Electric Vehicle Infrastructures Market Research, 2033

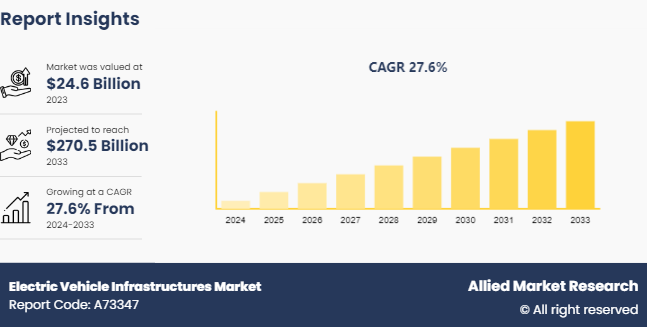

The global electric vehicle infrastructures market size was valued at $24.6 billion in 2023, and is projected to reach $270.5 billion by 2033, growing at a CAGR of 27.6% from 2024 to 2033.

Market Introduction and Definition

Electric vehicle infrastructure is defined as the structures, machinery, and equipment required to support an EV, such as battery chargers, rapid chargers, and battery swap stations. A battery charger is an electrical component assembly or cluster of component assemblies that is specifically designed to charge batteries in an electric vehicle. A quick charger is an industrial-grade electrical outlet that enables faster recharging of EV batteries using greater power levels.

A battery exchange station is a completely automated facility that allows an EV with a swappable battery to enter a drive lane and exchange the exhausted battery for a fully charged battery using an automated process. Infrastructure must meet or exceed all applicable state building codes, standards, and regulations.

Key Takeaways

The electric vehicle infrastructure market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major electric vehicle infrastructures industry participants along with authentic industry journals, trade associations releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious electric vehicle infrastructures market growth objectives.

Recent Key Developments

In January 2023, ABB E-mobility signed a global framework agreement to support Scania globally with EV charging solutions. ABB's E-mobility portfolio will enable Scania to provide complete EV solutions for customers, electrifying its fleet and supplying vehicles, chargers, services, and software globally.

In November 2023, Lotus, the UK-based automaker, introduced its suite of electric vehicle (EV) charging solutions, including an ultra-fast 450 kW DC charger, a power cabinet, and a modular unit capable of charging up to four vehicles simultaneously. These new charging solutions are specifically designed for the Indian market. The Liquid-Cooled All-in-One DC Charger is a cutting-edge charger that provides ultra-fast charging at rates of up to 450 kW.

In September 2023, Safran and Cuberg partnered to develop battery systems for advanced electric aviation. Future generations of aircraft will benefit from a high-performance propulsive energy storage system developed by Safran Electrical & Power and Cuberg using their complementary technologies and skills.

Key Market Dynamics

The growing government policies and subsidies is fueling the expansion of the electric vehicle infrastructure industry. Growing concerns about carbon emissions and increased adoption of electric cars (EVs) around the world are driving the expansion of the electric vehicle charging infrastructure market. Government rules and tax breaks encourage the use of EVs, increasing demand for EV charging infrastructure solutions.

Furthermore, significant technological breakthroughs in battery technology and lower lithium-ion battery costs are likely to contribute to market growth throughout the forecast period. In recent years, EVs have grown in popularity, owing primarily to increased environmental consciousness and an emphasis on sustainability.

Market Segmentation

The electric vehicle infrastructures industry is segmented into charger type, installation type, connector, deployment, application, and region. On the basis of charger type, the market is divided into slow charger and fast charger. On the basis of installation type the market is classified into fixed and portable. On the basis of connector, the market is segregated into CHAdeMO, CCS, and others. On the basis of deployment, the market is classified into private and public. On the basis of application, the market is fragmented into commercial and residential. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

Asia-Pacific experienced the largest electric vehicle infrastructures market share in 2023 and is predicted to expand at a considerable CAGR due to the presence of significant industry players in the region. Countries such as China, Japan, and South Korea, which are renowned as electric vehicle hubs, have invested significantly in charging infrastructure. For instance, in January 2022, the Chinese government announced plans to invest in EV infrastructure deployment in order to meet its goal of supporting 20 million EVs on the road by 2025.

Furthermore, in 2020, Japan's electric charging stations outnumber fuel stations, with approximately 40, 000 charging outlets. These factors contribute to the expansion of the Asia-Pacific EV charging infrastructure industry.

