The global electric aircraft market size was valued at $8.5 billion in 2021, and is projected to reach $23.5 billion by 2031, growing at a CAGR of 10.9% from 2022 to 2031.

An electric aircraft is one that is propelled by electricity, often using a single or many electric motors that turn propellers. The most popular way to supply electricity is using batteries, but there are other options as well. Since the 1970s, electrically driven models have been flown, and they were the precursors of the tiny unmanned aerial vehicles (UAVs) or drones that are now employed extensively for a variety of purposes in the twenty-first century.

The commercial applications of electric aircraft face several challenges such as requirement of large and bulky batteries to generate required power, need to charge the aircraft frequently before scheduled flight path and limited infrastructure capabilities. However, during the past ten years, there has been a rise in the development and use of electric aircraft because of environmental concerns, improved performance provided by cutting-edge electric motor and battery technology, and much lower maintenance costs related to electric aircraft. Within the next 20 years, it is anticipated that a significant percentage of the personal aircraft industry will be made up of electric aircraft, which are now sold by a large number of aircraft and helicopter manufacturers.

The growth of the electric aircraft market is driven by factors such as increase in environmental concerns, technological advancement in batteries and electric propulsion systems, rise in demand for short range regional routes, and surge in efforts to reduce overall carbon footprint and operational cost of aviation industry. The rise in efforts by major companies across the globe to develop electric aircraft capabilities, supported by their research and development budgets is serving as a major market accelerator. For instance, Collins Aerospace disclosed plans to expand its presence in the market in April 2019.

These plans include a high-power, high-voltage $50 million facility in Rockford, Illinois for creating and testing the "industry's most power dense and efficient propulsion motor." Rolls-Royce acquired Siemens' aircraft propulsion division for electric and hybrid-electric in June 2019, accelerating its electrification ambitions. In July 2019, BAE Systems made their most recent statement, announcing that they will collaborate with electric aircraft startup Wright Electric on "flight controls and energy management systems."

