Drone Defense System Market Summary

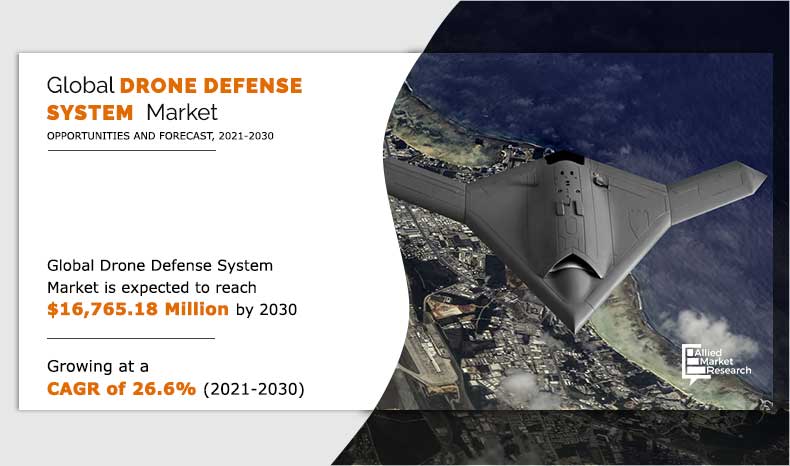

The global drone defense system market size was valued at $2,135.62 million in 2020, and is projected to reach $16,765.18 million in 2030, registering a CAGR of 26.6%. The need for drone defense systems is rising with the advancements in drones for checking the illegal entry of drones and countering potential drone attacks.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2020.

The global drone defense system market share was dominated by the military segment in 2020 and is expected to maintain its dominance in the upcoming years

The countermeasure systems segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2020 Market Size: USD 2,135.62 Million

- 2030 Projected Market Size: USD 16,765.18 Billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 26.6%

- Asia-Pacific: Generated the highest revenue in 2020

The development of advanced counter-drone technologies has become critical, owing to the exponential rise in the illegal entry of drones in security-critical places such as military bases. Several nations around the world have launched and implemented policies related to countering unmanned aerial systems. A drone defense system involves drone monitoring equipment, radio frequency (RF) analyzers, acoustic sensors, optical sensors, radars, RF jammers, and high-energy lasers to detect and/or destroy unauthorized drones.

Dramatic rise has been witnessed in the adoption of unmanned aerial vehicles (UAVs) for surveillance, recreational, and commercial applications across the world. The absence of security protocols and standards has resulted in a tremendous rise in the instances related to a security breach at military bases, government establishments, and public places. Furthermore, surge in demand for detection and identification of illegal drones has become a key factor to ensure overall national security, thus fueling the growth of the global drone defense system market.

Rise in drone-related incidents across the globe

The use of drones has increased drastically over the years, especially to ensure border safety, counter-insurgency, and to conduct surveillance across commercial properties. Drones or unmanned aerial vehicles (UAVs) can identify security and terrorism-related challenges and locate vulnerable zones that are prone to several risks. Drones are the modern force multiplier that can improve the abilities of security forces to monitor criminal activities and tackle evolving challenges in defense and homeland security. In addition, the commercialization of drones is being witnessed throughout the world, as they are often used by oil & gas companies, survey agencies, land & water resources protection agencies, and news agencies, which notably contributes toward the growth of the global drone defense system market.

Furthermore, falling prices of drones and their easy availability to public acts as the key driving forces of the drone defense system industry. In addition, increase in adoption of advanced drones to carry out aerial surveillance at restricted areas and public gatherings such as political rallies, sporting events, smuggling, terror missions, and other illegal activities boosts the market growth. In the last couple of years, the world has witnessed an increasing number of drones-related incidents globally. For instance, countries such as the UK, Saudi Arabia, France, the U.S., India, Spain, and Germany have witnessed aerial surveillance done by unverified drones, attacks on oil reserves, and arms & ammunitions dropping. Such incidents have experienced an exponential growth over the last five years, which notably augment the drone defense system market growth.

