Electrical Park Brake (EPB) Market Research, 2033

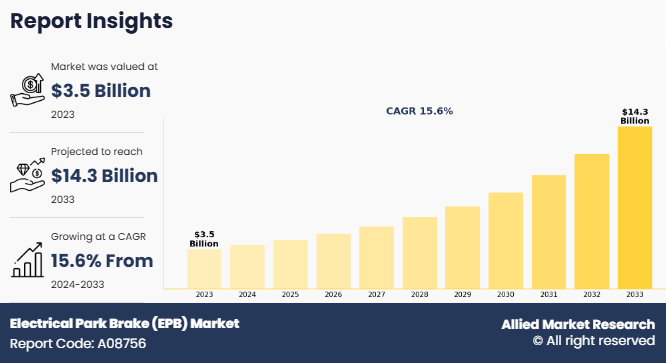

The global electrical park brake market size was valued at $3.5 billion in 2023, and is projected to reach $14.3 billion by 2033, growing at a CAGR of 15.6% from 2024 to 2033.

An electrical park brake (EPB) is an advanced braking system commonly found in modern vehicles that replaces the traditional mechanical handbrake. Instead of using a lever or pedal to engage the brake, the EPB utilizes electronic controls to activate the rear brakes. This system consists of several key components, including an electronic control unit (ECU), actuators mounted on the rear brakes, sensors, and a switch that replaces the mechanical lever. When the driver presses the switch, the EPB's ECU sends a signal to the actuators, which apply the rear brakes using electric motors. The system enhances safety by automatically engaging the brake when the vehicle is parked, and in some vehicles, it integrates with other systems such as hill-start assist to prevent rollback.

Recent Developments in the Electrical Park Brake (EPB) Industry

• In November 2023, ADVICS, a major provider of brake system products, launched its newest line of electric parking brake (EPB) actuator kits in North America. These kits are designed for easy integration with vehicle calipers, making the process of engaging the parking brake more efficient. The kits are compatible with Toyota and Lexus models manufactured between 2018 and 2023. Each kit comes as a complete package, including an actuator, bolts, and O-ring seals, ensuring a simplified installation process.

• In September 2023, Continental expanded its range of ATE Electronic Parking Brake (EPB) Calipers in the aftermarket, designed for easy installation on some of the most popular European vehicle brands. The latest release includes 10 new parts, which provide coverage for over 5 million vehicles in operation (VIO). These parts are compatible with models from BMW, Volkswagen, Audi, and Volvo, covering vehicles produced between 2016 and 2021.

• In May 2023, MG Motor announced the launch of the all-new MG3, a compact sedan, in the Middle East, expanding the brand's diverse lineup. The MG3 features a 1.5L petrol engine, delivering impressive performance and modern technology. The MG3 is expected to come in three trim levels such as STD, COM, and LUX, catering to a range of customer preferences. The COM trim adds features such as 16-inch alloy wheels, AC vents in the second row, an electric parking brake, and a sunroof, providing enhanced comfort and convenience.

Key Takeaways

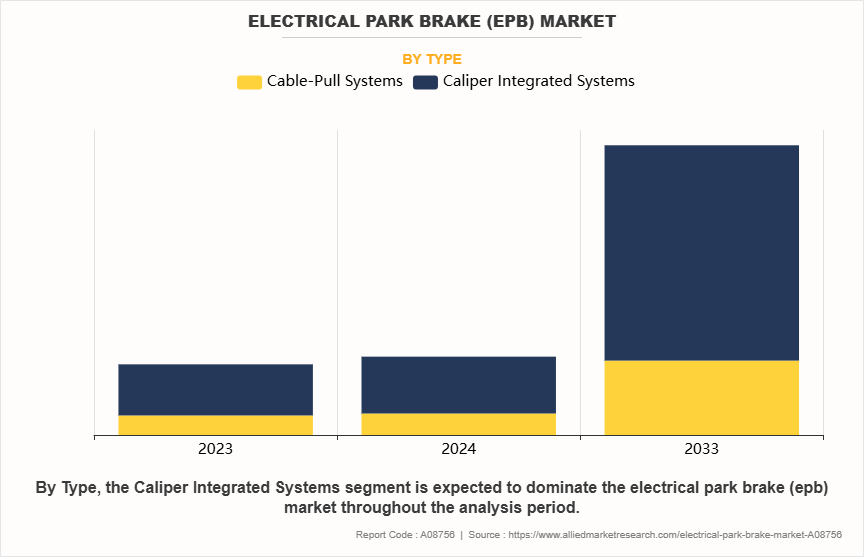

- On the basis of type, the caliper integrated systems segment held the largest share in the electrical park brake industry in 2023.

