DNA RNA Isolation and Purification Kit Market Research, 2033

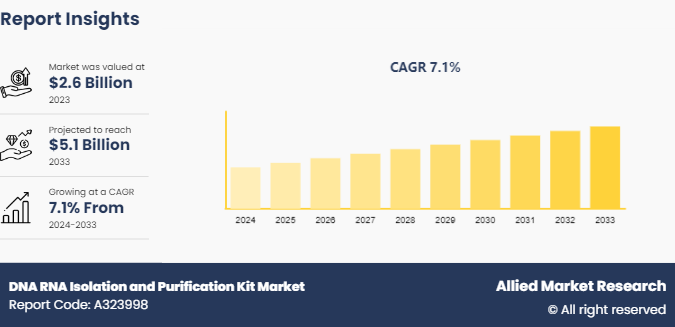

The global DNA RNA isolation and purification kit market size was valued at $2.6 billion in 2023, and is projected to reach $5.1 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033. The DNA RNA isolation and purification kit market growth is driven by increasing research in genomics and molecular biology, rising demand for personalized medicine, and advancements in technology for faster, more efficient isolation processes.

Market Introduction and Definition

A DNA and RNA isolation and purification kit is a laboratory tool designed to extract and purify DNA or RNA from biological samples. It typically includes reagents and materials such as buffers, enzymes, and columns or membranes. The kit's process involves lysing cells to release nucleic acids, removing contaminants and proteins, and isolating the nucleic acids in a pure form. These purified nucleic acids are essential for various applications, including molecular biology research, genetic analysis, and diagnostic testing, ensuring high-quality and uncontaminated samples for accurate results.

Key Takeaways

- The DNA RNA isolation and purification kit market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major DNA RNA isolation and purification kit industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The DNA RNA isolation and purification kit market growth is driven by rise in demand for high-quality nucleic acid samples in molecular biology research, genomics, and clinical diagnostics. As researchers and clinicians increasingly rely on precise genetic information to understand disease mechanisms, develop targeted therapies, and conduct genetic testing, the necessity for efficient and reliable isolation and purification methods. In addition, technological advancements in isolation and purification techniques, including the advent of automated systems and innovative reagent formulations, have significantly enhanced the efficiency, speed, and yield of nucleic acid extraction processes, thus driving DNA RNA isolation and purification kit market size. Rise in demand for personalized medicine, which emphasizes tailored treatment approaches based on individual genetic profiles, further propels the demand for advanced DNA/RNA isolation kits.

Furthermore, rise in prevalence of infectious diseases, has accentuated the need for rapid and accurate nucleic acid testing, thereby boosting the market for isolation and purification kits used in diagnostic assays. Moreover, the expanding applications of next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies in various domains, including oncology, pharmacogenomics, and agriculture, necessitate high-purity nucleic acid samples, thus fostering the growth during DNA RNA isolation and purification kit market forecast period. Further, the increasing investment in life sciences research by government bodies, private institutions, and biotech companies amplifies the demand for sophisticated nucleic acid extraction tools. In parallel, the growing awareness of genetic disorders and the importance of early diagnosis and intervention fuel the adoption of these kits in clinical settings.

However, the high costs associated with advanced kits and equipment can limit adoption, particularly in resource-limited settings. Technical complexities and the need for specialized training can pose barriers to usage, especially in non-specialist labs. Variability in sample quality and yield can affect the reliability and consistency of results, leading to potential inaccuracies thereby limits the market growth.

On the other hand, advances in automation and miniaturization of isolation kits enhance efficiency and convenience which provides DNA RNA isolation and purification kit market opportunity. Emerging markets, particularly in Asia-Pacific and LAMEA, provide vast growth opportunities. The integration of AI and data analytics in nucleic acid extraction processes offers innovation potential. Further, growing research funding and strategic collaborations stimulate market expansion.

FDA Approved Personalized Medicines, By Year

The Personalized Medicine Coalition data reveals a fluctuating trend in the adoption of personalized medicines from 2015 to 2022, highlighting significant advancements and shifts in this field. The percentage of personalized medicines began at 28.0% in 2015, dipped to 27.0% in 2016, and then saw a notable rise to 34.0% in 2017. The upward trajectory continued with a peak at 42.0% in 2018, indicating increased integration of personalized approaches in healthcare. However, there was a sharp decline to 25.0% in 2019, followed by a resurgence to 39.0% in 2020, and slight decreases to 35.0% and 34.0% in 2021 and 2022, respectively. This variability emphasizes the dynamic nature of the personalized medicine landscape, driven by innovations and market forces.

The growth of personalized medicine is intrinsically linked to advancements in genomic technologies, particularly DNA and RNA isolation and purification. These kits are essential for obtaining high-quality genetic material, enabling precise diagnostics and tailored treatments. As personalized medicine continues to expand, the demand for reliable DNA/RNA isolation and purification kits is expected to rise, driving growth in this market. Accurate genetic analysis is foundational for personalized therapies, making these kits critical tools in the advancement of personalized healthcare solutions.

