The global drilling and completion fluids market was valued at $8.6 billion in 2022, and is projected to reach $12.9 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Report Key Highlighters:

- The drilling and completion fluids market analysis study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million), volume (kilotons) for the projected period 2023-2032.

- The study incorporated research methodology aims to present a comprehensive outlook on global markets and aid key stakeholders & players in making well-informed decisions to accomplish their ambitious growth goals.

- Over 1,500 product literatures, industry statements, annual reports, and other comparable materials from major drilling and completion fluids industry participants were reviewed to gain a better understanding of the market.

- The drilling and completion fluids market is fragmented, with several players including Baker Hughes Incorporated, Halliburton, New Park Resources Inc., National Oilwell Varco (NOV INC), Schlumberger Limited, Scomi Group Bhd, Secure Energy, Tetra Technologies, Trican Well Service Ltd., and Weatherford International Plc. Also tracked key strategies such as acquisitions, product launches, developments, partnership, mergers, expansion etc. of the players operating in the drilling and completion fluids industry.

Drilling and completion fluid is used in drilling boreholes into the earth. Although drilling fluids and completion fluids vary in their functionalities, they can be used for different purposes in the same operations and the same applications such as oil & gas production and piling of metro pillars. Drilling fluids are used in oil & gas drilling to carry rock cutting to the surface and are used as lubricant & coolant for the drill bit. In addition, completion fluids are used to improve well productivity by reducing damage to the production zone and can help repair, prepare, clean out, and complete the well bore during the completion phase.

The global drilling and completion fluids market growth is driven by a surge in demand from oil & gas exploration and production sites and the construction industry. Drilling and completion fluids are used as additives in structures foundation. In addition, drilling and completion fluids are used in piling for piers or pillars for superstructures such as metro railway pillars and flyover pillars. Moreover, the expansion of the oil & gas industry, the surge in demand for conventional fuel, and the development of the construction industry escalated the demand for drilling and completion fluids.

Furthermore, the Middle East and North America are the potential markets for drilling and completion fluids, due to the presence of many oil fields and reserves. In addition, the development of automotive and aeronautical industries across developing countries, such as Brazil, China, and India, has propelled the demand for conventional fuels, which, in turn, led to an increase in demand for drilling and completion fluids.

However, drilling and completion fluids are acidic and reactive in nature; hence, are handled with special requirements while operating with such fluids. Thus, these challenges restrain the growth of the global market.

The drilling and completion fluids market scope are segmented into application, fluid system, well type, and region. By application, the market is bifurcated into onshore and offshore. On the basis of fluid system, it is segregated into water-based system, oil-based system, synthetic-based system, and Others. Depending on well type, it is fragmented into conventional wells and high-pressure high temperature (HPHT) wells. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

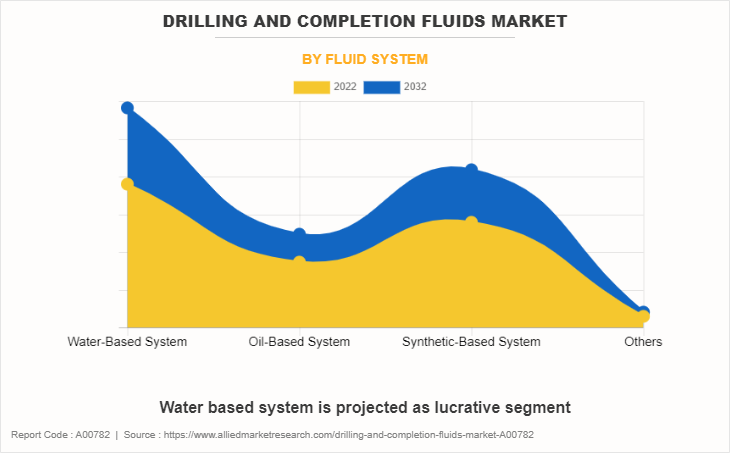

Based on the fluid system, the water-based system segment held the highest market share in 2022, accounting for nearly two-fifths of the global drilling and completion fluids market revenue, and is estimated to maintain its leadership status throughout the forecast period. The rapid increase in demand for oil has led to an increase in oil production, which increases the use of drilling and completion fluids. In addition, a water-based system regulates the temperature in oil fields and creates pressure in the wellbore, which acts as the key growth driver of the drilling and completion fluid market.

