Electronic Protection Device Coatings Market Research, 2032

The Global Electronic Protection Device (EPD) Coatings Market was valued at $1.1 billion in 2022 and is projected to reach $1.9 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. Electronic protection device coatings refer to specialized coatings or films applied to electronic devices to protect them from various external factors that can potentially damage or compromise their performance. These coatings provide a barrier or shield against moisture, chemicals, dust, temperature variations, abrasion, and electromagnetic interference.

EPD coatings can take various forms, such as conformal coatings, encapsulation materials, or potting compounds. Conformal coatings are thin, protective films that conform to the shape of the electronic device, providing a layer of insulation and protection. Encapsulation materials and potting compounds completely encase the electronic device, forming a protective shell around it.

The automobile industry is experiencing a significant increase in the integration of electronics into vehicles. Moreover, modern vehicles are equipped with a wide range of electronic components, including advanced driver-assistance systems (ADAS), infotainment systems, powertrain control modules, sensors, and others. The rising demand for these features in cars has led to an extensive increase in the integration of electronics, developing a need for advantageous safety towards a range of environmental factors. In addition, automotive electronic components are exposed to harsh working conditions such as temperature extremes, vibrations, moisture, chemicals, and UV radiation.

These conditions can cause damage, corrosion, and malfunctioning of the digital systems. EPD coatings provide a protective barrier against these factors, ensuring the reliability and durability of the components. Automotive producers and consumers demand high levels of reliability and durability from electronic components. Failure or malfunctioning of crucial electronic systems in vehicles can have severe consequences, such as security risks. Electronic protection system coatings offer enhanced protection, preventing failures and increasing the lifespan of the components.

The cost factor is indeed a significant restraint in the electronic protection device (EPD) coatings market. Advanced coatings that provide enhanced functionalities, such as high thermal conductivity, moisture resistance, and chemical resistance, typically involve complex formulations and require specialized materials. These factors contribute to higher production costs. The high cost of electronic protection device coatings can limit their adoption, especially in price-sensitive applications or industries with tight budget constraints. For example, consumer electronics manufacturers may be reluctant to invest in expensive coatings for their products if they can achieve satisfactory protection using more cost-effective alternatives. Similarly, industries such as automotive, aerospace, and healthcare, which often require large volumes of electronic devices, may face challenges in incorporating expensive coatings into their manufacturing processes due to cost considerations.

Electronic devices that are dependable, strong, and long-lasting are in high demand from both consumers and industries. By protecting them from moisture, dust, chemicals, abrasion, and other outside influences, coatings for electronic protection devices help these devices last longer and perform better. The rising use of electronic components in the automotive and consumer electronics sectors. These significant opportunities for industry players are anticipated to arise from the expanding electrical and electronics industry in the globe.

The key players profiled in this report include 3M, Henkel Corporation, P2i Ltd., ENDURA, Specialty Coating Systems Inc., Electronic Coating Technologies, MATERIAL SCIENCES CORPORATION, Aculon, ABB, and Electrolube. Investment and agreement are common strategies followed by major electronic protection device coatings market players. For instance, in March 2021, Anhui Shengran Insulating Materials Co. Ltd., a dominant Chinese manufacturer of wire enamels widely used in consumer electronics, electric vehicles, and industrial applications, was acquired by Philadelphia-based Axalta Coating Systems, Ltd. to increase Axalta's production capacity in the expanding Asian electronic protection device coatings market.

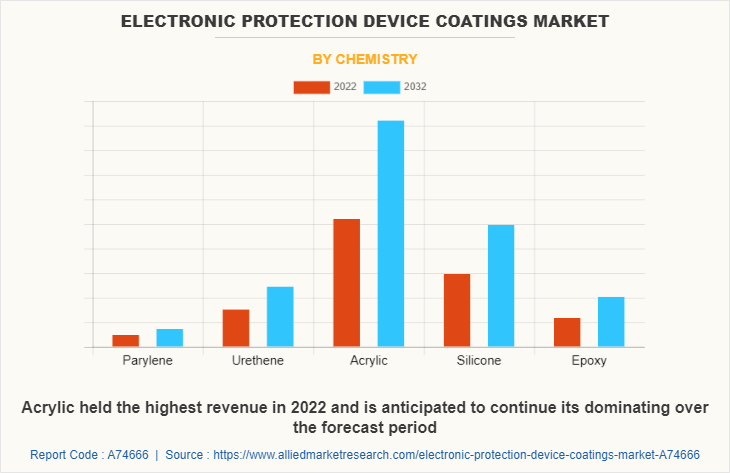

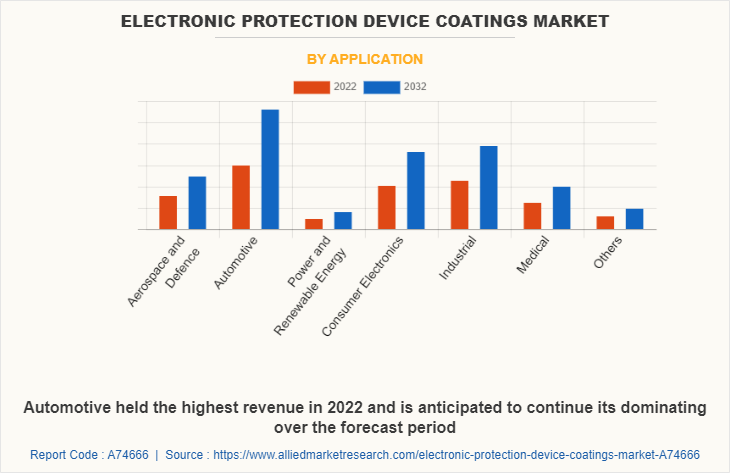

The electronic protection device coatings market outlook is segmented on the basis of chemistry, application, and region. By chemistry, the market is divided into perylene, urethane, acrylic, silicone, and epoxy. By application, the EPD coatings market is classified into aerospace and defense, automotive, power & renewable energy, consumer electronics, industrial, medical, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Overview

The electronic protection device coatings market is segmented into Chemistry and Application.

