Electric Power Substation Automation Market Research, 2032

The global Electric Power Substation Automation Market was valued at $4.4 billion in 2022, and is projected to reach $6.9 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032.

Electric power substation automation refers to the integration of advanced technologies and systems to enhance the monitoring, control, and management of electrical substations. Substations are crucial components of the power grid that facilitate the transmission, distribution, and transformation of electricity. Automation in substations involves the deployment of intelligent devices, communication networks, and software applications to enable real-time data collection, analysis, and decision-making processes.

In a substation automation system, various components work together to improve operational efficiency and grid reliability. These components include intelligent electronic devices (IEDS), which monitor and control the electrical equipment in the substation, such as circuit breakers, transformers, and meters. These devices provide accurate measurements, fault detection, and protection functions.

Communication networks, such as local area networks (LANs) or wide area networks (WANs), enable the exchange of data between different devices within the substation and with the central control center. Software applications, such as supervisory control and data acquisition (SCADA) systems, provide a centralized platform for monitoring, control, and visualization of the substation operations. The benefits of electric power substation automation are numerous. It allows utilities to monitor the condition of equipment, detect faults, and respond quickly to incidents, minimizing downtime and improving grid reliability.

Automation enables remote control and operation of the substation, reducing the need for manual intervention and enhancing operational safety. It also enables utilities to optimize power flow, balance loads, and integrate renewable energy sources effectively. Overall, electric power substation automation plays a critical role in modernizing the power grid, improving efficiency, and ensuring a reliable and resilient supply of electricity.

Segment Overview

The electric power substation automation industry is segmented into offering, type and component.

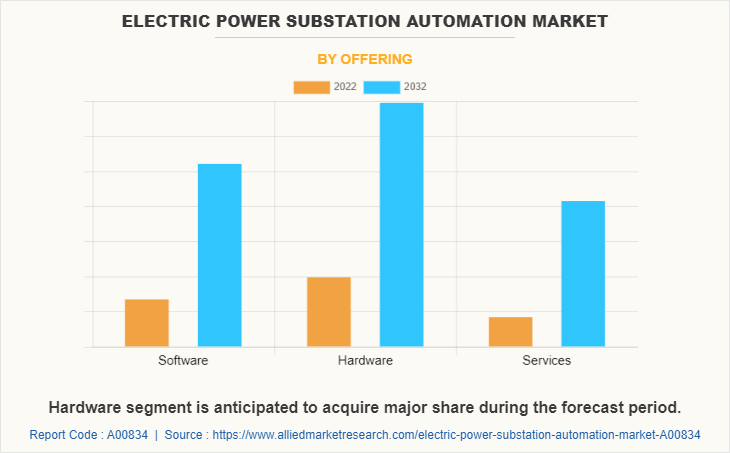

On the basis of offering, the electric power substation automation market size is bifurcated into software, hardware, and services. In 2022, the hardware segment dominated the market, in terms of revenue, and it is expected to acquire major market share till 2032.

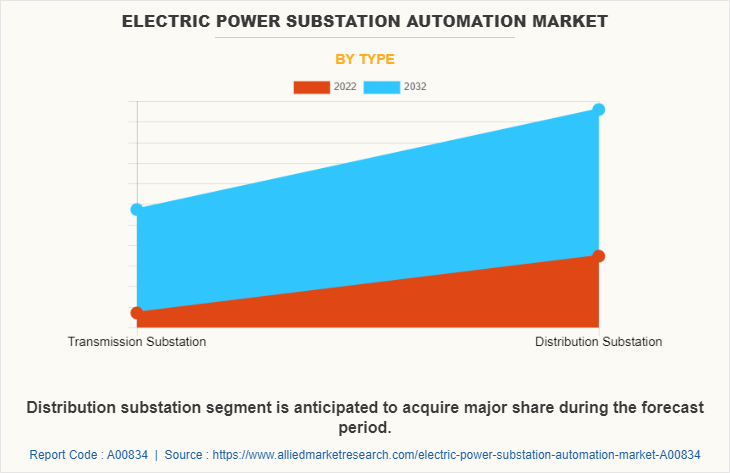

On the basis of type, the market is segregated into transmission substation, and distribution substation. The distribution substation segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

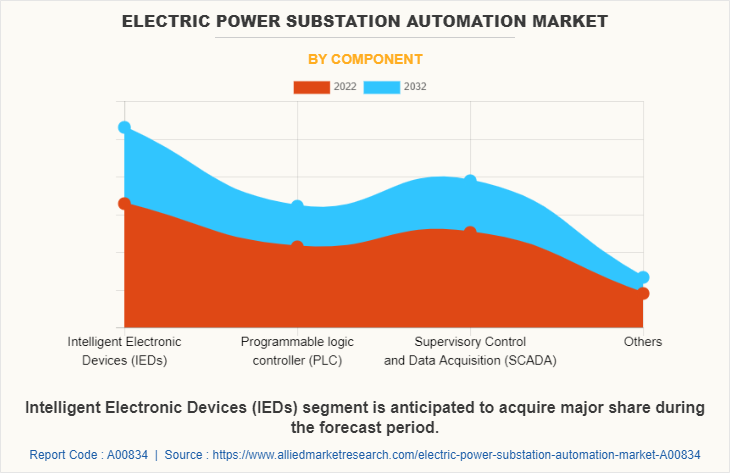

On the basis of component, the electric power substation automation market forecast is segregated into intelligent electronic devices (IEDS), programmable logic controller (PLC), supervisory control and data acquisition (SCADA), and others. The intelligent electronic devices (IEDS) segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2023 to 2032.

