EV Motor Market Insights, 2032

The global electric vehicle motor market size was valued at $24.9 billion in 2022, and is projected to reach $99.5 billion by 2032, growing at a CAGR of 15.2% from 2023 to 2032.

Report Key Highlighters:

- The electric vehicle motor market trends analysis covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The electric vehicle motor market share is highly fragmented, into several players including BorgWarner Inc., Continental AG, Magna International Inc., Nidec Corporation, Robert Bosch GmbH, ABB Ltd, Hitachi, Ltd, Mitsubishi Electric Corporation, Continental AG and AISIN CORPORATION. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

The electric motor are an important element of electric vehicle, the motor converts electric energy into torque which propels the vehicle. The power to the motor is delivered by the battery packs in the vehicle. Electric vehicles have motors that use regenerative braking which means that the motors start generating power and start delivering the power back to the battery pack when not consumed. There has been an increase in focus on electrification of public fleet due to the increasing price of fuel and high maintenance cost similarly the electric powered buses will aid in reduction of pollution level.

The electric vehicle motor market analysis is anticipated to witness strong growth during the review period owing to increasing demand for hybrid as well and electric vehicles, strengthening rules and regulation by government for automotive industry and growing research and development activities. However, the high manufacturing cost is predicted to hamper the market growth during the forecast period 2023-2032. Furthermore, proactive government initiatives set by the government for promoting EV, and the growing inclination towards autonomous driving technology is further expected to offer market growth opportunities for the companies operating in the market.

Additionally, there are numerous supportive government initiatives and subsidy program towards the purchase of electric vehicle, which resulted in increased electric vehicle penetration especially for use in commercial applications, due to this major companies are investing in manufacturing towards development of more efficient motors.

According to the World Economic Forum, in Norway electric vehicles share accounted for 79% of new passenger car registrations in 2022. It is leading as the major country for adopting electric mobility solutions. In addition, to promote clean mobility, the country has waived import duties and registration tax on purchase of EVs. Similarly, Poland also announced various financial measures & and subsidy schemes in June 2020, providing consumers with 15% of the price toward an electric vehicle purchase. Such factors are collectively driving the sales of electric vehicle motor market.

Moreover, The Chinese government is highly promoting autonomous vehicle development as a top tier focus. China has also introduced new laws which are specifically designed for on-road testing of the autonomous driving technology. Additionally, Chinese government is providing tax benefits as well as other financial support for manufacturers and research and development institution of autonomous driving technology, such initiatives are forecast to provide lucrative growth opportunity for electric vehicle motor industry , as majority of modern autonomous vehicle utilize hybrid or electric powertrain.