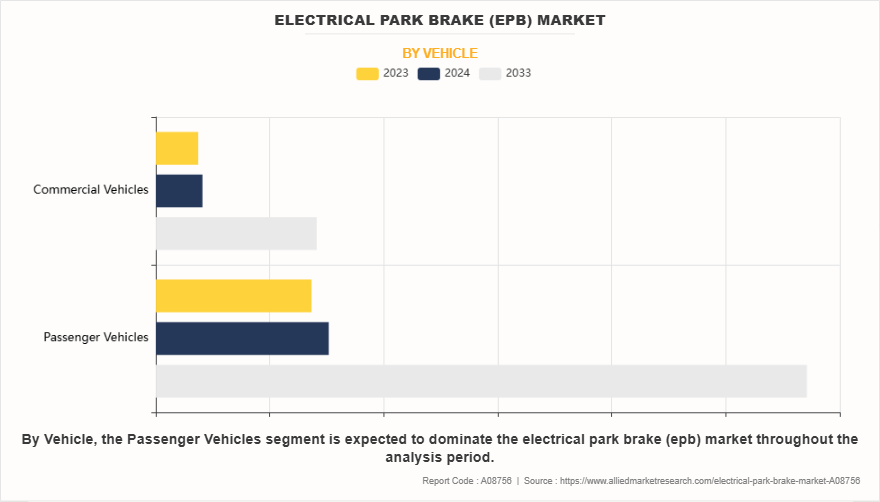

- On the basis of vehicle, the passenger vehicles segment held the largest share in the electrical park brake industry in 2023.

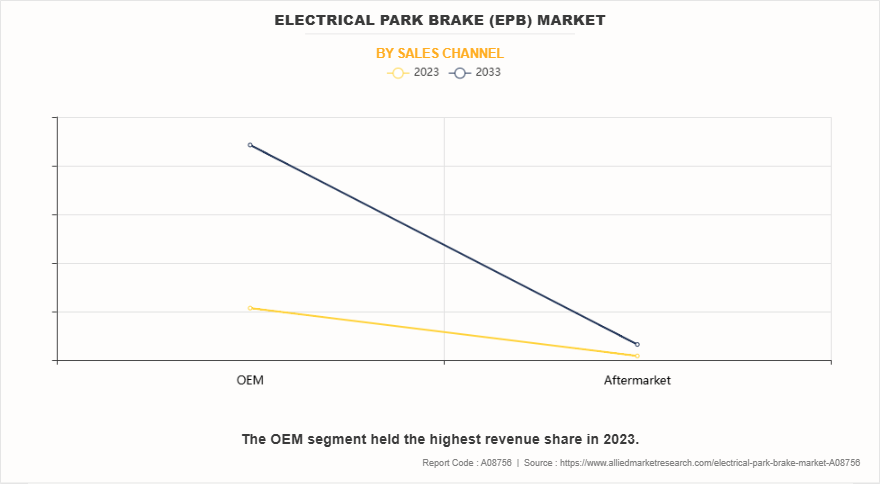

- On the basis of sales channel, the OEM segment held the largest share in the EPB market in 2023.

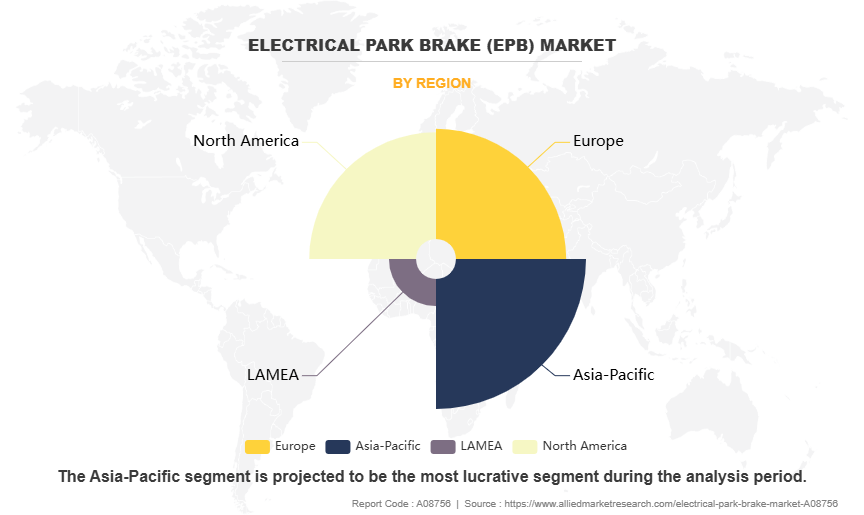

- By region, Asia-Pacific held the largest share in the market in 2023.

One of the key factors driving the growth of the market is the surge in demand for advanced safety features in vehicles and other products. As consumers become more safety-conscious, they expect manufacturers to provide better technologies that protect them in case of accidents or risky situations. In the automotive sector, for instance, this demand is evident in the increasing popularity of features such as autonomous emergency braking (AEB), lane-keeping assist, blind-spot detection, and adaptive cruise control.

