Disposable Cups Market Overview, 2033

The global disposable cups market size was valued at $12.5 billion in 2023 and is projected to reach $22.1 Billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033. Disposable cups, crafted from materials such as paper, plastic, or foam, fulfill the need for convenient and hygienic beverage consumption in different spaces, ranging from everyday coffee runs to large-scale events. Their widespread use is fueled by modern lifestyles that often prioritize single-use items over reusable alternatives due to time constraints and practicality. Businesses find them cost-effective, eliminating the labor and resource expenses associated with washing and maintaining reusable cups. Moreover, disposable cups cater to the growing trend of on-the-go consumption, accommodating individuals navigating busy schedules. However, their widespread use contributes significantly to environmental concerns, as they generate substantial waste and contribute to pollution. Thus, there is a rise in interest in eco-friendly alternatives, such as compostable or biodegradable cups made from renewable resources, as a means to address the environmental impact of disposable cup consumption.

Key Findings

The disposable cups market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the disposable cups market forecast.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major paper cup industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The disposable cup market thrives due to the convenience it offers, aligning with the demands of modern on-the-go lifestyles. With the rise in the number of individuals leading fast-paced lives, there is a heightened need for quick and efficient solutions for beverage consumption. Disposable cups provide a hassle-free option, eliminating the need for washing and maintenance associated with reusable alternatives. They cater to the convenience sought by consumers in environments such as coffee shops, convenience stores, and fast-food outlets, where time constraints and practicality are paramount. This preference for convenience fuels the growth of the disposable cup market as it continues to meet the evolving needs of consumers globally.

Disposable cups market demand is significantly driven by the growth of the food service industry, mirroring the global increase in dining out and food delivery services. Restaurants, cafes, and quick-service establishments rely on disposable cups for serving a wide range of beverages to their customers. With the convenience they offer in terms of hygiene and efficiency, disposable cups have become an indispensable part of the food service industry's operations. Moreover, rise in food delivery services further amplifies the need for disposable packaging, including cups, to accommodate the growing demand for takeaway and delivery orders, thus driving the disposable cups market growth.

- The events and hospitality sector fuels growth in the disposable cup market by creating a steady demand for single-use beverage containers in various gatherings, including conferences, parties, festivals, and outdoor events. As the frequency and scale of such occasions continue to expand globally, disposable cups remain indispensable for serving beverages conveniently and efficiently. Event organizers and caterers prefer disposable cups due to their convenience, cost-effectiveness, and ability to accommodate large crowds without the logistical challenges of cleaning and storing reusable alternatives, thus driving disposable cups market statistics.

