Embedded Processor Market Outlook – 2028

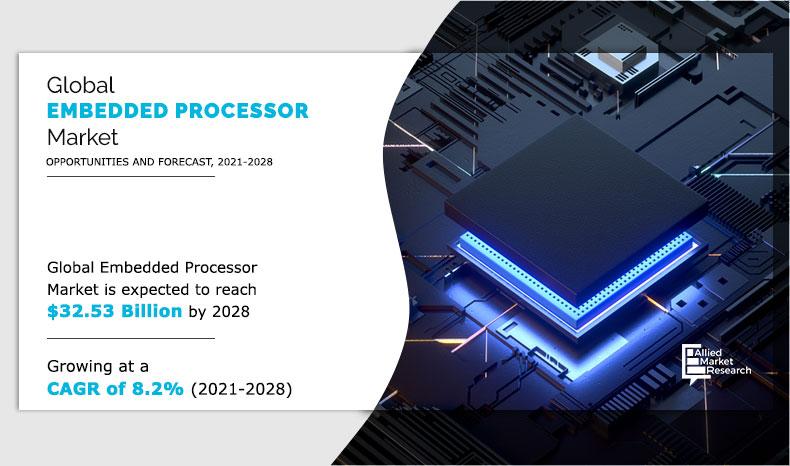

The global embedded processor market was valued at $19.36 billion in 2019 and is projected to reach $32.53 billion by 2028, registering a CAGR of 8.2% from 2021 to 2028.

An embedded processor is specially designed for embedded systems and can handle multiple processors in real time. It handles all the computational and logical operations of a computer. They are in the form of computer chips that are embedded in various microcontrollers and microprocessors to control various electrical and mechanical systems. These processors also offer features such as storing and retrieving data from the memory.

The microprocessor segment was the largest revenue contributor in 2019 and is expected to grow at a CAGR of 6.4% from 2021 to 2028. The embedded microprocessor systems are computer chips that find applications in residential, industrial units, and manufacturing. For instance, embedded microprocessors are used in lighting systems, home appliances, and industrial equipment. These processors are used in signal processing, general computing, and real-time data computing.

Microprocessors are used to control various parameters in devices and equipment such as temperature, speed, moisture, and pressure. All these factors make microprocessors a necessary component in computing devices and is expected to drive the growth of the embedded processors market globally. By application, consumer electronics is the leading largest contributor of revenue in 2019, the embedded processor is a microchip, which is used in many electronic devices such as digital watches, digital cameras, MP3 players, and other home appliances for processing the data at high speed. It helps in performing the system operations efficiently for continuous and repetitive operations.

By Application

Consumer Electronics segment is expected to secure the leading position during 2021 - 2028

Segment Overview

The global embedded processor market share is analyzed by type, application, and region. Based on type, the market is analyzed across microprocessors, microcontrollers, digital signal processors, embedded FPGA, and others. Based on application, the market is divided into consumer electronics, automotive & transportation, industrial, healthcare, IT & telecom, aerospace & defense, and others.

By Type

Microprocessor segment will dominate the market during the forecast period

Region-wise, the embedded processor market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific is leading the embedded processor market and is expected to be the fastest-growing regional segment shortly, with the highest CAGR. With an increase in demand for high-voltage operating devices, organizations across verticals are realizing the importance of embedded processors to ensure efficient power management.

By Region

Asia-Pacific region would exhibit the highest CAGR of 9.9% during 2021 - 2028

Leading embedded processor manufacturers such as NXP Semiconductors, Broadcom Corporation, STMicroelectronics, Intel Corporation, and Infineon Technologies AG are focusing their investment on technologically advanced and cost-effective products. For instance, in November 2020, Advanced Micro Devices (AMD) launched a new high-performance AMD Ryzen Embedded V2000 Series processor. With this launch, the company aims to give competition to its rival Intel.

In addition, in November 2018, Renesas Electronics launched the latest version of the microcontroller that will be integrated into automotive to deliver high-performance operation. Such companies aim for business expansion through mergers & acquisitions, partnerships, and product launches to prevent new entrants from capturing/entering the market.

