E-Axle Market Research, 2033

The global e-axle market size was valued at $15 billion in 2023, and is projected to reach $172.8 billion by 2033, growing at a CAGR of 28.2% from 2024 to 2033.

Report Key Highlighters:

- The e-axle market study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the e-axle market are ZF Friedrichshafen AG, Nidec Corporation, BorgWarner Inc., Continental AG, Linamar Corporation, AVL List GmbH, Cummins Inc. (AxleTech International, LLC.), Dana Limited, Schaeffler AG, and Robert Bosch GmbH. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

An e-axle combines several elements. The electric motor, power inverter, transmission and differential are embedded in a single package. E-axle also allows neat packaging and simplified integration vehicle platforms. e-axle is an electro-mechanical propulsion system equipped with axle structures, electric motor, power electronics, and transmission units. This device acts as a compact, cost-attractive electric drive solution for battery-electric vehicles and hybrid applications.

The growing demand for efficient and compact electric drivetrains is driving advancements in e-axle technology, making it a key component in modern electric and hybrid vehicles. For instance, in September 2023, Musashi Seimitsu Industry, Delta Electronics, and Toyota Tsusho established a joint venture to manufacture and sell e-axles for two-wheeled vehicles. The new company will focus on mass production in India while expanding sales to a broad customer base, thus supporting the growing demand for electric mobility solutions. Moreover, it is used in conjunction with a conventional ICE or hybrid powertrain. Moreover, it is used in conjunction with a conventional ICE or hybrid powertrain, contributing to the overall expansion of the e-axle market size as the adoption of electrified drivetrains accelerates globally.

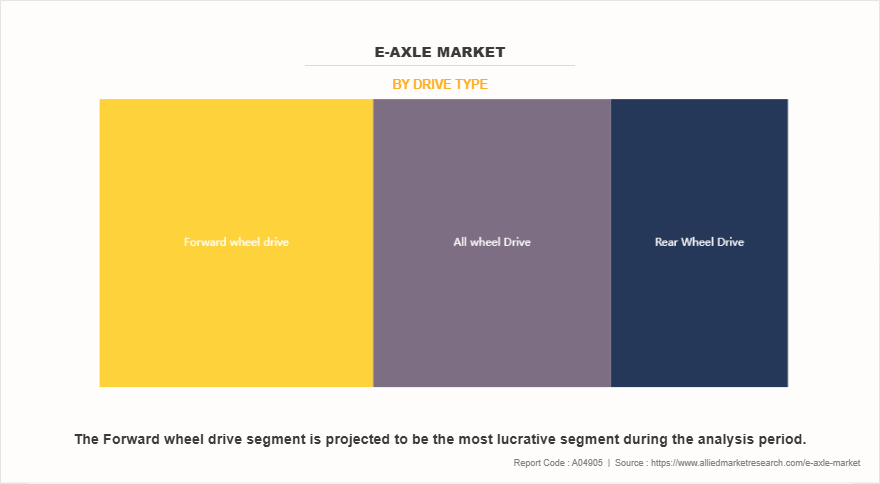

In addition, front-wheel drive (FWD) e-axles are commonly used in electric vehicles (EVs) because they are affordable and save space. In this setup, the electric motor, power electronics, and transmission are combined into the front axle, powering the front wheels. Automakers prefer FWD e-axles for small and mid-sized passenger cars since they offer good traction on regular roads while keeping the vehicle lighter and simpler. As more compact and budget-friendly EVs enter the market, the demand for FWD e-axles is growing, especially in cities where efficiency and cost matter most. Companies like Bosch, Nidec, and Magna are working on advanced FWD e-axles to improve power and energy use. However, FWD systems may not perform well in high-speed or offroad conditions, pushing some manufacturers to focus more on all-wheel drive (AWD) options.

Furthermore, commercial electric vehicles like delivery vans and trucks often use rear-wheel drive (RWD) configurations because they offer better load capacity and enhanced traction. However, RWD systems are usually more expensive than FWD options since they require stronger powertrain components, which can make them less suitable for budget-friendly EVs.