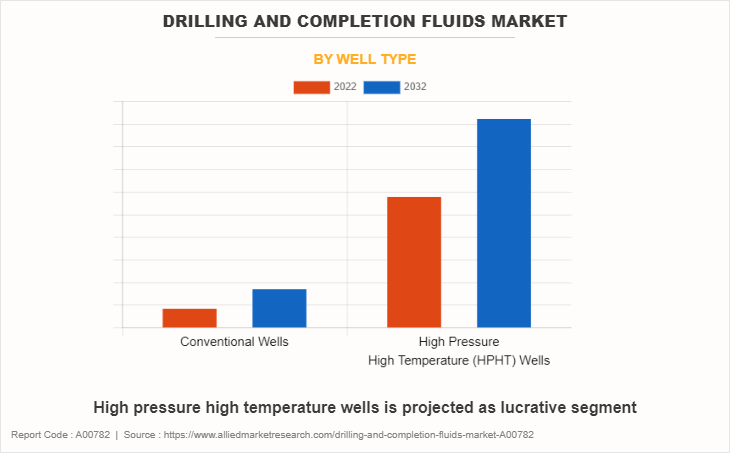

Based on well type, the high-pressure high-temperature segment held the highest market share in 2022, accounting for nearly three-fourths of the global drilling and completion fluids market size, and is estimated to maintain its leadership status throughout the forecast period. HPHT wells are majorly in the offshore basin, and the rise in deep water exploration activities leads to an increase in demand for drilling and completion fluids, which is expected to create the drilling and completion fluid market opportunities for lucrative expansion.

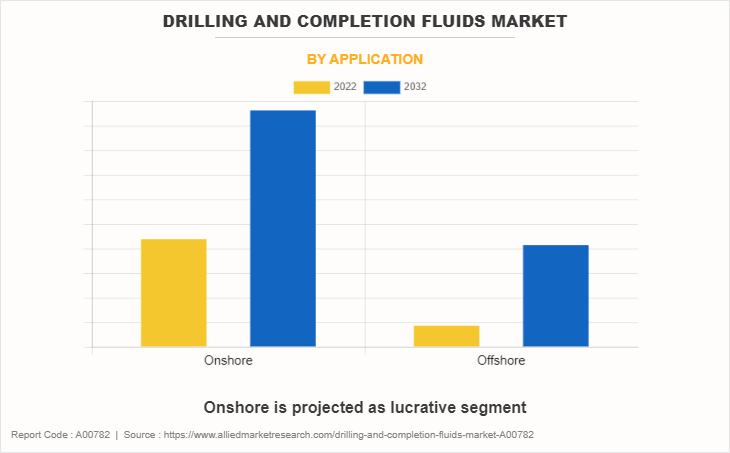

Based on application, the onshore segment held the highest market share in 2022, accounting for three-fifths of the global drilling and completion fluids market share and is estimated to maintain its leadership status throughout the forecast period and is projected to manifest a lucrative CAGR. The surge in demand for oil & gas and related products led to an increase in the production of drilling and completion fluid, which act as the major driver of the market. In addition, rising onshore sites propel the market growth, as onshore sites are easily operatable, and it takes fewer years for production in comparison to offshore

