Embedded Antenna Systems Market Outlook – 2031

The Global Embedded Antenna Systems Market was valued at $3.4 billion in 2021, and is projected to reach $12.7 billion by 2031, growing at a CAGR of 14.3% from 2022 to 2031.

An antenna is a specialized transducer that converts radio-frequency (RF) fields into alternating current (AC) or vice-versa. Embedded antennas are special category of antennas which use metamaterials to increase the performance of miniaturized antenna systems. The main purpose of these antennas is to launch energy into free space. The metamaterial makes the antenna behave as if it was much larger than it really is, because the antenna structure stores energy and re-radiates. Conventional antennas that are very small compared to the wavelength reflect most of the signal back to the source. On the contrary, embedded antenna designs incorporating metamaterials can step-up the antenna’s radiated power. Advanced lithography techniques are used to print metamaterial elements on the PCB of the device. These antenna systems have a wide variety of applications including portable interaction with satellites, wide-angle beam steering, emergency communications devices, micro-sensors and portable ground-penetrating radars to search for geophysical features and others.

Key Takeaways

The global market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The embedded antenna systems market is driven by the growing demand for compact and wireless communication devices, the rapid expansion of IoT and smart devices across various industries, and the increasing adoption of 5G and advanced connectivity solutions. However, one major restraint is the complexity involved in integrating these antenna systems into increasingly small and multi-functional devices, which can affect design and performance. Despite this, there is a significant opportunity for growth, especially with the expansion of smart city projects and the rise of industrial automation, which will drive further demand for advanced embedded antennas.

Segment Overview

The embedded antenna systems market is segmented into Antenna Type, Connectivity and End User.

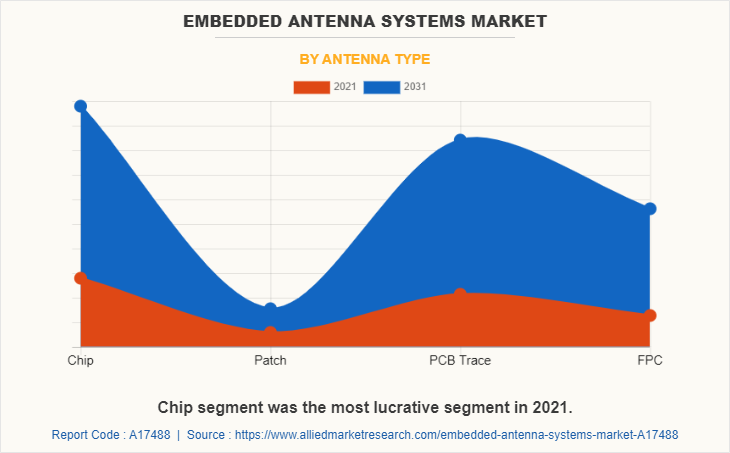

By antenna type, the embedded antenna systems market is divided into chip, patch, PCB trace and FPC. The chip segment was the highest revenue contributor to the market in 2021.

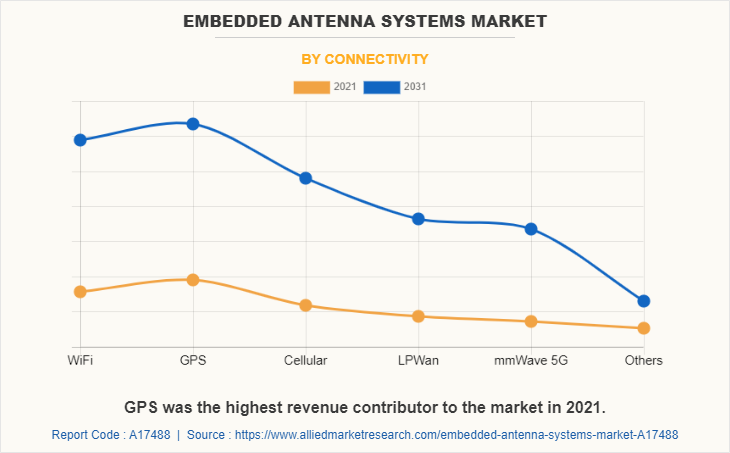

The connectivity segment is divided into Wi-Fi, GPS, cellular, LPWan, mmWave 5G and others. The GPS segment was the highest revenue contributor to the market in 2021.

