E-commerce Warehousing Market - 2032

The global e-commerce warehouse market size was valued at $158.4 billion in 2022, and is projected to reach $832.8 billion by 2032, growing at a CAGR of 18.4% from 2023 to 2032.

E-commerce warehousing involves storage and management of goods in a facility for online retailers. It includes various activities such as receiving, storing, picking, packing, and shipping products to customers. E-commerce warehousing is critical for online retailers to efficiently manage their inventory, streamline order fulfillment, and ensure timely deliveries. It often involves the use of advanced technologies such as automation, robotics, and inventory management systems to optimize operations. E-commerce warehousing plays a crucial role in the online retail supply chain, helping businesses meet customer demands, reduce shipping times, and enhance overall customer satisfaction.

The e-commerce warehousing market share is driven by the rapidly growing e-commerce industry, technological advancements in automation and inventory management, and increase in demand for faster fulfillment. The growth of online shopping has fueled the need for efficient warehousing facilities to store and manage inventory, fulfill orders, and ensure timely deliveries.

The e-commerce warehouse market trends includes advancements in automation, robotics, and other technologies are transforming the industry, enabling faster order processing, and increased operational efficiency. In addition, the demand for faster fulfillment to meet customer expectations for speedy shipping times is driving the need for strategically located warehousing facilities that can enable quick order processing and delivery. Therefore, the e-commerce warehousing market is dynamic, shaped by the evolving needs of the online retail industry and the adoption of innovative technologies to optimize operations and enhance customer satisfaction.

