Electric Boat Market Insights, 2031

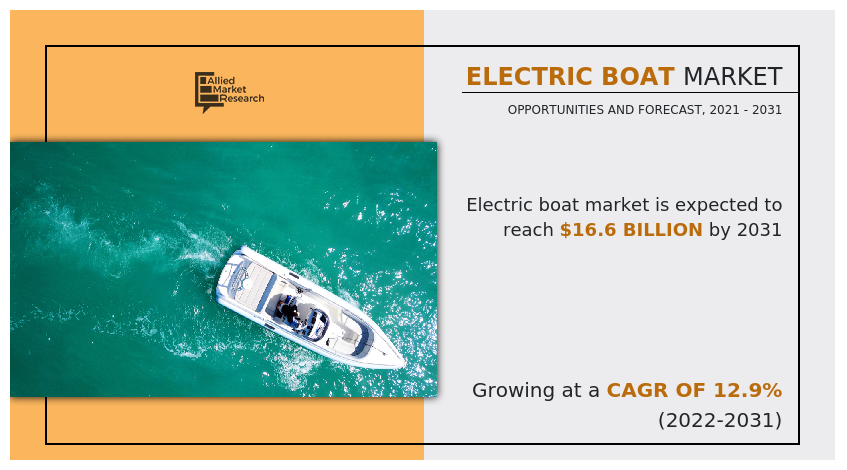

The global electric boat market size was valued at $5.0 billion in 2021, and is projected to reach $16.6 billion by 2031, growing at a CAGR of 12.9% from 2022 to 2031.

Rise in pollution levels and rise in awareness regarding climate conservation has incentivized many businesses across the globe to shift to green technology in their applications. These boats help in reduction of harmful gas emission in the atmosphere. Many governments across the globe have implemented emission regulations or standards that regulate air pollution and specify permissible amount of air pollutants that can be released into the atmosphere. This has led many countries to switch to battery-based technologies. Battery powered boats are completely smokeless, noiseless, and odorless. Electric boats do not sail for longer distances as they often need to dock to charge their batteries. A major benefit of electric engines over combustion engines is the initial take-off. However electric engines can accelerate quickly, they must be ignited at a certain speed to run the boat and generate enough power.

Electric boats are marine vessels with electric drive as propulsion technology. These boats use battery power for propulsion of rotor to achieve maximum speed. Electric boats can be pure electric, hydrogen fuel cell electric, or hybrid electric. Key components of an electric boat comprise electric charger, battery bank, controller, and electric motor. Electric charger controls and manages charges according to capacity of the battery. Battery bank is responsible for storing energy to propel electric boats. A transformer controller is a static electrical device that transfers energy between two circuits. The motor controller converts direct current into alternating current, while electric motor allows boats to operate, offering enhanced orientation and control of the boat. In addition, electric boats run on clean energy and do not create any pollution. Batteries used in in electric boats are similar to those used in electric vehicles.

Adoption of electric boats, owing to increase in environmental impact and strict emission regulations, rise in seaborne trade activities, and growth in the marine tourism industry globally are the major factors that drive growth of the global electric boat market. However, limited capacity of batteries in electric boats and high cost of electric propulsion systems are restrain the market growth. Furthermore, growth & development to expand charging infrastructure, government support to promote adoption of electric boats, and technological advancements are expected to provide growth opportunities during the forecast period.

The global electric boat industry is still in early stages of development and there is a huge scope for growth in the future. Majority of fuel used in transportation is petroleum based, initiatives by governments for reduction of these carbon emissions and focus on encouraging consumers to adopt eco-friendly boats and ships is expected to boost growth of the electric boat market. Pollution caused by emissions has severe impacts on the environment, thus availability of an alternative environmentally beneficial product assists in the market expansion. New rules designed to limit Green House Gas (GHG) emissions from the freight industry also boost the demand. Increase in boat transportation, boat leasing for leisure, increase in the standard of living, and urbanization also propel the market growth. Technological advancements in energy storage devices along with increase in investments from the defense sector also plays a key role in the market growth. In addition, numerous technological advancements such as remote monitoring, warning systems, and dashboard monitoring are integrated into electric boats to meet the consumer demand.