FDA Approved Personalized Medicines, By Year (%)

Year | Personalized Medicines |

2015 | 28% |

2016 | 27% |

2017 | 34% |

2018 | 42% |

2019 | 25% |

2020 | 39% |

2021 | 35% |

2022 | 34% |

Source : Personalized Medicine Coalition

Market Segmentation

The DNA RNA isolation and purification kit market is segmented into product type, application, end user, and region. On the basis of the product type, the market is segmented into DNA isolation and purification kits, RNA isolation and purification kits, and combination kits. By application, the market is classified into diagnostics, drug discovery & development, agriculture and animal research, and others. By end user, the market is divided academic and research laboratories, diagnostic laboratories, pharmaceutical and biopharmaceutical companies, forensic laboratories, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the DNA RNA isolation and purification kit market share in 2023, primarily due to the presence of leading biotechnology and pharmaceutical companies, advanced healthcare infrastructure, and significant investment in research and development. The U.S., in particular, has a high adoption rate of genomic technologies, driven by government initiatives and growing demand for molecular diagnostics. The Asia-Pacific region is expected to exhibit the fastest growth rate during the forecast period. Factors such as increasing healthcare expenditure, growing awareness of personalized medicine, and expanding biotechnology sector drive market growth in this region. Countries such as China, and Japan are at the forefront, with substantial investments in genomic research and a rising number of biotech startups. The region's large population base and the rising prevalence of chronic diseases also contribute to the increasing demand for DNA/RNA isolation and purification kits.

Industry Trends

In April 2024, the Medical Science Co-investment Plan outlined investment opportunities for the Australian government and industry to capitalize on the country's medical science strengths and target high-economic-potential areas. It highlights relevant fields such as digital health, where advancements in sequencing enable personalized medicine, and medical devices, which sometimes depend on nucleic acid technologies. Additionally, innovative therapeutics often require optimized DNA/RNA isolation workflows thereby supports the market growth.

In April 2023, the Government of Canada's $1.4 billion investment in strategic research at postsecondary institutions included significant funding for DNA and RNA-related research. McGill University received $165 million in funding for the project "DNA to RNA: An Inclusive Canadian Approach to Genomic-based RNA Therapeutics (D2R) ." This investment is dedicated to advancing research in genomic-based RNA therapeutics, focusing on the development and optimization of RNA therapies. The funding supports efforts to improve RNA sequencing, enhance nucleic acid isolation and purification technologies, and drive innovations in personalized medicine thereby supports the market growth.

Competitive Landscape

The major players operating in the DNA RNA isolation and purification kit market include Thermo Fisher Scientific Inc., QIAGEN, Genetix Biotech Asia Pvt. Ltd., Norgen Biotek Corp., F. Hoffmann-La Roche Ltd, Takara Bio Inc., Promega Corporatio, Zymo Research Corporation, Bio-Rad Laboratories, Inc., and Agilent Technologies, Inc. Other players in DNA RNA isolation and purification kit market includes MP Biomedicals and so on.

Recent Key Strategies and Developments in DNA RNA isolation and purification kit Industry

In August 2023, Danaher Corporation, a global science and technology innovator, announced that it has entered into a definitive agreement to acquire Abcam plc, a leading global supplier of protein consumables, pursuant to which Danaher will acquire all of the outstanding shares of Abcam for?$24.00?per share in cash, or a total enterprise value of approximately?$5.7 billion?including assumed indebtedness and net of acquired cash.

In July 2023, INOVIQ Limited an innovative developer of exosome solutions and precision diagnostics, and?Promega Corporation? (Promega) , a global leader in innovative technologies, tools and?technical support?to the life sciences industry announced a joint marketing agreement to co-market INOVIQ’s EXO-NET exosome capture technology and Promega?Nucleic Acid purification systems?worldwide.

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dna rna isolation and purification kit market analysis from 2024 to 2033 to identify the prevailing dna rna isolation and purification kit market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dna rna isolation and purification kit market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dna rna isolation and purification kit market trends, key players, market segments, application areas, and market growth strategies.

DNA RNA Isolation and Purification Kit Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.1 Billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 240 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Genetix Biotech Asia Pvt. Ltd., Agilent Technologies, Inc. , Thermo Fisher Scientific Inc., Norgen Biotek Corp. , Takara Bio Inc., QIAGEN, Zymo Research Corporation, Promega Corporation, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc. |

The total market value of DNA RNA isolation and purification kit market was $2.6 billion in 2023.

The market value of DNA RNA isolation and purification kits market is projected to reach $5.1 billion by 2033.

The forecast period for DNA RNA isolation and purification kit market is 2024 to 2033.

The base year is 2023 in DNA RNA isolation and purification kit market.

DNA isolation and purification kits are laboratory tools designed to extract and purify DNA from various biological samples, such as blood, tissue, and cells, ensuring high-quality nucleic acid for further analysis.

Key drivers include increasing research in genomics and molecular biology, rising demand for personalized medicine, technological advancements in extraction methods, and growing applications in clinical diagnostics and biotechnology.

Loading Table Of Content...