These technologies enhance the driving experience and significantly reduce the chances of accidents, making them highly desirable. Thus, major manufacturers have launched electric parking brakes (EPB) for old vehicles. For instance, ADVICS, a major provider of brake system products, launched its newest line of electric parking brake (EPB) actuator kits in North America. These kits are designed for easy integration with vehicle calipers, making the process of engaging the parking brake more efficient. The kits are compatible with Toyota and Lexus models manufactured between 2018 and 2023. Each kit comes as a complete package, including an actuator, bolts, and O-ring seals, ensuring a simplified installation process. Distribution of these kits is managed through AISIN warehouses, supporting timely availability across North America.

Increase in demand for advanced safety features, shift toward electrification, and technological advancements are expected to drive the global electrical park brake market growth during the forecast period. However, maintenance challenges and high initial cost are expected to hamper market growth during the forecast period. Moreover, integration with smart technologies and consumer preference for convenience are expected to offer lucrative opportunities for market in the future.

Segment Review

The electrical park brake (EPB) market is segmented into type, vehicle, sales channel, and region. On the basis of type, the market is divided into cable-pull systems and caliper integrated systems. By vehicle, the market is segregated into passenger vehicles and commercial vehicles. On the basis of sales channel, the market is bifurcated into OEM and aftermarket. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Because of type, the caliper integrated systems segment generated the highest revenue in 2023, as these systems offer smoother braking actions and are easier to integrate with modern safety features such as adaptive cruise control and emergency braking. The surge in demand for electric vehicles (EVs) and premium car models significantly drives the growth of this market segment, as manufacturers are increasingly equipping these vehicles with caliper integrated systems for enhanced performance and safety.

By Vehicle

On the basis of vehicle, the passenger vehicles segment generated the highest revenue in 2023, driven by consumer expectations for convenience, safety, and advanced features. The trend toward autonomous and semi-autonomous driving, particularly in high-end and mid-range vehicles, has accelerated the adoption of EPB systems.

By Sales Channel

On the basis of sales channel, the OEM segment generated the highest revenue in 2023, due to surge in incorporation of EPB systems as standard features in new vehicles, especially in electric vehicles (EVs) and high-end models.

By Region

By region, Asia-Pacific generated the maximum revenue in 2023, fueled by the automotive production hubs in China, India, Japan, and South Korea. China is experiencing strong demand for advanced automotive technologies due to government policies promoting electric and hybrid vehicles.

Competitive Analysis

The electrical park brake market analysis includes top companies operating in the market such as Aisin Seiki Co. Ltd., Continental AG, DURA Automotive Systems, TBK Co. Ltd., Hyundai Mobis Co. Ltd., Küster Holding GmbH, Mando-Hella Electronics Corp., Svenska Kullagerfabriken AB, ZF Friedrichshafen AG, Wuhu Bethel Automotive Safety Systems Co. Ltd., and Zhejiang Wanchao Electric Appliance Co. Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the electrical park brake (EPB) industry.

Increased demand for advanced safety features

A key factor that drives market growth is the surge in demand for advanced safety features in vehicles and other products. As consumers become more safety-conscious, they expect manufacturers to provide better technologies that protect them in case of accidents or risky situations. In the automotive sector, for instance, this demand is evident in the popularity of features such as autonomous emergency braking (AEB), lane-keeping assist, blind-spot detection, and adaptive cruise control. The electrical park brake market forecast predicts sustained expansion, fueled by increasing vehicle electrification, stringent safety regulations, and the adoption of smart braking systems in modern vehicles

These technologies enhance the driving experience and significantly reduce the chances of accidents, making them highly desirable. Thus, major manufacturers have launched electric parking brakes (EPB) for old vehicles. For instance, in November 2023, ADVICS, a major provider of brake system products, launched its newest line of electric parking brake (EPB) actuator kits in North America. These kits are designed for easy integration with vehicle calipers, making the process of engaging the parking brake more efficient. The kits are compatible with Toyota and Lexus models manufactured between 2018 and 2023. Each kit comes as a complete package, including an actuator, bolts, and O-ring seals, ensuring a simplified installation process. Distribution of these kits is managed through AISIN warehouses, supporting timely availability across North America. The electrical park brake market size is expanding due to increasing adoption in passenger and commercial vehicles.

Moreover, governments in many countries encourage or even mandate these features, which further drive adoption of EPB in vehicles. As a result, companies that invest in developing and integrating advanced safety systems are well-positioned to capture a growing electrical park brake market share.

