Drone Insurance Market Research, 2032

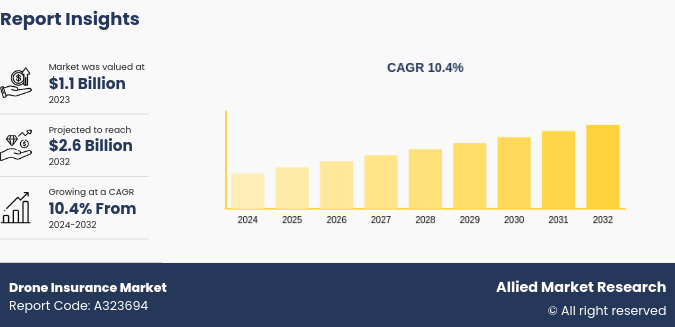

The global drone insurance market was valued at $1.1 billion in 2023, and is projected to reach $2.6 Billion by 2032, growing at a CAGR of 10.4% from 2024 to 2032. The drone insurance market is expanding rapidly, driven by the increasing commercial and recreational use of drones, which necessitates coverage for potential risks such as accidents, theft, and liability. Insurers are developing specialized policies to address this emerging industry's unique challenges and regulatory requirements.

Market Introduction and Definition

The global drone insurance market comprises a range of providers offering a variety of coverage options. The majority of the drone insurance providers offer comprehensive coverage for physical damage, third-party liability, and professional indemnity. Some providers also offer additional insurance coverage for specialized areas, such as cargo, loss of income, or personal injury. With the increasing use of drones in various industries, the demand for drone insurance market is expected to rise.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the drone insurance market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the drone insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global drone insurance market outlook, key players, market segments, application areas, drone insurance industry and market growth strategies.

Key Takeaways

The drone insurances market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major drone insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends:

In June 2020, Allianz Global Corporate & Specialty (AGCS) acquired UAV insurance specialist, SkyWatch.AI to provide specialized insurance solutions.

In June 2020, Allianz Global Corporate & Specialty (AGCS) partnered with SkyWatch.AI to provide UAV insurance solutions.

In Canada, Transport Canada's regulations mandate liability insurance for commercial drone operations. Commercial drone pilots are required to carry liability insurance coverage as part of their certification process. The insurance coverage must meet the minimum requirements specified by Transport Canada.

In July 2021, China announced plans to install over 30GW of energy storage by 2025 (excluding pumped-storage hydropower) , a more than three-fold increase on its installed capacity.

Key market dynamics

The rising demand for drone-based services across various industries such as defense, public safety, logistics, and consumer applications, has been the key driver of the global drone (UAV) insurance market. This is because the use of drones has enabled companies to receive real-time data of their operations, and to provide better services. In addition, the increasing trend of drone deliveries, especially in the e-commerce sector, has also contributed to the market growth. Furthermore, the rising investments in the development of smart drones has created a need for insurance policies related to the use of drones.

However, high costs associated with insurance policies for drones are hindering the growth of the global drone (UAV) insurance market. In addition, the lack of awareness about the availability of such insurance policies is also expected to hamper the market growth. Nonetheless, increase in investments by the governments in drone-based projects is expected to create new opportunities for the market in the near future.

Global Drone Market

The global drone insurance market is a rapidly growing sector with immense potential. The demand for drone insurance is driven by the increase in use of drones for commercial, military and recreational purposes. The global drone insurance market is expected to benefit from the growth in demand for drone (UAV) operations in agriculture, aerial photography, wildlife monitoring and surveillance, inspection, delivery, and other services. Furthermore, increase in investments made by government and private organizations in the drone (UAV) industry is expected to fuel the growth of the drone (UAV) insurance market during the forecast period. The growing number of regulations governing the use of drones (UAVs) is the primary factor driving the growth of the global drone (UAV) insurance market. The demand for drone (UAV) insurance is also driven by the increasing awareness of safety and risk management among drone (UAV) operators.”

