Embedded Banking Market Research, 2032

The global embedded banking market was valued at $13.6 billion in 2022, and is projected to reach $110.7 billion by 2032, growing at a CAGR of 23.6% from 2023 to 2032.

Embedded banking is a financial services framework that integrates and prioritizes the needs of the consumer by seamlessly integrating banking and financial products with non-banking platforms and apps. This concept makes financial management and transactions more accessible, easy, and efficient by integrating banking services into daily living. Furthermore, embedded banking fundamentally depends on Application Programming Interfaces (APIs) to link traditional banks or financial institutions with a variety of third-party platforms, such as e-commerce websites, mobile apps, and even internet of things (IoT) devices.

These APIs allow real-time access to banking services including loans, financial transfers, account management, payments, and more without requiring users to exit the platform or app they are now using. Moreover, the concept of embedded banking has gained considerable momentum in recent times, mostly due to the increase in need for customized and quick financial encounters. It removes the barrier to offering a wider range of financial services for companies, fintech startups, and other non-banking organizations without requiring them to obtain a full bank license.

Furthermore, customers may access and manage their money whenever and wherever they need to with embedded banking, frequently without even recognizing they are doing business with a bank. In addition, the new approach to banking has broad implications for a number of sectors, such as mobility, e-commerce, and healthcare, where user experiences heavily rely on financial transactions. Embedded banking involves dismantling traditional banking walls and bringing in a new era of financial accessibility and ease by seamlessly integrating banking services into various environments. The future of financial services is anticipated to be significantly shaped by embedded banking, which is expected to make banking more customer-focused, flexible, and responsive to shifting demands as technology develops.

The rise in trend of banking as a service (BaaS) is a significant driver of the growth of the embedded banking market. BaaS makes it possible for non-banking organizations to easily incorporate banking services into their products, including fintech firms, e-commerce sites, and even conventional enterprises. Furthermore, digitalization in banking sector has driven the demand of the embedded banking market. However, lack of digital literacy in emerging countries has hampered the growth of the embedded banking market since a large number of people in rural areas may not be comfortable or familiar with digital banking services and applications. s. They might not be aware of the advantages and security precautions of online banking, and they could only have irregular access to computers, smartphones, and the internet.

Moreover, security and data privacy are major factors that hamper the growth of embedded banking market. On the contrary, diversified revenue streams for non-banking entities are an opportunity for embedded banking market. The revenue of embedded banking through fees, commissions, or interest on financial transactions increases by integrating banking services into their platforms, with the increase in their business. This ultimately drives the expansion of the embedded banking market by allowing businesses to monetize their user base, improve their overall business model, and increase profitability.

The report focuses on growth prospects, restraints, and trends of the embedded banking market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the embedded banking market size.

