of prime players such as Apple Inc. and Intel Corporation, which have significant investments in next-generation 8K (UHDTV) solutions to develop next-generation digital display devices.

In Europe, the UK dominated the digital TV SoC market in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. Furthermore, Germany is expected to emerge as the fastest-growing country in Europe's digital TV SoC with a CAGR of XX%, owing to a significant development in the Internet of Things and consumer electronics solutions.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to a significant rise in investment by prime players in the next-generation system-on-chip solutions to boost the digital TV SoC market. However, South Korea is expected to emerge as a dominant country in the digital TV SoC market in the Asia-Pacific region.

In LAMEA, Latin America garnered a significant digital TV SoC market share in 2021 owing to the presence of prime vendors such as Intel Corporation, STMicroelectronics, Renesas Electronics, and others are significantly investing in smart TV SoC in Latin America. Moreover, the Middle East region is expected to grow at a high CAGR of XX% from 2022 to 2031.

Top Impacting Factors

Significant factors that impact the growth of the global digital TV SoC industry include the surge in demand for smart and power-efficient electronic devices paired with the surge in disposable income in developing economies. Moreover, integration with advanced technologies is expected to drive the digital TV SoC market opportunity. However, the high initial cost of design & development, and maintenance is acting as a prime barrier to early adoption, which hampers the growth of the market. On the contrary, the rise in demand for compact and scalable ICs is expected to offer potential growth opportunities for the digital TV SoC market during the forecast period.

Historical Data & Information

The digital TV SoC market forecast is highly competitive, owing to the strong presence of existing vendors. Vendors of digital TV SoC machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments / Strategies

Mediatek Inc., Samsung Electronics Co., Ltd., Qualcomm Inc., Toshiba Corporation, and Taiwan Semiconductor Manufacturing Company Ltd. are the top 5 companies holding a prime share in the digital TV SoC market. Top market players have adopted various strategies, such as product launches, partnerships, acquisitions, product upgrades, and product development, to expand their foothold in the digital TV SoC market opportunity

- In March 2022, MediaTek announced its TV SoC Dolby Vision IQ with Precision Detail. Precision Detail is a new innovative feature introduced for TVs with Dolby Vision IQ, which supports MediaTek’s Pentatonic series for 8K and 4K smart TVs..

- In July 2022, Intel and MediaTek announced a strategic partnership to manufacture chips using Intel Foundry Services’ (IFS) advanced process technologies. The agreement was designed to help MediaTek build a more balanced, resilient supply chain through the addition of a new foundry partner with significant capacity in the United States and Europe.

- In November 2021, Samsung Electronics Co., Ltd., introduced three of its automotive chip solutions: the Exynos Auto T5123 for 5G connectivity, the Exynos Auto V7 for comprehensive in-vehicle infotainment systems, and the ASIL-B certified S2VPS01 power management IC (PMIC) for the Auto V series.

- In March 2021, Qualcomm Incorporated announced that its subsidiary, Qualcomm Technologies, Inc., completed its acquisition of CPU and technology design company, NUVIA for $1.4 billion before working capital and other adjustments.

- In September 2022, Toshiba announced the release of two products. The N300 Pro and X300 Pro HDDs are excellent solutions for business owners and creative professionals, respectively, seeking a hard disk drive built for high performance and reliability. Both HDDs boast capacities of up to 18TB1 with workloads up to 300TB/year2 and come with a limited 5-year warranty.

- In July 2022, Laird Connectivity, a leader in wireless technology, announced the launch of its system-on-module (SOM) portfolio, the Summit SOM 8M Plus. This SOM is a highly integrated and comprehensive hardware and software solution that combines NXP® Semiconductors' multi-core applications processing with dual-band 2x2 Wi-Fi 5 and Bluetooth 5.3 connectivity.

- In January 2022, Intel announced the 12th Gen Intel Core™ family of mobile processors led by the launch of new H-series mobile processors featuring the flagship Intel® Core™ i9-12900HK – the fastest mobile processor ever1 and the world’s best mobile gaming platform2 – built on the Intel 7 process.

- In December 2021, TSMC introduced its N4X process technology, tailored for the demanding workloads of high-performance computing (HPC) products. N4X is the first of TSMC’s HPC-focused technology offerings, representing ultimate performance and maximum clock frequencies in the 5-nanometer family.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital TV soc market from 2021 to 2031 to identify the prevailing digital TV soc market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the digital TV social market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global digital TV social market trends, key players, market segments, application areas, and market growth strategies.

Digital TV SoC Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 28.2 billion |

| Growth Rate | CAGR of 12.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 328 |

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Intel Corporation, Taiwan Semiconductor Manufacturing Co. Ltd., Qualcomm Incorporated, NXP Semiconductors, STMicroelectronics N.V., Apple Inc., Toshiba Corporation, Broadcom Inc., MediaTek Inc, Samsung Electronics Co Ltd |

Analyst Review

System on Chip is an enhanced integrated circuit or microchip equipped with various electronic equipment such as memory, audio, and other systems. Companies globally such as MediaTek, Samsung, NXP Semiconductors, and others are putting resources into action to develop next-generation 8K digital Tv solutions equipped with artificial intelligence, Dolby Vision, and 120Hz refresh rate. Increasing demand for compact and scalable ICs in the global electronics industry has led to the higher adoption of digital TV Systems on Chip solutions.

The global digital TV SoC market is highly competitive, owing to the strong presence of existing vendors. digital TV SoC vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The rise in demand for smart grid solutions across the residential and commercial sectors globally is driving the need for the next generation to enhance digital TV SoC solutions. Moreover, prime economies, such as the U.S., China, Germany, and Japan, plan to develop and deploy next-generation SoC solutions across various consumer electronics applications such as portal devices, digital TVs, and more, which is anticipated to provide lucrative opportunities for market growth.

Among the analyzed geographical regions, Asia-Pacific exhibits the highest adoption of digital TV SoC and has been experiencing a massive expansion of the market. On the other hand, North America is expected to grow at a faster pace, predicting lucrative growth due to emerging countries such as U.S. and Mexico investing in these technologies. Regions such as the Middle East and Africa are expected to offer in new opportunities for the growth of the digital TV SoC market in the future.

The key players profiled in the report include Intel Corporation, Samsung Electronics Co. Ltd., Qualcomm Incorporated, Toshiba Corporation, NXP Semiconductors, Broadcom Inc., STMicroelectronics N.V., Apple Inc., MediaTek Inc., and Taiwan Semiconductor Manufacturing Co. Ltd are provided in this report.

Asia-Pacific is the largest regional market for Digital Tv SoC.

Significant factors that impact the growth of the global digital TV SoC industry include the surge in demand for smart and power-efficient electronic devices paired with the surge in disposable income in developing economies.

MediaTek, Samsung Electronics Co. Ltd., Qualcomm Incorporation, Toshiba Corporation, and Taiwan Semiconductor Manufacturing Company Ltd., are the top 5 companies holding a prime share in the digital TV SoC market

LCD is the leading application of the Digital Tv SoC market.

The global digital tv soc market was valued at $8.6 billion in 2021 and is projected to reach $28.2 billion by 2031, growing at a CAGR of 12.8% from 2022 to 2031.

Loading Table Of Content...