The global drone communication market size was valued at $2.3 billion in 2022, and is projected to reach $15.8 billion by 2032, growing at a CAGR of 21.4% from 2023 to 2032.

Drone communication refers to the set of technologies and methods employed by drones (unmanned aerial vehicles or UAVs) to establish a data link between the vehicle and ground control stations (GCS).

The drone communication technology plays a crucial role in facilitating command and control (C2), broadcasting telemetry data, and transmitting video and sensor data from the UAV to the control station. Utilizing various communication methods, such as radio, satellite communication (SATCOM), cellular communication, and drone-to-drone communication, the industry aims to establish reliable and efficient connections for seamless drone operations.

Key Takeaways of Drone Communication Market Report

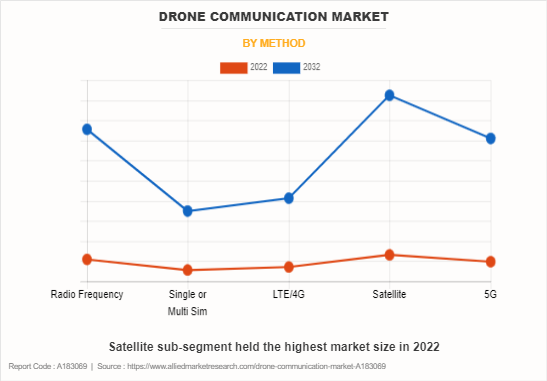

- Based on method, the satellite sub-segment emerged as the global leader in 2022 and the 5G sub-segment is anticipated to be the fastest growing during the forecast period.

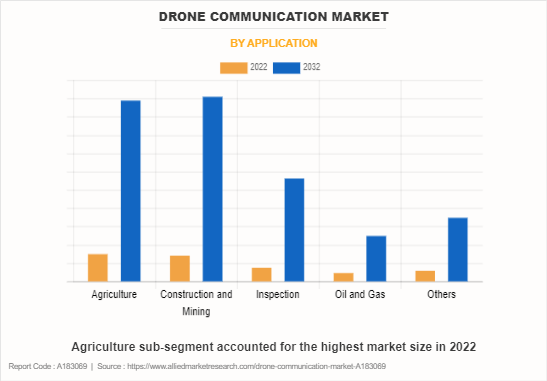

- Based on application, the construction & mining sub-segment emerged as the global leader in 2022 and the inspection sub-segment is predicted to show the fastest growth in the upcoming years.

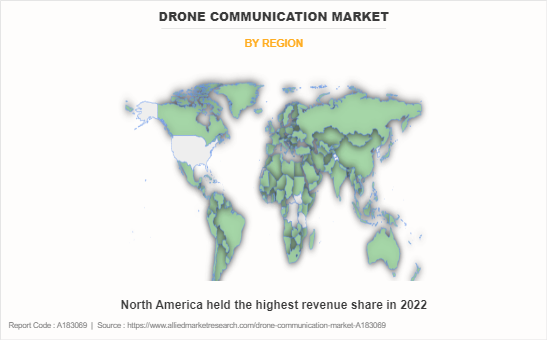

- Based on region, North America registered the highest market share in 2022 and Asia-Pacific is projected to the show fastest growth during the forecast period.

- The report on drone communication market comprehensively analyzes over 16 countries, conducting a segment analysis for each country based on value ($ billion) during the forecast period of 2023-2032.

- The research incorporates high-quality data, key industry participant's opinions, and crucial growth-driving factors to offer a balanced view of global markets.

- The objective of this study is to assist stakeholders in making well-informed decisions to achieve ambitious growth trends. Also, to gain deeper insights into the market, the study reviewed more than 3,700 product literature, annual reports, industry statements, and similar research materials from key industry participants.

Impact of Russia-Ukraine War on Drone Communication Industry

The Russia-Ukraine War had a profound impact on the drone communication market forecast, ushering in a series of changes driven by the complex geopolitical landscape and evolving military strategies. One notable consequence is the heightened demand for advanced drone technology for surveillance and reconnaissance purposes in conflict zones. As both sides deploy drones to gather intelligence and monitor enemy movements, the drone communication industry has experienced a surge in demand for robust, secure, and efficient communication systems. The conflict has prompted regulatory changes as governments seek to adapt to the evolving nature of warfare. New rules and restrictions on drone usage have been implemented, necessitating adjustments in communication protocols and encryption methods to ensure compliance with heightened security measures. This shift has compelled industry players to innovate rapidly, focusing on developing communication systems that can operate seamlessly in dynamic and challenging environments.

