Dual Interface Payment Card Market Research, 2032

The global dual interface payment card market was valued at $7.8 billion in 2022, and is projected to reach $37.9 billion by 2032, growing at a CAGR of 17.4% from 2023 to 2032.

A dual interface payment card is a physical transaction card embedded with a chip for offline transactions, while also providing features for virtual card transaction which is used for online card payment or mobile app payment. In addition, this type of dual interface payment card allows users to make transactions across various channels, by combining the traditional card experience with digital payment capabilities. It also provides convenience and flexibility to the consumers.

Furthermore, the combination of cloud computing and the internet of things has the potential to create several benefits for businesses and consumers alike. The main benefits of contactless payment include faster transactions. In addition, the use of advanced technology in conjunction with the IoT can help to improve data management and analytics, as well as providing businesses with a better understanding of their products. Such enhanced factors are expected to provide lucrative opportunities for dual interface payment card market forecast.

Factors such as growing digitalization and rising need for intelligent banking systems and increase in adoption of advanced technologies are positively impacting the growth of the market. In addition, increasing adoption of IoT devices, and growing demand for automation, are expected to fuel the growth of the market during the forecast period.

Furthermore, expansion of contactless applications in various industries such as healthcare, banking, and retail, among others are expected to provide lucrative growth opportunities for the dual interface payment card market trends. Moreover, development of contactless payment systems further helps to reduce time and expenses of businesses that spend on the operating card machines and counting cash, as well as it provides smoother and quicker checkout experience to the customers. Such benefits are anticipated to create lucrative opportunities for market growth during the forecast period.

Moreover, growing adoption of various strategies by government authorities and businesses propel the global dual interface payment card market growth. However, high initial cost and expenses consideration constraints are expected to hamper market growth. In addition, lack of consumer knowledge and awareness of dual interface payment card solutions can deter large and small and medium-sized enterprises (SMEs) from adopting these technologies. Furthermore, the surge in integration of advanced technologies is one of the major factors creating dual interface payment card market opportunities. Moreover, the growing utilization of NFC technology is expected to offer remunerative opportunities for the expansion of the dual interface payment card industry during the forecast period.

The dual interface payment card market is segmented into type and end user.

Segment Review

The dual interface payment card market is segmented into type, end user, and region. By type, it is bifurcated into plastic and metal. By end user, the market is classified into retail and e-commerce, transportation healthcare, hospitality and tourism, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

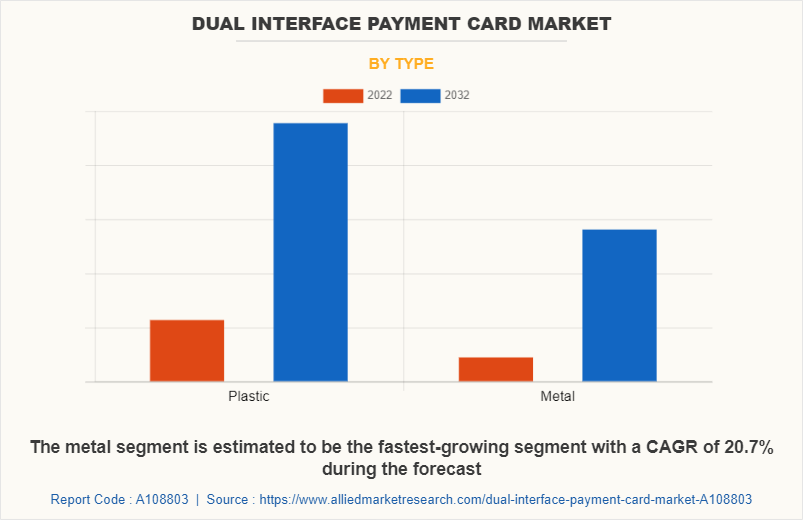

On the basis of type, the global dual interface payment card market share was dominated by the plastic segment in 2022 and is expected to maintain its dominance in the upcoming years, owing to improve their products, several businesses started to provide eco-friendly plastic cards produced from recycled plastic. However, the metal segment is expected to witness the highest growth, due to their endurance compared to plastic-based cards, metal cards are becoming more popular.

