Electric Vehicle Battery Housing Market Research, 2033

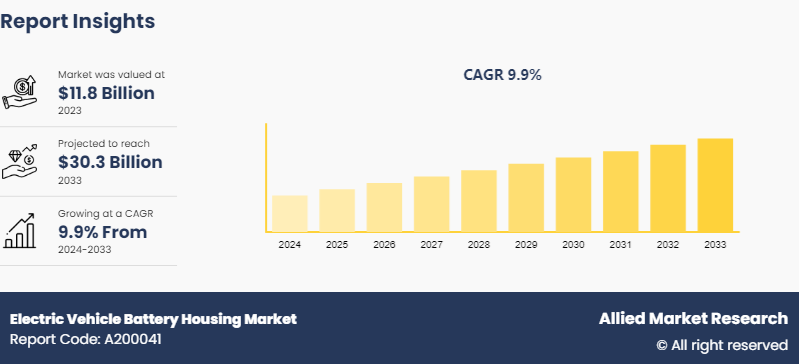

The global Electric Vehicle Battery Housing Market Size was valued at $11.8 billion in 2023, and is projected to reach $30.3 billion by 2033, growing at a CAGR of 9.9% from 2024 to 2033.

Market Introduction and Definition

The Electric Vehicle (EV) battery housing is a type of box specifically designed for batteries, such as the lithium-ion battery of an electric vehicle. It is also called a battery case and battery enclosure. The Electric Vehicle battery housing comprises a metal enclosure (top cover & bottom cover) or box that protects the battery cell from damage and moisture, dust, and debris. The housing also delivers structural support to the battery pack and for additional systems, such as thermal management systems, cooling systems, or battery management systems. The growing adoption of advanced EV battery pack (housing) technologies for enhanced performance is anticipated to propel the Electric Vehicle battery housing market growth.

Key Takeaways

- The electric vehicle battery housings market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major electric vehicle battery housing industry participants along with authentic Electric Vehicle Battery Housing Industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- July 2023 - Magna announced that the company would invest $790 million to build the first two supplier facilities at Ford’s BlueOval City supplier park in Stanton, Tennessee, and a stamping and assembly facility in Lawrenceburg, Tennessee. Magna will supply Ford’s BlueOval City with battery enclosures, truck frames, and seats for the automaker’s second-generation electric truck. Magna’s two BlueOval City supplier park facilities contain a new 800, 000-square-foot frame and battery enclosures and a 140, 000-square-foot seating facility.

- February 2023 - Magna signed a contract with General Motors (GM) to supply battery enclosures for the all-new 2024 Chevrolet Silverado EV, which will be assembled at GM’s Factory ZERO. Magna will produce the enclosures beginning later in 2023 at its Magna Electric Vehicle Structures facility in St. Clair, Michigan, where it already produces battery enclosures for the GMC HUMMER EV. The company is adding a 740, 000-square-foot expansion to the existing 345, 000-square-foot Magna Electric Vehicle Structures facility in St. Clair, which opened in 2021.

- January 2023 - Gestamp Automocion S.A. (Gestamp) announced its fourth hot stamping line in India and presented for the second time its range of products and innovations for new mobility at the Indian Auto Expo 2023. A new hot stamping line is planned to be opened by the end of 2023, in addition to the existing ones in Pune and Chennai. Gestamp unveiled its extreme size parts, battery boxes, cell-to-pack concepts, joining technologies, and chassis innovative lightweight solutions at the event.

- March 2022 - Gestamp Automocion S.A. announced that the company would build the NEV (New Energy Vehicle) Parts East China Base in Qiandeng Town, Kunshan City, Jiangsu Province. Gestamp Automotive Kunshan Co., Ltd., a subsidiary of Gestamp, signed the Gestamp NEV Parts East China Base Project. This project mainly supplies battery cases and door parts to EV makers, marking Gestamp’s first project with these components.

- January 2024, E-Works Mobility signed a technology partnership with SGL Carbon to supply battery cases made of glass fiber-reinforced plastic. The e-car manufacturer is replacing its currently used aluminum battery boxes with boxes made of glass fiber-reinforced plastic from SGL Carbon.

Key Market Dynamics

The Electric Vehicle (EV) Battery Housing Market in the U.S. exhibits a dynamic landscape shaped by various market dynamics. Key drivers, such as government incentives promoting EV adoption and increasing environmental awareness among consumers, are propelling Electric Vehicle Battery Housing Market Size growth. Additionally, advancements in battery technology and the expansion of EV charging infrastructure contribute to the market's upward trajectory. These drivers create lucrative Electric Vehicle Battery Housing Market Opportunity for stakeholders to capitalize on the growing demand for EVs and associated components.

However, certain restraints challenge the market's potential. Supply chain disruptions, particularly in raw materials like lithium and cobalt, pose significant challenges to battery production and, consequently, housing manufacturing. Moreover, regulatory uncertainties regarding EV policies and trade tariffs may hinder market expansion. Addressing these restraints requires proactive strategies focused on diversifying supply chains and navigating regulatory complexities.