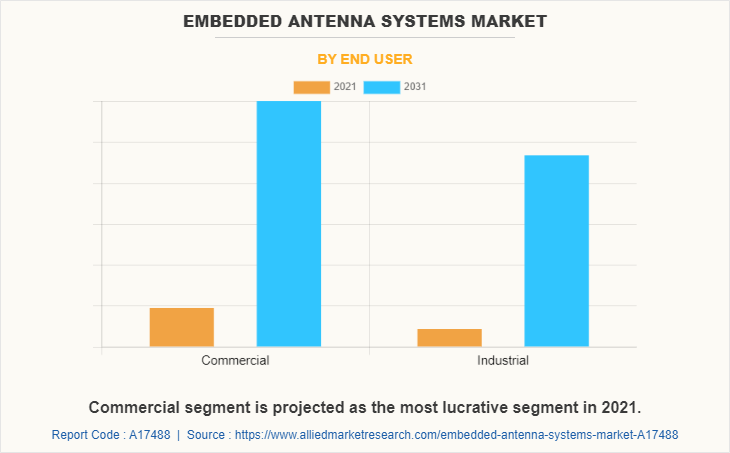

By end user, the embedded antenna systems market is analyzed across commercial and industrial. The commercial segment was the highest revenue contributor to the market in 2021.

Region wise, the embedded antenna systems market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, Netherlands, Belgium, Poland, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Malaysia, Thailand, Philippines, Indonesia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

The embedded antenna systems industry is expected to witness notable growth during the forecast period, owing to the emergence of the internet of things (IoT) and machine-to-machine interfaces in different verticals of businesses. Presently, antenna system design is gaining a lot of attention owing to its superior performance over conventional antennas. The rapid increase in the number of connected devices, wireless television antenna systems and growing inclination toward high-speed internet connectivity is fueling the adoption of 5G networks. Technological advancements in wireless communications, such as long-term evolution (LTE), enhanced mobility, and mobile data traffic surge, are driving the penetration of 5G technology. The growing penetration of 5G network is acting as a major driver influencing the growth of embedded antenna systems market share.

However, lack of skilled employees and high construction and maintenance costs for the infrastructure required to support flat panel antennas may hinder the embedded antenna system market growth. On the other hand, rising demand for low-power wide-area (LPWA) networks in IoT applications are key factors driving the embedded antenna systems market size.

Significant factors that impact the growth of embedded antenna systems industry include increasing adoption of embedded antenna in Internet of Things devices. Moreover, rapid adoption of embedded antenna systems in consumer electronics industry is expected to drive the market opportunity. However, lack of uniform frequency range for wireless applications might hamper the growth of the embedded antenna systems market. On the contrary, development of 5G is offering potential opportunity for the embedded antenna systems market growth during the forecast period.

Regional/Country Market Outlook

North America: The embedded antenna systems market benefits from strong technological advancements, widespread adoption of IoT, and increasing demand for wireless communication in industries like automotive, defense, and healthcare.

Europe: Growing emphasis on smart cities, industrial automation, and advanced wireless infrastructure is driving the demand for embedded antenna systems, especially in sectors like automotive and telecommunications.

Asia-Pacific: Rapid industrialization, increased consumer electronics production, and expanding telecom infrastructure, particularly in countries like China, India, and Japan, boost the market's growth.

LAMEA (Latin America, Middle East, Africa): Embedded antenna systems Market growth is driven by improving wireless connectivity, expanding telecom sectors, and rising demand for modern communication technologies in emerging economies.

Competitive analysis

The key players profiled in the report include Avnet, Inc., TE Connectivity, Mobile Mark, Inc. , Abracon, Tallysman, Linx Technologies, Kyocera Avx Components Corporation, Taoglas, Infinite Electronics International, Inc., Antenova Ltd, Airgain, Inc., 2J Antennas, S.R.O., The Antenna Company N.V., Myers Engineering International, Inc., Laird Connectivity, Maxtena Inc. and EnGenius Technologies are provided in this report.

Report Coverage & Deliverables

This report delivers in-depth insights into the embedded antenna systems market, by antenna type, connectivity, end user, and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Antenna Insights

Chip antennas are compact and suitable for small devices, providing efficient performance in minimal space. Patch antennas are widely used for their directional capabilities, particularly in GPS and communication devices on flat surfaces. PCB Trace antennas are integrated directly into circuit boards, making them cost-effective and ideal for compact designs, particularly in IoT devices. Flexible Printed Circuit (FPC) antennas are used in devices where flexibility and lightweight structures are needed, such as in wearables and foldable electronics.

Connectivity Insights

WiFi remains dominant in consumer and commercial applications, providing wireless internet connectivity for homes, offices, and public spaces. GPS is essential for location-based services, navigation, and tracking, making it a key feature in mobile devices, transportation, and logistics. Cellular connectivity supports global communication networks, making it vital for mobile phones and connected devices. LPWan (Low Power Wide Area Network) is ideal for IoT applications that require long-range communication with minimal energy consumption. mmWave 5G provides ultra-fast, low-latency communication and is crucial for applications like smart cities, autonomous vehicles, and industrial automation. Other connectivity options, such as Bluetooth, ZigBee, and NFC, are used for short-range communication in smart devices and IoT systems.