Segment Review

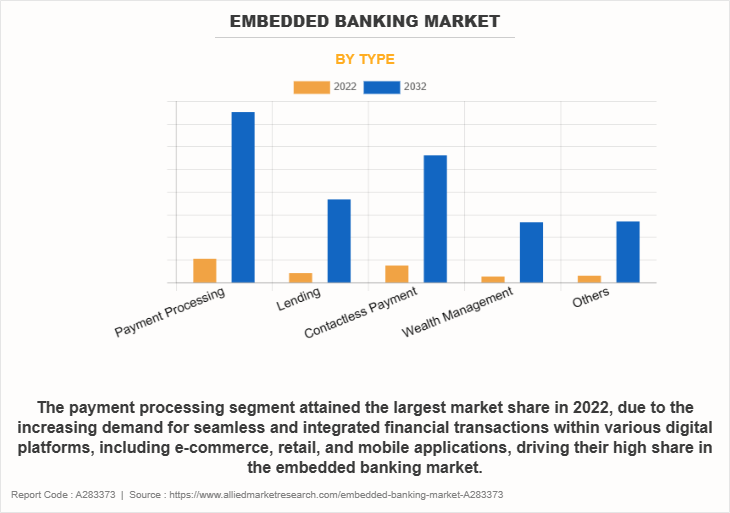

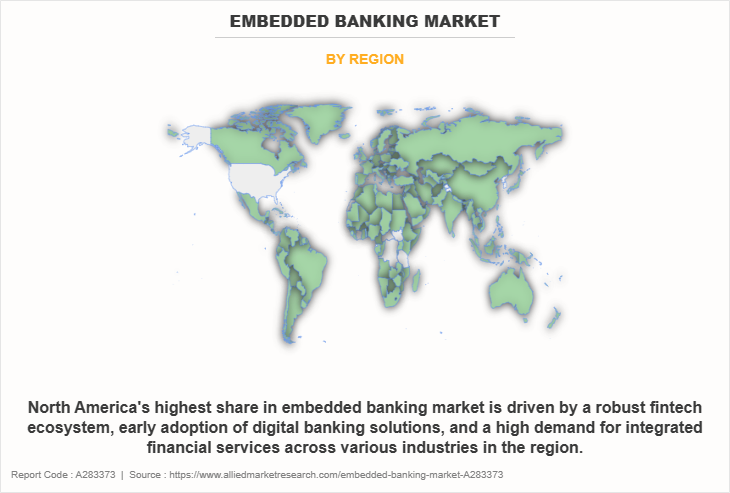

The embedded banking market is segmented on the basis of type, industry vertical and region. On the basis of type, the market is segmented into payment processing, lending, contactless payment, wealth management and others. On the basis of industry vertical, it is bifurcated into retail and e-commerce, transportation and logistics, healthcare, media and entertainment, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the payment processing segment attained the highest market share in 2022 in the embedded banking market. This can be attributed to the fact that the increase in demand for convenient and easy financial transactions, as integrating banking services into different applications, such e-commerce, mobile wallets, and peer-to-peer payment systems, has grown more important as more companies and customers look for effective payment solutions. Meanwhile, the wealth management segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the increase in desire for accessible and automated financial planning and investment services. Embedded wealth management solutions allow individuals to seamlessly access and manage their investments, assets, and financial portfolios within the applications they already use, such as mobile banking or investment apps. This convenience, coupled with the potential for cost savings and personalized financial advice, has driven the rapid adoption of embedded wealth management.

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the embedded banking market. This is attributed to the fact that the U.S. and other countries in North America have led the way in technological innovation. Its well-established fintech and tech startup ecosystem has sped up the creation and adoption of embedded banking solutions. On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the embedded banking market during the forecast period. This growth is attributed to the fact that the Asia-Pacific region has seen a rapid adoption of digital and mobile technology, frequently eschewing traditional banking infrastructure. The area has a "mobile first" mentality, which fits in nicely with digital and mobile-friendly embedded banking solutions.

The report analyses the profiles of key players operating in the embedded banking market such as Cybrid Inc., EdgeVerve Systems Limited, Finastra, Fiserv, Inc., Lendflow, Moshpit Technologies, Inc., PayPal, PAYRIX, Stripe, Inc., Zopa Bank Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the embedded banking market.

Competitive Analysis

Recent Expansion in the Embedded Banking Market

In October 2023, Fiserv expanded its embedded banking industry solution by aiming to enhance the way financial institutions, software platforms, and payment facilitators serve their respective clientele by granting access to a select group of partners and clients via a carefully selected set of application program interfaces (APIs). Furthermore, Fiserv is anticipated to revolutionize the way financial institutions, software platforms, and payment facilitators service their customers. Such businesses are expected to be able to broaden their service offerings and give their customers the option to use the company platform to obtain financial services directly, by doing this.

Recent Partnership in the Embedded Banking Market

In August 2023, embedded banking software company has partnered with academy bank to brought embedded finance service to its customer in the financial service industry. The partnership aims to fulfil the growth in need for "scalable and adaptable solutions that efficiently fulfil the change in requirements of enterprises and clients. The goal of the partnership is to offer businesses seamless access to deposit services of Academy Bank, enabling them to offer FDIC-insured accounts to their customers while remaining fully compliant with regulatory requirements.

