Education Computing Devices Market Research, 2032

The global education computing devices market size was valued at $101.3 billion in 2022, and is projected to reach $368.1 billion by 2032, growing at a CAGR of 14.1% from 2023 to 2032.

Laptops, computers, and mobile phones have developed into effective learning aids both in and out of the classroom. Mobile computers have increasingly been introduced into educational settings during the previous two decades. Most people carry their own personal compact computers with exceptional computing capabilities, such as laptops, personal digital assistants (PDAs), tablets, cellphones, personal computers (PCs), and e-book readers because of advancements in mobile technology. One-to-one computing is a great learning tool for conventional classrooms and outside informal learning owing to its high processing power and mobility, along with wireless connections and context-aware technology.

The ease of accessibility and flexibility that digital learning offers are considered to be the main drivers boosting the growth of the education computing devices market. In recent decades, digital learning has revolutionized education computing devices. The overall growth of the education computing devices sector is being driven by low-cost e-learning platforms, enhanced student involvement, and other interesting factors of e-learning approaches. The user may get a lot of information in one place because of growing technical advancements like Learning Content Management Systems (LCMS), which effectively integrate content generation, publication, and analysis. Also, cutting-edge technology, LMS, gives online learners tracking and access to the learning materials so they can manage them all effectively. The expansion of the education computing devices market is anticipated to be driven by such technological advancements. The proliferation of the Internet is increasing, high-speed Internet is becoming more widely available at reasonable prices, electronic gadgets are exploding, and education PCs' simple user interfaces are creating profitable chances for the education computing devices market growth. Non-profit organizations are increasingly assisting youngsters in the field of education in a number of areas.

The expansion of the education computing device industry is being significantly hampered by a lack of qualified teachers who do not have knowledge about cutting-edge smart software and procedures as well as by subpar facilities and infrastructure in some regions around the globe. Increasing time spent in front of screens and prolonged computer use while learning may have an adverse effect on a person's general health owing to poor posture, eye difficulties, and headaches. The higher initial investment costs for implementing systems and software in the educational sectors, particularly in emerging regions is projected to be one of the major factors hampering the education computing devices market opportunity during the forecast period.

Education computing devices can be leveraged to provide assistive technologies that support students with disabilities and special educational needs. Opportunities exist for the development of accessibility features, assistive software, and hardware adaptations that facilitate inclusive education and ensure equal access to educational opportunities for all students. Text-to-speech software converts written text into spoken words, allowing students with visual impairments or reading difficulties to access written information. Speech-to-text tools also enable students with motor disabilities or writing challenges to convert their spoken words into written text. Augmentative and Alternative Communication (AAC) devices assist individuals with communication impairments or non-verbal students by providing alternative means of communication. These devices can range from simple picture-based communication boards to sophisticated speech-generating devices that convert symbols or text into spoken words.

The education computing devices market forecast players profiled in this report include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Technologies, Hewlett-Packard Development Company, Lenovo, OPPO, Samsung Electronics, Vivo Mobile Communication Co., Ltd., and Xiaomi Corporation. Investment and agreement are common strategies followed by major market players. For instance, in January 2022, Lenovo announced new additions to its extensive education portfolio aimed at improving learning efficiency in a new era of education. The new devices are designed specifically to fulfill the demands of in-person and distant learning.