With upsurge in manufacturing of drones throughout the world, adverse events are likely to increase exponentially, and it is of paramount importance for governments to safeguard their borders, people, and assets from the evolving nature of threats. If gone unchecked, drone-related threats may result in immense financial implications and loss of many lives throughout the world. Thus, rise in in malicious drone-related incidents has led to increase in use of drone defense technologies, which can spot and destroy the drones or make them nonfunctional. This acts as a major factor that fuels the growth of the global drone defense system market. Moreover, various companies have a wide range of counter-drone technologies that can detect, classify, alert, and destroy any foreign drones, which is anticipated to propel the market growth during the forecast period.

By End-user

Military is projected as the most lucrative segments

Emergence of various start-ups offering drone defense systems

With rise in demand for counter-drone technologies across the world, multiple new companies have been set up over the years to offer their solutions in the drone defense system market. They have come up with smart solutions that can detect, disarm, and destroy any unauthorized drone trying to enter restricted boundaries. Some of the prominent start-ups in the field of the drone defense industry are Dedrone, DroneShield, and Fortem Technologies. Through strategies such as product launch, product development, and partnership, these companies have gained strong traction in the market.

Dedrone is a provider of artificial intelligence (AI)-based intelligent airborne safety solutions. Its portfolio contains a wide range of RF sensors to spot, classify, and trace several drones instantaneously based on different factors, for instance, shape, sound, & movement patterns. In addition, the company has a machine learning (ML)-based drone defense platform to mechanize the safety of airspaces against unlawful drones.

DroneShield Ltd. is one of the prominent developers of a drone detection system. Its technology detects the entry of unauthorized drones based on real-time warnings produced by audio recognition systems. It senses drones that go imperceptible by radars. The company’s product portfolio includes drone sentries, drone nodes, long-range sensors for far-reaching drone detection, omnidirectional sensors for wide full-range drone detection, and a drone shield user interface (UI) for online checking of drone activity.

Fortem Technologies, Inc. makes radar systems for spotting aerial objects and counter drone systems for military, commercial, and law enforcement uses. Its DroneHunter is a self-governing perimeter detection and protection solution made to detect, classify, and protect against illegal drones. In addition, the company offers a military version of DroneHunter that has been designed to meet the specific safety needs of the U.S. armed forces.

Thus, launch of various cutting-edge counter-drone systems by start-ups and the adoption of several strategies to enhance their product offerings are expected to propel the growth of the global drone defense system market during the forecast period.

By Technology

Countermeasure Systems is projected as the most lucrative segments

Issues associated with drone defense technologies

Counter-drone technologies have been introduced to help nations to offer protection against the rise in instances of drones being used for unlawful activities. However, certain limitations are associated with the use of these technologies in detecting and destroying drones. For instance, radar is a suitable instrument used for the detection of aircraft. However, multiple challenges with the usage of radars for detecting drones limit their adoption across the globe.

For instance, the nature of the drone’s low altitude and speed of flying as well as small radar cross-section (RCS) make it hard to differentiate noise or clutter from the actual target. Currently, the challenges being encountered regarding counter-drone technology are multiple as drone technology is itself evolving at a rapid rate. Reconnaissance, intelligence, surveillance & target acquisition (RISTA) as well as drone defense system systems will have to function as a single unit to handle the risks associated with both standalone and drone swarms. Furthermore, technical challenges get intensified when authorities try to spot and restrict drone swarms in which it will not be necessary that all drones have a detectable radio frequency (RF) signature. These issues related to the counter-drone technologies are anticipated to hamper the growth of the global drone defense system market.

By Application

Ground Station is projected as the most lucrative segments

Technological advancements in tackling drone swarms

Although drones are small and lightweight, they are capable to cause devastating outcomes if they are equipped with weapons. Drone swarms involve multiple drones flying in sync, which can be controlled remotely or fly autonomously to carry out surveillance or to drop weapons or drugs in unauthorized territories. To detect and destroy such a large number of drones is challenging, as even a single drone is capable of creating havoc by attacking its target. Manufacturers are designing and testing cutting edge radars that can detect and alarm the personnel early to the arrival of drone swarm’s entry at the required area (for instance, Q-53 radar by Lockheed Martin). Such radars can be highly useful in detecting drone attacks as they evolve.

Another important counter-drone technology that industry experts and universities are working on is the high-power laser beam technology, which integrates various fiber lasers to produce a high-energy weapon beam to detect and defeat drone swarms. High-power laser beam technology will be easily scalable to meet different levels of power and fire repeatedly.

Thus, introduction of such counter-drone technologies is expected to offer remunerative opportunities for the expansion of the global drone defense system market during the forecast timeframe.

