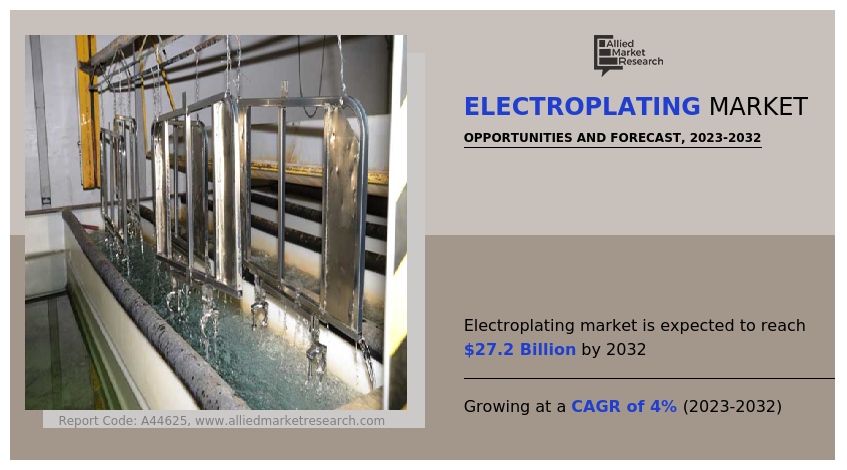

Electroplating Market Research, 2032

The global electroplating market size was valued at $18.3 billion in 2022 and is projected to reach $27.2 billion by 2032, growing at a CAGR of 4% from 2023 to 2032. Rise in demand in the automotive industry and increase in consumer electronics are key drivers fueling the growth of the electroplating market. In the automotive sector, the need for corrosion-resistant, durable, and aesthetically appealing metal finishes has surged due to the growing production of electric vehicles and high-performance components

Report Key Highlighters:

- The electroplating market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) or the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The electroplating market is highly fragmented, with several players including Allied Finishing Inc., Cherng Yi Hsing Plastic Plating Factory Co. Ltd., Atotech, Sheen Electroplaters Pvt Ltd., Precision Plating Company., Summit Corporation of America, Klein Plating Works, Inc., Superchem Finishers, Sharretts Plating Company, Jing-Mei Industrial Limited.

Introduction

Electroplating is a process that involves coating a metal object with a thin layer of another metal using an electric current. The object to be plated is submerged in an electrolyte solution containing dissolved metal ions, and it acts as the cathode (negatively charged). A metal anode (positively charged) is also placed in the solution, when an electric current is passed through the solution, the metal ions in the electrolyte are reduced and deposited onto the surface of the object. This process is used to improve the object's appearance, enhance corrosion resistance, reduce friction, or increase wear resistance. Common metals used in electroplating include gold, silver, nickel, and chromium.

The rising demand in the automotive industry will contribute to the expansion of the electroplating market during the forecast period.

Electroplating creates a defensive barrier to minimize friction and stop the oxidation of a surface. In addition to defending the surface from wear and tear, a thin, resilient metal coating is applied. Coating a non-metallic surface with steel alters the surface characteristics of the object. In addition to providing wear resistance, corrosion protection, and abrasion resistance, a metallic coating is every now and then used to alter the appearance of components. In addition, electroplating can make inexpensive metals resemble metals of greater quality. Automobiles, airplanes, electronics, recreational, and agricultural industries are making use of electroplating at a higher rate than ever before. Consequently, the global electroplating market share is anticipated to expand during the forecast period.

Increasing demand for electroplating purposes in the car industry is fueling the market for electroplating. The automotive industry is likely the largest consumer of electroplating technology, making use of all zinc-to-gold electroplating gear available. In cutting-edge vehicles, plastic electroplating is also utilized to chrome-plate lightweight components. Palladium plating is utilized in the manufacturing of exhaust systems due to its capability to hold copious quantities of hydrogen. In the car industry, producers are consistently searching for techniques to protect their products from eroding forces. Despite the fast increase in the auto industry, the electrification procedure is commonly utilized in several automobile components.

Increase in demand for consumer electronics

The electroplating market is experiencing a surge in demand driven by means of the growing popularity of electronic products. With the fast development of technology and the massive adoption of purchaser electronics, there is a growing need for electroplating techniques in the manufacturing of digital components. The increase of the electroplating market is pushed through the increasing prominence of digital products, which is an end result of ongoing product innovation, technological know-how adoption, and demand for electrical devices. Electroplating is required for the uniform coating of steel surfaces in the production of electrical devices, components, and digital products.

The electrical and electronics industry employs each valuable and non-precious plated component to enhance the product's corrosion resistance, wear resistance, solderability, and electrical conductivity for a number of end-use applications. Moreover, numerous companies have made enormous investments in the manufacturing of digital products. India plans to produce mobile phones really worth a whole of $24 billion with the aid of 2020 and $190 billion by way of 2025.

The economic improvement of developed regions, such as North America and Europe, has slowed due to the fact these markets are mature and therefore journey exceptionally gradual growth. This is anticipated to proceed all through the forecast period. Consequently, it is predicted that the slowdown in economic development in North America and Europe will hinder the growth of the electroplating market for the duration of the forecast period.