Top Impacting Factors

Rise in Trend of Banking as a Service Platform

The embedded banking market has expanded due in large part to the growth in trend of Banking as a Service (BaaS). BaaS makes it possible for non-banking organizations to easily incorporate banking services into their products, including fintech firms, e-commerce platforms, and even conventional enterprises. Payments, financing, account management, and other services are included in this list. BaaS is appealing because it offers a turnkey solution to companies that want to improve customer experience by providing financial services, all without having to deal with the hassles of opening a full-fledged bank. Furthermore, businesses may reduce their time to market and cut costs by utilizing BaaS to access the vast infrastructure and experience of well-established financial institutions. This trend makes banking services available through a variety of non-traditional channels, which not only encourages innovation but also financial inclusion. In addition, as more companies look to incorporate banking services into their platforms to improve consumer engagement, diversify their service offerings, and create new revenue streams, the embedded banking market industry gains from this trend. Consequently, the cooperation between non-banking organizations and traditional banks has driven the growth of the embedded banking market, which is crucial to the advancement of the financial technology sector. Therefore, rise in trend of banking as a service platform has driven the demand for embedded banking market forecast.

Enhanced Customer Experience

Financial services may be easily integrated into a variety of digital platforms, such as e-commerce websites, mobile applications, and other programs that interact with customers, due to embedded banking. Consumers enjoy a more seamless and integrated experience since they can conveniently access banking and financial services without ever leaving the platform they are using. Furthermore, embedded banking uses analytics and data to provide more individualized financial services. Businesses can customize their products to each consumer, increase in their relevance and value, by having an in-depth understanding of their behavior and preferences. Great connections are created, and the client experience is improved by this degree of customization. Moreover, consumers appreciate one-stop shops that offer a variety of services. Businesses can offer a full range of financial services within their platforms due to embedded banking. An e-commerce platform, for example, can provide lending, savings, and payment processing, giving users a convenient and comprehensive experience. In addition, embedded banking makes financial operations and transactions more efficient. Faster service delivery, shorter wait times, and quicker money access are all outcomes of this efficiency. Consumers value quickness and reactivity of embedded banking solutions since they enhance the whole experience. Therefore, enhanced customer experience has driven the demand for the embedded banking market growth.

Security and Data Privacy

Information about sensitive customers may be public due to security breaches, which can result in fraud and identity theft. It makes sense that when utilizing digital banking services, users are worried about the security of their personal and financial information. Embedded banking platforms may lose credibility as a result of widely reported data breaches. Furthermore, strict restrictions are in place to safeguard customer privacy and data in the financial sector. Some may find it difficult to get started in the embedded banking industry due to the complicated regulatory environment they must manage. It can be expensive and time-consuming to ensure adherence to industry standards and data protection legislation. Moreover, an essential component of embedded banking adoption is trust, as users must have confidence in the security of their data and respect for their privacy. People could be afraid to use embedded banking services if they do not feel trusted. Therefore, data breaches and identity theft, regulatory compliance, and user trust have restrained the demand of the embedded banking market share.

Diversify Revenue Streams for Non-banking entities

Providing embedded banking industry services opens up new revenue streams for non-banking organizations. They may get money from service fees, interest income, or transaction fees. This enhances the financial stability of companies by enabling them to generate revenue streams outside of their primary business activities. Furthermore, cross-selling, and upselling opportunities are made possible by embedded banking. For instance, point-of-sale financing for purchases made by customers can be provided via an e-commerce platform, which may result in higher sales and bigger shopping carts. In the same way, non-banking businesses might provide relevant financial goods to customers based on their financial activity, which generates more money. Moreover, embedded banking has the potential to set one company apart in competitive marketplaces. Non-banking organizations can differentiate themselves from rivals and draw in new business by offering complete financial solutions. Furthermore, non-banking organizations can connect with underserved or unbanked people through embedded banking. Non-banking organizations can expand their user base and reach new markets by providing these individuals with basic financial services. Therefore, diversified revenue streams for non-banking entities provide lucrative opportunities for the growth of the embedded banking market outlook.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the embedded banking market analysis from 2022 to 2032 to identify the prevailing embedded banking market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the embedded banking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global embedded banking market trends, key players, market segments, application areas, and market growth strategies.

