Electric Forklift Truck Market Research, 2033

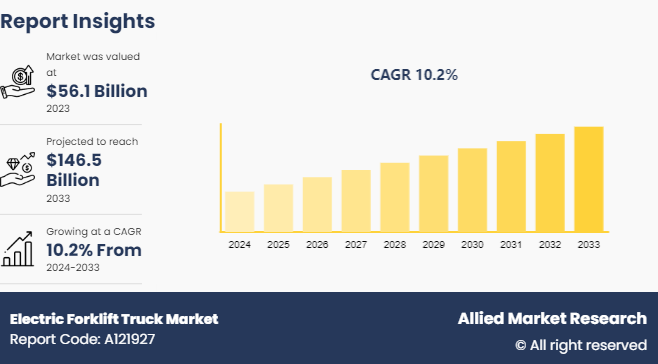

The global Electric Forklift Truck Market Size was valued at $56.1 billion in 2023, and is projected to reach $146.5 billion by 2033, growing at a CAGR of 10.2% from 2024 to 2033.

Market Introduction and Definition

The electric forklift truck market refers to the global industry focusing on producing, selling, and utilizing forklifts powered by electric batteries instead of internal combustion engines. Electric forklifts are key tools in different industries, including warehousing, manufacturing, retail, and logistics. An electric forklift truck is a kind of commercial vehicle used for elevating and transferring materials over a short distance within a warehouse, distribution centers, and other industrial settings. Forklifts are powered by internal combustion engines that utilize diesel, gasoline, and propane, whereas electric forklifts are powered by electric batteries.

Electric forklift trucks are powered with the help of battery. The electric forklift trucks are usually provided with rechargeable batteries, usually lead-acid and lithium-ion types. The batteries are useful in thrusting electric motoring that assists in propelling the forklift. There are different components that are associated with electric forklift trucks. The different components are namely, electric motor, battery, mast, forks, control system, chassis, and wheels.

Electric forklift trucks offer different benefits such as eco-friendly application, low operating costs, silent operation, and reduced maintenance. These trucks are environment oriented as they produce zero emissions during the point of utilization and reduce their carbon footprint. Electric forklift trucks usually operate at low expenditure due to lesser movable parts and low fuel costs. Electric forklift trucks produce less noise that is advantageous for indoor use and also improves the working environment. Electric forklift trucks require lesser mechanical parts that erode out.

Electric forklift trucks consist of various applications such as warehousing, manufacturing, retailing, distribution, and cold storage. The truck plays an important part in the movement of goods from one place to another. The truck helps transport materials between different stages of production. The truck transport goods to retail and distribution centers. The truck is suitable for refrigerated warehouses where fuel and fuel emissions are the concerns.

Key Takeaways

The Electric Forklift Truck Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major electric forklift truck industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

In 01/06/2022, Toyota Material Handling launched 22 new electric forklifts as part of the company’s growing portfolio of world-class material handling products and solutions. Toyota Material Handling (TMH) is elevating its position as the industry’s most innovative manufacturer of material handling products and warehousing solutions.

As per the article published by Recycling Product News on 08/24/2021, Komatsu launched the enhance the bottom line, the new FH100-160-1 series of forklifts from Komatsu integrate components and technology from the company's wheel loaders, bulldozers and excavators, making them ideal for high cycle and heavy load applications. The hydrostatic drive system allows FH100-160 forklifts to shuttle continuously with virtually no wear on drive and brake components, meaning more uptime and reduced maintenance costs, leading to better performance than traditional torque converter systems.

In October 2023, Heli launched the first 4-5 tons hydrogen fuel cell forklift in Shanghai. It is the first hydrogen-powered forklift of this tonnage class in China. This fuel cell forklift is an essential member of hydrogen-powered forklifts developed by Anhui Heli Co., Ltd. The fuel cell system power is up to 25kW, the peak power is 55kW, and the performance is advanced internationally. The hydrogen-powered forklift is safe, efficient, maintenance-free, long-life, and adaptable to both high and low temperatures.

In November 2021, Hyundai Construction Equipment launched a new line of electric forklift trucks in 2023, specifically the 9-series models including the 40B-9, 45B-9, and 50B-9. These electric sit-down forklifts are designed for enhanced performance, ergonomics, serviceability, and safety. They feature advanced technology such as curve control for smooth turning, an anti-roll back system, and excellent gradeability.

In March 2024, Komatsu Ltd. announced the launch of a new electric forklift truck equipped with sodium-ion batteries. The new forklifts will undergo Proof-of-Concept (PoC) tests at customer worksites starting in March 2024. These forklifts are designed for light-load operations and feature rapid charging capabilities, long cycle life, and lower operational costs due to the stable and abundant supply of sodium.

Key Market Dynamics

The electric forklift truck market is experiencing significant Electric Forklift Truck Market Growth driven by key market dynamics such as increasing environmental regulations, the rising demand for sustainable and energy-efficient material handling solutions, and advancements in battery technology. As industries aim to reduce carbon footprints and comply with stricter emission standards, electric forklifts are becoming a preferred choice over traditional internal combustion engine (ICE) forklifts due to their lower operating costs, reduced maintenance requirements, and zero emissions. Additionally, the development of high-capacity lithium-ion batteries and improvements in charging infrastructure are enhancing the performance and adoption of electric forklift trucks across various sectors, including manufacturing, logistics, and warehousing.

