Document Management Market Insights, 2032

The global document management market size was valued at $7.1 billion in 2022, and is projected to reach $34.2 billion by 2032, growing at a CAGR of 17.3% from 2023 to 2032.

Rising adoption of cloud-based solutions in businesses and implementation of advanced DMS solutions in organizations are the factors driving the growth of global document management system market size. In addition, there is an increase in demand for remote and distributed workforces, which in turn is expected to create numerous opportunities for the growth of the market. However, employee training and adoption and data privacy concerns and regulatory compliance hamper the growth of the market.

Furthermore, surge in adoption of big data management and data analyzing tools by enterprises and Integration of robotic process automation (RPA), which creates opportunities for document management solutions to optimize business operations. For instance, in June 2021, Oracle Corporation upgraded its document management and launched capture capabilities, which enable companies to capture, store, and process business documents in a cost-effective, efficient, and timely manner.

Document management is the technique of using a computer system and software to store, arrange, and track electronic documents as well as electronic versions of paper-based information that have been scanned in. In addition, it offers centralized storage, audit trails, access control, document security, and faster search and retrieval.

Moreover, advanced document management solutions help organizations rapidly make, operate, and innovate with data to solve business issues. DMS may assist enterprises in increasing productivity and efficiency while lowering expenses. Additionally, it can provide customers with greater ease and superior user experience. In addition, the increasing demand for seamless data accessibility in several businesses for handling vast amounts of data is another driver boosts the document management market trends. Such enhanced factors are expected to provide lucrative opportunities for market growth during the forecast period.

For instance, in April 2022, Hyland Software Inc. enhanced its cloud-native capture products to deliver automatic separation by barcode for automated document splitting of 1D and 2D barcodes. This eliminates the need for manual separation, improving employee experience by rededicating workers to higher-value tasks.

Also, the growing trend of advanced technologies in organizations is one of the major factors driving the global market growth. A document management platform may combine various documents for improved control, access, and workflow. By combining this capability with AI and cloud computing, organizations may advance their operations. Moreover, it has benefits for information retrieval, security, governance, and decreased operational costs. In addition, the increase in need of organizations to solve common document management challenges is one of the major factors driving the document management market growth.

Segment Review:

The document management market is segmented into component, deployment mode, enterprise size, end-user, and region. The report provides information on various components including solutions and service. In addition, it is categorized by deployment mode including on-premise and cloud. Based on enterprise size, the market is classified into large enterprises and small & medium-sized enterprises. The details of the end-user namely BFSI, healthcare, government, retail and e-commerce, education, industrial manufacturing and others are also provided in the report. In addition, it analyzes the current market trends across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

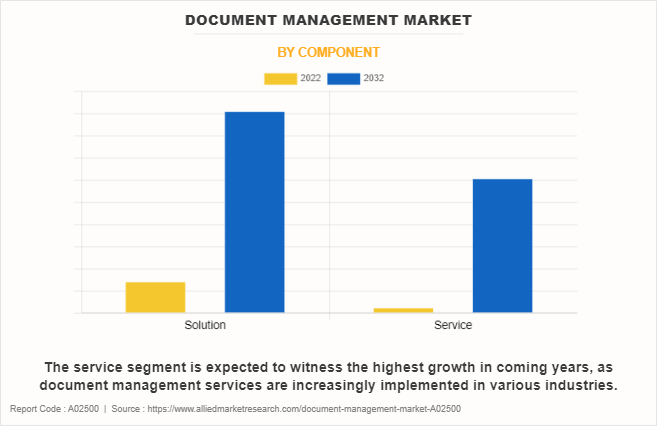

On the basis of component, the global document management market share was dominated by the solution segment in 2022 and is expected to maintain its dominance in the upcoming years, owing to advances in technologies enabling document management to transform several industries globally. However, the service segment is expected to hold the highest growth, as document management services help to reduce the time and costs associated with optimizing systems in the initial phase of deployment.

By region, North America was largest market share in 2022 for the document management market. This region is more focused towards the regulatory compliance solutions for data privacy and security further anticipated to propel the growth of the market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of advanced technology are expected to provide lucrative growth opportunities for the market in this region. For instance, in May 2023, Xiao-I Corporation launched its Intelligent Document Processing (“IDP”) product. This innovative solution is delivered by a smart and efficient platform that streamlines and automates the document management process, empowering businesses toward an era of intelligent operations.

