E-Polylysine Market Research, 2033

Market Introduction and Definition

The global e-polylysine market size was valued at $7.3 billion in 2023 and is projected to reach $11.6 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033. E-polylysine is a naturally derived antimicrobial agent produced through the fermentation of the amino acid lysine by specific bacteria. It is primarily used as a preservative in the food and beverage industry to inhibit the growth of bacteria, yeast, and molds, thereby extending the shelf life of products. Its effectiveness and safety profile make it a preferred choice over synthetic preservatives. The market for E-Polylysine exists due to its ability to enhance food safety, maintain product quality, and meet consumer demand for natural and less chemically processed ingredients. Additionally, its use in pharmaceuticals and cosmetics as a stabilizer or antimicrobial agent further drives market growth. E-polylysine offers a natural, effective solution for preserving a wide range of products, aligning with the increasing consumer preference for clean label and sustainable ingredients.

Key Takeaways

The e-polylysine market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the forecast period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major e-polylysine industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

As consumers become more health-conscious, there is a growing preference for natural and clean-label products. E-polylysine, a naturally occurring preservative, aligns with this trend by offering a safe, effective alternative to synthetic preservatives. The rising awareness about the adverse effects of artificial additives on health is driving manufacturers to adopt E-polylysine to meet consumer demands for transparency and natural ingredients in food and beverages.

The global food and beverage industry is expanding due to population growth, urbanization, and changing dietary preferences. This expansion increases the need for effective preservation methods to extend shelf life and ensure food safety. E-polylysine, known for its antimicrobial properties, is increasingly used to preserve a wide range of food products. The industry's growth is thus driving the e-polylysine market growth.

Governments and regulatory bodies are increasingly supporting the use of natural ingredients and preservatives in food products. This support includes the approval of E-polylysine as a safe and effective preservative, which encourages manufacturers to incorporate it into their formulations. Regulatory approvals and endorsements enhance market confidence and expand the application scope of E-polylysine, contributing to its growing adoption across various food and beverage segments.

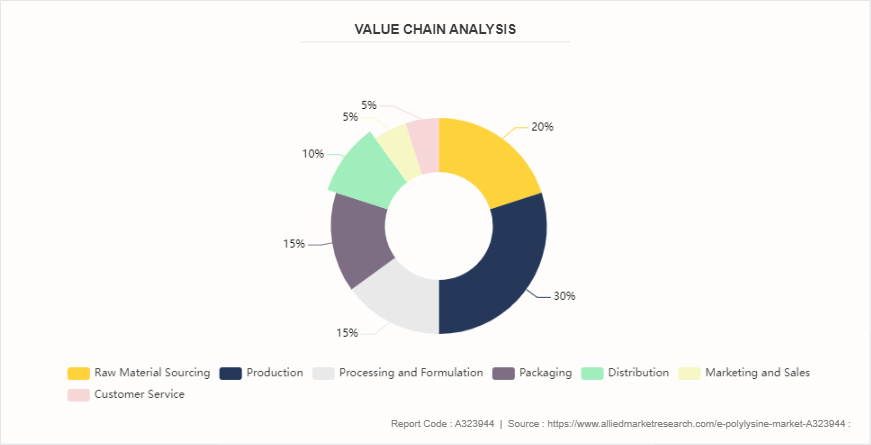

Value Chain Analysis

Raw Material Sourcing: The value chain begins with the procurement of raw materials, primarily amino acids and fermentation substrates. High-quality sourcing is crucial for producing effective E-polylysine. Suppliers are selected based on purity, cost, and reliability.

Production: The raw materials undergo fermentation and purification processes to produce E-polylysine. This stage involves optimizing fermentation conditions and quality control to ensure a high yield and consistent product.

Processing and Formulation: The produced E-polylysine is formulated into various product forms, such as powders or liquid solutions. This step includes blending with other ingredients and adjusting concentrations to meet specific application needs.

Packaging: The formulated E-polylysine is packaged for distribution. Packaging materials are chosen for their ability to preserve product integrity and ensure safety during transport and storage.

Distribution: Packaged E-polylysine is distributed to manufacturers, primarily in the food and beverage industry. Distribution channels include wholesalers and direct sales to ensure timely and efficient delivery to end-users.

Marketing and Sales: This stage involves promoting E-polylysine to potential customers through advertising, trade shows, and digital marketing. Sales strategies focus on highlighting the benefits of E-polylysine, such as its natural preservation qualities and regulatory compliance.

Customer Service: Post-sale support is provided to address any issues or inquiries from clients. This includes technical assistance, product training, and feedback collection to improve future product offerings and customer satisfaction.