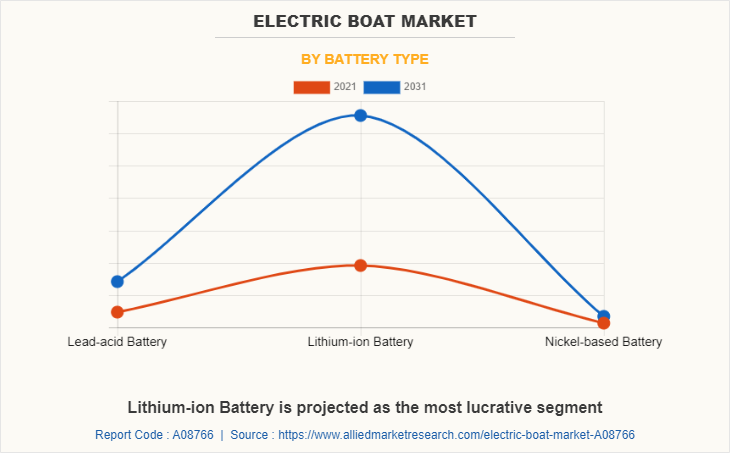

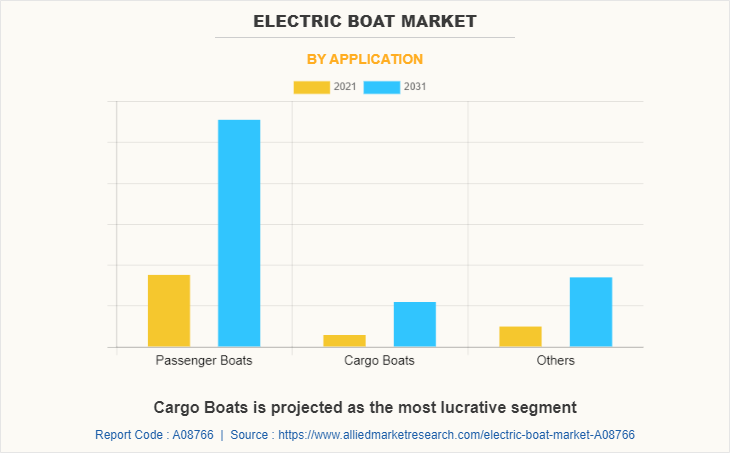

The electric boat market is segmented on the basis of propulsion type, battery type, range, power output, application, and region. By propulsion type, it is segmented into pure electric boats and hybrid electric boats. By battery type, it is classified into lead-acid battery, lithium-ion battery, and nickel-based battery. By range, it is fragmented into less than 50 km, between 50 and100 km, between 101 and 1,000 km, and greater than 1,000 km. By power output, it is categorized into below 5kW, between 5kW and 30kW, and above 30kW. By application, it is segmented into passenger boats, cargo boats, and others. Region wise, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies in the electric boat report include ABB Ltd., Aquawatt (Aquawatt Green Marine Technologies), Boesch Motorboote AG, Boote Marian GmbH, Candela Technology AB, Corvus Energy, Domini Yachts, Duffy Electric Boat Company, Echandia AB, ElectraCraft, Inc., Frauscher Bootswerft GmbH & Co KG, Greenline Yachts, Grove Boats SA, LearBoats USA, Inc., NavAlt Solar & Electric Boats Pvt. Ltd., Quadrofoil d.o.o., RAND Boats ApS, Ruban Bleu, Soel Yachts B.V., Torqeedo GmbH, Vision Marine Technologies Inc., X Shore, and Yamaha Motor Co., Ltd.

Introduction of stringent emission regulations

Electric boats operate through battery-powered rotor for propulsion. These boats are increasingly replacing fuel powered boats, owing to stringent government norms for controlling carbon emissions and growing environmental concerns. Traditional or conventional boats produce a large amount of exhaust gases including nitrogen oxide, sulfur oxide, and CO2. With cargo ships being one of the highest sources of pollution in seaports, there has been a greater emphasis on reducing emissions from boats and ships.