By chemistry, the acrylic sub-segment dominated the market in 2022. There is an increasing focus on developing environmentally friendly acrylic coatings. Water-based acrylic coatings and low volatile organic compound (VOC) formulations have gained popularity due to their reduced environmental impact compared to solvent-based alternatives. These eco-friendly options align with sustainability initiatives and regulations related to emissions and hazardous substances. The acrylic segment in the EPD coatings market is expected to witness steady growth in the upcoming years. The demand for electronic devices continues to rise across various industries, driving the need for reliable and durable protection coatings. Acrylic coatings' versatility, cost-effectiveness, and favorable performance properties make them a preferred choice for many electronic applications. These are predicted to be the major factors affecting the electronic protection device coatings market size during the forecast period, too.

By application, the automotive sub-segment dominated the global electronic protection device coatings market share in 2022. The automotive industry has specific standards and regulations related to electronic component protection. Coatings used in automotive applications must meet industry standards for performance, durability, electrical insulation, and environmental impact. These standards include the International Electrotechnical Commission (IEC) 61086, IPC-CC-830, and automotive OEM specifications. The automotive segment is witnessing advancements in electronic protection device coatings. Manufacturers are developing coatings with improved performance characteristics, such as enhanced adhesion, increased resistance to chemicals and UV radiation, and better thermal management properties. In addition, the development of eco-friendly coatings with low VOC content and compliance with regulatory requirements is gaining importance in the automotive industry

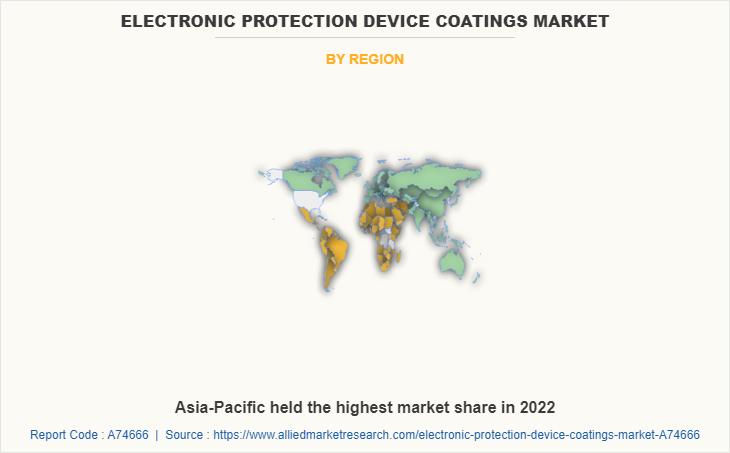

By region, Asia Pacific dominated the global market in 2022 and is projected to be the fastest-growing region during the electronic protection device coatings market forecast period. The region has a large consumer base and a growing middle class with increasing disposable incomes. This has led to a surge in demand for consumer electronic devices like smartphones, tablets, laptops, and wearables. EPD coatings are essential to enhance the durability and longevity of these devices. Asia-Pacific is known for its technological advancements and innovations. There is a continuous need for miniaturization of electronic components and the development of advanced electronic devices. EPD coatings play a vital role in protecting these miniature components from external factors, contributing to the EPD coatings market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the electronic protection device coatings market segments, current trends, estimations, and dynamics of the electronic protection device coatings market analysis from 2022 to 2032 to identify the prevailing EPD coatings market opportunity.

- Electronic protection device coatings market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the electronic protection device coatings market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global electronic protection device EPD coatings market.

- Electronic protection device coatings Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global electronic protection device (EPD) coatings market trends, key players, market segments, application areas, and market growth strategies.

Electronic Protection Device Coatings Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.9 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Chemistry |

|

| By Application |

|

| By Region |

|

| Key Market Players | Aculon, Specialty Coating Systems Inc., MATERIAL SCIENCES CORPORATION, ENDURA, ABB, Electronic Coating Technologies, P2i Ltd., 3M, Henkel Corporation, Electrolube |

The proliferation of electronic devices across various industries, including consumer electronics, automotive, aerospace, healthcare, and telecommunications, is a significant driver for electronic protection device coatings. As electronic devices become more advanced and integrated into everyday life, there is a growing need to protect them from environmental factors, ensuring their reliability and durability.

The major growth strategies adopted by electronic protection device coatings market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global electronic protection device coatings market in the future.

3MHenkel Corporation, P2i Ltd, ENDURA, and Specialty Coating Systems Inc. are the major players in the electronic protection device coatings market.

The automotive sub-segment of the application acquired the maximum share of the global electronic protection device coatings market in 2022.

Automotive industries are the major customers in the global electronic protection device coatings market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global electronic protection device coatings market from 2022 to 2032 to determine the prevailing opportunities.

Various industries have specific standards and regulations pertaining to electronic component protection. Automotive, aerospace, and medical industries, for example, have stringent requirements for the reliability and safety of electronic devices. Electronic protection device coatings help manufacturers comply with these standards and regulations, driving their adoption.

Loading Table Of Content...

Loading Research Methodology...