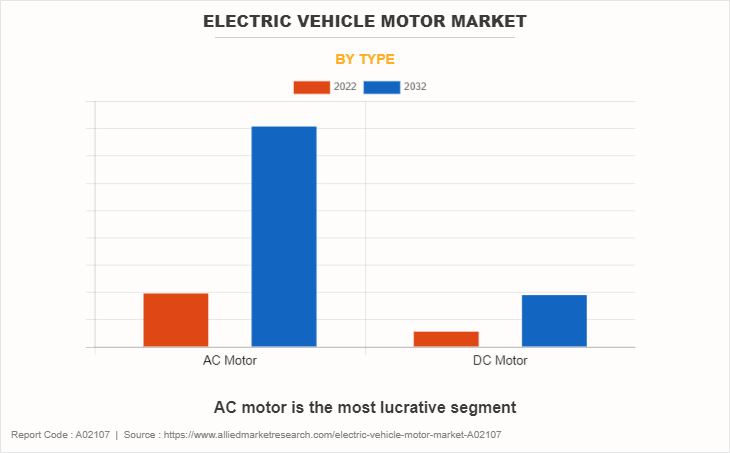

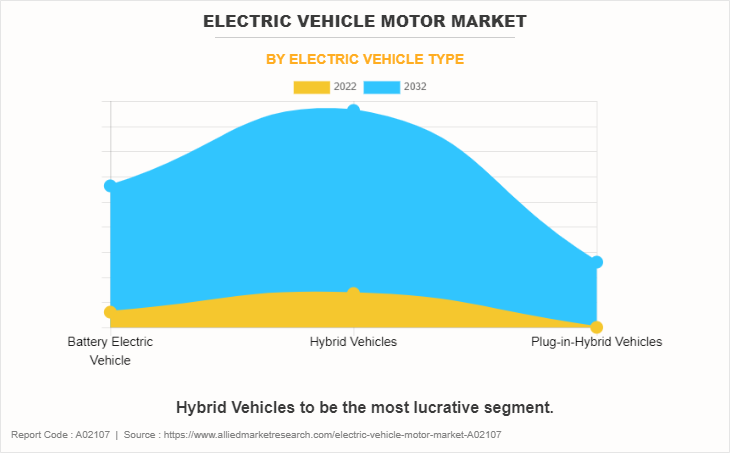

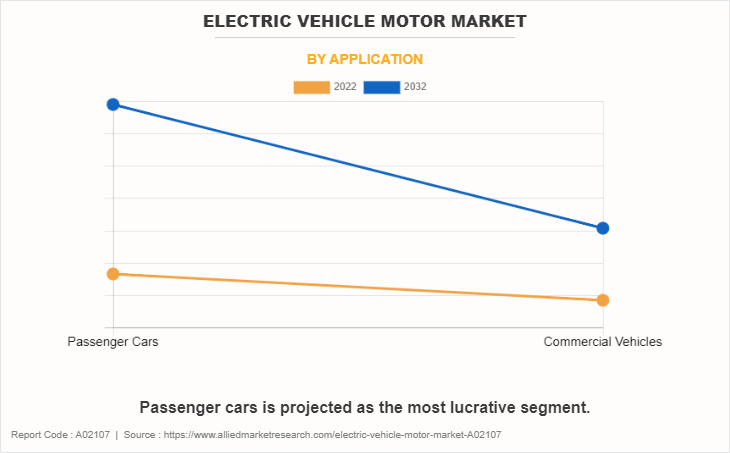

The electric vehicle motor industry is segmented on the basis of motor type, vehicle type, application, and region. By motor type, it is bifurcated into AC motor, and DC motor. By vehicle type, it is classified into battery electric vehicle, hybrid vehicle, and plug-in hybrid vehicle. By application, it is fragmented into passenger cars, and commercial vehicles. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Developments in EV Motor Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In June 2023, AISIN CORPORATION partnered with Tohoku Magnet Institute (TMI) to develop an ultrahigh-efficiency EV motor using NANOMET. NANOMET is a nanocrystalline soft magnetic alloy that achieves both high saturation magnetic flux density and ultralow iron loss.

- In August 2023, Robert Bosch GmbH developed an 800V inverter motor for electric vehicles. It started production of its new powertrain, which is based on its 800-Volt technology. According to the company, this technology will enable recharging the battery faster. In the current variant of the electric motor, Bosch has increased the power density, this has reduced weight and allows for a more compact design. In terms of power-to-weight ratio, this motor delivers 35% more power density, at 60 kW/kg. It also offers an excellent torque density of 105 N·m/kg.

- In August 2023, Borgwarner Inc. developed Li Auto, its advanced integrated drive module (iDM220) for EVs. The module offers high efficiency, smooth and quiet operation, and exceptional performance.

- In September 2021, TOSHIBA CORPORATION partnered with Sojitz Corporation, CBMM for the commercialization of next-generation lithium-ion batteries using niobium titanium oxide (NTO) as the anode material. The NTO battery is installed on a new electric vehicle designed by Volkswagen Caminhões e Ônibus as a pilot project and parties collect the valuable vehicle operation data.

Increase in Research and Development Activities

As EV and hybrid vehicles have comparatively lower running cost, and are also more environmentally friendly. Furthermore, governments across the globe have put in place certain legislation and amendments in order to promote green mobility. The regulatory bodies are offering incentives, subsidies and tax benefit while buying new electric vehicles. For instance, according to a recent study published by National Renewable Energy Laboratory (NREL) in collaboration with Idaho National Laboratory report titled ‘’Levelized Cost of Charging Electric Vehicles in the United States. The study shows that using EV in contrast to traditional vehicles, enables a cost saving of $14,500 on fuel over a span of 15 years. Moreover, the prices of fuels such as petrol and diesel used in traditional vehicles, have seen constant fluctuation in prices in recent years. This has resulted in shift of vehicle manufacturers towards the development of more fuel efficient and green mobility solutions. Hence, the increase in research and development activities is positively impacting the electric vehicle motor market growth.