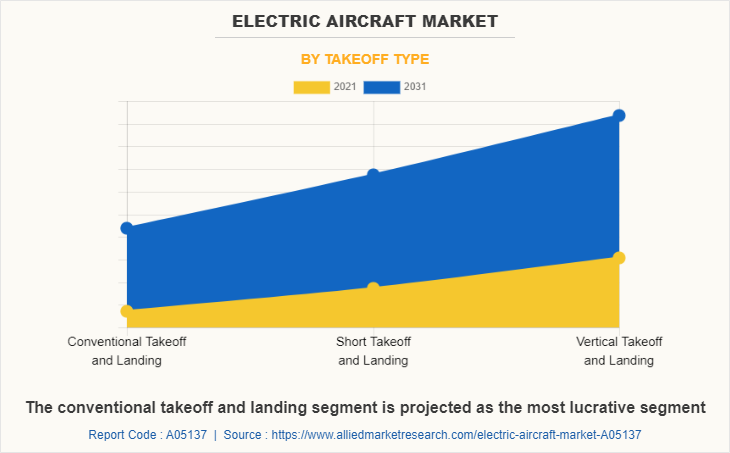

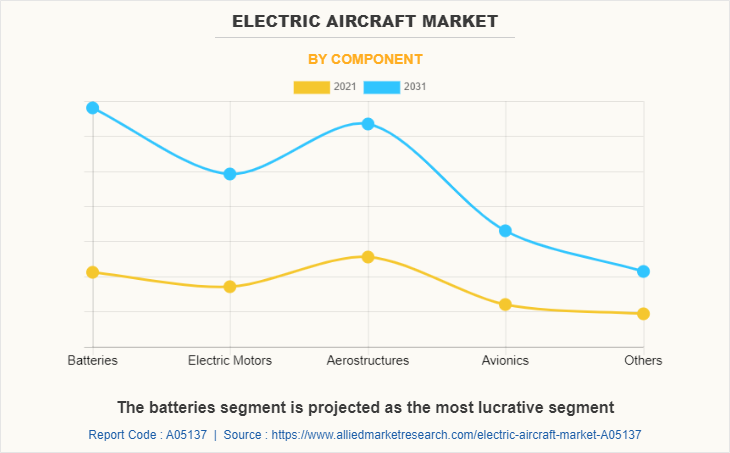

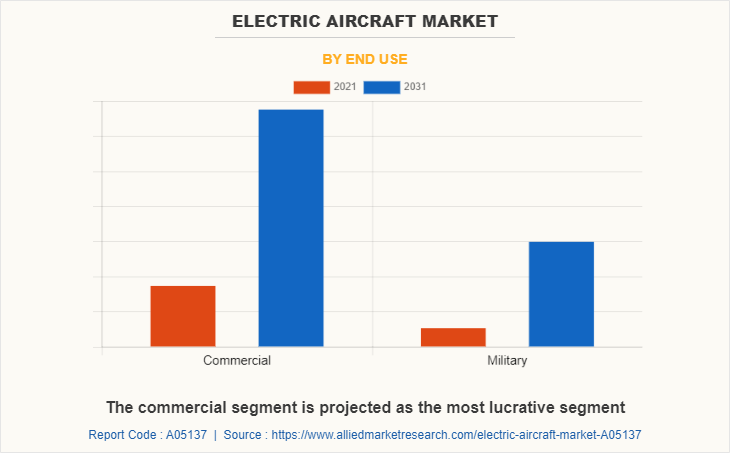

The global electric aircraft market is segmented on the basis of takeoff type, component, end use, and platform. Depending upon the takeoff type, the market is fragmented into conventional takeoff and landing, short takeoff and landing, and vertical takeoff and landing. By component, it is divided into batteries, electric motors, aerostructures, avionics, and others. By end use, it is categorized by commercial and military. The platform segment is bifurcated into fixed wing and rotary wing. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The market in Europe is analyzed across the UK, Germany, France, and rest of Europe. Europe is anticipated to witness a notable growth rate within the electric aircraft market owing to rise in aircraft modification programs within the military sector while catering to the rise in demand within the commercial segment.

The European aviation industry is facing complex operational challenges. In March 2022, in the wake of European states easing travel restrictions, the recovery of passenger traffic has accelerated sharply and suddenly. Coping with this sudden increase and concentration of air traffic has been challenging for airports, their operational partners, supply chain players as well as OEM manufacturers. Long order backlogs of commercial aircrafts, and rise in demand for short term routes has allowed airline operators to incline toward electric aircrafts on commercial front.

UK has a dominant market presence within the aviation industry and serves as one of the most important players in the European Union. The companies operating within the regions are increasingly taking efforts to increase their efficiency, upscale their business capacities, and generate efficient electric aircrafts.

Companies have adopted product development and product launch as their key development strategies in the electric aircraft industry. Moreover, collaborations and acquisitions are expected to enable leading players to enhance their product portfolios and expand into different regions. The key players that operate in the electric aircraft market are AeroVironment, Airbus, Ampaire, Duxion, EHang Holdings Ltd., Elbit Systems Ltd., Embraer SA, Eviation, Joby Aviation, Lilium, Pipistrel Aircraft, Rolls Royce Plc, Volocopter GMBH, Wright Electric, Inc., and ZeroAvia.

The prominent companies operating in the market are adopting strategies such as product launch and expansion to strengthen their market position. In April 2022, AeroViroment had successfully demonstrated multi-domain unmanned aircraft having computer vision and sensor software. This demonstration has been done in International Maritime Exercise 2022. In September 2022, Airbus revealed the world’s first zero emission electric commercial aircraft which could enter service in 2035. It has turbofan design with 2000+ nautical miles with blended wing-body design. In June 2022, Ampaire and Black & Veatch partnered for focusing on planning, engineering and building electrified aviation infrastructure for electric aircraft’s landing and takeoff.

Rise in efforts by industry stake holders to reduce carbon footprint generated by the aviation industry

The rise in awareness by regional and international players toward achieving carbon neutrality by 2050, is one of the major driving factors of the electric aircraft market growth. Emission reductions are the key factors in the global adoption of electric aircrafts. While a combination of technologies using drop-in replacement fuels, like SAF, will reduce emissions, flights in the regional travel sector provide a particularly high opportunity for improvement. Based on emissions, short-haul aircrafts are thought to be up to 50% less efficient than long-haul flights.

The reduced operational cost of electric aircraft as compared to conventional aircraft will serve as a major market accelerator. Major aircraft manufacturers are inclined toward electrification of aircraft to ensure business profits. For instance, Ampaire estimates that around 15-passenger aircrafts would see a 90% reduction in fuel expenses and a 50% reduction in maintenance costs. Such more affordable cost structures are projected to provide a chance to revive service on less profitable routes.

According to the NASA Regional Air Mobility study, local communities' opposition to new airports and increased air service is a result of noise and possible pollution. Due to its electric motor and steep rise and descent profiles, regional electric aircrafts have the potential to be less noisy. Internal studies from United Technologies Corporation, according to Collins Aerospace (White 2020), show that commercial hybrid-electric and electric propulsion could reduce aircraft noise by up to 85% (for electric), improve fuel consumption by 40% (for hybrid), reduce CO2 emissions by more than 20% (for hybrid), and reduce operating and maintenance costs for airlines by up to 20% (electric and hybrid).

Rise in regional travel market

Regional aviation is anticipated to have the fastest growth in regions where travels are fewer than 500 km (310 miles). This is due to the existing technology's constrained battery capacity and the new economic feasibility of operating these routes. Many of these routes only use a limited number of airports, underutilizing other minor airports. Only 30 (0.6%) of the 5,050 U.S. airports that are open to the public, according to the NASA Regional Air Mobility study, support 70% of domestic air travel. There are an additional 5,000–8,000 public and private usage airports that are now unprofitable regional destinations that may be successfully supplied by electric aircraft.