Market Segmentation

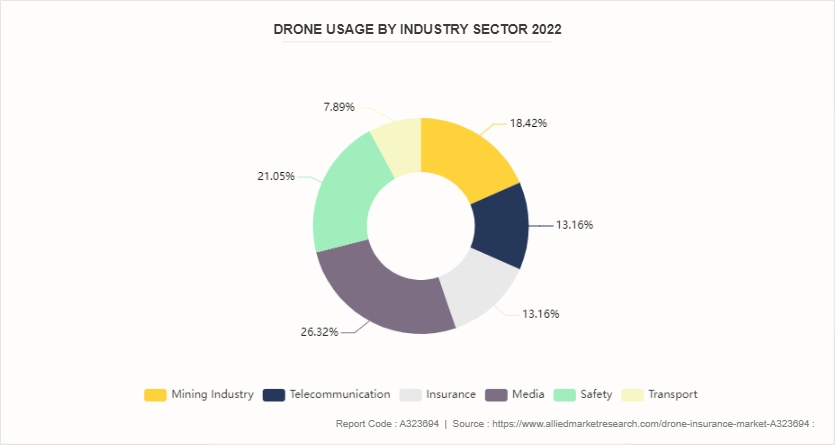

The drone insurance market is segmented into insurance type, application, drone type, and region. By insurance type, the market is divided into drone third-party liability insurance, drone fuselage damage insurance, drone hull insurance, and drone cargo insurance. As per application, the market is segregated into commercial, and personal. By drone type, the market is classified into fixed-wing, multi-rotor, and hybrid. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Drone (UAV) Insurance Market in North America is experiencing rapid growth due to the increasing demand for drone services in the region. The growth is driven by the increasing use of drones in commercial applications such as aerial photography, surveying, and delivery services. Additionally, the increasing number of drone operators in the region is also driving the growth of the market. The North American region is also witnessing a surge in the number of drone-related regulations, which is further driving the growth of the market. These regulations are aimed at ensuring the safety of the public and the environment and are helping to create a more secure and reliable drone industry.

Furthermore, the increasing demand for drone insurance is also driving the growth of the market. Drone insurance provides coverage for physical damage to the drone, liability coverage for third-party property damage, and coverage for bodily injury. Overall, the Drone (UAV) Insurance Market in North America is experiencing rapid growth due to the increase in demand for drone services, the increase in number of drone operators, and the increase in number of drone-related regulations. Additionally, the increasing demand for drone insurance is also driving the growth of the market.

In June 2020: Allianz Global Corporate & Specialty (AGCS) introduced a new UAV insurance product with innovative features.

In July 2020, Global Aerospace partnered with Global UAV to provide UAV insurance solutions.

Competitive Landscape

The major players operating in the drone insurance market include BWI, Thimble Insurance, SkyWatch.AI, Avion Insurance, USAIG, REIN, Coverdrone, Driessen Assuradeuren, Embroker, and Moonrock Insurance. Other players in drone insurance market includes InsureTech Connect, Global Aerospace Inc, Santam Group, Towergate, American International Group, Inc, and so on.

Recent Key Strategies and Developments

In June 2020, Allianz Global Corporate & Specialty (AGCS) introduced a new UAV insurance product with innovative features.

In August 2023, AXA XL introduced a new UAV insurance product with innovative features.

Key Sources Referred

Drone Industry Insights

Allianz Global Corporate & Specialty (AGCS)

SkyWatch.AI

ITRI Ltd.

European Aviation Safety Agency (EASA)

International Energy Agency

World Economic Forum

Willis Towers Watson

Key Benefits For Stakeholders

This report provides a quantitative analysis of the drone insurance market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities, and Drone Insurance Market Growth.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Drone insurance Market size segmentation assists to determine the prevailing drone insurance market opportunity and drone insurance market forecast.

Major countries in each region are mapped according to their revenue contribution to the global Drone insurance Market Share and Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global drone insurance market trends, key players, market segments, application areas, and market growth strategies.

Drone Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.6 Billion |

| Growth Rate | CAGR of 10.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Insurance Type |

|

| By Application |

|

| By Drone Type |

|

| By Region |

|

| Key Market Players | Avion Insurance, USAIG, Coverdrone, InsureTech Connect, SkyWatch.AI, REIN, Global Aerospace Inc., Driessen Assuradeuren, BWI, Towergate, Thimble Insurance, American International Group, Inc., Moonrock Insurance, Santam Group, Embroker |

The drone insurance market is projected to reach $2,586.53 million by 2032.

The drone insurance market is estimated to grow at a CAGR of 9.2% from 2024 to 2032.

The global drone (UAV) insurance market is driven by increasing demand for drone-based services across industries such as defense, logistics, and e-commerce, enabling real-time data collection and improved service delivery. The growing trend of drone deliveries, particularly in e-commerce, further fuels market growth.

The key players profiled in the report include Allianz Global Corporate & Specialty, AIG US, Coverdrone, Avion Insurance, Driessen Assuradeuren, ALIGNED, Flock, SkyWatch.AI and so on.

The key growth strategies of drone insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...