Top Impacting Factors:

Rising Adoption of Cloud-based Solutions in Businesses:

The surge in the expansion of cloud-based services is a key driver for the growth of the global market. This is attributed to the rising number of countries committing to adopt cloud based DMS solutions. Further, government policies are undertaking increased initiatives to embrace advanced technology, with plans for integrating a new digital solution. For instance, in April 2023, the Japanese government raised $31.7 million (4.2 billion yen) in funding to develop shared quantum computing using a business-friendly cloud platform. The Japanese government intends to broaden quantum computing's accessibility so that businesses may take advantage of its benefits. Therefore, cloud based DMS solutions gained wider traction among end-users, taking advantage of cloud computing solutions in several industries.

Moreover, cloud-based DMS solutions leverage the economies of scale provided by cloud computing. Organizations may avoid the upfront costs associated with purchasing and maintaining on-premises hardware infrastructure. Consequently, regional governments and private and public businesses invest in cloud-based AI solutions. For instance, in September 2020, Upland Software launched Upland’s Document Workflow Cloud solutions onto HP Workpath, to modernize the flow of information between paper and digital. It is a fully end-to-end unified cloud-based workflow platform for document capture, image processing, and data extraction. Such initiatives and advancements in cloud-based DMS solutions will eventually contribute to the growth of the document management market forecast.

Implementation of Advanced DMS Solutions in Organizations:

The implementation of advanced document management (DMS) solutions has become a critical strategy for organizations aiming to streamline their document-related processes and adapt to the digital age. These solutions offer a comprehensive platform for capturing, storing, organizing, and retrieving information efficiently. During implementation, organizations typically start by assessing their current document workflows, identifying pain points, and defining objectives. Then, they customize the DMS to align with their specific needs, integrating it with existing systems for seamless data exchange.

Moreover, advanced DMS solutions often feature automation capabilities, intelligent search algorithms, and robust security measures, reducing manual data entry, enabling quick data retrieval, and safeguarding sensitive information. The implementation process involves data migration from legacy systems, user training, and change management to ensure smooth adoption across the organization. Once implemented, these solutions offer numerous benefits, including improved collaboration, reduced paper dependency, enhanced compliance, and increased productivity.

Furthermore, they facilitate remote work by enabling access to documents from anywhere, fostering agility and business continuity. In today's fast-paced business environment, advanced DMS solutions have become indispensable tools for organizations seeking to optimize their operations, enhance decision-making, and stay competitive in a rapidly evolving digital landscape.

Competition Analysis:

Competitive analysis and profiles of the major players in the document management market includes OpenText Corporation, IBM Corporation, Oracle Corporation, Canon Inc., Ricoh Company, Ltd., SpringCM, Hyland Software Inc., Revver, Inc, Xerox Corporation and Zoho Corporation. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the document management industry globally.

Regional Insights:

The document management market is witnessing significant growth globally, driven by the increasing adoption of digital solutions, regulatory compliance needs, and the shift toward paperless environments in various sectors.

North America leads the global market, primarily due to the early adoption of advanced technologies, including cloud-based document management systems (DMS). The U.S. and Canada are key contributors, with industries like healthcare, finance, and government driving demand for DMS to ensure data security, streamline operations, and meet stringent regulatory requirements like HIPAA and Sarbanes-Oxley. The region's focus on digital transformation, along with a mature IT infrastructure, positions North America at the forefront of the market.

Europe follows closely, with significant demand for document management systems across industries such as manufacturing, legal, and public administration. The region's strict data protection laws, such as the General Data Protection Regulation (GDPR), have led to increased investment in secure and compliant DMS solutions. Countries like the U.K., Germany, and France are key markets, where enterprises are focusing on optimizing workflow efficiency and reducing administrative costs through automation and digital document solutions.