Segment Overview

The drone communication market analysis is provided on the basis of Method and Application.

By method, the satellite sub-segment dominated the global drone communication analysis in 2022. Drone communication via satellite method has gained significant popularity in recent years owing to its growing applications across military unmanned aerial vehicles (UAVs). For instance, military UAVs often operate outside their home territory, requiring continuous communication beyond the line of sight. Satellite networks overcome traditional limitations and ensure uninterrupted connectivity. Also, mission requirements demand higher resolution real-time transmission of video, imaging, and sensing data. Satellite links provide the necessary bandwidth for achieving these demands, enabling superior situational awareness among warfighters.

As military UAVs perform Intelligence, Surveillance, and Reconnaissance (ISR) operations by relying on live battlefield situational awareness, the use of satellite communication in such cases ensures constant data relay, allowing warfighters to stay informed and make informed decisions. For instance, SpaceBridge Inc., the Canada-based leading drone company offers Tactical satellite communication (SATCOM) Network architecture that enhances UAV communication by providing higher data throughput rates. This technology enables UAVs to access large bandwidth pools with low latency, improving network efficiencies. These factors are predicted to boost the satellite drone communication market growth in the upcoming years.

By application, the agriculture sub-segment dominated the global drone communication market share in 2022. Drone communication plays a vital role in the agriculture sector for precision irrigation, crop monitoring, and optimized resource management. For instance, drone communication facilitates real-time crop monitoring and analysis by utilizing sensors like multispectral and thermal cameras. This enables farmers to detect diseases, pests, and nutrient deficiencies early, leading to proactive measures and improved crop yields. Also, effective drone communication aids in optimizing agricultural resource management such as water, fertilizers, and pesticides. Drones also gather the data related to soil moisture, nutrient content, and pest infestations that help in increasing productivity and minimizing the environmental impact.

Furthermore, drone communication assists farmers in complying with environmental regulations by providing accurate data on farming practices. This includes monitoring pesticide application, assessing soil erosion, and ensuring adherence to conservation measures, contributing to transparent and traceable farming practices. In the precision irrigation sector, drone communication is crucial as it offers real-time data on soil moisture and crop water requirements. Drones with thermal imaging identify areas with inadequate irrigation, enabling precise irrigation strategies, conserving water resources, and promoting sustainable agricultural practices. These factors are anticipated to drive the drone communication demand in the agriculture sector during the forecast period.

By region, North America dominated the global drone communication industry in 2022. North America is home to major global players in the drone industry such as Skydio, 3D Robotics, PrecisionHawk, AeroVironment, and others, resulting in a large number of drone-related businesses. The demand for both hardware and software, including drone services, has led to the emergence of numerous companies and startups, indicating a thriving market. In addition, ongoing efforts to establish a robust Unmanned Traffic Management (UTM) system, that facilitates the multiple drone operations conducted beyond visual line-of-sight (BVLOS), contribute significantly to the North America drone communication market opportunities.

In addition, increasing demand for drone services in North America across various sectors, such as photography, surveillance, construction, and agriculture is contributing to the market growth. Drone companies like Zipline, specializing in medical drone deliveries, have opened avenues for advanced drone applications, expanding the role of drones in diverse industries. Also, well-aligned drone regulations in North America, particularly in the U.S., provide clarity for drone operators in terms of safety measures, licensing & certification of drones, registration requirements, and other processes. The Federal Aviation Administration (FAA) maintains transparent rules, ensuring a conducive environment for drone flights, fostering ease of operation within the drone community.

Competitive Analysis

The key players profiled in the drone communication market report include DJI, Parrot Drone SAS, AeroVironment, Inc., Yuneec, Skydio, Inc., AgEagle Aerial Systems Inc, Draganfly Innovations Inc., Teal Drones, Microdrones, and Freefly Systems. Product launch, business expansion, and partnership are common strategies followed by major market players. For instance, in November 2023, Chinese scientists achieved a milestone in drone technology by creating a fleet of drones capable of engaging in ‘group chat’ for collaborative tasks. Unlike traditional drone swarms inspired by bee and ant colonies, this innovative approach allows drones to communicate and cooperate like human teams. The breakthrough opens up diverse applications, notably enhancing security patrols, disaster rescue operations, and optimizing aerial logistics.