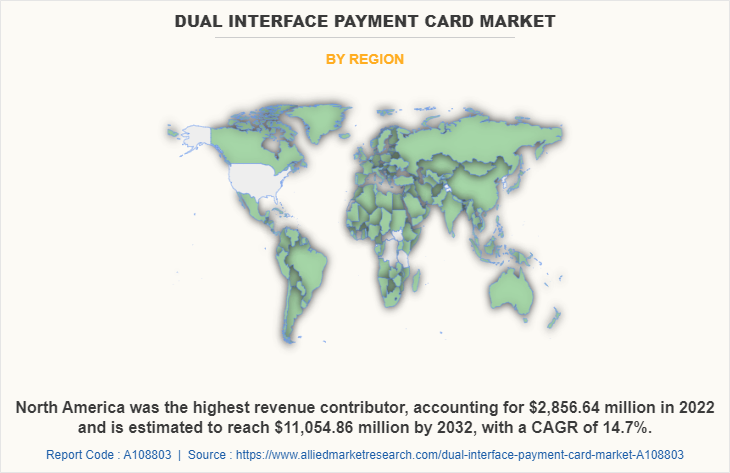

By region, North America dominated the market share in 2022. The increasing investment in advanced technologies such as cloud-based services, AI, ML, and IoT to improve banking and finance businesses and the customer experience are anticipated to propel the growth of the dual interface payment card market segmentation. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of advanced technology are expected to provide lucrative opportunities for the dual interface payment card market demand in this region.

COVID-19 Impact Analysis

The global COVID-19 pandemic significantly impacted banking operations, owing to the spread of novel coronavirus has led to restrictions on people, as it has forced individuals or different organization to adopt the work from home mode. It further caused a global decline in the demand for traditional bank operations due to lockdown measures and transport restrictions imposed by national authorities, while enabling bank authorities to deliver crucial services. These measures directly impacted on the economy of the banking and finance sector, with the partial or complete shutdown of bank activities, particularly traditional banking services.

On the other hand, some countries have incorporated different technological strategies in their business operations to deal with this pandemic situation. Many consumers are shifting their preference towards online banking operations. According to the World bank, in June 2022, the usage of digital payments has expanded as a result of a pandemic. Over 40% of individuals in low- and middle-income countries paid a merchant in-person or online with a card, phone, or the internet. Thus, such trends are expected to boost the online payment operations in the banking sector. Consequently, these factors are expected to have less negative impact on the growth of the global dual interface market in the forecast period. In the long-run outlook, the market witnessed a significant upturn, owing to the robust demand for dual interface payment card system across the world and escalating use of digital services in banking sector post the COVID-19 pandemic, thus accelerating market growth.

Top Impacting Factors

The Increase in Demand for Contactless Payments

The rise in trend of contactless payment options in BFSI sector to improve optimization has directly influenced the growth of the global dual interface payment card market. Radical advancements in the payment environment, enabled through communication technologies, require revising present business models and maintenance strategies. Consequently, contactless payment systems have gained significant adoption to increase the use of IT and control systems among banking operators, particularly IoT and other digital technologies. As per Barclays, in February 2023, nearly 91.2% of all eligible card transactions were initiated using contactless payments in 2022. In addition, increased use of IoT and digital solutions helps finance managers to improve payment availability, prolong asset lifetime, and empower technical staff to efficiently make maintenance. These factors are likely to contribute to the increased installation of dual interface payment card market, globally.

Furthermore, the integration of contactless payments helps to reduce the transaction time and prioritize banking maintenance tasks. In addition, the integration of automated systems in payments operations has reduced the rate of errors, such as system errors, as well as improper card detection. Hence, these multiple benefits offered by contactless payments used in payment operations and maintenance services are expected to boost the demand for dual interface payment card market.

Moreover, businesses are continuously involved in promoting digitalization in banking operations. For instance, the Punjab National Bank (PNB) partnered with Patanjali Ayurved Limited and launched co-branded contactless credit cards in partnership with the National Payments Corporation of India (NPCI). These cards provide clients with a variety of advantages and purchase-based waivers. Such strategies pooling in the digitalizing of the payment infrastructure are anticipated to fuel the demand for dual interface payment card, which in turn, augment the market growth on a global scale.

Growth in Adoption of Various Strategies by Government Authorities and Businesses

The supportive government policies and increase in investment by public and private authorities to expand smart bank infrastructure have impacted the market growth. Several regional governments have made strategic investments in expanding banking infrastructure and maintenance operations. In addition, this has been attributed to the rise in the number of countries committing to reduce stress added to banking and finance infrastructure caused by system incompatibility, rigorous manual banking operations.