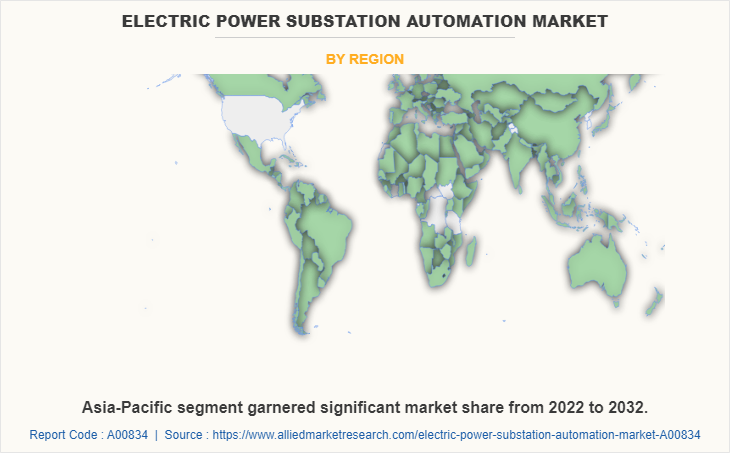

Region-wise, the electric power substation automation industry are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive Analysis

Competitive analysis and profiles of the major global electric power substation automation market players that have been provided in the report include ABB Ltd, Cisco, Eaton, Hitachi Energy Ltd., Honeywell International Inc., Itron Inc., NovaTech, LLC., Rockwell Automation, Schneider Electric, and Siemens. The key strategies adopted by the major players of the electric power substation automation market are product launch, product development, partnership, investment, acquisition, contract, branding, and expansion.

Country Analysis

Country-wise, the U.S. acquired a prime share in the electric power substation automation market opportunity in the North American region and Canada is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, rest of Europe, dominated the electric power substation automation market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. However, the Germany is expected to emerge as the fastest-growing country in Europe's substation automation with a CAGR of 5.45%.

In Asia-Pacific, China, is expected to emerge as a significant market for the electric power substation automation market industry, owing to a significant rise in investment by prime players due to increase in electrification of rural and urban regions.

By LAMEA region, the Africa garner significant market share in 2022. The LAMEA electric power substation automation market has been witnessing improvement, owing to the growing inclination of companies towards utilizing the 5G technology in components such as intelligent electronic devices (IEDs), programmable logic controller (PLC) and expanding installation of utility projects across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 4.70% from 2023 to 2032.

Top Impacting Factors

The electric power substation automation market analysis is anticipated to expand significantly during the forecast period owing to grid modernization initiatives and increase in demand for electricity globally. Additionally, during the forecast period, the electric power substation automation market is anticipated to benefit regional grid expansion. On the contrary, the high initial investment, and complexity of integration is the restraint for electric power substation automation market growth during the forecast period.

Historical Data & Information

The global electric power substation automation market is highly competitive, owing to the strong presence of existing vendors. Vendors of the electric power substation automation market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

ABB Ltd, Cisco, Eaton, Hitachi Energy Ltd., Honeywell International Inc., Itron Inc., NovaTech, LLC., Rockwell Automation, Schneider Electric, and Siemens are the top companies holding a prime share in the electric power substation automation market. Top market players have adopted various strategies, such as product launch, product development, partnership, investment, acquisition, contract, branding, and expansion to expand their foothold in the electric power substation automation market.

- In April 2022, ABB announced its expanded digital substation products and digital systems factory in Vadodara, Gujarat. This factory meets the growing demand for a wide range of digital substation products and digital solutions in India and in more than 50 countries. The manufacturing portfolio includes products like relays, while the solutions range from centralized protection and control systems, distribution automation, to bus transfer systems and arc protection for the electrical distribution network.

- In January 2022, ABB in Finland delivered and installed the primary power distribution solution with switchgear and protection relays, as well as robotic technologies with ABB's robotics partners. ABB also implemented services of the entire system.

- In April 2023, Eaton received a contract to design and construct the essential electrical system for the University of Michigan's new hospital in Ann Arbor, Michigan. Eaton provided a wide range of intelligent electrical equipment and turnkey engineering services to establish a foundation of safe, resilient and sustainable power at University of Michigan Health.