Only 60% of Americans live within the same distance of a commercial airport, whereas 90% of Americans live within a 30-minute drive of a regional airport. Reduced air access costs for underserved places are also encouraged by the expense of federal subsidies to keep vital air service to small villages operating. Currently, the federal government provides subsidies for unprofitable legacy service routes in order to retain scheduled air service and the related economic advantages of linked mobility.

Encouragement of a transportation mode shift away from ground transportation for regional destinations could reduce congestion and the need for vehicle parking at airport hubs for those accessing larger markets in addition to reducing emissions by switching air travel to clean electric power for local destinations. Electric aircraft may offer a practical, cost-effective substitute for flights to and from remote locations while cutting down on travel time and expenses.

Airports and public institutions are mainly interested in the potential of electric aviation to stimulate economic development by serving presently undeserved areas, opening markets that have been phased out, purposing general aviation airports to offset operational costs, and improving pilot training operations. In addition, there is a lot of interest in promoting new innovations and technologies.

Technological drawbacks, limiting commercial acceptance

Electric propulsion in commercial aviation has a variety of difficulties, from wiring and cooling to batteries and motors. The batteries' poor energy density is a major problem. While commercially available lithium-ion batteries have an energy density at the cell level of around 250 Wh/kg, jet fuel has an energy density of over 12,000 Wh/kg. When weight penalties for thermal-runaway containment and other safety precautions are taken into account, energy density at the pack level is generally 20% lower. Even while it would seem difficult to close that gap, pioneers in electric propulsion think they can use readily accessible batteries to create tiny, short-range aircraft that are economically viable. Short-range refers to travels under 250 miles, whereas "small" refers to aircraft with up to 19 passengers.

The rate of improvement for batteries is 5-8 percent yearly. By 2030, all-electric, 30-seat aircraft with a 350-Wh/kg energy density at the pack level might be commercially available, according to a cautious projection from NASA. Batteries that are "commercially ready" will have big pack sizes and sufficient cycle lifetimes. It is believed that pack-level energy densities between 400 and 500 Wh/kg represent a sweet spot with possible uses in hybrid-electric aircraft with seating capacities ranging from 50-seat regional jets to 150-seat single-aisles. By 2035, 400-Wh/kg batteries may be available commercially, according to NASA, but reaching 400 Wh/kg would require further investment in new battery technologies. Hence, technological drawbacks limit the commercial acceptance of electric aircrafts.

By Region

North America would exhibit the highest CAGR of 12.3% during 2022-2031

Key Benefits For Stakeholders]

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric aircraft market analysis from 2021 to 2031 to identify the prevailing electric aircraft market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric aircraft market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric aircraft market trends, key players, market segments, application areas, and market growth strategies.

Electric Aircraft Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 23.5 billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 329 |

| By Takeoff Type |

|

| By Component |

|

| By End Use |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Elbit Systems Ltd., Wright Electric, Inc., Joby Aviation, AeroVironment, Inc., Duxion, VOLOCOPTER GMBH, lilium, ZeroAvia, PIPISTREL d.o.o., Embraer SA, Ampaire Inc., Rolls Royce Plc, Airbus, Eviation, EHang Holdings Ltd. |

Analyst Review

The electric aircraft market is expected to undergo a major shift in the coming years. Reduction of overall carbon footprint by aviation industry, development of electric propulsion system, advancement in peripheral electrical and semiconductor technologies, and increase in demand in short haul domestic travel are some of the major market accelerators projected to positively shift the business dynamics of the electric aircraft market.

Along with battery producers in the automotive and storage industries, aerospace manufacturers are investing a significant amount of time and money in the development of aircraft battery technology. Battery-powered flights could not be that far off as next-generation aircraft grow lighter and more aerodynamic and as battery energy density increases. On a limited scale, in training flights and two-person operations, electric aircraft are already in the air. Over 100 projects are now ongoing in various locations across the globe to investigate ideas for employing electric or hybrid-electric propulsion.

Some major examples catering to the initial innovation of market include the Eviation Alice, which can carry nine passengers and two pilots up to 650 miles at a cruising speed of 240 knots, and the Pipistrel Alpha Electro, a well-known two-seat trainer with an endurance of one hour + 30 minutes reserve. Three 260kW electric motors created by the Siemens eAircraft division, recently bought by Rolls-Royce, power Alice. The battery makes about 60% of the aircraft's take-off weight at 3,700 kg.

The global electric aircraft market was valued at $8.5 billion in 2021 and is projected to reach $23.5 billion in 2031, registering a CAGR of 10.9%.

The largest regional market for electric aircraft is North America.

The leading application of electric aircraft market is commercial.

The upcoming trends in the electric aircraft market include increasing usage of superconducting technology and rise in demand for electric aircrafts for regional travel.

The top companies to hold the market share include AeroVironment, Airbus, Ampaire, Duxion, EHang Holdings Ltd., Elbit Systems Ltd., Embraer SA, Eviation, Joby Aviation, Lilium, Pipistrel Aircraft, Rolls Royce Plc, Volocopter GMBH, Wright Electric, Inc., and ZeroAvia.

Loading Table Of Content...

Loading Research Methodology...