Embedded Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 110.7 billion |

| Growth Rate | CAGR of 23.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 334 |

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Zopa Bank Limited , Lendflow, PayPal Holdings, Inc., EdgeVerve Systems Limited, Fiserv, Inc., Cybrid Inc., Moshpit Technologies, Inc., Stripe, Inc., Finastra, PAYRIX |

Analyst Review

Embedded banking enhances the customer experience by providing financial services within the context of daily activities of the user. This can lead to increased customer loyalty and retention, making it an attractive option for businesses. Furthermore, embedded banking innovation is being derived by collaboration between fintech businesses and traditional financial institutions. Fintech companies typically supply technology and flexibility, while traditional banks supply the customer trust and regulatory knowledge. Moreover, embedded banking solutions are being added by e-commerce platforms and marketplaces on a regular basis to enhance their value proposition by providing their clients with financing, payment processing, and other financial services. In addition, businesses have enabled clients to manage their accounts, make payments, and get credit directly through the business software they use by embedding banking functions within their Software as a Service (SaaS) services. Furthermore, embedded banking solutions can help businesses make informed decisions and customize their offerings to meet the demands of their customers by utilizing the data created through their services to deliver insightful information. Moreover, the need for embedded banking services is being driven by the rapid digital revolution occurring across industries. Businesses aim to provide customers with a wider range of financial services, such as loans, savings, and payments within their current digital ecosystems. In addition, through a variety of digital platforms and applications, such as mobile apps and e-commerce platforms, embedded banking is expected to increase financial services accessibility for underserved or unbanked communities.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in February 2022, PAYRIX was acquired by FIS to expand e-commerce, embedded payments, and finance experiences for SMB merchants via platforms. This acquisition is consistent with aim of FIS of expanding its e-commerce products to businesses of all sizes and industries by embedding payment capabilities within software-as-a-service (SaaS) platforms. This acquisition is anticipated to also allow FIS to leverage the value of its extensive solution portfolio by providing embedded financial capabilities to small and medium-sized businesses (SMBs) in addition to its e-commerce solutions. Moreover, in June 2023, Stripe expanded its embedded banking service by providing financial services that can be integrated into various non-financial platforms and applications, catering to startups and businesses looking to embed financial functionality into their products and services. This reflects commitment of Stripe to expand its services and presence in the embedded finance sector. These strategies by the market players operating at a global and regional level are expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Cybrid Inc., EdgeVerve Systems Limited, Finastra, Fiserv, Inc., Lendflo, Moshpit Technologies, Inc., PayPal, PAYRIX, Stripe, Inc., Zopa Bank Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in embedded banking.

The upcoming trend in the embedded banking market is the increasing convergence of financial services with non-financial platforms, often referred to as "embedded finance." This trend involves the seamless integration of a wide array of financial services, such as payments, lending, insurance, and investment, directly into applications and platforms outside the traditional banking sector. Businesses across industries, from e-commerce to healthcare and beyond, are leveraging embedded banking to provide comprehensive and customized financial solutions to their users.

Payment Processing is the leading application of Embedded Banking Market.

North America is the largest regional market for Embedded Banking

1,10,667.66 is the estimated industry size of Embedded Banking.

Cybrid Inc., EdgeVerve Systems Limited, Finastra, Fiserv, Inc., Lendflow, Moshpit Technologies, Inc., PayPal, PAYRIX, Stripe, Inc., Zopa Bank Limited are the top companies to hold the market share in Embedded Banking.

Loading Table Of Content...

Loading Research Methodology...