Market Segmentation

The e-polylysine market has been segmented based on source, form, application, and region. Based on nature, the e-polylysine market is bifurcated into natural and synthetic. Based on form, the market is segmented into powder and liquid. Based on application, the market is segmented into food and beverages, pharmaceuticals, cosmetics and personal care, and others. Region-wise, the market is divided into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Regional Market Outlook

North America held the major e-polylysine market share in 2023. As health-conscious consumers increasingly seek products with natural and transparent ingredient lists, manufacturers are responding by incorporating clean-label solutions. E-polylysine, a natural preservative, meets these consumer preferences by offering an alternative to synthetic additives. This shift towards clean-label products is further supported by regulatory trends favoring natural ingredients, driving significant growth in the North American E-polylysine market as food and beverage companies strive to align with evolving consumer expectations and maintain competitive market positions. ???????

Industry Trends

The increase in consumer preference for quick and easy-to-prepare meals is a major growth driver for the e-polylysine market. With busy lifestyles and more working professionals, there is a surge in demand for convenience foods that require minimal preparation time. Kemin, a biotechnology company, is focusing on expanding its E-polylysine product line to cater to the rise in demand for clean label solutions.

merging markets in Asia-Pacific and Latin America are experiencing increased demand for E-polylysine due to rapid urbanization and changing dietary patterns. This growth is facilitated by rising disposable incomes and a growing awareness of food safety and quality standards in these regions. Novozymes is advancing its enzyme technologies to optimize the production of E-polylysine.

Innovations in production technology are enhancing the efficiency and cost-effectiveness of E-polylysine manufacturing. Advances such as improved fermentation techniques and enzyme engineering are contributing to higher yields and reduced production costs, making E-polylysine more competitive in the market. Nippon Shokubai is expanding its E-polylysine production capacity to meet the rising global demand during the e-polylysine market forecast.???????

Competitive Landscape

The major players operating in the e-polylysine market include Ajinomoto Co., Inc., Kemin Industries, Inc., Shin-Etsu Chemical Co., Ltd., Jiangsu Boli Bioproducts Co., Ltd., Hangzhou Focus Chemical Co., Ltd., Ginkgo BioWorks, Inc., Nihon Shokuhin Kako Co., Ltd., Sichuan Deebio Pharmaceutical Co., Ltd., Jinan Haoyuan Bio-Tech Co., Ltd., and Shaanxi Xindongfa Biological Technology Co., Ltd

Recent Key Strategies and Developments

In November 2023, Ajinomoto Group acquired Forge Biologics Holdings, LLC, a Columbus, Ohio-based premier gene therapy contract development & manufacturing organization

In December 2022, Novozymes and Chr. Hansen entered into an agreement to create a leading global biosolutions partner through a statutory merger of the two companies.

In November 2021, Novozymes acquires a majority stake in Synergia Life Sciences Pte. Ltd., a leading player in the field of spore probiotics and vitamin K2-7, for a cash payment of DKK.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the e-polylysine market analysis from 2024 to 2033 to identify the prevailing e-polylysine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the e-polylysine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global e-polylysine market trends, key players, market segments, application areas, and market growth strategies.

E-Polylysine Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 11.6 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 215 |

| By Source |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ginkgo BioWorks, Inc., Ajinomoto Co., Inc., Kemin Industries, Inc., Hangzhou Focus Chemical Co., Ltd., Nihon Shokuhin Kako Co., Ltd., Shin-Etsu Chemical Co., Ltd., Jinan Haoyuan Bio-Tech Co., Ltd., Shaanxi Xindongfa Biological Technology Co., Ltd, Jiangsu Boli Bioproducts Co., Ltd., Sichuan Deebio Pharmaceutical Co., Ltd. |

The e-polylysine market was valued at $7.3 billion in 2023 and is estimated to reach $11.6 billion by 2033, exhibiting a CAGR of 4.8% from 2024 to 2033.

The e-polylysine market has been segmented based on source, form, application, and region. Based on nature, the e-polylysine market is bifurcated into natural and synthetic. Based on form, the market is segmented into powder and liquid. Based on application, the market is segmented into food and beverages, pharmaceuticals, cosmetics and personal care, and others. Region wise, the market is divided into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

North America is the largest regional market for E-polylysine

The e-polylysine market has been segmented based on source, form, application, and region. Based on nature, the e-polylysine market is bifurcated into natural and synthetic. Based on form, the market is segmented into powder and liquid. Based on application, the market is segmented into food and beverages, pharmaceuticals, cosmetics and personal care, and others. Region wise, the market is divided into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

The global E-polylysine market report is available on request on the website of Allied Market Research.

Loading Table Of Content...