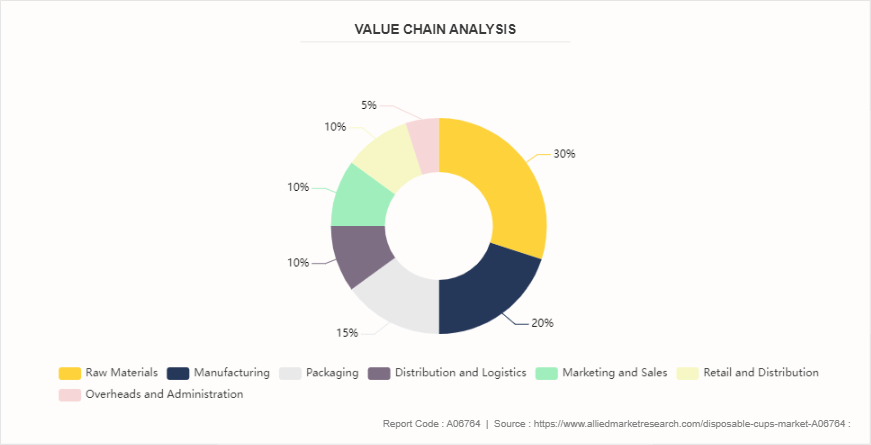

Value Chain Analysis

The value chain analysis of the disposable cups industry highlights the key stages and their impact on the final product cost. Raw materials, including plastic or paper pulp and additives, are significant initial expenses. The manufacturing process, involving production, quality control, and waste management, adds considerable cost. Packaging costs cover primary and secondary packaging materials, as well as labeling. Distribution and logistics expenses arise from transportation and warehousing needs. Marketing and sales efforts, such as advertising, maintaining a sales force, and promotions, contribute to the overall cost. Retail and distribution costs include the retailer's markup and fees from intermediaries. Lastly, overheads and administration encompass management, research and development, and legal compliance. Each of these stages is essential in shaping the final price of disposable cups, reflecting a combination of material costs, production efficiencies, and market strategies.

New Innovation in the Disposable Cup Market

Biodegradable Materials: Innovations in disposable cups focus on eco-friendly materials such as PLA (polylactic acid) derived from renewable resources such as corn starch, sugarcane bagasse, or bamboo fiber, reducing environmental impact and waste accumulation.

Compostable Solutions: Manufacturers are increasingly offering compostable disposable cups, designed to break down into natural elements under composting conditions, contributing to soil health, and reducing landfill waste.

- Advanced Insulation: Some disposable cups feature advanced insulation technology, maintaining beverage temperature for longer durations, enhancing user experience, and reducing the need for additional cup sleeves or double cupping.

- Smart Packaging: Innovations integrate technology into disposable cups, including QR codes for recycling instructions, NFC (Near Field Communication) tags for interactive experiences, or temperature-sensitive indicators to ensure beverage freshness and safety.

- Customization and Branding: Disposable cups are customizable to meet branding needs, providing businesses with opportunities to boost brand visibility and engage customers through personalized designs, logos, and messages.

- Health and Safety Features: Recent innovations focus on enhancing hygiene and safety, with features such as antimicrobial coatings or germ-resistant materials, addressing concerns amid health crises and promoting consumer confidence in using disposable cups.

Market Segmentation

The disposable cups market is segmented into type, end-use, distribution channel, and region. By type, the market is divided into paper, plastic, and foam. By end use, the market is segregated into household and commercial. By distribution channel, the market is bifurcated into business-to-business and business-to-consumer. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Regional Market Outlook

Europe held the major disposable cups market share of the market in 2023. European countries have been at the forefront of environmental initiatives, leading to a significant shift towards sustainable packaging solutions, including disposable cups made from biodegradable and compostable materials. On the other hand, the disposable cup market in the Asia-Pacific region is experiencing rapid growth, driven by urbanization, changing consumer lifestyles, and the expansion of the food and beverage industry. Countries such as China, India, Japan, and South Korea are witnessing an increase in demand for disposable cups, particularly in urban areas with a growing café culture and rising disposable income levels. However, there are also concerns about plastic pollution and efforts to promote sustainable alternatives.

Industry Trends

With the rise in environmental concerns, the disposable cup industry is witnessing a surge in demand for sustainable alternatives to plastic cups. The global consumption of disposable paper cups has exceeded 220 billion and reached 32 per capita in 2018. In addition, it is reported that the amount of annually consumed disposable paper cups in the UK and China has reached more than 2.5 billion and 10 billion, respectively.

There is a notable shift towards biodegradable and compostable materials in the disposable cup industry. The demand for biodegradable paper cups is projected to witness significant growth, driven by stringent regulations against plastic usage and an increase in consumer awareness about environmental sustainability.

- Stringent regulations aimed at reducing single-use plastic consumption and promoting sustainable packaging solutions are influencing the disposable industry. Manufacturers are increasingly adopting sustainable practices and investing in eco-friendly materials to align with regulatory requirements and consumer preferences. In addition, industry associations and initiatives focused on promoting sustainable packaging, such as the sustainable packaging coalition, are driving awareness and collaboration in the disposable cup industry to address environmental challenges.

Competitive Landscape

The major players operating in the disposable cups market include Dart Container Corporation, Huhtamaki Group, Georgia-Pacific LLC, International Paper, Solo Cup Company, Pactiv LLC, Genpak, Fabri-Kal Corporation, ConverPack Inc., Eco-Products, Inc., Biodegradable Food Service LLC, WinCup, Lollicup USA, Inc., Anchor Packaging, Vegware, Dopla S.p.A., and D&W Fine Pack.