Rise in sales of electric and hybrid vehicles across the globe, increase in fuel costs, and advancements in e-axle technology are expected to drive the global e-axle market growth during the forecast period. However, the high cost of electric axle drive systems and complex manufacturing and integration challenges are anticipated to hamper the growth of the market during the forecast period. Moreover, the rise in demand for commercial electric vehicles and the integration of smart and connected technologies are expected to offer lucrative opportunities for the market in the future.

The a-axle market is segmented into drive type, vehicle type, component type, and region. On the basis of drive type, the market is divided into forward wheel drive, rear wheel drive, and all wheel drive. As per vehicle type, the market is segregated into passenger vehicles, commercial vehicles, and electric vehicles. On the basis of component type, the market is categorized into combining motors, power electronics, transmission, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the report include ZF Friedrichshafen AG, Nidec Corporation, BorgWarner Inc., Continental AG, Linamar Corporation, AVL List GmbH, Cummins Inc. (AxleTech International, LLC.), Dana Limited, Schaeffler AG, and Robert Bosch GmbH.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In September 2024, VL List GmbH launched E-axle, a compact solution for trucks designed to meet rising market demands from the automotive industry. The E-axle featured low weight, high performance, maximum efficiency, and a service life of 1.5 million kilometers.

- In May 2023, Schaeffler AG, through its parent company Schaeffler India, received a $315 million order for its two-in-one electric axles as it transitioned to electrification from internal combustion. The electric axle, designed for passenger vehicles, integrated an electric motor, gearbox, and power electronics into one compact unit.

- In July 2023, Continental AG, through its subsidiary Vitesco Technologies, a leading supplier of drive technologies and electrification solutions, signed an agreement to deliver its integrated axle drive EMR3 to Honda for its new B-segment all-electric SUV. The E-drive is a 3-in-1 unit integrating power electronics, an electric motor, and a reducer. This third-generation integrated axle drive proved to be a market success for the company.

Segmental analysis

The a-axle market is segmented into drive type, vehicle type, component type, and region. On the basis of drive type, the market is divided into forward wheel drive, rear wheel drive, and all wheel drive. As per vehicle type, the market is segregated into passenger vehicles, commercial vehicles, and electric vehicles. On the basis of component type, the market is categorized into combining motors, power electronics, transmission, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Vehicle Type

By vehicle type, the global e-axle market is divided into passenger vehicles, commercial vehicles, and electric vehicles. The passenger vehicles segment accounted for the largest market share in 2023. This is due to the global shift toward electric mobility. Automakers are focusing on improving the efficiency, range, and performance of electric cars by integrating advanced e-axle systems. Consumers are becoming more environmentally conscious, leading to higher adoption of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), both of which rely on efficient powertrain solutions like e-axles.

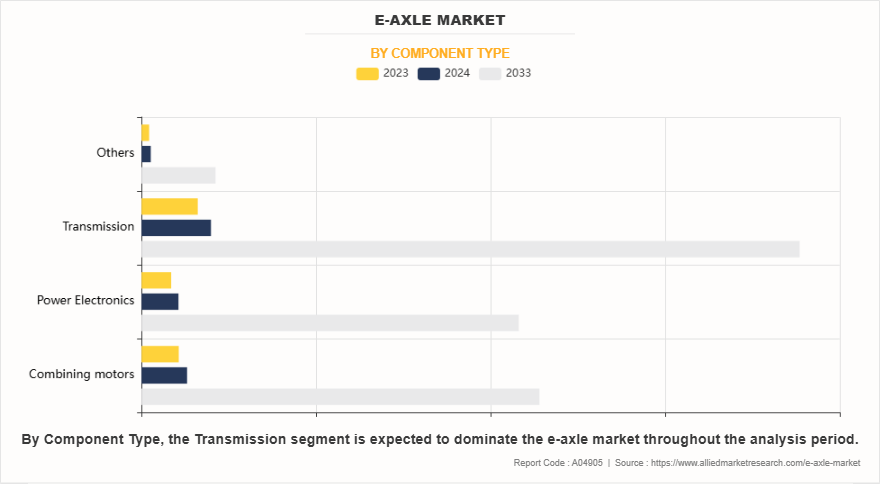

By Component Type

By component type, the global e-axle industry is categorized into combining motors, power electronics, transmission, and others. The transmission segment accounted for a dominant market share in 2023, as major players are focusing on integrated transmission solutions, where the gearbox is combined with the electric motor and power electronics into a compact unit. This approach minimizes mechanical losses and improves overall drivetrain efficiency.