Governments in developed regions such as North America and Europe are anticipated to implement increasingly more stringent environmental guidelines on the use of electroplating due to its unfavorable effects on human health and the environment, which is predicted to restrain the development of the electroplating market. The electroplating enterprise is one of the largest contributors to environmental pollution, as its methods release toxic materials, heavy metals, and solid wastes with the aid of effluents and air emissions, which is anticipated to restrict the electroplating market growth in the coming years.

Nanotechnology in electroplating affords pretty lucrative opportunities for the market. By integrating nanoscale coatings into the electroplating process, agencies can provide products with improved houses such as the most beneficial corrosion and wear resistance, extended electrical conductivity, and other superior functionalities. These brand-new coatings cater to industries the place performance and toughness are paramount, such as aerospace, electronics, and automotive. By investing in research and improvement to supply nanotechnology-based solutions, electroplating corporations can gain a competitive advantage, attract high-value customers, and faucet into emerging markets, driving huge boom and profitability in the electroplating market forecast.

Market Segmentation

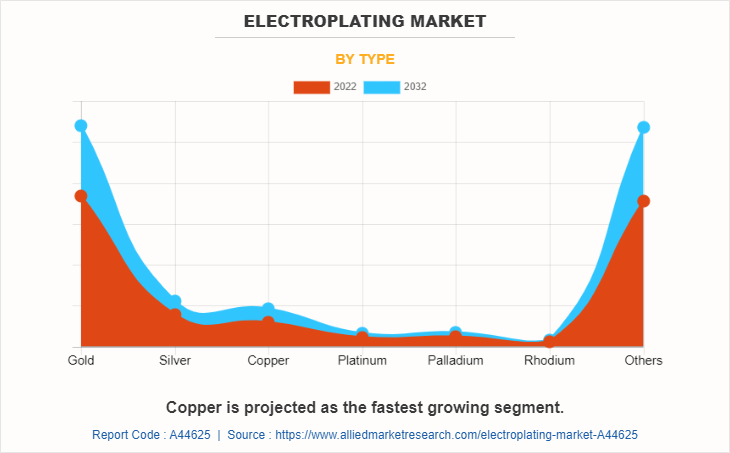

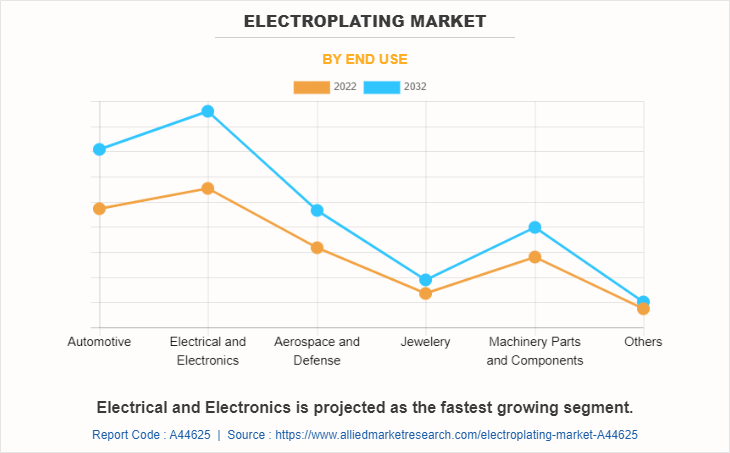

The electroplating market is segmented into type, end-use, and region. Depending on the type, the market is divided into gold, silver, copper, platinum, palladium, rhodium, and others. On the basis of end-use, it is categorized into automotive, electrical and electronics, aerospace and defense, jewelry, machinery parts and components, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The gold segment accounted for the largest market share in 2022, accounting for around two-fifths of the global electroplating market revenue. The high demand for gold electroplating is pushed via its aesthetic appeal, corrosion resistance, and conductivity, making it appropriate for jewelry, electronics, and decorative items. Additionally, its prestigious reputation and perceived cost contribute to its popularity in a number of industries.

Copper is anticipated to register the highest CAGR of 4.6%. The rise in the electronics industry, increased adoption of electric vehicles, infrastructure development, and increasing renewable power areas are driving the high demand for copper electroplating. Copper's excellent electrical and thermal conductivity, corrosion resistance, and cost-effectiveness make it a critical choice for a number of applications.

The electrical and Electronics segment accounted for the largest market share in 2022, accounting for around one-third of the global electroplating market revenue, and is expected to register the highest CAGR of 4.5%. The drivers of high demand for Electrical and Electronics are technological advancements, making bigger automation across industries, upward thrust in client electronics needs, development of renewable strength solutions, and surge in infrastructure projects. These elements fuel the demand for skilled professionals and modern products, riding the market’s growth.

North America garnered the largest market share in terms of revenue in 2022, accounting for more than one-third of the global electroplating market revenue. The high demand for electroplating in North America is pushed by way of increase in the manufacturing sector, elevated adoption in automotive and electronics industries, corrosion protection needs, ornamental applications, and stringent environmental regulations promoting sustainable surface finishing methods.