Further, government policies are undertaking increased initiatives to embrace advanced technology, with plans for integrating new digital banking operations to modernize the ageing system. For instance, in December 2020, State Bank of India (SBI), National Payments Corporation of India (NPCI) and Japan's Japan Credit Bureau (JCB) International Co. launched the 'SBI RuPay JCB Platinum Contactless Debit Card'. SBI and JCB collaborated to launch this card on the RuPay network. This digital card system improves service performance and maintains safety standards in the country. Therefore, the dual interface payment card gained wider traction among end-users, taking advantage of internet services by optimizing payment performance.

Moreover, government policies have been critical to the development of digital banking infrastructure to ensure the efficient management of payments with a specific focus on mitigating system and payment operation errors. For instance, in November 2020, IDEMIA launched full metal dual interface payment card in Middle East, in partnership with CompoSecure. The full metal dual interface card delivers secure, high-quality proprietary products to exclusive customers globally. Such strategies in banking and finance operations are anticipated to eventually contribute to the growth of the global dual interface payment card market.

Key Benefits for Stakeholders

- The study provides an in-depth dual interface payment card market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the dual interface payment card market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the Dual interface payment card industry.

- The quantitative analysis of the global dual interface payment card market for the period 2022–2032 is provided to determine the market potential.

Dual Interface Payment Card Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 37.9 billion |

| Growth Rate | CAGR of 17.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 219 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Giesecke+Devrient GmbH, Infineon Technologies AG, Paragon Group Limited, Wuhan Tianyu Information Industry Co., Ltd., Thales Group, Goldpac, CPI Card Group Inc., Watchdata Co., Ltd., Eastcompeace Technology Co., Ltd., IDEMIA |

Analyst Review

As the dual interface payment card industry continues to evolve, CXOs have evaluated the opportunities and challenges regarding this emerging technology. The dual interface payment card industry has grown rapidly in response to the rise in adoption of Internet of Things (IoT) devices and the growth in need for contactless payment systems. CXOs have considered the benefits that dual interface payment cards can offer, such as the ability to provide a unified and scalable solution for managing and processing the number of payments services with the help of IoT devices, enabling real-time insights and decision-making. In addition, dual interface payment cards can help BFSI organizations optimize their operations, reduce costs, and improve customer experience by automating transaction tasks and provide personalized services. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, dual interface payment cards can enable innovation and collaboration by providing an open and modular architecture that allows developers and partners to build and integrate new applications and services. However, CXOs recognize the challenges associated with the dual interface payment cards. One significant challenge is the industry's fragmentation, with multiple vendors offering different solutions and technologies, which can make it challenging for banking and finance organizations to select the right services for their needs. In addition, dual interface payment cards require significant investment in infrastructure, high speed internet capabilities, and talent, which can become barriers for the small and medium-sized enterprises (SMEs) to enter the market.

Furthermore, ethical and regulatory concerns related to data privacy and security must be addressed, as well as the need for a strong ecosystem of partners and developers to build and integrate applications and services. CXOs must evaluate the services based on their organization's specific needs and requirements, including factors such as scalability, reliability, and security. By addressing these challenges, CXOs can unlock the full potential of dual interface payment cards to transform their payment operations, create value, and gain a competitive advantage in their industry. For instance, in March 2021, Thames Technology launched a new innovative product aimed at the banking and financial sector called a biometric payment card. The new card offers higher levels of security and an improved user experience by securely authenticating a contact or contactless transaction using a built-in fingerprint sensor.

The North America is the largest market for the Dual Interface Payment Card.

The Dual Interface Payment Card Market is expected to reach $37,911.03 Million by 2032

Factors such as the increase in demand for contactless payments and the rise in adoption of internet banking are the key factors that are expected to positively impact the growth of the market in the future.

The key growth strategies for Dual Interface Payment Card include product portfolio expansion, acquisition, partnership, merger, and collaboration.

Thales Group, CPI Card Group Inc., Eastcompeace Technology Co., Ltd., Giesecke+Devrient GmbH, Goldpac, IDEMIA, Infineon Technologies AG, Paragon Group Limited, Watchdata Co., Ltd. and Wuhan Tianyu Information Industry Co., Ltd.

Loading Table Of Content...

Loading Research Methodology...