EV Solid State Battery Market Insights, 2035

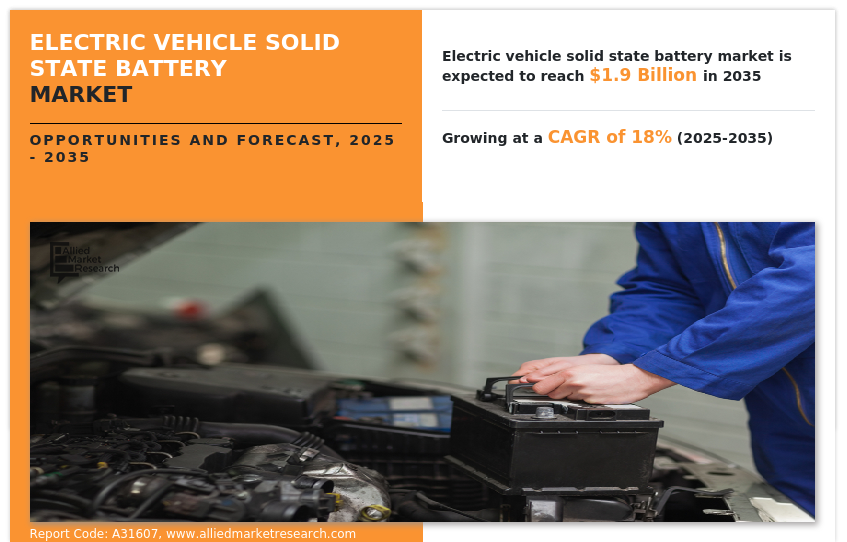

The global electric vehicle solid state battery market is expected to be valued at USD 0.37 billion in 2025, and is projected to reach USD 1.9 billion by 2035, growing at a CAGR of 18% from 2025 to 2035.

A solid-state battery is a rechargeable energy storage system that resembles the lithium-ion battery in overall structure and operation. The lithium-ion batteries contain a liquid electrolyte, whereas solid-state batteries contain a solid electrolyte. This reduces the weight of solid-state batteries, improves energy density, extends cruising range, and speed ups charging. Solid-state batteries are more stable and compact. Solid electrolytes are made from common materials such as ceramics and glasses. Solid-state batteries in electric vehicles offer improved safety, size, and stability, as well as faster charging times, longer range, and higher energy density.

Factors, such as rising global pollution levels and depleting fossil fuels, have created demand for development of sustainable transportation systems. The automotive manufacturers have implemented innovative technologies to tackle the growing concern for environmental sustainability. The electrification of passenger and commercial transport conveyance infrastructure presents a viable eco-friendly opportunity for the automotive industry. The electrification of a vehicle involves replacing conventional power sources, gasoline and diesel power with an electric energy power source such as batteries. The electric vehicle emits zero emissions and also delivers a highly efficient driving experience.

The rise in innovations and development of advanced battery systems with large power delivery capabilities are the factors attributed to the growth of the electric vehicle solid state battery market. The automotive manufacturers have increased the adoption of electric vehicle battery solutions & advancements for reducing greenhouse gas emissions and combating climate change. For instance, General Motors announced plans for investing $1 billion in the installation of electric vehicle manufacturing units in Mexico. The investment comes under the plans of General Motors for making all its vehicle offerings electrically powered by 2035. Moreover, in April 2020, Ilika and Comau, members of the Fiat Group, began a collaboration to develop the Goliath series of all-solid-state batteries for use in electric vehicles. The two companies are expected to bring Ilika's batteries to market faster and more cost-effectively by expanding production capacity. Such developments in electric vehicle industry are expected to create a demand for EV solid state battery market during the forecast period.

Several automakers are now investing in start-ups and companies working on solid-state batteries to replace the heavy and mining-intensive lithium-ion compositions. For instance, in February 2022, Mercedes-Benz announced a high double-digit investment in solid-state battery developer ProLogium. The German automaker plans to start testing his ProLogium solid-state battery cells in vehicles, along with prototype cells from other companies

Factors such as an increase in demand for fast charging technology in electric vehicles, an increase in the need for long-range electric vehicle, and a reduction in chances of overheating as compared to lithium-ion batteries makes solid-state batteries safer. These are anticipated to boost the growth of the global electric vehicle solid state battery market during the forecast period. However, the higher cost compared to conventional EV batteries, and technological challenges for the development of solid state batteries are expected to hinder the growth of the global market during the forecast period. Moreover, the to fulfil of zero-emission electric vehicles, favorable government regulations, and the development of battery-as-a-service model is expected to create an opportunity for the EV solid state battery market in near future.