Competitive Landscape

The major players operating in the global electroplating market are Allied Finishing Inc., Cherng Yi Hsing Plastic Plating Factory Co. Ltd., Atotech, Sheen Electroplaters Pvt Ltd., Precision Plating Company., Summit Corporation of America, Klein Plating Works, Inc., Superchem Finishers, Sharretts Plating Company, Jing-Mei Industrial Limited.

Other players include Saporito Finishing Company, Pioneer Metal Finishing, Valence Surface Technologies, Reliable Plating Works, Inc., Roy Metal Finishing, Columbia Chemical Corporation, Bales Metal Surface Solutions, Cadillac Plating Corporation, and Artcraft Plating & Finishing.

⦁ Allied Finishing Inc. is a well-established player, focusing on automotive and other industrial applications. Known for its high-quality electroplating services, it has a reputation for consistent performance, offering a range of finishes, including nickel, chrome, and zinc.

⦁ Cherng Yi Hsing Plastic Plating Factory Co. Ltd. stands out for its expertise in plastic electroplating, serving the automotive, electronics, and household goods industries. Based in Taiwan, the company excels in innovative plating solutions for plastic components.

⦁ Atotech is a global leader in surface-finishing solutions, with a focus on both decorative and functional electroplating applications. With an extensive portfolio of environment-friendly technologies and advanced systems, Atotech serves industries such as electronics, automotive, and heavy machinery.

⦁ Sheen Electroplaters Pvt Ltd. is a prominent Indian company, recognized for its precision plating services in various sectors, including telecommunications, electronics, and automotive. The company offers a diverse range of metal finishing solutions, including zinc, nickel, and gold plating.

Russia-Ukraine War Impact Analysis

The conflict disrupted supply chains for various industries, including the electroplating market. Ukraine, as a significant global producer of metals such as zinc, nickel, and steel, which are essential for electroplating processes, experienced disruptions in the production and transportation of these metals. This led to supply shortages and price fluctuations in the electroplating market.

Geopolitical tensions and uncertainties surrounding the conflict resulted in price volatility for raw materials used in electroplating. Investors and businesses became cautious, leading to fluctuations in metal prices. This volatility posed challenges for electroplating companies in managing their production costs and pricing their products competitively.

In response to the conflict, international sanctions and export restrictions were imposed on Russia and Ukraine. These restrictions further impacted the availability of metals and chemicals used in electroplating and hindered the trade of finished electroplated products from the region.

The geopolitical situation prompted some companies to reassess their supply chain strategies and look for alternative sourcing options. Manufacturers sought to diversify their suppliers to reduce dependence on the region, leading to potential shifts in market dynamics within the electroplating industry.

The Russia-Ukraine conflict had broader economic ramifications for the region. The destabilized economy in either country led to reduced industrial activity and overall demand for electroplating services and products in the affected areas.

Geopolitical conflicts created an atmosphere of uncertainty, which affected global business sentiments. Companies delayed investments and expansion plans in the electroplating sector until the situation stabilized, impacting growth prospects for the industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the electroplating market analysis from 2022 to 2032 to identify the prevailing electroplating market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the electroplating market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global electroplating market trends, key players, market segments, application areas, and market growth strategies.

Electroplating Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 27.2 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 240 |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Jing-Mei Industrial Limited, Precision Plating Co., Sheen Electroplaters Pvt. Ltd., Summit Corporation of America, Sharretts Plating Company, Atotech, Klein Plating Works, Inc, Superchem Finishers, Cherng Yi Hsing Plastic Plating Factory Co.Ltd, Allied Finishing, Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, electroplating is becoming more popular around the world because of its many uses in industries such as automotive, electrical and electronics, aircraft and defense, jewelry, and industrial machinery. Multiple innovations are being developed to enhance the quality of electroplating and expand the markets for decorative electroplated nickel or chromium plating in response to the increasing demand for the superior corrosion performance of decorative multilayers in automotive decorative plating.

CXOs further added that the growing concern over toxic residues generated by metal finishing operations in the electroplating process and the potential to develop alternative clean technologies are expected to restrain market growth. However, expanding end-use industries and low-cost metal shielding advantages are projected to overcome any market restraints in the electroplating industry.

The Electroplating market attained $18.3 billion in 2022 and is projected to reach $27.2 billion by 2032, growing at a CAGR of 4.0% from 2023 to 2032.

Electrical and electronics is the leading end-use of Electroplating Market

Increasing demand for Sustainable Electroplating Solutions are the upcoming trends of Electroplating Market in the world.

Allied Finishing Inc., Cherng Yi Hsing Plastic Plating Factory Co. Ltd., Atotech, Sheen Electroplaters Pvt Ltd., Precision Plating Company., Summit Corporation of America, Klein Plating Works, Inc are the top companies to hold the market share in Electroplating.

The increase in demand for electroplating in the automotive industry and the increase in demand for consumer electronics are the driving factor of Electroplating Market.

The Electroplating Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Electroplating.

Loading Table Of Content...

Loading Research Methodology...