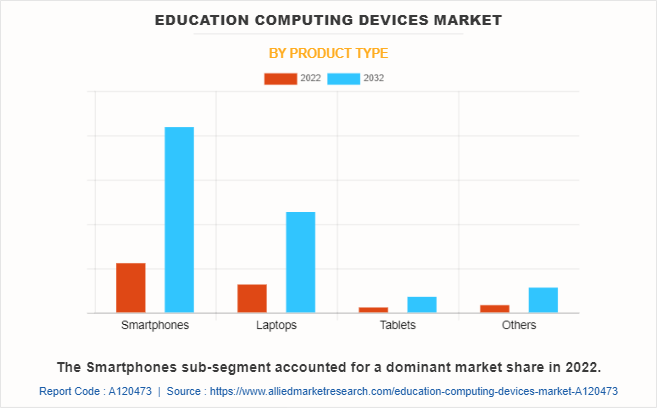

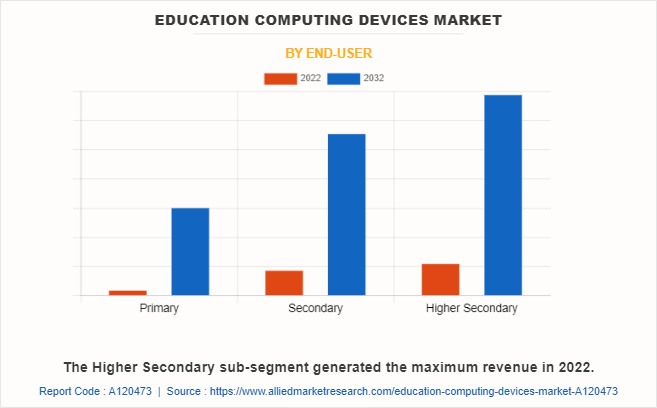

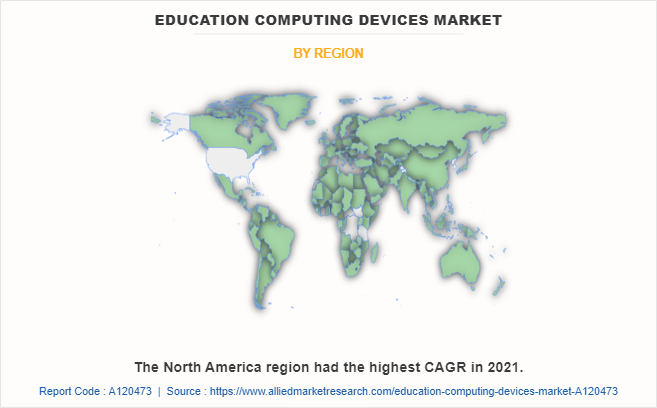

The education computing devices market overview is segmented on the basis of product type, end user, and region. By product type, the market is divided into laptops, smartphones, tablets, and others. By end user, the market is classified into primary, secondary, and higher secondary. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The education computing devices market is segmented into Product Type and End-user.

By product type, the smartphones sub-segment dominated the market in 2022. Technology is rapidly advancing in all parts of modern society, including education. Information and communication technology is increasingly being used in educational activities as a teaching and learning. Academic institutions, like schools, colleges, and other online learning platforms place a high value on the use of new technology to aid their success, particularly in the areas of teaching and learning. Smartphones have a variety of applications that can help with the teaching and learning process, including general software like Excel, Word, and PowerPoint and other applications like mathematical problem-solving software, language learning, and others.

By end user, the higher secondary sub-segment dominated the global education computing devices market share in 2022. Computing devices facilitate multimedia learning experiences in higher secondary education. Students can access educational videos, simulations, virtual labs, and interactive learning modules to explore complex concepts in subjects like science, mathematics, and engineering. These interactive resources enhance understanding, visualization, and engagement with the curriculum. For instance, in 2022, Harappa Education, an online higher education start-up owned by upGrad, expanded its reach by launching its leadership programs in the U.S. and the UK. With a learner base of over 600,000 people, Harappa focused on the importance of soft skills that complemented technical degrees. By entering these new markets, Harappa aimed to cater to a wider audience and provide valuable leadership education to learners seeking to enhance their professional skills.

By region, North America dominated the global market in 2022. The region's improving economic situation and the government initiatives to expand infrastructure in the education and commercial sectors are some of the reasons driving the growth of the regional market. In recent years, there has been an increase in the use of laptop computers and wireless devices in schools, colleges, and institutions. Furthermore, North America has adopted augmented reality and virtual reality technology earlier than the rest of the world. Also, various counties in North America have provided interactive displays and interactive tables for students to study their areas of interest in schools and universities. All these are major factors projected to drive the regional education computing devices industry growth in the upcoming years.

Impact of COVID-19 on the Global Education Computing Devices Industry

- The COVID-19 pandemic resulted in school closures all across the world. Therefore, the education sector has undergone major changes with the distinct rise of e-learning, which involves remote teaching and learning on digital platforms.

- The pandemic highlighted the importance of robust technological infrastructure in education. In the post-COVID-19 era, educational institutions and governments are likely to invest in improving Internet connectivity, providing adequate devices, and upgrading network infrastructure to support seamless access to education computing devices.

- The increased use of educational computing devices raises concerns about data privacy and security. In the post-pandemic period, there is an increased focus on implementing robust data protection measures, ensuring compliance with privacy regulations, and educating stakeholders about responsible data handling and digital citizenship.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the education computing devices market analysis from 2022 to 2032 to identify the prevailing education computing devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the education computing devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global education computing devices market trends, key players, market segments, application areas, and market growth strategies.

Education Computing Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 368.1 billion |

| Growth Rate | CAGR of 14.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Product Type |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Samsung Electronics Co Ltd, Dell Technologies Incorporated, OPPO, Acer Inc., ASUSTeK Computer Inc., Xiaomi Corporation, Hewlett- Packard Development Company LP., Lenovo, Apple Inc., Vivo Mobile Communications Co., Ltd |

There is a rising demand for portable and lightweight computing devices from the education sector. Laptops, tablets, and convertible devices are popular choices due to their mobility, allowing students and educators to access educational resources and engage in learning activities from anywhere, both inside and outside the classroom. These driving factors are projected to create several growth opportunities in the market.

The major growth strategies adopted by education computing devices market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global education computing devices market in the future.

Nudge Rewards Inc., GuideSpark, Beekeeper AG, Sociabble, Inc., SocialChorus. Inc., Poppulo, OurPeople, Smarp, theemployeeapp, and Workvivo Limited are the major players in the education computing devices market.

The smartphones sub-segment of the product type acquired the maximum share of the global education computing devices market in 2022.

Students and educational institutions are the major customers in the global education computing devices market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global education computing devices market from 2022 to 2032 to determine the prevailing opportunities.

Education computing devices such as smartphones and tablets are becoming more popular in classrooms. Their portability, affordability, and ease of use make them attractive alternatives for educational purposes. The education computing devices market is expected to witness a growing demand for mobile devices optimized for learning, which includes these with larger displays and more desirable functionalities.

Loading Table Of Content...

Loading Research Methodology...