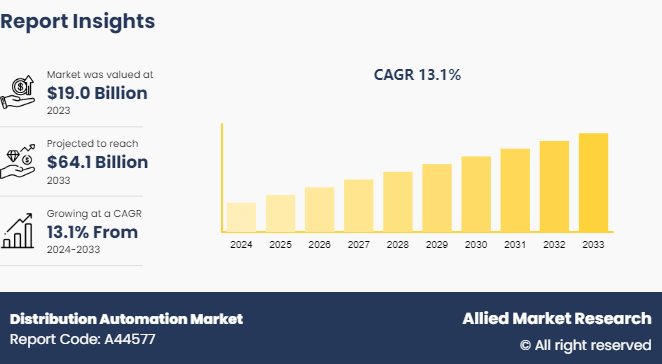

The global distribution automation market size was valued at $19.0 billion in 2023, and is projected to reach $64.1 billion by 2033, growing at a CAGR of 13.1% from 2024 to 2033.

Market Introduction

Distribution automation refers to the implementation of advanced digital and communication technologies to enhance the efficiency and reliability of electrical power distribution systems. By integrating intelligent devices, real-time monitoring, and automated control mechanisms, distribution automation enables utilities to detect, diagnose, and respond to faults swiftly, thus minimizing outages and improving service quality. Its applications extend across various industries, including residential, commercial, and industrial sectors, where it plays a crucial role in optimizing energy consumption and reducing operational costs. Key components of distribution automation systems include smart meters, automated switches, and advanced communication networks. The growth of this technology is particularly significant in developing regions, where the rising demand for reliable power supply and the development of offshore support vessels drive the need for robust and efficient power distribution solutions.

Key Takeaways

- The distribution automation market report covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major distribution automation industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and to assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The increasing integration of renewable energy sources like solar and wind is driving the need for advanced distribution automation (DA) systems, thus progressing distribution automation market growth. As these energy sources are inherently variable, maintaining grid stability becomes a complex challenge. Advanced DA systems are essential for managing this variability, ensuring a reliable and efficient power supply. Consequently, the demand for distribution automation is set to rise, driven by the necessity to adapt to and optimize the performance of a more diverse and dynamic energy grid. This trend highlights the critical role of DA systems in the evolving landscape of energy distribution.

However, the integration of new automation technologies with traditional power distribution systems is complex and costly, as many existing systems were not originally designed for modern automation. This challenge significantly hampers the demand for distribution automation, as utilities face high expenses and technical difficulties in upgrading their infrastructure. The intricacies involved in merging old and new technologies act as a barrier, slowing down the adoption of advanced automation solutions in the power distribution sector.

Advancement and deployment of smart grid technologies are significantly driving the adoption of distribution automation systems and thus progressing distribution automation market forecast. These systems enhance grid reliability, efficiency, and resilience by enabling real-time monitoring and control. Therefore, the demand for distribution automation is expected to increase, driven by the need for improved grid performance and the integration of renewable energy sources. The ability to quickly respond to grid disturbances and optimize power distribution are key benefits that make distribution automation systems essential for modernizing electrical infrastructure.

Increasing Electricity Demand

The global distribution automation market is expected to witness substantial growth, due to the rising demand for electricity and the ongoing electrification across various sectors. According to a 2024 report by the International Energy Agency (IEA) , global electricity demand increased by 2.2% in 2023. This growth was notably strong in China, India, and Southeast Asia, despite declines in advanced economies attributed to macroeconomic challenges. Looking forward, the IEA projects that global electricity demand will continue to rise at an average annual rate of 3.4% through 2026. This anticipated increase is driven by an improving economic outlook and significant advancements in electrification, especially within the residential and transport sectors. As electrification expands and modernizes, the need for efficient, reliable distribution systems becomes crucial, further driving the market for distribution automation. Enhanced distribution automation enables better management and optimization of electricity networks, supporting the integration of renewable energy sources and improving grid reliability and resilience. Consequently, the intersection of rising electricity demand and technological progress in electrification highlights a significant growth trajectory for the global distribution automation market in the upcoming years.

Global Electricity Demand, 2021-2023 (TWh)

Year | TWh |

2021 | 1,421 |

2022 | 593 |

2023 | 731 |

Source : IEA, AMR Analysis, Secondary Research

In 2023, the global electricity demand was 731 TWh in comparison to 593 TWh in 2022.