By Region

Asia-Pacific would exhibit the highest CAGR of 30.7% during 2021-2030.

Segments Overview

The global drone defense system market segmentation into end user, technology, application, and region. On the basis of end user, the is segregated into military, homeland security, and commercial. Depending on technology, it is categorized into identification & detection systems and countermeasure systems. By application, it is fragmented into drone mounting and ground station. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

The key players operating in the global market include Aaronia AG, Aselsan AS, Blighter Surveillance Systems Ltd., Dedrone, Inc., Droneshield, Hensoldt, Leonardo S.P.A., Mistral Solutions Pvt. Ltd., Rheinmetall AG, and Rinicom Ltd.

Key Benefits For Stakeholders

This study presents analytical depiction of the global drone defense system market analysis along with current trends and future estimations to depict imminent investment pockets.

The overall market opportunity is determined by understanding profitable drone defense system market trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and drone defense system market opportunities with a detailed impact analysis.

- The current drone defense system market forecast is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the drone defense system industry.

Key Market Segments

By End-User

Military

- Homeland Security

- Commercial

By Technology

Identification & Detection Systems

Countermeasure Systems

By Application

Drone Mounting

Ground Station

By Region

North America

U.S.

Canada

- Mexico

Europe

- Germany

- UK

- France

- Russia

- Rest of Europe

Asia-Pacific

China

Japan

- India

- South Korea

- Rest of Asia Pacific

LAMEA

Latin America

Middle East

- Africa

Key Players

Aaronia AG

- Aselsan AS

- Blighter Surveillance Systems Ltd.

- Dedrone, Inc.

- Droneshield

- Hensoldt

- Leonardo S.P.A.

- Mistral Solutions Pvt. Ltd.

- Rheinmetall AG

- Rinicom Ltd.

Analyst Review

The global drone defense system market is expected to witness significant growth due to the superior protection offered by drone defense system, against the ever-evolving drone technology and continuously rising instances related to illegal entry of drones in restricted places.

Rise in drone-related incidents across the globe and the emergence of various startups offering drone defense systems are expected to drive drone defense system market during the forecast period. However, issues related with the drone defense related technologies and inefficiencies of counter drone technologies are anticipated to hamper the growth of the market. Conversely, technological advancements in tackling drone swarms and rise in defense expenditure globally are expected to offer lucrative opportunities in future.

Rise in usage of drones for carrying out stealth spying solutions at security-critical places and regions has brought about an increase in awareness regarding the threats that drone pose to the security of a nation. Unmanned aerial systems or drones are fitted with advanced sensors that are capable of recording audio/video across any location. Militaries across the globe are procuring intelligent drone defense systems to tackle the rising issues with rogue drones. Prominent players operating in the market are developing innovative counter-drone technologies that monitor and prevent the drones from flying over unauthorized territory.

The government agencies such as Federal Aviation Administration (FAA) are supporting the development and testing of efficient drone detection and mapping technologies, as they deliver precise tracking and improved discovery of drones, together with anti-jamming and direction finding (DF) abilities. Market players are employing different strategies such as product launch, acquisition, partnerships, and contracts to gain a fair share of the market.

The drone defense system holds promising potential in enhancing border security along with offering safety against the unrestricted entry of drones in confidential and security critical commercial and government assets. Moreover, drone destroying systems are vital for checking the drone operations and immediately bringing them down in case the drone enters critical zones.

The global drone defense system market size was valued at USD 2,135.62 million in 2020, and is projected to reach USD 16,765.18 million by 2030.

The global drone defense system market is projected to grow at a compound annual growth rate of 26.6% from 2021-2030 to reach USD 16,765.18 million by 2030.

The key players profiled in the reports includes Aaronia AG, Aselsan AS, Blighter Surveillance Systems Ltd., Dedrone, Inc., Droneshield, Hensoldt, Leonardo S.P.A., Mistral Solutions Pvt. Ltd., Rheinmetall AG, and Rinicom Ltd.

Asia-Pacific dominated and is projected to maintain its leading position throughout the forecast period.

Rise in drone-related incidents across the globe, Emergence of various start-ups offering drone defense systems, Issues associated with drone defense technologies, Technological advancements in tackling drone swarms majorly contribute toward the growth of the market.

Loading Table Of Content...