EV Charger Market Overview

The global electric vehicle charger market size was valued at USD 7.2 billion in 2022, and is projected to reach USD 91.2 billion by 2032, growing at a CAGR of 29.3% from 2023 to 2032. Factors such as the implementation of stringent government regulations to limit environmental pollution, increase in penetration of electric vehicles, and increase in government initiatives for the development of electric vehicle charging infrastructure boost the growth of the electric vehicle charger market. However, limited number of EV charging stations and lack of standardization of EV charging is anticipated to hinder the market growth. Surge in demand for luxurious & feature-enabled vehicles, and wireless charging for electric vehicles, on the other hand, provide a remarkable growth opportunity for the market players operating in the EV charger market.

Key Market Trend & Insights

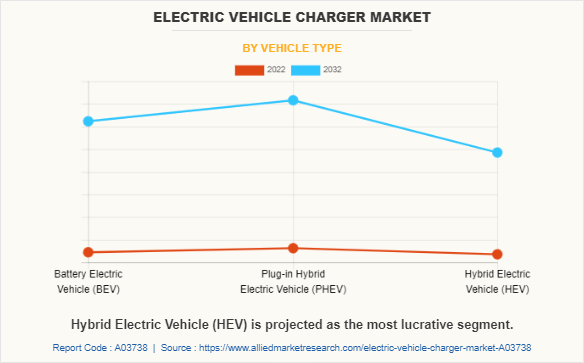

- Hybrid electric vehicles expected to witness strong growth.

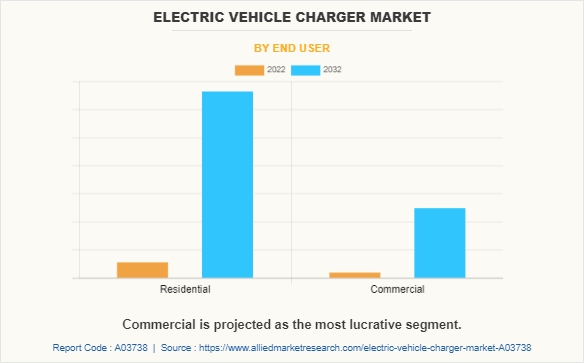

- Commercial segment emerging as a major end-user market.

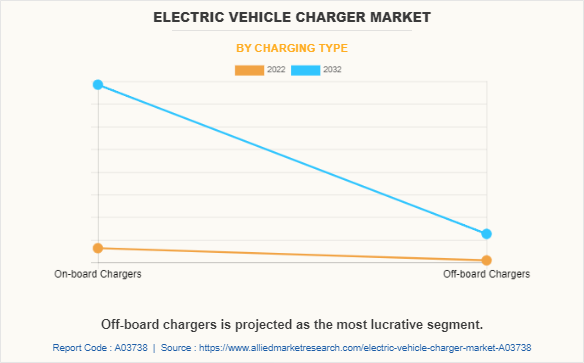

- Off-board chargers segment projected for significant expansion.

- North America forecasted to record the highest CAGR.

- Global emission regulations driving EV adoption.

- Government incentives like FAME-II and PLI boosting EV uptake.

Market Size & Forecast

- 2032 Projected Market Size: USD 91.2 billion

- 2022 Market Size: USD 7.2 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 29.3%

Report Key Highlighters:

The electric vehicle charger market study covers more than 15 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2022-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The electric vehicle charger market is highly fragmented, with several players including Chargemaster, Chroma ATE Inc, Delphi Technologies, Robert Bosch GmbH, AeroVironment, Inc., Schaffner Holding AG, Pod Point, ABB, Siemens, and ChargePoint, Inc. Key strategies such as product launch, expansion, agreement, partnership of the players operating in the market are tracked and monitored.