Recent Key Strategies and Developments

In February 2023, Huhtamaki acquired full ownership of Huhtamaki Tailored Packaging Pty Ltd. (HTP) , the Australian food service packaging distribution and wholesale group. HTP employs more than 130 people and is one of the largest importers and distributors of food service packaging in Australia serving a wide network of customers including metropolitan and regional packaging wholesalers, food wholesalers, club and hospitality suppliers, and national quick service restaurant businesses.

In September 2023, Red Leaf Pulp announced a partnership with Dart Container. Dart Container As Red Leaf’s new strategic partner, Dart is to have exclusive rights to use the alternative fiber manufactured by Red Leaf, which is made using wheat straw residuals. Dart is expected to use this material for producing its own molded fiber food service packaging.

- In March 2022, Dart Container Corp. acquired Solo Cup Co. in a transaction valued at approximately $1 billion. Both companies are in the consumer and food service disposable packaging business. The transaction, which is subject to regulatory approval, is expected to close by the third quarter of this year. The two companies are to continue to operate independently until government approval is secured and the transaction closes.

- In September 2021, Huhtamaki completed the acquisition of Elif, a major supplier of sustainable flexible packaging to global brand owners. Huhtamaki completed the acquisition of Elif Holding A.?. (Elif) , a major supplier of sustainable flexible packaging to global FMCG brand owners, with operations in Turkey and in Egypt.

- In November 2018, The Recycling Partnership announced that Dart Container Corp. joined the organization and, in the process, became the 25th funder partner for the group.

Key Sources Referred

Plastics Industry Association (PLASTICS)

Foodservice Packaging Institute (FPI)

- The Solid Waste Association of North America (SWANA)

- National Coffee Association (NCA)

- Environmental Protection Agency (EPA)

- International Solid Waste Association (ISWA)

- World Health Organization (WHO)

- Paper Cup Alliance

- American Chemistry Council (ACC)

- American Forest & Paper Association (AF&PA)

- European Paper Cup Association (EPCA)

- U.S. Environmental Protection Agency (EPA)

- European Environment Agency (EEA)

- Trade Publications

- Local Government Recycling Programs

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the disposable cups market analysis from 2024 to 2033 to identify the prevailing disposable cups market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the disposable cups market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global disposable cups market trends, key players, market segments, application areas, and market growth strategies.

Disposable Cups Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 22.1 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 325 |

| By Type |

|

| By End Use |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | WinCup, Fabri-Kal Corporation, ConverPack Inc., Lollicup USA, Inc., Eco-Products, Inc., Dopla S.p.A., Biodegradable Food Service LLC, Genpak, Dart Container Corporation, Anchor Packaging Pty Ltd., D&W Fine Pack, Vegware, Solo Cup Company, Pactiv LLC, Huhtamaki Group, international paper, wincup, Georgia-Pacific LLC, D&W Fine Pack LLC |

The global disposable cups market was valued at $12.5 billion in 2023 and is projected to reach $22.1 Billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

The disposable cups market is segmented into type, end-use, distribution channel, and region. By type, the market is divided into paper, plastic, and foam. By end use, the market is segregated into household and commercial. By distribution channel, the market is bifurcated into business-to-business and business-to-consumer. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Europe is the largest regional market for disposable cups

The major players operating in the disposable cups market include Dart Container Corporation, Huhtamaki Group, Georgia-Pacific LLC, International Paper, Solo Cup Company, Pactiv LLC, Genpak, Fabri-Kal Corporation, ConverPack Inc., Eco-Products, Inc., Biodegradable Food Service LLC, WinCup, Lollicup USA, Inc., Anchor Packaging, Vegware, Dopla S.p.A., and D&W Fine Pack

The global disposable cups market report is available on request on the website of Allied Market Research.

Loading Table Of Content...