Electric Utility Vehicle Market Insights, 2031

The global electric utility vehicle market was valued at USD 8.59 billion in 2021, and is projected to reach USD 24.98 billion by 2031, growing at a CAGR of 11.4% from 2022 to 2031.

Electric utility vehicle is a zero-emission vehicle, which utilizes electric motor to carry out a specific task. These are primarily an alternative for traditional utility terrain vehicles that are powered by internal combustion engines. It can have a high-capacity battery, a battery swap system, or a lithium-ion battery with a quick charging system. It is a quiet and green alternative to conventional utility vehicle and aids in reducing carbon footprints.

The growth of the global electric utility vehicle market is propelling, due to launch of new and improved electric utility vehicle, stringent government rules and regulations toward vehicular emission, and increase in fuel costs. However, lack of charging infrastructure and limited driving range of electric vehicle are factors that hamper the growth of the electric utility vehicle industry. Furthermore, technological advancements and proactive government initiatives are expected to offer growth opportunities in the market during the forecast period.

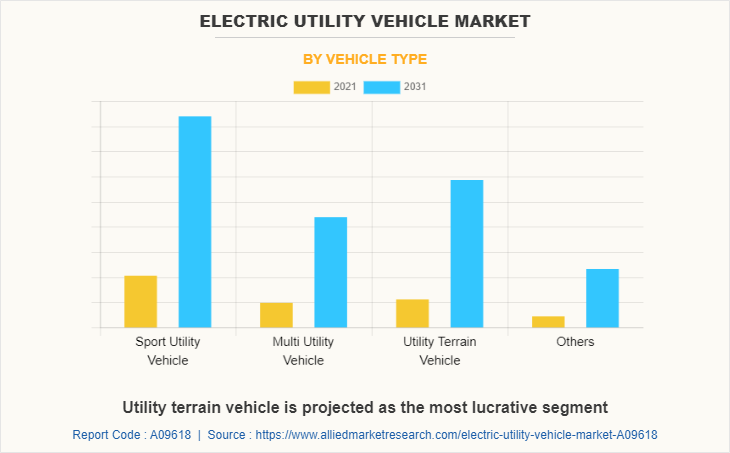

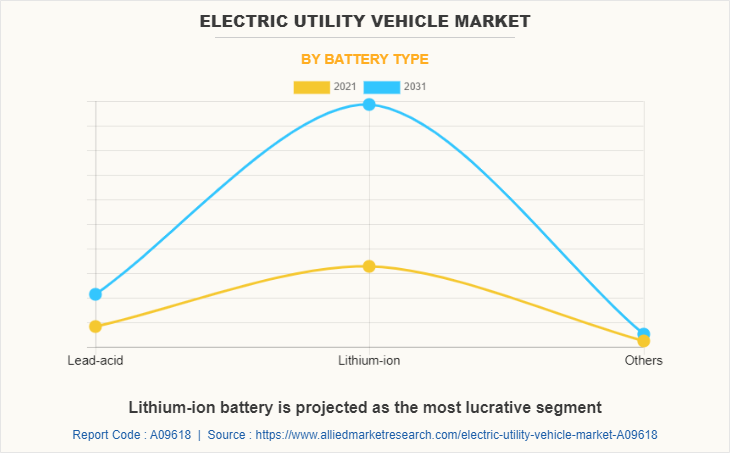

The electric utility vehicle market is segmented on the basis of battery type, vehicle type, application, and region. By battery type, it is segmented into lithium-ion, lead-acid, and others. By vehicle type, it is classified into sport utility vehicle, multi utility vehicle, utility terrain vehicle, and others. By application, it is fragmented into passenger commute, industrial, agricultural, sports, and others. Region-wise, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the electric utility vehicle market report comprise Alke, Bollinger Motors Inc., Club Car, Columbia Vehicle Group Inc., Ford Motor Company, General Motors, Hyundai Motor Company, Mahindra Electric Mobility Limited, Marshell Green Power, Neuron Energy, Polaris Inc., Star EV Corporation, Tesla, Inc., Toyota Motor Corporation, and Tropos Technologies Inc.

Launch of new and improved electric utility vehicle

Electric utility vehicle are utilized for recreation, such as hunting and fishing. It is also used for agricultural purposes, such as feeding cattle, towing, and construction tasks. At present, most of the utility vehicles are based on internal combustion engines, which uses fossil fuels to run the vehicle and create emissions. However, electric utility vehicle runs on clean energy and do not create any emission and also have low maintenance cost, which in turn is driving the demand for electric utility vehicle.

In addition, manufacturers across the globe are focusing on electrification of vehicles owing to environmental concerns. Numerous manufacturers are developing and introducing new electric utility vehicle to reduce carbon footprints. For instance, in May 2022, Alpha Motor Corporation unveiled pure electric utility vehicle namely, REX. REX is built on a common platform that powers the WOLF Truck series. The REX is expected to be equipped with a four-wheel-drive system and independent suspension to manage rough terrain. It will also include an 85 kWh lithium-ion battery with a range of 275 miles. Moreover, in December 2021, Polaris, a manufacturer of multi-utility vehicles, introduced its all-new electric UTV named as RANGER XP Kinetic. It comprises two models: one is premium trim which has a single 14.9 kWh lithium-ion battery with a range of 70 kms, and other model has 29.8 kWh lithium-ion battery with a range of 130 kms.