Introduction

An electric vehicle charger is a device that supplies the required electrical energy to recharge an electric battery of the vehicle. It is a crucial part of the infrastructure for charging electric vehicles and enables recharging of vehicles at home, at work, or in public areas such as charging stations or parking lots. An electric vehicle (EV) charger charges electric vehicles with a battery and an electrical source that helps to charge the battery. Charging of such vehicles is achieved through various levels of charging, that is, level 1, level 2, and level 3. The cost in addition to the maintenance cost of electric vehicles is lower compared to conventional petrol/diesel cars. It typically consists of an input power connector, a power conversion unit, control electronics, and an output connector compatible with charging port of the EV.

Market Segmentation

The electric vehicle charger market is segmented on the basis of vehicle type, charging type, end user, and region. On the basis of vehicle type, the market is divided into battery electric vehicles (BEV), plug-in electric vehicles (PHEV), and hybrid electric vehicles (HEV). On the basis of end user, it is bifurcated into residential and commercial chargers. On the basis of charging type, it is classified into on-board chargers, and off-board chargers. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific includes countries such as China, India, Japan, South Korea, and the rest of Asia-Pacific. Numerous countries in the region have implemented policies and incentives to promote electric vehicle adoption. These include subsidies, tax benefits, and the establishment of charging infrastructure. Favorable government policies related to electric vehicles are thus expected to accelerate the development of electric vehicle chargers.

Which are the Top Electric Vehicle Charger companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the electric vehicle charger industry.

- Chargemaster

- Chroma ATE Inc

- Delphi Technologies

- Robert Bosch GmbH

- AeroVironment, Inc.

- Schaffner Holding AG

- Pod Point

- ABB

- Siemens

- ChargePoint, Inc.

Market Dynamics

The development of an extensive and reliable charging infrastructure is crucial for the widespread adoption of electric vehicles. Governments, businesses, and charging infrastructure providers are actively investing in the expansion of charging networks across the region. Therefore, such initiatives to develop charging infrastructure support the growth of the EV charger market. China has been actively expanding its charging infrastructure network. The government and private companies have invested heavily in building charging stations, including fast-charging stations along highways.

The rise in popularity of electric vehicles in China drives the demand for EV chargers. For instance, according to a 2023 report from the International Energy Agency, electric car sales reached over 10 million units globally in 2022. China accounted for approximately 60% of the electric car market, indicating its dominance in electric vehicle sales. The need for a robust and widespread charging infrastructure grows as more individuals and businesses adopt electric vehicles. Moreover, Chinese companies are at the forefront of developing EV charging technologies. They have made significant advancements in fast-charging technologies, battery-swapping solutions, and smart charging systems. Therefore, this creates opportunities for the expansion of the EV charger market.

According to data by Japan Automobile Dealers Association and Japan Light Motor Vehicle and Motorcycle Association, the sales of electric vehicles (EVs) within the country experienced a significant increase in March. Specifically, light passenger EV sales surged more than 30 times compared to 2022, reaching approximately 4,500 units. The surge in EV sales encourages the expansion of the charging network and the development of chargers. Moreover, the government has actively promoted the adoption of electric vehicles and the development of charging infrastructure. For instance, in January 2023, Japan announced plans to ease regulations on fast electric vehicle (EV) chargers in an effort to accelerate the deployment of charging infrastructure across the country. This move aims to boost the growth of the EV charger industry and support the widespread adoption of electric vehicles in Japan.

What are the Top Impacting Factors

Key Market Driver

Implementation of stringent government regulations to limit environmental pollution

The conventional gas-powered vehicle makes use of an internal combustion engine to generate power. In an ideal scenario, the combustion system completely incinerates the fuel and emits carbon dioxide and water as waste; however, the combustion system generates various greenhouse gases, leading to environmental pollution. However, an electric vehicle uses an electric motor powered via a continuous supply of current, therefore, it does not lead to emission of pollutants.