Market Segmentation

The electric forklift truck market is segmented into product type, battery type, load capacity, end user and region. Based on product type, the market is categorized into electric counterbalance forklift, electric warehouse forklift, electric pallet jacks and stackers, electric reach, electric order pickers and others. Based on battery type, the market is categorized into lead-acid batteries, lithium-ion batteries and fuel cells. Based on load capacity, the market is categorized into 0-5 tons, 5-10 tons, 10-15 tons and above 15 tons. Based on end-user, the market is categorized into manufacturing, logistics and warehousing, retail, construction, food and beverage, e-commerce, chemicals and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/ Country Market Outlook

In the vast landscape of electric forklift manufacturers, a few Chinese giants are emerging such as BYD forklift and Hangcha Group.

Godrej Material Handling launched Uno electric forklift truck. The new Uno Electric Forklift is a workhorse in the 1.5 to 3-tonne forklift category. Its performance is near comparable to a diesel forklift in the same tonnage category with the added benefit of it being gentle on the environment and rugged on the job. The product was launched in India.

The agreement was signed?by the United Arab Emirates (UAE) and the Swedish tech startup Einride to construct the electric road freight system in Abu Dhabi as part of Falcon Rise Grid could herald increased trade between the two nations in March 2024. In Abu Dhabi and Al Ain, Einride plans to roll out 1, 000 electric heavy-duty trucks, 100 driverless cars, and infrastructure for charging them. The Abu Dhabi Department of Municipalities and Transport, the parent organization of the Integrated Transport Center, signed the deal last month.?

Competitive Analysis

The major players operating in the electric forklift truck market include Toyota Material Handling (Japan) , Godrej & Boyce (India) , Mitsubishi Logisnext (Japan) , Komatsu Limited (Japan) , Hangcha Group Co. Ltd. (China) , Anhui Heli Company Limited (China) , EP Equipment (China) , BYD Company Limited (China) , Doosan Industrial Vehicle (South Korea) , Hyundai Heavy Industries (South Korea) , Lonking Holdings Limited (China) , Heli Forklift Co. Limited (China) and Tailift Co. Limited (Taiwan) .

The following players adopted product launches, and other strategies to increase their Electric Forklift Truck Market Share in the global electric forklift truck industry.

The other players in the industry include Crown Equipment Corporation (U.S.) , Hyster Yale Materials Handling (U.S.) , Clark Material Handling International (U.S.) , and Cascade Corporation (U.S.)

Industry Trends

The increasing use of electric vehicles in the handling of material is driving the growth of electric forklift truck market. As per the article published by Industrial Safety and Hygiene News on 18th August 2022, in an effort to avert a global warming catastrophe and shift away from fossil fuels, some nations are considering outright prohibitions on ICE-fueled machinery and cars. Bans imposed by South Korea and Norway will take effect in 2025. 2026 will see Belgium come next, while 2027 will see Austria. Eight nations and one state called Washington will outlaw internal combustion engines by 2030. In the upcoming years, more nations and governments will take similar action.

Advancements in battery technology, specifically in the field of lithium-ion cells, are improving the efficiency, duration, and reliability of electric forklifts. Compared to standard lead-acid batteries, these batteries offer faster charging times, more operating hours, and demand minimal upkeep. For instance, energy density is a new improvement in lithium-ion batteries. The quantity of energy grasped per unit volume or weight of the battery is referred to as its energy density. To provide electric vehicles with a longer lifespan and longer driving ranges, scientists and engineers have made significant progress in increasing the energy density of lithium-ion batteries across time. More efficient power storage options have been made feasible by innovations in battery cell design, electrode materials, and electrolytes.

Key Sources Referred

Industrial Safety and Hygiene News

Recycling Product News

Toyota Fork Lift.com

Helichina.net

B2B Purchase

For construction pros.com

Komatsu Newsroom

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric forklift truck market analysis from 2024 to 2033 to identify the prevailing Electric Forklift Truck Market Opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the electric forklift truck market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global electric forklift truck market trends, key players, market segments, application areas, and market growth strategies and Electric Forklift Truck Market Forecast.

Electric Forklift Truck Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 146.5 Billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 262 |

| By Product Type |

|

| By Battery Type |

|

| By Load Capacity |

|

| By End User |

|

| By Region |

|

| Key Market Players | Heli Forklift Co. Limited (China), BYD Company Limited (China), Anhui Heli Company Limited (China), Hyundai Heavy Industries (South Korea), Godrej & Boyce (India), Cascade Corporation (U.S.), Komatsu Limited (Japan), Toyota Material Handling (Japan), EP Equipment (China), Tailift Co. Limited (Taiwan), Crown Equipment Corporation (U.S.), Mitsubishi Logisnext (Japan), Hyster Yale Materials Handling (U.S.), Doosan Industrial Vehicle (South Korea), Lonking Holdings Limited (China), Clark Material Handling International (U.S.), Hangcha Group Co. Ltd. (China) |

The transition from internal combustion engines to electric power is a significant trend. Advances in battery technology, such as lithium-ion batteries, offer longer life, faster charging times, and more efficient power management compared to traditional lead-acid batteries. This shift not only reduces the carbon footprint but also lowers operational costs over the vehicle's lifetime.

The lead-acid battery segment is the leading application of Electric Forklift Truck Market. This was due to its ability to withstand harsh working conditions, lower upfront costs, and long-term viability for heavy-duty applications in various industries such as manufacturing and warehousing.

Europe is the largest regional market for Electric Forklift Truck. This is due to stringent environmental regulations and government incentives promoting the adoption of electric vehicles across industries. Countries such as Germany, France, and the Netherlands are leading in terms of electric forklift truck deployment, driven by strong environmental policies and a focus on reducing carbon footprints.

$146.5 Billion is the estimated industry size of Electric Forklift Truck.

Toyota Material Handling (Japan), Godrej & Boyce (India), Mitsubishi Logisnext (Japan), Komatsu Limited (Japan) are the top companies to hold the market share in Electric Forklift Truck.

Loading Table Of Content...