Market Dynamics

In the realm of drone and UAV technology, communication is fundamental for enabling a seamless flow of information between the aerial vehicles and their operators on the ground. Drones utilize a range of communication methods to relay crucial data, including location, telemetry, and live video feeds. From traditional radio-frequency (RF) signals to advanced satellite and cellular communication, each method serves specific purposes, contributing to the overall efficiency and capabilities of drone systems. As drone applications diversify, from surveillance to delivery services, the significance of robust and adaptable communication systems becomes increasingly vital.

Availability of robust communication technologies, advancements in satellite communication technologies, and range optimization are the key factors driving the drone communication market. For instance, various communication technologies, including radio, satellite communication (SATCOM), cellular, and drone-to-drone communication, drives innovation in the drone communication industry. For instance, the widespread coverage and excellent uptime provided by SATCOM facilitate global connectivity, thereby projected to drive the market growth during the forecast period. Furthermore, cellular communications using 4G and 5G open avenues for beyond visual line of sight (BVLOS) operations. The benefits of cellular datalinks including enhanced data rates and ultra-low latency make them suitable for bandwidth-intensive applications such as streaming high-definition video, driving the industry to leverage these capabilities.

Challenges linked with long-distance communication, scalability, and computational variability are anticipated to restrain the drone communication demand in the upcoming years. For instance, communicating at scale with fleets of numerous drones over extensive distances poses a significant challenge. This is because the current radio prototypes lack the reliability needed to manage large drone fleets effectively.

Also, achieving scalability in multi-robot applications while accommodating mission-specific behaviors for each drone is a restraint. In addition, variability in computational capabilities among different drones within a fleet presents a challenge for the drone communication industry. This is because ensuring optimal mission performance requires addressing the computational variability, implementing adaptive communication strategies, and developing solutions that account for the diverse computing capabilities of the drone fleet which is difficult at the moment.

Growing applications of drone communication in the construction and mining industry to generate excellent opportunities in the market. This is because drones contribute to significantly safer construction and mining sites by capturing 3D views with centimeter-level resolution and accuracy. This creates opportunities for real-time communication and monitoring of safety protocols, reducing the need for risky physical inspections and enhancing overall site safety.

In addition, the use of construction drones leads to massive savings on survey-grade site surveys. This is majorly owing to the high-resolution imagery and precise data collection that enable faster and more cost-efficient topographical surveys. This presents an opportunity for streamlined communication of accurate survey information, facilitating better decision-making throughout the project lifecycle. Furthermore, the drones offer real-time tracking through updated and accurate construction data. This facilitates continuous monitoring of project progress, enabling stakeholders to align actual construction with planned objectives.

The opportunity lies in leveraging this real-time tracking for efficient communication among project managers, contractors, and stakeholders, reducing delays and ensuring project timelines are met. Drones offer a cost-effective solution for maintenance inspections in construction and mining. This is majorly owing to the visual inspections of large assets or hard-to-reach areas facilitated by drone communication. These factors are predicted to have a positive impact on the drone communication industry during the forecast timeframe.

Key Benefits For Stakeholders

- The report provides an exclusive and comprehensive analysis of the global drone communication market trends along with the market forecast.

- The report elucidates the market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the market growth.

Drone Communication Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.8 billion |

| Growth Rate | CAGR of 21.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | AgEagle Aerial Systems Inc., Draganfly Innovations Inc., Yuneec, DJI, Skydio, Inc., Microdrones, teal drones, Parrot Drone SAS, freefly systems, AeroVironment, Inc. |

The drone communication industry is estimated to reach $15,759.9 million by 2032.

The top companies to hold highest market share in drone communication industry are DJI, Parrot Drone SAS, AeroVironment, Inc., Yuneec, Skydio, Inc., AgEagle Aerial Systems Inc, Draganfly Innovations Inc., Teal Drones, Microdrones, and Freefly Systems.

The growing demand for advanced surveying solutions and enhanced safety protocols that is facilitated by the drone communication market are the upcoming trends in the market.

North America is the largest regional market for drone communication.

The use of drones in agriculture, construction & mining are the leading applications of the drone communication industry.

Loading Table Of Content...

Loading Research Methodology...