In addition, organizations such as International Maritime Organization (IMO) have implemented numerous regulations to cut down emissions, which, in turn, boosts adoption of electric boats during the forecast period. For instance, the 2030 Green Ship-K promotion strategy, a central part of South Korea’s plans to achieve carbon-neutrality by 2050, specifically targets advancements and wider use of low-carbon ship technology, including hydrogen fuel cells and propulsion systems.

Moreover, electric boats run on clean energy and offer several features such as noiseless engine, cheaper & less maintenance, which contributes toward adoption of electric boats. Thus, rise in adoption of electric boats, owing to environmental concerns and stringent emission regulations drives growth of the electric boat industry.

Rise in seaborne trade activities

Ships carry around 90% of goods transported globally, and the shipping sector accounts for around 3% of the global greenhouse gas emissions. According to UNCTAD (United Nations Conference on Trade and Development), annual growth in maritime trade between 2022 and 2026 will slow to 2.4% as compared to 2.9% between 2000 and 2020. However, increase in the seaborne trade activities owing to increase in consumer spending on goods and growth of the e-commerce industry during the forecast period will boost the adoption of electric boats.

Ships utilized in transportation of goods through sea routes generally use diesel engines, which contributes in pollution by emitting harmful gases. However, ships or boat manufacturers are focusing on development and introduction of electric ships for transportation of goods, which is expected to contribute toward growth of the market. For instance, in 2021, Asahi Tanker, a Japanese shipping company, unveiled its new electric vessel which is powered by only lithium-ion batteries supplied by Corvus Energy. The new ship is anticipated to aid the shipping industry of Japan to tackle carbon dioxide emissions and air pollution produced by ships. Thus, rise in seaborne trade activities is expected to drive growth of the market.

Growth in marine tourism industry across the globe

Maritime tourism refers to sea-based tourist activities including boating, cruising, yachting, and nautical sports. In recent years, maritime tourism has gained traction across the globe. As per a review undertaken by the World Economic Forum, maritime and coastal tourism is expected to grow at a global rate of 3.5% by 2030.

In addition, several governments have taken initiatives to promote maritime travel & tourism activities. For instance, in 2021, the government of India planned to develop 78 maritime tourism landmarks across India to enhance development of existing lighthouses and its surrounding areas into unique maritime tourism landmarks.

Moreover, maritime tourism activities require yachts, ferries, and cruise ships. Generally, these ships or vessels run on traditional fossil fuel-based engines, which emit harmful pollutants such as nitrogen oxide, sulphur oxide, and CO2. However, boat manufacturers have started to introduce electric powered boats and ships to support marine tourism activities as well as to reduce carbon footprints and pollution, which supplements growth of the market. For instance, in 2022, Candela unveiled P-8 Voyager electric boat. The boat is designed to be a long-range water taxi to be used for tourism. It has a range of 40 nautical miles at a speed of 22 knots. The electric boat market is segmented into Propulsion, Battery Type, Range, Power and Application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric boat market analysis from 2021 to 2031 to identify the prevailing electric boat market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

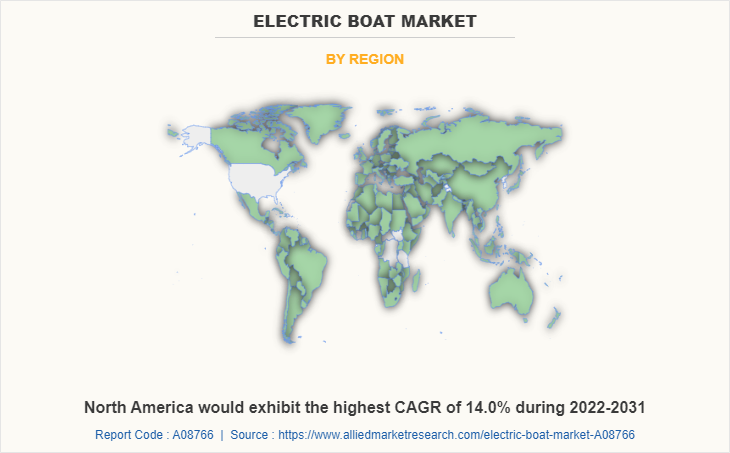

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric boat market trends, key players, market segments, application areas, and market growth strategies.