Stringent government rules and regulations toward vehicular emission

With the growing environmental concerns, governments and environmental agencies globally are enacting stringent emission norms and laws to reduce vehicle emission. Major regulatory measures are stringent emissions targets for the reduction of nitrogen oxides (NOx) and carbon dioxide (CO2) in air. High amounts of greenhouse gases being emitted from vehicles and federal and state governments in the U.S. are stepping up efforts to make transportation cleaner.

For instance, the U.S. Environmental Protection Agency (EPA) announced that they are working on new rules to decrease emissions of nitrogen oxide (NOx) and other pollutants from heavy-duty trucks.

In addition, the California Air Resources Board (CARB) is adopting heavy-duty Low NOx Omnibus Regulation, which aims to achieve a 90% reduction from current NOx emissions limits by 2027. Moreover, in Europe, the European Union (EU) committed within the Paris agreement (COP21) to achieve its 20% greenhouse gas reduction target in 2020 for the second phase of the Kyoto Protocol. The EU has also set a target to achieve 40% greenhouse gas reduction by 2040 and net-zero by 2050.

Therefore, with enactment of the emission regulations for fossil fuel-powered vehicle, the burden on vehicle manufacturers, especially on commercial vehicle manufacturers, has further increased. This, in turn, is expected to drive the demand for electric utility vehicles. Thus, stringent emission norms imposed on fossil-fuel powered commercial vehicles significantly drive the growth of the electric utility vehicle market.

The electric utility vehicle market is segmented into Vehicle Type, Application and Battery Type.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric utility vehicle market analysis from 2021 to 2031 to identify the prevailing electric utility vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric utility vehicle market segmentation assists to determine the prevailing market opportunities.

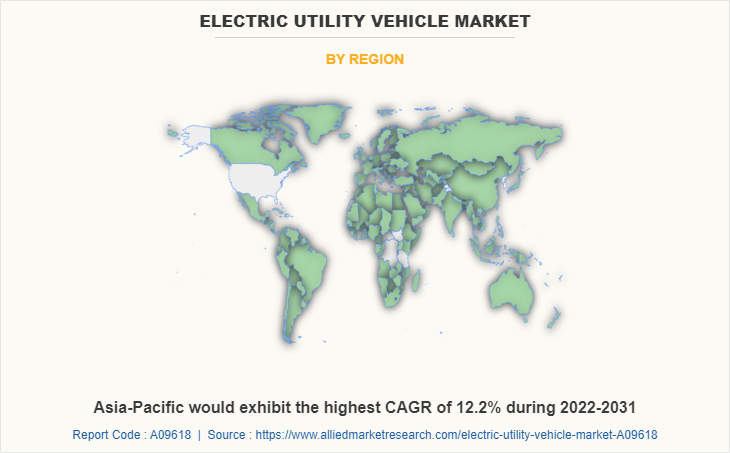

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric utility vehicle market trends, key players, market segments, application areas, and market growth strategies.

Electric Utility Vehicle Market Report Highlights

| Aspects | Details |

| By Vehicle Type |

|

| By Application |

|

| By Battery Type |

|

| By Region |

|

| Key Market Players | Alkè, Hyundai Motor Company, Star EV Corporation, Ford Motor Company, Tesla, Inc., Mahindra Electric Mobility Limited, Columbia Vehicle Group Inc., Marshell Green Power, Neuron EV, Tropos Motors, Bollinger Motors, Polaris Inc., The General Motors Company, Club Car, Toyota Motor Corporation |

Analyst Review

The global electric utility vehicle market is expected to witness significant growth owing to launch of new and improved electric utility vehicle and stringent government rules and regulations toward vehicular emission.

Automobile companies are focusing on production of advanced electric vehicle systems that are expected to have lower particular emission at relatively lowers costs. Companies have also started producing downsized engines to be implemented in vehicles as smaller engines aids to achieve stringent emission norms. This is because they produce lesser emissions as compared to heavier and larger engines. Compactness and cost-effectiveness of these downsized small engines also add another dimension to their usefulness.

Significant rise in demand for ATVs in sports owing to increase in the number of sports racing events across the globe is the primary factor that propels the growth of the segment. In addition, international ATV and UTV sports events, such as UTV World Championship and the Grand National Cross Country (GNCC) are attracting youth participants, thereby driving the market growth. Moreover, companies are also launching electric version of ATVs and UTVs to provide a greener alternative solution with same power specifications, which in turn, boosts the growth of the segment.

The global electric utility vehicle market was valued at USD 8.59 billion in 2021, and is projected to reach USD 24.98 billion by 2031.

The global electric utility vehicle market is projected to grow at a compound annual growth rate of 11.4% from 2022-2031 to reach USD 24.98 billion by 2031.

The key players that operate in the electric utility vehicle market such as Alke, Bollinger Motors Inc., Club Car, Columbia Vehicle Group Inc., Ford Motor Company, General Motors, Hyundai Motor Company, Mahindra Electric Mobility Limited, Marshell Green Power, Neuron Energy, Polaris Inc., Star EV Corporation, Tesla, Inc., Toyota Motor Corporation, and Tropos Technologies Inc.

Significant rise in demand for ATVs in sports owing to increase in the number of sports racing events across the globe is the primary factor that propels the growth of the segment.

Loading Table Of Content...