E-Learning Market Research, 2032

The global e-learning market size was valued at $263.5 billion in 2023, and is projected to reach $933.5 billion by 2032, growing at a CAGR of 14.8% from 2024 to 2032. E-learning provides numerous benefits to the students, which include low cost of education and specialized course learning. In addition, e-learning has become an integral part of the majority of organizations as it enhances the performance of employees.

E-learning is a formalized learning approach that uses electronic resources. While teaching can be based in or out of the classrooms, the use of computers and the Internet forms the major component of e-learning. It is a network-enabled transfer of skills and knowledge, in which education is delivered to many receivers at the same or different times.

Key Takeaways

The e-learning market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major e-learning industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The global e-learning market growth is significantly rising due to several factors such as the rise in remote learning during the pandemic the demand for low-cost convenient learning systems and the surge in the use of AI and machine learning in e-learning systems are some of the main factors anticipated to propel the growth of the market. However, the lack of face-to-face interactions in the E-learning systems acts as a restraint for the e-learning market. In addition, the emergence of several trends such as micro-learning, gamification, adaptive learning, and mobile learning will provide ample opportunities for the market's development during the forecast period.

E-learning Adoption

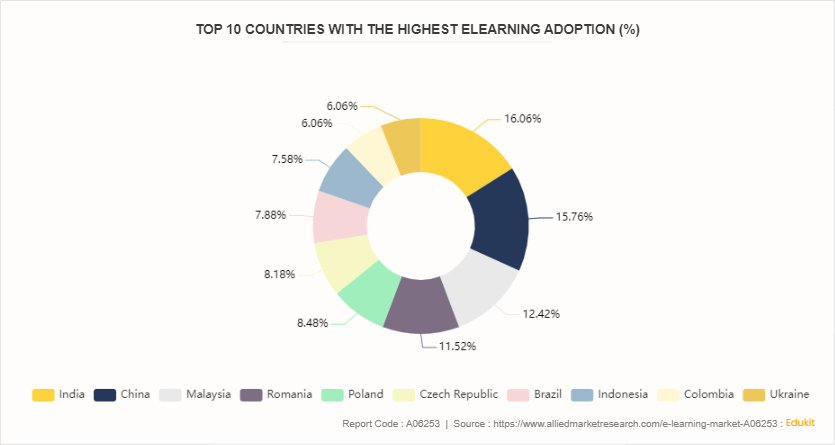

According to Edukit, in 2021, India stood first with 53% amongst all the other countries, which means India has adopted online learning to a significant extent. Indian educators and students are expected to extensively experiment with and adopt online learning. Followed by China, Malaysia, and Romania, in these nations, e-learning solutions have grown and transformed significantly, driven by advances in technology, increased internet penetration, and government support. These factors are further expected to fuel the growth of the global market.

FIGURE 1: Top 10 Countries with the Highest eLearning Adoption (%)

Market Segmentation

The e-learning market share is segmented on the basis of provider, deployment mode, course, end user, and region. By provider, it is bifurcated into content and service. By deployment mode, it is categorized into on-premises and cloud. By course, it is divided into primary & secondary education, higher education, online certification & professional course, and test preparation. By end user, it is classified into academic, corporate, and government. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The global online learning market has experienced substantial growth, with North America playing a pivotal role in this expansion. North America led the digital learning market in 2023 propelled by robust technological infrastructure, significant investments in smart technologies, and stringent safety regulations that encourage the integration of advanced learning solutions. Europe follows closely, with countries such as Germany and the UK at the forefront, leveraging e-learning solutions. In the Asia-Pacific region, rapid digitalization and increasing awareness of smart learning solutions are driving the adoption of AI and IoT technology solutions, particularly in China and Japan, where government initiatives support technological advancements.

In February 2022, the Indian government introduced the Union Budget 2022, focused on setting up groundwork with the Higher Education Commission of India and the National Education Policy for the penetration of digital education across the country and promoting upskilling.

In October 2022, the government of India initiated several programs and digital education guidelines with standards to address digital education with equitable learning in India.

Industry Trends

In June 2023, SWAYAM (Study Webs of Active-Learning for Young Aspiring Minds) , the Massive Open Online Courses (MOOC) platform, has emerged as the clear leader in the era of eLearning with an impressive 2.4 crore enrollments for credit-yielding courses and over 26 lakh students successfully earning credits.

In March 2023, the Government of Canada raised $17.6 million in investment in the second phase of the Digital Literacy Exchange Program (DLEP) . This significant investment supports the organizations in teaching digital literacy skills.

Competitive Landscape

The major players operating in the e-learning market share include Adobe, Aptara Inc., Articulate Global, LLC, CERTPOINT, Cisco Systems, Inc., Citrix Systems, Inc., D2L Corporation, Microsoft Corporation, Oracle Corporation, and SAP SE.

Recent Key Strategies and Developments

In June 2024, Wildix launched its new e-learning platform, a significant development designed to enhance training and certification processes for managed service providers (MSPS) and system integrators (SIs) . The platform is now open for guests, allowing partners to invite their customers to explore courses such as the Collaboration series.

In March 2024, Accenture launched Accenture LearnVantage, a technology learning and training service for its clients. The company invested $1 billion in Accenture LearnVantage over three years and has agreed to acquire educational platform Udacity.

In August 2023, McGraw Hill's launched a McGraw Hill Edge, built in association with Edmingle. McGraw Hill Edge is a comprehensive digital learning solution that provides students with the guidance and resources they need to prepare for and excel in competitive exams such as CAT, UPSC, CTET, JEE, and NEET.

Key Sources Referred

ESCAP E-learning Platform

Government of India

Scope E-learning

Online Learning Consortium (OLC)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the e-learning market forecast segments, current trends, estimations, and dynamics of the e-learning market analysis from 2023 to 2032 to identify the prevailing online learning market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the digital learning market segmentation assists to determine the prevailing e-learning market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global e-learning industry Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global e-learning market trends, key players, market segments, application areas, and market growth strategies.

E-Learning Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 933.5 Billion |

| Growth Rate | CAGR of 14.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Provider |

|

| By Deployment Mode |

|

| By Course |

|

| By End User |

|

| By Region |

|

| Key Market Players | Oracle Corporation, CERTPOINT, Microsoft Corporation, Aptara Inc., Citrix Systems, Inc., D2L Corporation, Adobe, SAP SE, Cisco Systems, Inc., Articulate Global, LLC |

The global E-Learning market is experiencing significant growth, driven by technological advancements, changing educational needs, and the increasing demand for flexible learning solutions.

Academic segment is the leading end user of E-Learning Market.

North America is the largest regional market for E-Learning.

$933.5 billion is the estimated industry size of E-Learning by 2032.

Adobe, Aptara Inc., Articulate Global, LLC, CERTPOINT, Cisco Systems, Inc., Citrix Systems, Inc., D2L Corporation, Microsoft Corporation, Oracle Corporation, and SAP SE are the top companies to hold the market share in E-Learning.

Loading Table Of Content...