Electric Boat Market Report Highlights

| Aspects | Details |

| By Propulsion |

|

| By Battery Type |

|

| By Range |

|

| By Power |

|

| By Application |

|

| By Region |

|

| Key Market Players | Vision Marine Technologies Inc., Ruban Bleu, Frauscher Bootswerft GmbH & Co KG, Corvus Energy, ElectraCraft Power Boats, Echandia Group AB, Greenline Yachts, Duffy Electric Boat Company, Boote Marian GmbH, Boesch Motorboote AG, Soel Yachts B.V., ABB LTD, Aquawatt Green Marine Technologies, Candela Technology AB, RAND Boats ApS, Grove Boats SA, Domani Yachts, NavAlt Solar & Electric Boats Pvt. Ltd, Quadrofoil d.o.o., Yamaha Motor Co., Ltd., X Shore, Torqeedo GmbH, Learboats USA, Inc. |

Analyst Review

Growth of the market is driven by environmental concerns and factors such as increase in adoption of electric boats, stringent emission regulations and technological advancements. There has been an increase in focus on improving battery technology to attain a competitive edge over other players in the market. For instance, in 2020, Holland Ship Electric selected Corvus Energy to deliver lithium-ion battery-based energy storage systems (ESS). This system is developed for five new all-electric ferries developed by Holland Shipyards Group for GVB, a municipal public transport operator in Amsterdam.

Several developments have been carried out by key players operating in the electric boat industry. For instance, in January 2021, ABB Ltd., signed a contract with shipyard Haemin Heavy Industries to deliver comprehensive power and propulsion solutions for Busan Port Authority’s first all-electric passenger ferry. Moreover, in February 2019, Boote Marian GmbH launched its flagship M800 Spyder boat, which can be motorized with up to 150kW. The whole architecture is oriented to reduce power usage and enable faster speeds.

Rise in demand for electric boats from regions such as Europe, coupled with stringent environmental regulations and emission standards is expected to supplement the market growth. Several destinations in Europe have banned combustion engines. Annie Zamojski, product manager at Pure Watercraft stated that more and more bodies of water are becoming electric. Europe is leading the way in electric-only bodies of water, which are now being adopted by different regions of the globe, thereby driving adoption of electric boats. She further stated that the appeal of electric boats is driven by consumers wanting to be clean and green. Features offered by electric boats such as reduced noise, no regular maintenance, and fewer moving parts contribute toward its increasing adoption. In 2020, Pure Watercraft collaborated with Highfield Boats USA to design a new, environmentally friendly all-electric-powered rigid inflatable boat.

The upcoming trends include greater use of electric cargo boats, and development of batteries and related systems to offer higher capacity and range.

The leading application is passenger electric boats.

Europe is the largest regional market for electric boats.

The global electric boat market was valued at $5.02 billion in 2021 and is projected to reach $16.64 billion in 2031, registering a CAGR of 12.9%.

Some leading companies profiled in the electric boat market report include ABB Ltd., Aquawatt (Aquawatt Green Marine Technologies), Boesch Motorboote AG, Boote Marian GmbH, Candela Technology AB, Corvus Energy, Domini Yachts, Duffy Electric Boat Company, Echandia AB, ElectraCraft, Inc., Frauscher Bootswerft GmbH & Co KG, Greenline Yachts, Grove Boats SA, LearBoats USA, Inc., NavAlt Solar & Electric Boats Pvt. Ltd., Quadrofoil d.o.o., RAND Boats ApS, Ruban Bleu, Soel Yachts B.V., Torqeedo GmbH, Vision Marine Technologies Inc., X Shore, and Yamaha Motor Co., Ltd.

Loading Table Of Content...