Rise in Demand for Electric and Hybrid Vehicles

Due to increase concerns for increasing pollution level form automotive industry, major cities have implemented ban of high emission vehicle in a certain areas, moreover the increasing price of fuel resulted in shifting focus towards electric and hybrid vehicles.

According to the International Energy Agency, as of 2022, the electric vehicle segment sales were around 10 million; according to the data, the sales of EVs have more than tripled in the last three years, accounting for 4% in 2020 and reaching approx. 14% in 2022. As per the data, around 14% of all cars sold in 2022 were electric, which was 9% in 2020. Three markets dominate the market globally that include China, Europe and the U.S. China alone accounts for a major share of global EV sales. Europe was the second largest market in 2022. The sales of EV increased by 15% in the region due to strong government support and technology development. Electric vehicle sales in the U.S saw an increase of 55% in 2022, in the same year in the U.S EV accounted for 8% of the overall automobile sales. The growing demand for electric and hybrid vehicles is expected to continue in coming years, thereby driving the market for EV motor industry.

Proactive Government Initiative for Promoting Electric Vehicles

It is projected that the rise in urbanization and increased demand for fuel-efficient vehicles along with attractive incentives for electric vehicles from various governments will present lucrative opportunities for the expansion of the market. In addition, due to proactive government measures, the industry witnessed increased development in charging infrastructure, battery recycling and technological development. For example, according to data from the Ministry of Road Transport and Highways in India. In the country, there were 1,037,011 EV registrations, which accounted for 6.4% of the total automobile sales in the country. The increase in sales of EV are due to their increased adoption for commercial and personal use.

High Manufacturing Cost

Electric vehicles offers major advantages over conventional automobiles, however they are more expensive. According to a report, the manufacturing cost of an EV is currently much higher compared to ICE variants, but by 2030, the cost is expected to be 50% cheaper compared to diesel and petrol options due to falling price of battery and constant technological advancement. Furthermore, the EV industry also faces procurement issues related to such as shortage of rare earth metals used in permanent magnets for motors. These metals are vulnerable to export restrictions and supply chain disruption. Moreover, the EV industry is still in its developing phase, resulting in consumers and investors in making hefty investment in the technology.

Russia-Ukraine War Impact Analysis on EV Motor Industry

The ongoing war between Russia and Ukraine has had a negative impact on global trade. The conflict has generated uncertainty, which has severely impacted the global economy. The war not only has hampered trade flows, but has also disrupted supply chains, and harmed the confidence of investors. For instance, the impact on trade is the disruption of exports of rare earth elements. Russia and Ukraine account for a huge share of metal and rare earth elements globally and have reserves of vast and unexplored territories. These metals and rare earth elements are extensively used in modern automobiles and electronics. Major countries across the world rely on Russia and Ukraine for exports of raw materials. Furthermore, the war has also resulted in trade containment policies. Countries have implemented sanctions and trade restrictions on Russia, affecting global trade dynamics These measures have disrupted established trade relationships and supply chains, leading to a decline in trade volumes and increased costs for raw materials used in electric vehicle motors.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the electric vehicle motor market segments, current trends, estimations, and dynamics of the market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Motor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 99.5 billion |

| Growth Rate | CAGR of 15.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 269 |

| By Type |

|

| By Electric Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Magna International Inc., Continental AG, BorgWarner Inc., Robert Bosch GmbH, AISIN CORPORATION, ABB, NIDEC CORPORATION, TOSHIBA CORPORATION, Mitsubishi Electric Corporation, Hitachi, Ltd. |

High power density motors are upcoming trend in the electric vehicle motor market.

Passenger cars are the leading application of electric vehicle motor.

Asia-Pacific is the largest regional market for electric vehicle motor.

The electric vehicle motor market was valued at $24.90 billion in 2022.

Robert Bosch GmbH, Mitsubishi Electric Corporation, AISIN CORPORATION and Hitachi, Ltd are some of the major company operating in the electric vehicle motor market.

Loading Table Of Content...

Loading Research Methodology...