In addition, growing urbanisation and population expansion in APAC countries have raised the demand for environmentally friendly transportation alternatives such as electric vehicles and charging stations. Urban regions with dense populations and high pollution levels are especially incentivized to switch to cleaner modes of transportation, resulting in an increase in EV adoption and charging infrastructure deployment.

Competitive Landscape

The major players operating in the electric vehicle infrastructure market include ChargePoint, Inc., ABB Ltd., Tritium DCFC Limited, Delta Electronics, Inc., BTC Power, Siemens, Schneider Electric, Eaton Corporation plc, bp pulse, Webasto Group, Tesla Inc.

Industry Trends

Investments in the automotive sector are still rising, with $ 5.2 billion in FDI inflow recorded in 2022, bringing the total FDI received by the sector to $34.11 billion between April 2000 and December 2022, accounting for approximately 5.45% of India's total FDI inflow during the same period.

In September 2023, the central government allocated $1.4 billion for electric mobility under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) II scheme, signaling its commitment to EV adoption and in turn creating new avenues for ACM manufacturers.

In 2020, the International Organization of Motor Vehicle Manufacturers estimated that 70.50 million passenger cars would be produced worldwide (OICA) .

According to a study by the Victoria Transport Policy Institute (VTPI) , more than 70% of fully autonomous vehicles will be used for ridesharing, with only 30% likely to be privately owned.

Regulatory Analysis of Global Electric Vehicle Charging Infrastructure Market

Infrastructure Standards and Safety: Governments are establishing technical standards to ensure the safety and interoperability of charging stations. These standards cover aspects such as connector types, power ratings, and safety protocols to prevent electrical hazards.

Building Codes and Zoning Laws: New building codes are being updated to require the installation of EV charging points in residential, commercial, and public buildings. Zoning laws are also being revised to facilitate the placement of charging stations in accessible and convenient locations.

Incentives and Funding: Many governments offer financial incentives, grants, and subsidies to encourage the installation of EV charging infrastructure. These can include tax credits, rebates, and funding programs aimed at both private and public sector entities.

Utility Regulations: Utilities are being regulated to support the integration of EV charging infrastructure. This includes policies on time-of-use pricing to encourage off-peak charging, as well as grid upgrades to handle increased electricity demand.

Accessibility and Equity: Regulations are increasingly focusing on ensuring equitable access to EV charging infrastructure. This includes mandates for a certain percentage of chargers to be installed in underserved and low-income areas, as well as requirements for public charging stations to be accessible to people with disabilities.

Environmental Regulations: To promote sustainability, some regulations require that EV charging infrastructure is powered by renewable energy sources. There are also guidelines to ensure that the environmental impact of the production, installation, and disposal of charging equipment is minimized.

Key Sources Referred

India Brand Equity Foundation

California Air Resource Board

U.S. Department of Transportation

Global Environment Facility

United Nations Environment Program

International Energy Agency

International Transport Forum

Occupational Safety and Health Administration

ANSI Organization

National Aeronautics and Space Administration

Key Benefits for Stakeholders

This report provides a quantitative analysis of the electric vehicle infrastructures market size segments, current trends, estimations, and dynamics of the electric vehicle infrastructure market analysis from 2022 to 2032 to identify the prevailing electric vehicle infrastructures market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the electric vehicle infrastructure market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global electric vehicle infrastructures market forecast statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global electric vehicle infrastructures market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Infrastructures Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 270.5 Billion |

| Growth Rate | CAGR of 27.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 324 |

| By Charger Type |

|

| By Installation Type |

|

| By Connector |

|

| By Deployment |

|

| By Application |

|

| By Region |

|

| Key Market Players | bp pulse, Delta Electronics, Inc., Tesla Inc., ABB Ltd., Siemens, ChargePoint, BTC Power, Webasto Group, Schneider Electric, Eaton Corporation plc, Tritium DCFC Limited |

The electric vehicle infrastructure market was valued at $24.5 Billion in 2023.

The upcoming trends of Electric Vehicle Infrastructures Market include high levels of innovation and quickly growing technology developments.

The commercial is the leading application of electric vehicle infrastructure market.

Asia-Pacific is the largest regional market for electric vehicle infrastructure.

ChargePoint, Inc., ABB Ltd., Tritium DCFC Limited, Delta Electronics, Inc., BTC Power are the top companies to hold the market share in Electric Vehicle Infrastructures.

Loading Table Of Content...