- In January 2022, Eaton announced the acquisition of Royal Power Solutions, a U.S.-based manufacturer of high-precision electrical connectivity components used in energy management, industrial and mobility markets. Eaton paid $600 million for Royal Power Solutions acquisition.

- In March 2021, Hitachi ABB Power Grids in India awarded a project by Bharat Aluminum Company (BALCO), to ensure improved reliability of the power distribution system at its Korba plant in Chhattisgarh. It equipped the substations with advanced MicroSCADA automation solution to monitor and control the aluminum producer's grid in real time and ensure maximum power availability.

- In August 2022, Honeywell launched an Industrial Automation Lab in conjunction with the University Politehnica of Bucharest's Department of Automation and Computer Science to help students build the technical skills and knowledge required to join, compete and succeed in the global industrial automation sector. The lab allows students to put classroom theories to the test by getting hands-on with the latest industrial automation technologies. These include Honeywell's ControlEdge Programmable Logic Controller (PLC) which – when combined with the Honeywell Experion Process Knowledge System and reduce plant integration costs, minimize downtime, decrease risk through embedded cybersecurity, and lower total cost of ownership.

- In May 2022, Yokogawa India Ltd. deployed Itron Inc.'s water operations management solution in Madhya Pradesh, India. The Water operations management solution is a suite of offerings meant to help utilities increase operational visibility and reduce losses. The deployment is part of the Satna Smart City project, where Satna Smart City Development Limited (SSCDL) helps monitor and reduce water loss in the city's water transmission network. The city use SCADA data with Itron's hydraulic modelling to optimize the water distribution network, identify leaks, and help with water demand fluctuations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric power substation automation market analysis from 2022 to 2032 to identify the prevailing electric power substation automation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric power substation automation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global electric power substation automation market overview.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric power substation automation market trends, key players, market segments, application areas, and market growth strategies.

Electric Power Substation Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.9 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 272 |

| By Offering |

|

| By Type |

|

| By Component |

|

| By Region |

|

| Key Market Players | Rockwell Automation Inc., ABB Ltd., Honeywell International Inc., Eaton Corporation, NovaTech, LLC, Schneider Electric SE., Hitachi, Ltd., Siemens, Cisco, Itron, Inc. |

Analyst Review

There is a strong expectation for significant growth in the market in the coming years. These industry leaders believe that several factors will drive this growth and create ample opportunities for companies operating in the electric power substation automation sector.

The increasing global demand for electricity is a key driver. As populations expand, industrial activities grow, and the adoption of electric vehicles rises, the need for a reliable and efficient power supply becomes critical. Substation automation plays a crucial role in ensuring the seamless transmission and distribution of electricity, enabling utilities to meet the rising demand.

The integration of renewable energy sources is driving the need for advanced substation automation. As countries strive to transition to cleaner and more sustainable energy systems, the integration of solar, wind, and other renewable sources into the power grid requires intelligent monitoring, control, and management capabilities. Substation automation technologies enable utilities to efficiently manage and integrate these renewable energy sources into the grid.

The emphasis on grid resilience and reliability is pushing utilities to invest in substation automation. The ability to detect and respond to faults, minimize downtime, and restore power quickly is crucial for maintaining a reliable power supply. Automation technologies provide real-time monitoring, predictive maintenance capabilities, and fault detection systems, improving grid resilience and minimizing the impact of disruptions. In addition, advancements in technology are creating opportunities for innovation and growth in the electric power substation automation market.

The development of communication protocols, IoT (Internet of Things) devices, artificial intelligence, and data analytics has opened up new possibilities for improving substation automation systems. Companies that can leverage these technological advancements to provide comprehensive and integrated solutions are expected to thrive in the market.

Moreover, regulatory initiatives and government policies aimed at modernizing power infrastructure and promoting sustainable energy solutions are creating favorable market conditions for electric power substation automation. Governments are investing in smart grid projects, setting standards and regulations for automation, and providing incentives for utilities to adopt advanced technologies.

Therefore, the perspectives of CXOs in the electric power substation automation market indicate a strong belief in significant market growth. Factors such as increasing electricity demand, renewable energy integration, grid resilience needs, technological advancements, and supportive government policies are expected to drive the growth and create opportunities for companies operating in this sector.

Smart grid integration, increased automation and control, and others are the upcoming trends of Electric Power Substation Automation Market in the world.

Monitoring and Control, Fault Detection and Diagnostics, and others are the leading application of Electric Power Substation Automation Market.

North America is the largest regional market for Electric Power Substation Automation.

The global electric power substation automation market was valued at $4,429.66 million in 2022.

ABB Ltd, Cisco, Eaton, Hitachi Energy Ltd., Honeywell International Inc., Itron Inc., NovaTech, LLC., Rockwell Automation, Schneider Electric, and Siemens are the top companies to hold the market share in Electric Power Substation Automation.

Loading Table Of Content...

Loading Research Methodology...