Shift towards electrification

The shift toward electrification is another significant factor that drives market growth across various sectors, especially in the automotive industry. With increase in awareness of environmental issues and stricter government regulations on emissions, there is a clear move toward electric and hybrid vehicles. Consumers have become more interested in eco-friendly transportation options, and the development of electric vehicles (EVs) has gained momentum. Battery technology advancements, along with the expansion of charging infrastructure, have made EVs more practical and appealing to a broader audience.

In addition, many governments offer incentives such as tax breaks or rebates to encourage people to switch to electric vehicles, further boosting demand for EPB in the vehicles. This shift toward electrification is not just limited to cars, however, it also affects other industries such as power generation and household appliances, as people look for greener and more efficient energy solutions. Companies that adapt to this trend are likely to witness robust growth opportunities as the world continues to move toward a more sustainable future.

Technological advancements

Technological advancements play a significant role in driving market growth across various industries. As technology continues to evolve, it opens new possibilities for innovation, efficiency, and product development. In the automotive industry, for instance, advancements in areas such as autonomous driving, electric vehicles, and smart infotainment systems reshape the way cars are designed and used. These innovations enhance the performance & safety of vehicles and improve the overall driving experience. Similarly, in sectors such as healthcare, new technologies such as telemedicine, wearable devices, and AI-powered diagnostics have transformed the way medical services are delivered, making healthcare more accessible and personalized.

Moreover, in manufacturing & logistics industries, automation, robotics, and advanced data analytics enable companies to streamline operations, reduce costs, and respond more quickly to electrical park brake market demand. These technological improvements allow businesses to operate more efficiently, giving them a competitive edge. The rapid pace of innovation encourages companies to continuously update their products and services to meet changes in consumer needs. As a result, industries that leverage these advancements are expected to witness growth and increased market share in the future.

Maintenance challenges

One of the key restraints in the EPB market is the issue of maintenance challenges. Unlike traditional mechanical handbrakes, EPBs rely on electronic systems, which are more complex to repair or replace when they malfunction. For instance, if the electronic control unit (ECU) that manages the brake system fails, specialized diagnostics and skilled technicians are required to fix the issue. This results in higher maintenance costs for vehicle owners. Moreover, EPBs involve various sensors and wiring that wear out over time, especially in harsh environments, leading to potential failures. These challenges discourage some consumers or fleet owners from adopting EPB systems, as they prefer the reliability and ease of maintenance of conventional brake systems.

Integration with smart technologies

An emerging opportunity in the market is the integration of electrical park brake (EPB) systems with smart technologies. As vehicles become more connected and automated, there is rise in demand for integrating various vehicle systems with smart features such as advanced driver assistance systems (ADAS), Internet of Things (IoT) capabilities, and autonomous driving technologies. For instance, EPB systems are linked with sensors and AI algorithms that automatically engage the brakes in response to detected obstacles or in emergency situations. This enhances vehicle safety and aligns with the broader trend of automation in the automotive industry.

In addition, the rise of smart vehicle ecosystems, where systems communicate and coordinate in real-time, opens opportunities for EPBs to become part of a larger network that improves driving efficiency and user experience. A notable example is Tesla’s electric vehicles, which integrate EPBs with autopilot systems, allowing seamless braking in autonomous driving modes. This trend represents a significant growth opportunity for EPB manufacturers innovating and adapting to the smart vehicle landscape.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electrical park brake (epb) market analysis from 2023 to 2033 to identify the prevailing electrical park brake market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electrical park brake (epb) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electrical park brake market trends, key players, market segments, application areas, and market growth strategies.

Electrical Park Brake (EPB) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.3 billion |

| Growth Rate | CAGR of 15.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Vehicle |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Marquardt Management SE, KSTER Unternehmensgruppe, Carlisle Brake & Friction, Bethel Automotive Safety Systems Co., Ltd., AISIN CORPORATION, ZF Friedrichshafen AG, DURA & Shiloh, HL Mando Corp., HYUNDAI MOBIS, Continental AG |

The leading type of Electrical Park Brake (EPB) Market is caliper integrated systems

The upcoming trends of Electrical Park Brake (EPB) Market are integration with smart technologies and consumer preference for convenience

The largest regional market for Electrical Park Brake (EPB) is Asia-Pacific

The global electrical park brake market size was valued at $3.5 billion in 2023, and is projected to reach $14.3 billion by 2033, growing at a CAGR of 15.6% from 2024 to 2033.

The electrical park brake (EPB) market analysis includes top companies operating in the market such as Aisin Seiki Co. Ltd., Continental AG, DURA Automotive Systems, TBK Co. Ltd., Hyundai Mobis Co. Ltd., Küster Holding GmbH, Mando-Hella Electronics Corp., Svenska Kullagerfabriken AB, ZF Friedrichshafen AG, Wuhu Bethel Automotive Safety Systems Co. Ltd., and Zhejiang Wanchao Electric Appliance Co. Ltd.

Loading Table Of Content...

Loading Research Methodology...