Amidst the drivers and restraints, the market presents promising opportunities for innovation and strategic partnerships. Collaboration between EV manufacturers and housing suppliers to develop lightweight and cost-effective housing solutions could enhance product performance and market competitiveness. Additionally, leveraging renewable energy sources for battery production and recycling initiatives aligns with sustainability goals, fostering long-term growth opportunities while mitigating environmental impact.

Market Segmentation

The electric vehicle battery housing market is segmented into vehicle type, material, and region. Based on type, the market is segmented into passenger cars and commercial vehicles. Based on material the market is segmented into steel, aluminum, and others. Based on region the market is classified into North America, Europe, Aisa-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

China emerges as a powerhouse in the Electric Vehicle (EV) Battery Housing Market, showcasing robust growth and dominating Electric Vehicle Battery Housing Market Share. With a rapidly expanding EV market, China leads in both production and consumption of EVs, driving significant demand for battery housing solutions. Recent statistics indicate a staggering growth rate, with EV sales in China surpassing 5 million units in 2023, marking a substantial increase from previous years. This surge in EV adoption underscores the critical role of battery housing in supporting the country's ambitious electrification goals.

The rising demand for electric vehicle battery housing led companies such as CATL and BYD to expand their production capacities and innovate new housing designs to cater to diverse market needs. Additionally, government support through subsidies and favorable policies further propels market growth, incentivizing both consumers and manufacturers to embrace electric mobility.

The Chinese market outlook for EV battery housing is characterized by intense competition and rapid technological advancements. Players are focusing on enhancing energy density, safety, and cost-effectiveness of battery housings to stay ahead in the competitive landscape. Collaborations between EV manufacturers and housing suppliers aim to integrate batteries seamlessly into vehicle designs, optimizing performance and range.

Moreover, China's commitment to sustainable development fuels investments in green technologies, including EVs and associated components. As the world's largest EV market, China presents immense opportunities for market expansion and innovation in EV battery housing. However, challenges such as regulatory uncertainties and supply chain disruptions remain pertinent, necessitating adaptive strategies for sustained growth and resilience in this dynamic market landscape.

Competitive Landscape

The major players operating in the electric vehicle battery housing market are Constellium SE, Gestamp Automocion, GF Linamar LLC, Hanwha Advanced Materials, Minth Group, Nemak, POSCO, ThyssenKrupp AG, TRB Lightweight, and UACJ Corporation

Other players in the electric vehicle battery housing market include Farasis Energy Europe GmbH, SGL Carbon, EDAG Group, and Novelis and so on.

Industry Trends

- March 2024 - U.S.: Tesla announced the launch of its new, highly efficientEV Battery Housing Market design, aimed at maximizing energy density and range. The innovation is set to revolutionize the U.S. EV market.

- June 2023 - China: CATL, a leading EV battery manufacturer in China, revealed plans for a strategic merger with a local housing supplier to streamline production and meet growing demand in the Chinese EV Battery Housing Market.

- October 2023 - Australia: LG Energy Solution expanded its presence in the Australian EV Battery Housing Market by establishing a new manufacturing facility for advanced battery housings, signaling a commitment to local production and supply chain resilience.

- August 2023 - UK: Panasonic, a key player in the EV battery industry, announced a partnership with a British automotive company to develop customized battery housing solutions tailored to the UK market's specific needs.

Key Sources Referred

- Tesla

- Panasonic

- LG Chem

- CATL (Contemporary Amperex Technology Co. Limited)

- BYD Company

- Samsung SDI

- General Motors

- BMW Group

- Nissan

- Ford Motor Company

- Volkswagen Group

- Hyundai Motor Company

- Audi AG

- Magna International

- Bosch

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle battery housing market analysis from 2024 to 2033 to identify the prevailing electric vehicle battery housing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle battery housing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle battery housing market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Battery Housing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 30.3 Billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Vehicle Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | TRB Lightweight Structures, ThyssenKrupp AG, POSCO, Minth Group Ltd., GF Linamar LLC, Nemak, UACJ Corporation, Gestamp Automoción S.A., Constellium SE, Hanwha Advanced Materials |

The global electric vehicle battery housing market was valued at $11.8 billion in 2023, and is projected to reach $30.3 Billion by 2033, growing at a CAGR of 9.9% from 2024 to 2033

From 2024-2033 would be forecast period in the market report.

$11.8 billion is the market value of Electric Vehicle (EV) Battery Housing market in 2023.

2023 is base year calculated in the Electric Vehicle (EV) Battery Housing market report.

Constellium SE, Gestamp Automocion, GF Linamar LLC, Hanwha Advanced Materials, Minth Group, Nemak, POSCO, ThyssenKrupp AG, TRB Lightweight are the top companies hold the market share in Electric Vehicle (EV) Battery Housing market.

Loading Table Of Content...