Various countries across the globe have implemented emission regulations for vehicles, including regulations targeting greenhouse gas emissions. These regulations are primarily driven by environmental concerns and the need to address climate change. For instance, in April 2023, the United States Environmental Protection Agency (EPA) implemented regulations that set standards for greenhouse gas emissions from vehicles. These regulations are made to reduce the amount of carbon dioxide and other greenhouse gases emitted during vehicle operation. Moreover, in April 2023, the U.S. government put forth a proposal for stringent automobile pollution limits that would necessitate up to two-thirds of new vehicles sold in the U.S. to be electric by 2032.

In addition, Indian government has already launched initiatives, such as, Faster Adoption of Manufacturing of Electric Vehicles Scheme – II (FAME – II) and Production Linked Incentive Scheme (PLI) to promote the adoption of electric vehicles. Numerous initiatives, regulations, and subsidiaries for electric vehicles to control emissions are thus expected to drive the growth of the market.

Increase in penetration of electric vehicles

Gasoline being a fossil fuel is not a renewable source of energy and is expected to exhaust in the future. It is important to develop and use alternative sources of fuel to support sustainable development. This involves the use of electric vehicles, which do not use gas and are more economical compared to conventional vehicles. According to the International Global Electric Vehicle Outlook of Energy Agency, global sales of electric cars surpassed 10 million units in 2022. Moreover, the report projects a further 35% growth in sales for the year 2023, with an estimated 14 million electric cars expected to be sold worldwide.

Furthermore, by 2030, electric vehicles (EVs) are projected to make up more than 10% of the total road vehicle fleet. The sales of EVs are expected to exceed 20 million units in 2025 and surpass 40 million units in 2030. These figures represent over 20% and 30% of all vehicle sales worldwide, respectively. Therefore, the demand for fuel-efficient vehicles has increased, owing to the rise in the price of petrol and diesel. This is attributed to the depletion of fossil fuel reserves and environmental concerns. Thus, these factors boost the need for advanced fuel-efficient technologies, leading to a surge in demand for electrically powered vehicles, which, in turn, propels the demand for electric vehicle chargers.

Restraints

Limited number of EV charging stations

Establishing a robust charging infrastructure network necessitates substantial investments and a considerable amount of time. The installation of charging stations entails intricate procedures such as acquiring permits, identifying appropriate locations, and ensuring access to reliable electrical grids. Given the relatively recent acceleration in the adoption of electric vehicles, the development of charging infrastructure still strives to meet the increase in demand. Insufficient availability of charging stations may impede the widespread adoption of electric vehicles in specific regions or countries.

The absence of adequate charging infrastructure may create reluctance among potential buyers to transition to electric vehicles, thereby hampering the overall growth of the EV market and subsequently reducing the demand for EV chargers. The lack of presence of an adequate number of EV charging stations is thus anticipated to hamper the market growth of the market.

Opportunity

Surge in demand for luxurious & feature-enabled vehicles

There is a significant increase in consumer interest and purchasing preferences toward high-end vehicles that offer advanced features, technology, and luxury amenities. Luxurious vehicles provide integration of state-of-the-art technologies, including advanced infotainment systems, driver-assistance features, premium audio systems, and the use of high-quality materials and superior craftsmanship. These vehicles provide an elevated level of comfort, aesthetics, and prestige that surpasses standard vehicles.

Moreover, manufacturers and automakers are responding to this surge in demand by introducing new models and variants that cater to the luxury segment. For instance, in April 2023, Volkswagen, an automobile manufacturer, introduced an electric luxury sedan as part of its commitment to electrification and sustainable mobility. The vehicle is designed to offer a luxurious driving experience while being powered by an electric drivetrain, aligning with the global shift towards electric vehicles (EVs) and reducing dependence on fossil fuels.

The surge in demand for luxurious vehicles drives luxury car manufacturers to introduce electric models specifically tailored to meet the preferences of luxury car buyers. As a result, there is a rise in demand for EV chargers as owners of luxury electric vehicles seek reliable, convenient, and efficient charging solutions to accommodate their high-end vehicles. The rapid escalation in penetration of luxurious and feature-enabled EVs across the globe is thus expected to boost the growth of the electric vehicle charger market.