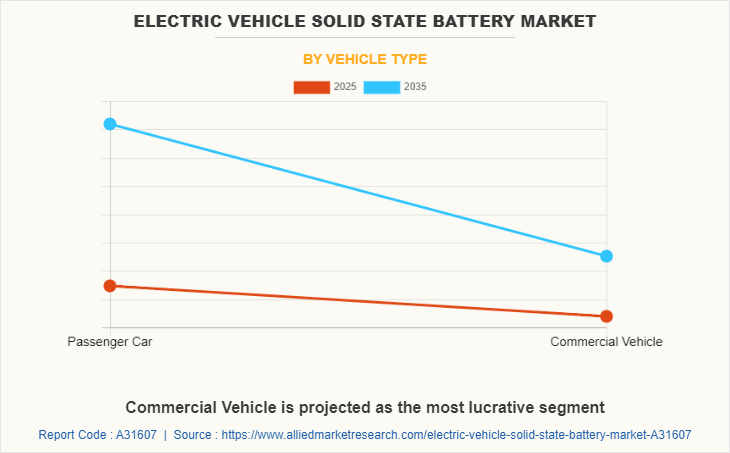

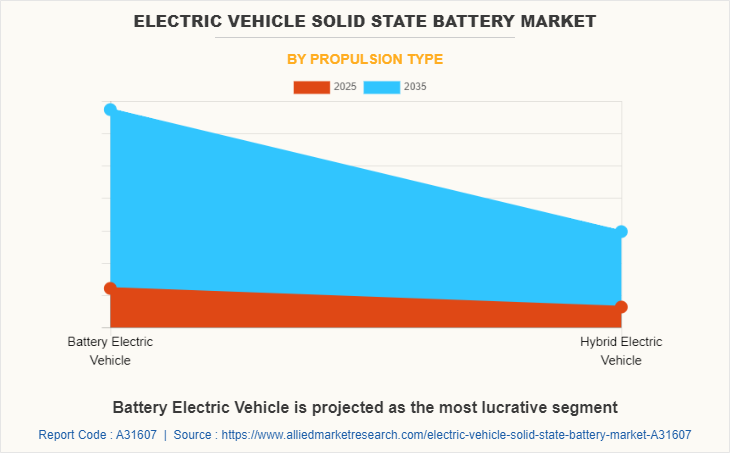

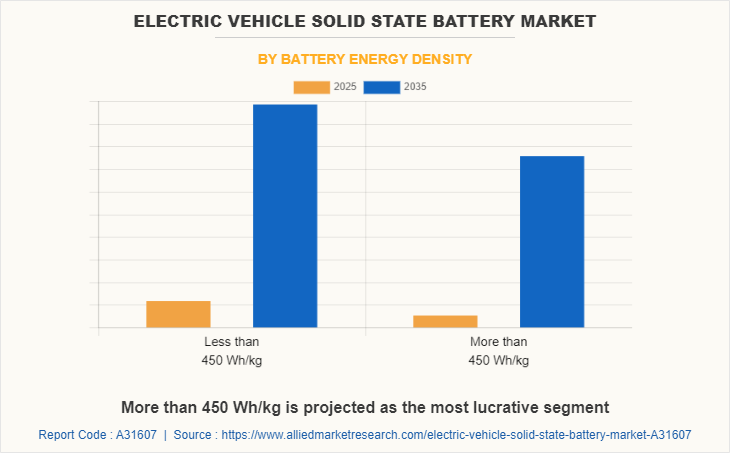

The global electric vehicle solid state battery market is segmented on the vehicle type, propulsion type, and battery energy density. On the basis of vehicle type, it is divided into passenger car, and commercial vehicle. On the basis of propulsion type, it is segmented into battery electric vehicle and hybrid electric vehicle. On the basis of battery energy density, it is divided into less than 450 Wh/kg, and more than 450 Wh/kg. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the electric vehicle solid state battery industry report comprises Cymbet, Contemporary Amperex Technology Co., Limited (CATL), Ilika, LG Chem, Northvolt AB, Panasonic Corporation, QuantumScape Corporation, Samsung SDI Co., Ltd., Solid Power, STMicroelectronics, Toyota Motor Corporation, and TDK Corporation. The leading companies are adopting strategies such as product launch, business expansion, and collaboration to strengthen their market position.