By Drive Type

By drive type, the global e-axle market is divided into forward wheel drive, rear wheel drive, and all wheel drive. The all wheel drive segment accounted for the largest market share in 2023. The increasing demand for AWD electric SUVs and off-road vehicles, driven by consumer preference for adventure ready EVs, is fueling the growth of this segment.

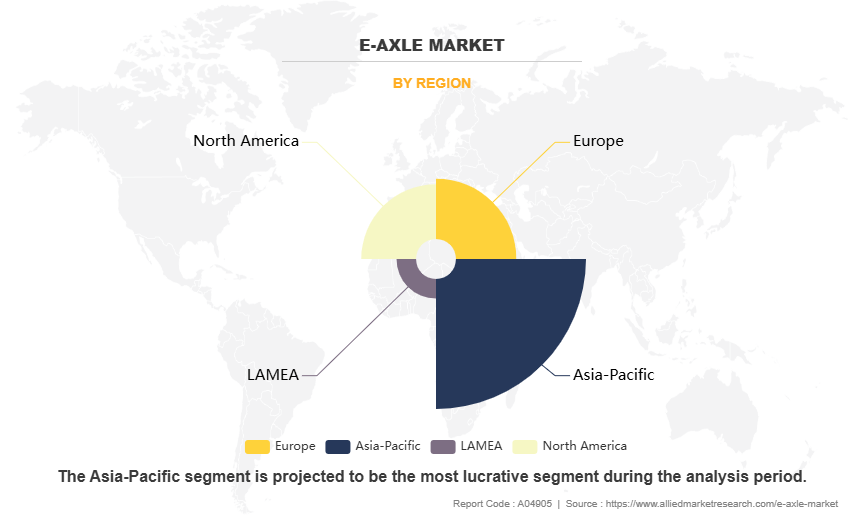

By Region

Region wise, Asia-Pacific held the largest e-axle market share in 2023, primarily driven by China, Japan, South Korea, and India. The region's rapid expansion is fueled by government incentives, aggressive EV adoption policies, and strong domestic manufacturing capabilities.

Rise in sales of electric and hybrid vehicles across globe

The increasing adoption of electric vehicles (EVs) and hybrid vehicles worldwide is a major factor driving the growth of the e-axle market. Governments, automakers, and consumers are shifting towards clean energy transportation, reducing dependence on fossil fuels and lowering carbon emissions. This transition is fueled by government policies, technological advancements, and change in consumer preferences, leading to a rapid rise in EV and hybrid vehicle sales.

One of the biggest reasons for this growth is government incentives and regulations. Many countries have introduced strict emission norms and fuel efficiency standards, compelling automakers to develop and promote electric and hybrid vehicles. Nations such as China, the U.S., Germany, the UK, France, and Norway are offering tax credits, purchase subsidies, and exemptions from tolls and registration fees to encourage EV adoption. The European Union’s plan to ban the sale of new gasoline and diesel cars by 2035 and similar policies in the U.S. and China are accelerating the transition to electric mobility, further driving the e-axle market forecast, as automakers invest in next-generation electric drivetrains to meet regulatory requirements and market demand.

Automakers are responding to this trend by investing heavily in EV production. Leading companies such as Tesla, BYD, Volkswagen, Ford, General Motors, and Hyundai are launching a wide range of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The competition among automakers has led to lower production costs, improved battery efficiency, and greater availability of EVs in different price segments, making them more accessible to a larger consumer base.

Therefore, the rising sales of EVs and hybrids are directly increasing the demand for e-axles, as these components are essential for improving vehicle performance and efficiency. With ongoing policy support, continuous technological advancements, and increasing consumer acceptance, the global EV and hybrid market will continue to expand, further driving growth in the e-axle industry.