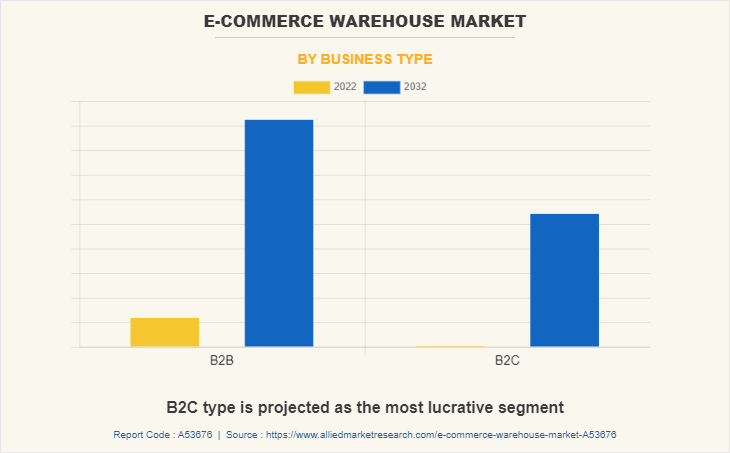

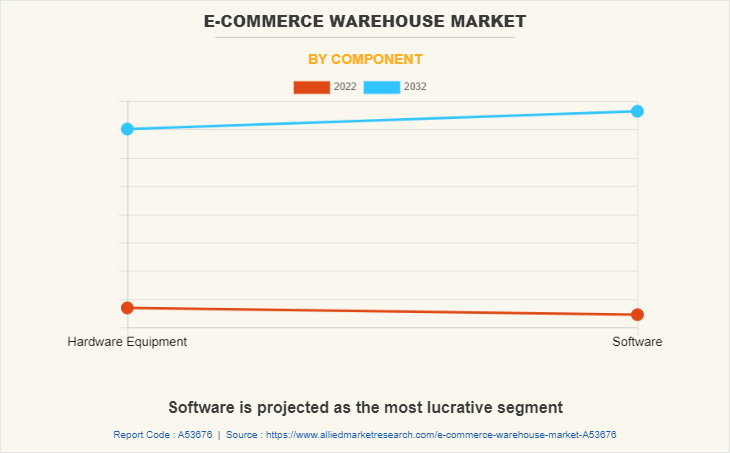

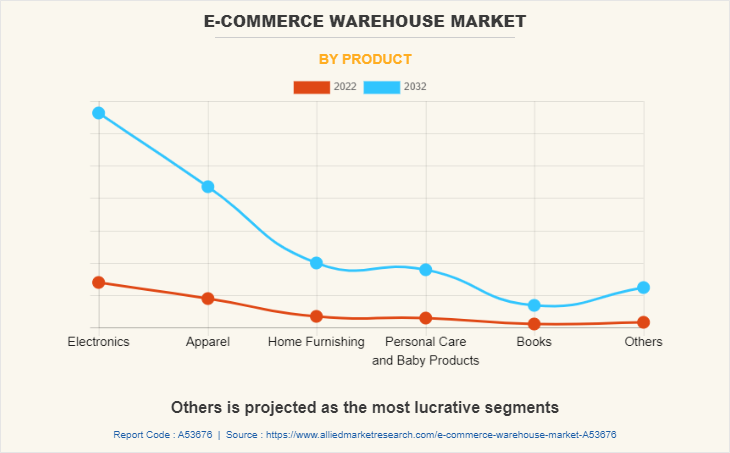

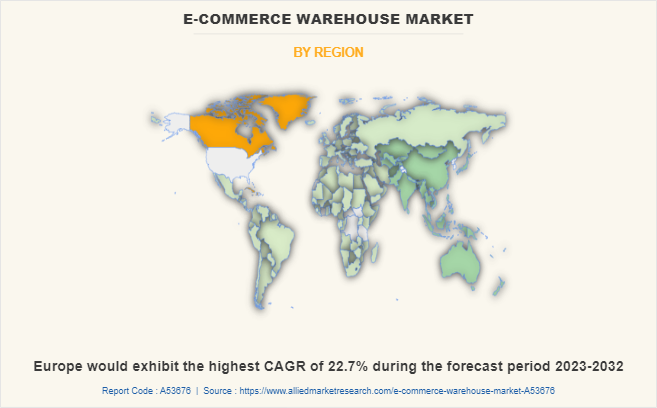

The e-commerce warehousing market is segmented into business type, product, component, and region. By business type, it the market is further divided into B2B, and B2C. By component, the e-commerce warehousing market is segmented bifurcated into component and software. By product, the market is segmented classified into electronics, apparel, home furnishing, personal care and baby products, books, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some of the key players profiled in the e-commerce warehouse market include FedEx, Deutsche Post DHL Group, Kenco, SHOPIFY INC., ShipMonk, ShipBob, United Parcel Service of America, Inc., Red Stag Fulfillment, ShipNetwork, and Amazon.com Services LLC.

Rapid growth of online shopping

Rapid growth of online shopping has indeed increased the demand for e-commerce warehouses in the last few years. With more people turning to online shopping for their everyday needs, e-commerce companies are projected to expand their warehouse capacity to keep up with the growing demand. E-commerce warehouses play a critical role in the online shopping process, serving as the central hub where orders are received, processed, and shipped to customers. Warehouses are also responsible for receiving, storing, and managing inventory, as well as picking, packing, and shipping products.

According to the U.S. Census Bureau, e-commerce sales in the U.S. increased by more than 32% in 2020, driven in part by the COVID-19 pandemic. This surge in online shopping has created a need for larger and more advanced e-commerce warehouses that can handle the increased volume of orders. Moreover, online shopping offers consumers the convenience of shopping from anywhere and at any time, without the need to physically visit brick-and-mortar stores. This flexibility has been particularly appealing to time-constrained consumers, who value the ability to shop at their own pace and according to their own schedule.

Increasing adoption of automation and robotics

As online retailers seek to improve their efficiency and reduce costs, they are turning to technologies such as automated conveyor systems, robots, and drones to optimize their warehouse operations. These technologies allow warehouses to process orders faster, reduce errors, and improve inventory accuracy, all of which are critical in the fast-paced world of e-commerce.

The adoption of automation and robotics is becoming increasingly common in the e-commerce warehouse market, as companies look to improve efficiency, speed, and accuracy in order fulfillment. In the current scenario, Amazon has implemented a range of automation technologies in their fulfillment centers, including robots that transport inventory, automated guided vehicles (AGVs) that move goods around the warehouse, and robotic arms that pick and pack products. Also, Alibaba's logistics subsidiary Cainiao, has implemented a range of automation technologies, including automated guided vehicles (AGVs), autonomous mobile robots, and drones to move goods around their warehouses and between facilities.