In May 2022, Contemporary Amperex Technology Co., Ltd. (CATL) entered into a collaboration with European leading electric bus manufacturer Solaris Bus & Coach sp. z o.o. (Solaris) in the area of battery supply to push forward electrification of city transportation in Europe.

In October 2021, Panasonic Corporation launched battery prototype for Tesla that’s cheaper and bigger than existing batteries. This new battery prototype promises five times more energy storage, which may increase ranges significantly.

In September 2019, Ilika opened its new large format battery facility (Goliath Pre-Pilot Line, or GPPL), for the development and initial production of solid-state batteries in Hampshire, UK.

Increase in demand for fast charging technology in electric vehicles

Both solid-state and lithium-ion batteries contain lithium (Li). In both batteries, Li+ ions move from one part of the battery to another, allowing negatively charged electrons to move through the circuit. Conventional lithium-ion batteries use liquid electrolytes, while solid-state batteries use solid-state materials. Solid state battery is more efficient than regular lithium battery. Lithium battery offers benefits such as high energy density. However, the technology has drawbacks such as safety issues, poor thermal management. Solid state battery has more stability that allows them to store up to 50% more energy than its lithium-ion counterpart, claiming to reach 80% charge in 12 minutes. Battery technology companies have set up pilot-scale facilities to manufacture solid-state batteries. The current demand for higher energy and power densities, fast charging and safety concerns promotes research and development in the battery industry. Some battery manufacturers have started development of solid state battery to enable faster charging in electric vehicles and provide long range. For instance, in December 2020, QuantumScape released performance data for its all-solid-state battery technology based on the developed prototype. It takes 15 minutes to charge the battery to 80% and has a longer range than traditional lithium-ion batteries. Moreover, it can be used over a wider temperature range. With the rapid development of electric vehicles, fast charging has attracted particular attention. Therefore, such factors are expected to drive the growth of the EV solid state battery market.

Increase in need for long range electric vehicle

Using a solid electrolyte result in smaller size, higher energy density, longer life, and improved safety. All-solid-state batteries can store twice as much energy as lithium-ion batteries. Researchers are working on next-generation batteries that replace wet electrolytes with solids to increase the energy density of the cells. For instance, in March 2020, Samsung's Institute of Advanced Technology (SAIT) and Samsung R&D Institute Japan (SRJ) announced new research revealing the next generation of all-solid-state batteries. The new lithium metal solid state battery offers better energy density than traditional lithium-ion batteries. At 50% less volume than typical lithium-ion batteries, Samsung's prototype solid-state pouch cell could enable 500 miles of electric vehicle range and over 1,000 charge lifetimes. There is increase in demand for solid state battery to cater to the demands of electric vehicle users such as long range. Therefore, electric vehicle manufacturers aim to incorporate solid state batteries in electric vehicle to accelerate adoption of electric vehicles, which is expected to drive the growth of the electric vehicle solid state battery market.

Higher cost compared to conventional EV batteries

Lithium-ion batteries are widely used as they are cheap and work well. The cost of these batteries has dropped significantly. Therefore, they are considered as good alternative for long-term applications as these batteries have achieved low cost and increased energy density. Solid-state batteries are expensive compared to other alternatives available such as lithium batteries. Solid-state battery prices are estimated to range from $800/kWh to $400/kWh by 2026, compared to liquid electrolyte batteries, which are currently around $156/kWh. Solid-state technology is yet to become an economically viable alternative. Relatively high costs can significantly impede the production and distribution of solid-state batteries, which is expected to hinder the growth of the EV solid state battery market during the forecast period.