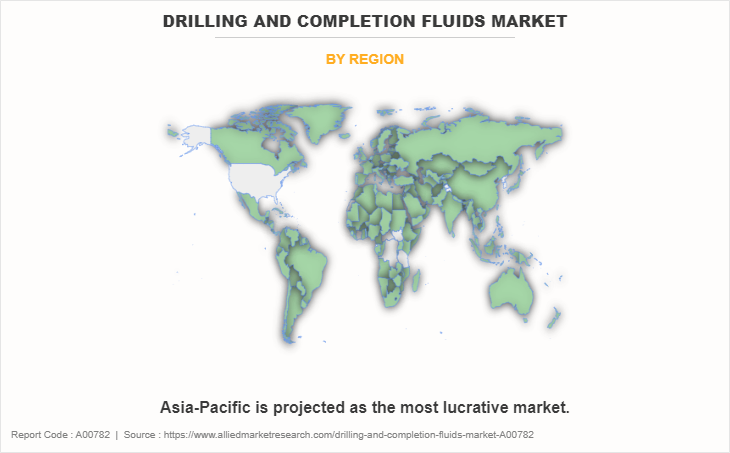

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global market revenue, and is likely to dominate the market during the drilling and completion fluids market forecast period. The high rate of production and exploration activities in North America has led to an increase in demand for drilling and completion fluids, which acts as a major driver of the market. In addition, North America is involved in both onshore and offshore production, which is expected to boost the need for drilling and completion of fluids.

The major players studied and profiled in the drilling and completion fluids are Baker Hughes Incorporated, Halliburton, New Park Resources Inc., National Oilwell Varco (NOV INC), Schlumberger Limited, Scomi Group Bhd, Secure Energy, Tetra Technologies, Trican Well Service Ltd., and Weatherford International Plc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the drilling and completion fluids market analysis from 2022 to 2032 to identify the prevailing drilling and completion fluids market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the drilling and completion fluids market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global drilling and completion fluids market trends, key players, market segments, application areas, and market growth strategies.

Drilling and Completion Fluids Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.9 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 291 |

| By Fluid System |

|

| By Well Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Scomi Group Bhd, TETRA Technologies Inc., Baker Hughes Inc., NOV INC., New Park Resources Inc., Secure Energy Services Inc, Weatherford International Ltd., TRICAN, Halliburton Company, Schlumberger Limited |

Analyst Review

According to CXOs of leading companies, the drilling and completion fluid market is anticipated to witness notable growth during the forecast period driven by a surge in demand for conventional fuels and a rise in construction activities. The oil & gas market is witnessing growth globally at a significant pace, which acts as a key driver of the drilling and completion market. In addition, an increase in demand for automotive and the expansion of the construction industry in the emerging economies of Brazil, India, and China, are expected to augment the market growth during the forecast period. Furthermore, an increase in the use of conventional fuel in major industries such as automotive and aeronautical is expected to boost the demand for drilling and completion fluids.

Although LAMEA has emerged as a lucrative region for investors, North America is perceived as a mature market for drilling fluids due to the rise in oil & gas exploration and production activities in the region. An increase in demand for drilling fluids from developing nations such as the UAE, India, and China, is expected to drive the growth of the market during the forecast period.

Environmentally Friendly Formulations, Digitalization and Automation, Rise of Renewable Energy Sources, Advanced Wellbore Stability Solutions, Nanotechnology Integration are the upcoming trends of Drilling and Completion Fluids Market in the world.

Onshore is the leading application of Drilling and Completion Fluids Market.

North America is the largest regional market for Drilling and Completion Fluids.

Some of the top companies that hold significant market share in the Drilling and Completion Fluids industry include: 1. Baker Hughes Incorporated 2. Halliburton 3. Newpark Resources Inc. 4. National Oilwell Varco (NOV INC) 5. Schlumberger Limited 6. Scomi Group Bhd 7. Secure Energy 8. Tetra Technologies 9. Trican Well Service Ltd. 10. Weatherford International Plc. These companies are key players in providing drilling and completion fluid solutions, offering a wide range of products and services to the oil and gas industry globally.

The estimated industry size of Drilling and Completion Fluids is about $12.9 billion in 2032.

Loading Table Of Content...

Loading Research Methodology...