Asia-Pacific is experiencing rapid growth in the market due to increasing digitalization initiatives across businesses and government agencies. Countries like China, Japan, India, and Australia are seeing a rise in DMS adoption as they modernize business processes and shift toward cloud-based solutions. The region's expanding IT sector, coupled with the growth of industries such as BFSI (Banking, Financial Services, and Insurance) and retail, is driving the demand for efficient document management systems. In particular, India and China are focusing on improving data management and compliance, which is boosting market growth.

Latin America and the Middle East & Africa are emerging regions in the market. In Latin America, countries like Brazil and Mexico are increasingly adopting digital document solutions to enhance business productivity and meet regulatory standards. The Middle East, particularly the UAE and Saudi Arabia, is investing in DMS as part of broader digital transformation strategies aimed at improving public sector efficiency and reducing reliance on paper-based processes.

Recent Partnerships in the Market:

In September 2023, Coforge partnered with Newgen, to deliver insurance lifecycle management solutions in Customer Communications Management (CCM), Document and Content Management (DCM) on the Low Code platform.

Recent Product Launches in the Market:

In August 2022, dox2U launched a new feature to its platform to enhance the user experience. dox2U is democratizing document management at workplaces by creating a single source for all documented information.

Recent Collaboration in the Market:

In July 2023, Adlib Software collaborated with Generis to launch a software connector that provides seamless integration between both technology platforms. The platform provides standardized apps for regulatory, quality, safety, and clinical processes powered by a single structured data lake that gives users instant access to cross-functional data and enables powerful process optimization.

Recent Acquisition in the Market:

For instance, in May 2023, Valsoft Corporation Inc. acquired Irosoft Inc.(“Irosoft”). Irosoft offers a large array of consulting services in the field of information management and digital transformation.

Key Benefits for Stakeholders:

- The study provides an in-depth document management market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the document management market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the document management industry.

- The quantitative analysis of the global document management market for the period 2022–2032 is provided to determine the market potential.

Document Management Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 34.2 billion |

| Growth Rate | CAGR of 17.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By End-User |

|

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | SpringCM A DocuSign Company, Zoho Corporation, Hyland Software Inc., Canon Inc., OpenText Corporation, Revver, Inc, Ricoh Company, Ltd., Xerox Corporation, Oracle Corporation, IBM Corporation |

Analyst Review

As the document management industry continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. Storing business documents physically is expensive as well as risky. DMS, particularly cloud based DMS, includes a variety of features including digital archiving and storage, and others. that focus on improved digital preservation, data backup, and recovery in the situation of emergencies or catastrophes. In addition, IT infrastructure transformation is one of the main advantages of document management systems. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, using DMS can reduce the need for human labor, which will ultimately be profitable for several industries including manufacturing. The combination of document management systems aims at reducing costs as for on-premises data centers, there is no requirement for additional expenses. However, businesses also recognize the challenges associated with the document management systems market. One significant challenge is the connectivity concerns, document management systems need constant communication. The benefits of cloud-based AI tools might be hampered by insufficient internet connectivity, which can make it challenging for organizations to adopt document management systems solutions. In addition, document management systems require significant investment in infrastructure, data analytics capabilities, and expertise, which can limit the global adoption of market.

Furthermore, sensitive data used by businesses is frequently targeted by hackers for data breaches. Therefore, while utilizing document management systems, businesses need to establish privacy rules and safeguard all data. By addressing these challenges, businesses can unlock the full potential of document management systems to transform their operations, create value, and gain a competitive advantage in their industry. For instance, in July 2023, Adlib Software collaborated with Generis to launch a software connector that provides seamless integration between both technology platforms. The platform provides standardized apps for regulatory, quality, safety, and clinical processes powered by a single structured data lake that gives users instant access to cross-functional data and enables powerful process optimization.

North America is the largest market for the Document Management.

The growing trend of advanced technologies in organizations is one of the major factors driving the global market growth.

The Document Management Market is expected to reach $34,200.93 Million by 2032.

The key growth strategies for Document Management include product portfolio expansion, acquisition, partnership, merger, and others.

The key players operating in the market include OpenText Corporation, IBM Corporation, Oracle Corporation, Canon Inc., Ricoh Company, Ltd., SpringCM, Hyland Software Inc., Revver, Inc, Xerox Corporation and Zoho Corporation.

Loading Table Of Content...

Loading Research Methodology...