Increase in fuel costs

Increase in fuel costs over the past decade has led to a rise in the adoption of electric vehicles as a mode of daily commute. Increase in fuel prices has led to surge in crude oil cost, which is majorly controlled by the OPEC countries. With presence of limited sources of crude oil globally, the prices are further expected to escalate in the future. Although gasoline prices have been increasing, electricity costs have been low in many countries such as China, Germany, and Denmark. Electric vehicles equipped with electric motors help in maintaining higher speed more effectively, reducing the overall weight, and increasing efficiency. Hence, the rise in consumer inclination toward electric and hybrid vehicles has fueled the growth of the market.

High cost of electric axle drive system

Electric axle systems are widely used in different types of vehicles such as passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles. The e-axle unit is equipped with electronic motor, power electronic components, and different transmission units depending upon the system used in the vehicle. These parts are costlier, thereby increasing the overall price of electric axle drive system. High cost of e-axle system is in turn responsible for the hike in car prices.

Hence, upsurge in adoption of electric axle in countries other than China is limited by high costs. Hence, it is anticipated that high cost associated with e-axle drive units may inhibit global e-axle market growth. However, the electric vehicle market is growing at a rapid rate, which may reduce the impact of this restraint in the near future.

Integration of smart & connected technologies

The integration of smart and connected technologies in e-axle systems is another key opportunity for market growth. As vehicles become more digital and software-driven, manufacturers are incorporating real-time data monitoring, predictive maintenance, and advanced control systems into e-axles to enhance performance and reliability.

One of the biggest advantages of smart e-axle technology is the ability to monitor and optimize power distribution based on driving conditions. Advanced electronic control units (ECUs) and AI-powered algorithms can adjust torque delivery and regenerative breaking, improving energy efficiency and battery life. For instance, Tesla’s Model S and Model X utilize intelligent torque vectoring through e-axle integration, enhancing traction control and driving stability.

Predictive maintenance is another major benefit of connected e-axles. Fleet operators and vehicle owners can use Internet of Things (IoT)-based diagnostics to detect potential issues in electric motors, inverters, or gear mechanisms before they lead to system failure. Companies such as Bosch and ZF have developed AI-powered diagnostics for e-axle systems, helping fleet operators reduce downtime and maintenance costs. This is especially beneficial for commercial vehicle fleets, where unexpected breakdowns can result in significant financial losses. As the adoption of connected and intelligent drivetrains increases, e-axle market insights indicate a growing demand for advanced diagnostic solutions that enhance vehicle reliability and operational efficiency.

Another emerging trend is V2X (Vehicle-to-Everything) communication, which enables e-axle-powered electric vehicles to interact with smart grids, charging stations, and traffic systems. This technology is expected to enhance energy management, reduce charging times, and optimize battery usage, making E-Axle-equipped vehicles even more efficient. As the demand for intelligent, connected electric drivetrains grows, automakers, Tier-1 suppliers, and technology companies have a massive opportunity to develop next-generation e-axle systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the e-axle market analysis from 2023 to 2033 to identify the prevailing e-axle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the e-axle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global e-axle market trends, key players, market segments, application areas, and market growth strategies.

E-Axle Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 172.8 billion |

| Growth Rate | CAGR of 28.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 409 |

| By Vehicle Type |

|

| By Component Type |

|

| By Drive type |

|

| By Region |

|

| Key Market Players | ZF Friedrichshafen AG, AVL List GmbH, NIDEC CORPORATION, Schaeffler AG, Cummins Inc. (AxleTech International, LLC.), Linamar Corporation, BorgWarner Inc., Robert Bosch GmbH, Continental AG, Dana Limited |

• The key players in the e-axle market are ZF Friedrichshafen AG, Nidec Corporation, BorgWarner Inc., Continental AG, Linamar Corporation, AVL List GmbH, Cummins Inc. (AxleTech International, LLC.), Dana Limited, Schaeffler AG, and Robert Bosch GmbH.

The largest regional market for E-Axle is Asia-Pacific

The leading application of E-Axle Market is passenger vehicle

The global e-axle market was valued at $15 billion in 2023, and is projected to reach $172.8 billion by 2033, growing at a CAGR of 28.2% from 2024 to 2033.

The upcoming trends of E-Axle Market in the globe are the rise in demand for commercial electric vehicles and the integration of smart and connected technologies

Loading Table Of Content...

Loading Research Methodology...