Market Segmentation

The distribution automation market share is segmented into communication technology, component, utility, and region. On the basis of communication technology, the market is classified into wired and wireless. By component, the market is divided into field devices, software, and services. Based on utility, the market is classified into private utility and public utility. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America is anticipated to see a progressive increase in demand for distribution automation, driven by significant advancements in technology. Innovations such as advanced sensors, real-time data analytics, and smart grid technologies are revolutionizing the distribution networks, making them more efficient and reliable. For example, in the U.S., there is a widespread adoption of advanced grid management technologies, including Automated Distribution Management Systems (ADMS) . These systems integrate real-time monitoring, control, and analytics to enhance the reliability and efficiency of electrical grids. For example, the deployment of smart meters and sensors allows utilities to gather detailed data on grid performance and quickly identify issues, such as outages or equipment failures. In addition, the implementation of advanced fault detection, isolation, and restoration (FDIR) technologies enables quicker resolution of power disruptions, minimizing downtime and improving service reliability. Another significant development is the integration of artificial intelligence (AI) and machine learning into grid operations, which helps in predictive maintenance and optimizing energy distribution. These advancements collectively contribute to more resilient and efficient distribution networks, aligning with the evolving demands for smart grid infrastructure across the U.S.

- In February 2024, at DISTRIBUTECH International 2024, Gridspertise unveiled its virtualization and edge processing platform for MV and LV grid automation, addressing the increasing complexity in electricity grids. With rising demand, electric vehicle loads, and distributed energy resources, along with extreme weather and decarbonization goals, grids face challenges like bidirectional power flows and fluctuating demand. Gridspertise's quantum edge device enhances visibility and control by running essential grid functions directly on the edge of the MV/LV distribution substation. This reduces equipment needs, boosts resilience, and ensures faster response times and uninterrupted power.

Competitive Landscape

The major players operating in the distribution automation market overview include ABB, Siemens AG, Eaton, Xylem, S&C Electric Company, G&W Electric, Schneider Electric, GE, Schweitzer Engineering Laboratories, Inc., Cisco, and others.

Recent Key Strategies and Developments

- In February 2021, England Securities served as the exclusive financial advisor to Beckwith Electric Co., Inc. in its sale to Hubbell Utility Solutions, a division of Hubbell Incorporated. Beckwith Electric, based in Largo, Florida, is a leading manufacturer of protection and control products for the global electric utility and industrial markets. Its technology solutions are crucial for advanced distribution automation infrastructure and integrating distributed energy resources. The acquisition strengthens Hubbell's product portfolio and enhances its capabilities in advanced distribution automation technology for utility customers. This acquisition marks the first for Hubbell’s new Utility Solutions business unit, focusing on protection and control in the utility sector.

Industry Trends

- In May 2024, Siemens introduced LV Management within its Gridscale X offering, a part of the Xcelerator portfolio, aimed at enhancing grid operators' insights and transparency over the low voltage grid. This tool supports Distribution System Operators (DSOs) by providing observability and control features, enabling them to efficiently manage the grid. Through continuous and automated detection, assessment, and action steps, DSOs can quickly leverage untapped grid capacity while ensuring reliability. Siemens claims that this new offering can reduce model maintenance efforts by 50%, significantly aiding DSOs in maintaining and optimizing grid operations.

- In March 2024, Rockwell Automation, Inc., a company in industrial automation and digital transformation, announced the regional availability of its CUBIC product line. CUBIC offers IEC-61439 compliant modular enclosure systems for power and electrical panel construction, catering to fast-growing industries such as renewable energy, mining, data centers, chemical, food & beverage, and infrastructure. Initially limited in some Asian markets, CUBIC is now widely available across the region. The manufacturing sector's smart transformation toward sustainability relies on stable, reliable electrical power management systems, which are essential for optimizing processes and enabling safer, more sustainable, smart manufacturing environments.

Key Sources Referred

- Institute of Electrical and Electronics Engineers

- National Electrical Manufacturers Association

- Smart Electric Power Alliance

- Electric Power Research Institute

- Siemens AG

- Rockwell Automation, Inc.

- ABB

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the distribution automation market segments, current trends, estimations, and dynamics of the distribution automation market analysis from 2023 to 2033 to identify the prevailing distribution automation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the distribution automation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global distribution automation market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global distribution automation market trends, key players, market segments, application areas, and market growth strategies.

Distribution Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 64.1 Billion |

| Growth Rate | CAGR of 13.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Communication Technology |

|

| By Component |

|

| By Utility |

|

| By Region |

|

| Key Market Players | ABB, S&C Electric Company, Xylem, G&W Electric, Siemens AG, Eaton, Schweitzer Engineering Laboratories, Inc., Schneider Electric, General Electric, Cisco |

The distribution automation market is estimated to reach $18.99 billion by 2033, exhibiting a CAGR of 13.1% from 2024 to 2033.

The growth of urban areas and the development of smart cities require advanced electrical infrastructure to support increased energy demands and integrate various smart technologies, driving the need for distribution automation.

Asia-Pacific is experiencing unprecedented urbanization and industrial growth. Countries like China, India, and Southeast Asian nations are witnessing a rise in demand for electricity, necessitating the modernization of their power grids to ensure reliable and efficient energy distribution.

The public utility sub-segment is anticipated to lead the distribution automation market during the forecast period.

The major players operating in the distribution automation market include ABB, Siemens AG, Eaton, Xylem, S&C Electric Company, G&W Electric, Schneider Electric, GE, Schweitzer Engineering Laboratories, Inc., and Cisco.

Loading Table Of Content...