End User Insights

The commercial sector encompasses healthcare, communications, and various other industries that rely on antennas for IoT integration, medical devices, and smart infrastructure. In the industrial sector, consumer electronics, automotive, aerospace, and defense industries make extensive use of embedded antenna systems to support connectivity in smart devices, advanced machinery, and military equipment. Other applications include sectors like energy and transportation, where antennas enable reliable wireless communication.

Key Strategies and Developments

In November 2023, PCTEL, Inc., a prominent global provider of wireless technology solutions, introduced a new embedded antenna platform tailored for integrated radio deployments. The company's embedded antenna lineup features compact, low-profile designs that deliver broad coverage across the 2.4 GHz, 5 GHz, and 6 GHz frequency bands. These antennas are engineered for easy installation and seamless integration into confined spaces, ensuring reliable performance. With robust mechanical construction, the antennas are designed to support portable and network devices across a wide range of industries and applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the embedded antenna systems market analysis from 2021 to 2031 to identify the prevailing embedded antenna systems market opportunity.

- The embedded antenna systems market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the embedded antenna systems market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global embedded antenna systemsmarket.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the embedded antenna systems market players.

- The report includes the analysis of the regional as well as global embedded antenna systems market trends, key players, market segments, application areas, embedded antenna systems market forecast and market growth strategies.

Embedded Antenna Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.7 billion |

| Growth Rate | CAGR of 14.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 337 |

| By Antenna Type |

|

| By Connectivity |

|

| By End User |

|

| By Region |

|

| Key Market Players | Airgain, Inc., The Antenna Company N.V., EnGenius Technologies, Myers Engineering International, Inc., Abracon, Infinite Electronics International, Inc., Kyocera Avx Components Corporation, Laird Connectivity, Maxtena Inc., TE Connectivity (Linx Technologies), Tallysman, TE Connectivity, Taoglas, Avnet, Inc., 2J Antennas, S.R.O., Mobile Mark, Inc., Antenova Ltd. |

Analyst Review

The embedded antenna systems has enormous development potential across industrial and commercial sectors. Furthermore, the contribution to the worldwide market is predicted to grow considerably in coming years. In addition, rise in adoption of wireless connectivity solutions is driving the antenna market through digital transformation.

The embedded antenna system market is highly competitive, owing to strong presence of existing vendors. Battery energy storage system vendors, are investing substantially in R&D and skilled workforce, are anticipated to gain a competitive edge over their rivals. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

The demand for embedded antenna system in consumer electronics is estimated to expand at a rapid pace during the forecast period due to an increase in usage of embedded antenna systems in smart TVs, smartphones, tablets, wearables, gaming consoles, and other peripheral devices for wireless applications such WLAN, Bluetooth, Wi-Fi, and GPS. Moreover, major economies, such as the U.S., China, the UK, and Japan plan to develop and deploy advanced embedded antenna system across various sectors.

The key players profiled in the report include embedded antenna system market players, such as Avnet, Inc., TE Connectivity, Mobile Mark, Inc., Abracon, Tallysman, Linx Technologies, Kyocera Avx Components Corporation, Taoglas, Infinite Electronics International, Inc., Antenova Ltd, Airgain, Inc., 2J Antennas, S.R.O., The Antenna Company N.V., Myers Engineering International, Inc., Laird Connectivity, Maxtena Inc. and EnGenius Technologies.

The Embedded Antenna Systems Market is expected to grow at a CAGR of 14.26% during the forecast period.

The Embedded Antenna Systems Market is projected to reach $12,665.5 million by 2031.

The leading players in Embedded Antenna Systems Market are Avnet, Inc., TE Connectivity, Mobile Mark, Inc. , Abracon, Tallysman, Linx Technologies, Kyocera Avx Components Corporation and others.

The embedded antenna system market is segmented on the basis of antenna type, connectivity, end user, commercial type, communication type, industrial type and region. By antenna type, the market is divided into chip, patch, PCB trace and FPC. The connectivity segment is divided into Wi-Fi, GPS, cellular, LPWan, mmWave 5G and others. By end user, the market is analyzed across commercial and industrial.

By end user, the Embedded Antenna Systems Market is analyzed across commercial and industrial. The commercial segment is further divided into healthcare, communication and others. The communication segment is bifurcated into datacom and telecom. The industrial segment is divided into consumer electronics, automotive, aerospace & defense and others.

Loading Table Of Content...