Rise in adoption of zero-emission electric vehicles

The demand for fuel-efficient electric vehicles has increased recently, owing to rise in price of petrol and diesel. This is attributed to depleting fossil fuel reserves and growth in tendency of companies to gain maximum profit from these oil reserves. Thus, these factors give rise to the need for advanced fuel-efficient technologies, leading to surge in demand for electrically powered vehicles for travel. With the growing environmental concerns, governments and environmental agencies across the world are enacting stringent emission norms and laws to reduce vehicle emission. Major regulatory measures are stringent emissions targets for the reduction of nitrogen oxides (NOx) and carbon dioxide (CO2) in air. Therefore, all these factors encourage the adoption of electric vehicles. A rechargeable battery is used to power the electric motors of a battery electric vehicle (BEV) or hybrid electric vehicle (HEV). Solid-state batteries are expected to be used in electric vehicles (EVs) to store more energy, charge faster and offer greater safety, which is expected to provide potential opportunities for the growth of the electric vehicle solid state battery market. For instance, In May 2021, BMW and Ford expanded an existing joint development agreement with Solid Power to develop and secure solid-state batteries for future electric vehicles. Working with Volta Energy Technologies, Solid Power funded $130 million to develop the solid-state batteries.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electric vehicle solid state battery market analysis from 2025 to 2035 to identify the prevailing electric vehicle solid state battery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electric vehicle solid state battery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electric vehicle solid state battery market trends, key players, market segments, application areas, and market growth strategies.

Electric Vehicle Solid State Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 1.9 billion |

| Growth Rate | CAGR of 18% |

| Forecast period | 2025 - 2035 |

| Report Pages | 218 |

| By Vehicle Type |

|

| By Propulsion Type |

|

| By Battery Energy Density |

|

| By Region |

|

| Key Market Players | QuantumScape Corporation, Contemporary Amperex Technology Co., Limited, Solid Power, Cymbet, TDK Corporation, LG Chem, Ilika, st microelectronics, Samsung SDI Co., Ltd., Panasonic Corporation, Northvolt AB, TOYOTA MOTOR CORPORATION |

Analyst Review

The electric vehicle solid state battery market is expected to witness significant growth, due to rise in production and sales of electric vehicles across the globe. Manufacturers of battery systems focus on providing safety efficiency, high energy density, and a wide variety of operating temperatures in solid state batteries. System manufacturer are developing next-generation batteries that are expected to enable electric vehicles to travel longer, charge faster, be safer, and support the transition from traditional energy sources to a low-carbon future.

Electric vehicle manufacturers have developed a novel battery-as-a-service business model for increasing the convenience of owning electric vehicles. The manufacturers offer battery asset management services in which the service providers rent battery services to the customer periodically. The rental plan for the battery removes a large amount of cost associated with owning an electric vehicle and facilitates the sales of electric vehicles. Several companies are setting up battery-as-a-service platforms in the region owing to the surge in demands for a battery service provider in the electric vehicle industry. For instance, in March 2021, Ample announced the commencement of testing activities of electric vehicle battery swapping stations in California. The battery swapping stations will recharge the electric vehicle in 10 minutes through its modular battery-swapping system.

In addition, battery-as-a-service providers also offer battery maintenance, repair, and logistics services for electric vehicle batteries. For instance, in May 2021, Daimler Trucks North America (DTNA) launched Detroit eConsulting service for planning the customers in navigating the transition towards the electric truck. The service also includes providing assistance for installing energy storage projects, charging infrastructure, solar panels, and other services. Factors such as an increase in the number of both commercial and private electric vehicles have promoted the growth in adoption of battery services business model by multiple companies. The growing battery as-a-service business model is forecasted to offer an opportunity for the growth of the electric vehicle batteries which in turn is expected to fuel the demand for electric vehicle solid state battery market

The global electric vehicle solid state battery market is expected to be valued at USD 0.37 billion in 2025, and is projected to reach USD 1.9 billion by 2035.

The global electric vehicle solid state battery market is projected to grow at a compound annual growth rate of 18% from 2025 to 2035 to reach USD 1.9 billion by 2035.

The key players that operate in the electric vehicle solid state battery market such as Cymbet, Contemporary Amperex Technology Co., Limited (CATL), Ilika, LG Chem, Northvolt AB, Panasonic Corporation, QuantumScape Corporation, Samsung SDI Co., Ltd., Solid Power, STMicroelectronics, Toyota Motor Corporation, and TDK Corporation.

Asia-Pacific is the largest regional market for electric vehicle solid state battery.

Factors, such as rising global pollution levels and depleting fossil fuels, have created demand for development of sustainable transportation systems. The automotive manufacturers have implemented innovative technologies to tackle the growing concern for environmental sustainability.

Loading Table Of Content...