Rise in cost of real estate

As e-commerce companies expand their operations and seek to build warehouses closer to urban centers to meet the demand for faster delivery times, the cost of land can be prohibitively high, making it difficult for companies to expand their warehouse operations. Furthermore, e-commerce companies often require large warehouse facilities to store and process large volumes of inventory, which can further increase the cost of real estate. These large facilities require significant amounts of space and often have specialized infrastructure requirements, such as loading docks, parking areas, and security systems, which can further increase the cost of real estate.

For instance, in New York City, the cost of land for industrial use has been on the rise for several years. According to a report from real estate services firm CBRE, the average cost of industrial land in the city increased by more than 70% between 2012 and 2017. This has made it difficult for e-commerce companies to build or expand warehouse facilities in the city. Also, The San Francisco Bay Area is another region where the cost of real estate is high. According to a report from JLL, a real estate services firm, the average rent for industrial space in the Bay Area increased by 19.3% in 2018. This has made it difficult for e-commerce companies to find affordable warehouse space in the region.

Integration of sustainability initiatives into warehouse operations

As consumers become environmentally conscious, there is increasing demand for sustainable products and practices. This presents an opportunity for companies to differentiate themselves by adopting sustainable practices in their warehouses, such as using renewable energy sources or reducing waste. For instance, REI, a specialty outdoor retailer, has implemented several sustainability initiatives in its warehouses, including using solar power and rainwater harvesting systems.

For instance, Walmart announced in January 2022 its commitment to achieving zero emissions across its global operations by 2040, including its warehouse operations. This commitment includes expanding its use of renewable energy, transitioning to electric vehicles and equipment, and implementing sustainable practices in its operations. In addition, in February 2022, Amazon announced a new program called "Climate Pledge Friendly" which makes it easier for customers to identify and purchase sustainable products, including products that are shipped using renewable energy.

The e-commerce warehouse market is segmented into Business Type, Component and Product.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the e-commerce warehouse market analysis from 2022 to 2032 to identify the prevailing e-commerce warehouse market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the e-commerce warehouse market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global e-commerce warehouse market trends, key players, market segments, application areas, and market growth strategies.

E-Commerce Warehouse Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 832.8 billion |

| Growth Rate | CAGR of 18.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 246 |

| By Product |

|

| By Business Type |

|

| By Component |

|

| By Region |

|

| Key Market Players | United Parcel Service of America, Inc., FedEx, ShipBob, SHOPIFY INC., Red Stag Fulfillment, ShipMonk, ShipNetwork, Kenco, Amazon.com Services LLC., Deutsche Post DHL Group |

Analyst Review

The e-commerce warehouse market is expected to witness significant growth due to rise in sales of e-commerce products at a global level. The adoption of automation, robotics, and other advanced technologies in e-commerce warehousing can enhance operational efficiency, reduce costs, and improve order processing times. Through this, companies can leverage these technological advancements to optimize warehouse operations, streamline fulfillment processes, and gain a competitive edge in the market.

E-commerce warehouses play a crucial role in ensuring timely deliveries and meeting customer expectations for fast shipping. Companies can focus on improving the customer experience by optimizing order fulfillment processes, reducing shipping times, and implementing effective inventory management strategies. For instance, in August 2022, after a $100 million burst of venture money, warehouse automation vendor Geek+ intends to quicken its global market expansion and engage in research and development on its autonomous mobile robot (AMR) technology.

E-commerce giants including Amazon, Alibaba, and JD.com have continued to expand their operations and invest in e-commerce warehousing to support their growing online retail businesses. For instance, Amazon announced plans to open new fulfillment centers globally and launched new products such as "Amazon One," a contactless palm recognition payment technology, to enhance its warehousing and fulfillment capabilities.

The global e-commerce warehouse market was valued at $158.38 billion in 2022, and is projected to reach $832.77 billion by 2032.

Some of the key players profiled in the e-commerce warehouse market include FedEx, Deutsche Post DHL Group, Kenco, SHOPIFY INC., ShipMonk, ShipBob, United Parcel Service of America, Inc., Red Stag Fulfillment, ShipNetwork, and Amazon.com Services LLC.

Asia-Pacific is the largest region for E-commerce warehouse market.

The B2B segment is the leading business type of the E-commerce warehouse market.

The major factors impacting the growth of the market include rapid growth of online shopping, increase in adoption of automation and robotics, and developments in the e-commerce industry in the developing countries.

Loading Table Of Content...

Loading Research Methodology...