What are the Recent Developments in the Electric Vehicle Charger Market

In January 2023, ABB expanded its production of EV chargers in South Carolina. This significantly reduces delivery and lead times for DC fast chargers in the US, enabling charging developers, owners, and operators to deploy reliable chargers rapidly.

In January 2023, ChargePoint, Inc. signed an agreement with Stem, one of the global leaders in AI-driven clean energy solutions and services to accelerate the deployment of EV charging and battery storage solutions for highway corridor DC fast charging and other EV charging applications.

In April 2023, ChargePoint Holdings Inc signed an agreement with ALD Automotive to establish a new EV charging business in Europe, aiming to accelerate corporate fleet electrification by providing a comprehensive charging solution for drivers with access to over 485,000 charging ports through a single app and charging card.

In May 2023, Siemens entered into an agreement to acquire the EV division of Mumbai-based Mass-Tech Controls Private Limited. The division is engaged in the design, engineering, and manufacturing of a wide range of AC chargers, and 30 to 300kW capacity DC chargers for various end applications for EVs.

In July 2023, Robert Bosch GmbH launched electric vehicle (EV) chargers, the EV300 Level 2 EV Charging Station, and EV3000 DC Fast Charger. Both chargers were created to provide a more affordable charging option without compromising safety & amp, charging capabilities.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle charger market analysis from 2022 to 2032 to identify the prevailing electric vehicle charger market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the electric vehicle charger market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global electric vehicle charger market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Charger Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 91.2 billion |

| Growth Rate | CAGR of 29.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 380 |

| By Vehicle Type |

|

| By End User |

|

| By Charging Type |

|

| By Region |

|

| Key Market Players | Pod Point, Schaffner Holding AG., Robert Bosch GmbH., ABB, Siemens, ChargePoint, Inc., Delphi Technologies PLC, Chroma ATE Inc., AeroVironment, Inc., Chargemaster |

Analyst Review

The global electric vehicle charger market is expected to witness growth owing to a rise in electric vehicle adoption, and favorable government initiatives to build charging infrastructure.

Charging infrastructure is vital for the mass adoption of electric vehicles. Several government initiatives have been undertaken to provide EV charging stations across the world. Governments across the globe have recognized the importance of building a robust charging network to facilitate the widespread adoption of EVs. As a result, they have implemented various initiatives to accelerate the development of charging infrastructure. For instance, in September 2022, the U.S. government announced the approval of the first 35 state plans to build out electric vehicle (EV) charging infrastructure. The plans are part of the broader efforts to accelerate the adoption of electric vehicles and support the transition to cleaner transportation.

Moreover, there is a rise in the efforts and actions taken by governments to support and promote the expansion of charging infrastructure for electric vehicles (EVs). For instance, in October 2022, the German government approved a plan to allocate $6.9 billion (6.3 billion euros) over three years for the purpose of rapidly expanding the number of charging stations. This investment is in line with the commitment of Germany to achieving net-zero emissions from the transportation sector, and it aims to accelerate the transition toward electric mobility by ensuring an extensive and accessible charging infrastructure network. Therefore, government initiatives for the development of electric vehicle charging infrastructure play a crucial role in driving the growth of the market.

The estimated industry size of electric vehicle charger is $7.12 billion in 2022.

The top companies to hold the market share in electric vehicle charger are Chargemaster, Chroma ATE Inc, Delphi Technologies, Robert Bosch GmbH, AeroVironment, Inc., Schaffner Holding AG, Pod Point, ABB, Siemens, and ChargePoint, Inc.

The largest regional market for electric vehicle charger is Asia-Pacific

Residential is the leading charging type of electric vehicle charger market.

The upcoming trends electric vehicle charger market in the world are demand for luxurious & feature-enabled vehicles, and wireless charging for electric vehicles.

Loading Table Of Content...

Loading Research Methodology...