Top Impacting Factors

Factors such as the rise in space constraints in semiconductor wafers, the increase in demand for smart consumer electronics, and the emerging usage of embedded processors in the automotive industry boost the global embedded processor market growth. However, the high implementation cost of embedded processors in different applications acts as a major restraint hampering the embedded processor industry. Furthermore, the increase in popularity of IoT, the rise in the trend toward electric vehicles, and the increase in usage of embedded processors in the biomedical sectors offer lucrative opportunities for the market globally.

Competitive Analysis

Competitive analysis and profiles of the major embedded processor market players such as NXP Semiconductors, Broadcom Corporation, STMicroelectronics, Intel Corporation, Infineon Technologies AG, Analog Devices Inc., Renesas Electronics, Microchip Technology Inc., Texas Instruments, and ON Semiconductor. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

COVID-19 Impact Analysis

The global embedded processor market has been significantly impacted by the COVID-19 outbreak. The production facilities of electronics and semiconductors have been halted, owing to the slowdown and unavailability of the workforce across the globe. The COVID-19 outbreak has caused a significant and protracted drop in manufacturing utilization, and travel bans & facility closures kept workers out of their factories, which led to a slowdown in the growth of the market in 2020.

The Asian and European countries under lockdowns have suffered in major loss of business and revenue, due to the shutdown of manufacturing units in the region. The operations of the production and manufacturing industries have been heavily impacted by the outbreak of the COVID-19 disease; thereby, leading to a slowdown in the growth of the embedded processor market in 2020.

However, the negative impact of COVID-19 on the embedded processor market is expected to be there for a short period, and by early 2021 the market is anticipated to observe a robust recovery rate along with the extensive demand for embedded processors in post-pandemic. For instance, the need for ventilators along with other advanced medical equipment has rapidly increased across the world. This is anticipated to positively impact the embedded processor market as several embedded hardware components are used in the manufacture of advanced ventilators as well as other medical equipment such as medical robots.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the global embedded processor market size, current trends, and future estimations to depict the imminent investment pockets.

- The overall embedded processor market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current embedded processor market forecast is quantitatively analyzed from 2019 to 2028 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the embedded processor market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Embedded Processor Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | STMICROELECTRONICS N.V., RENESAS ELECTRONICS CORPORATION, ANALOG DEVICES, INC., INTEL CORPORATION, NXP SEMICONDUCTORS N.V., MICROCHIP TECHNOLOGY INC, ON SEMICONDUCTOR CORPORATION, INFINEON TECHNOLOGIES AG, BROADCOM CORPORATION (BROADCOM INC.), TEXAS INSTRUMENTS INC. |

Analyst Review

The embedded processor market is expected to leverage high potential for the automotive and healthcare industry verticals in 2028. The current business scenario is witnessing an increase in the demand for smart consumer electronics, particularly in the developing regions such as China, India, and others due to increase in demand for technological advancements such as adoption of AI and IoT in this sector. Moreover, companies in this industry are adopting various innovative techniques such as mergers and acquisition activities to strengthen their business position in the competitive matrix.

The embedded processor market is steadily gaining traction, owing to rise in demand for enhanced technologies in various industry verticals such as integration of IoT & AI and growth in demand for smart consumer electronics. Furthermore, technological development by the emerging economies in Asia-Pacific boosts the embedded processors market growth. The ambitious project of 100 smart cities in India is projected to surge the adoption of smarter solutions for storage, since the project is based on the concept of using sensors and wireless technology to establish a wide connectivity network.

The embedded processors market provides numerous growth opportunities to the market players such as NXP Semiconductors, STMicroelectronics, Renesas Electronics, and Broadcom Corporation.

The Embedded Processor Market is estimated to grow at a CAGR of 8.2% from 2021 to 2028.

The Embedded Processor Market is projected to reach $32.53 billion by 2028.

To get the latest version of sample report

Rise in space constraints in semiconductors wafers, and increase in demand for smart consumer electronics etc. boost the Embedded Processor market growth.

The key players profiled in the report include NXP Semiconductors, Broadcom Corporation, STMicroelectronics, Intel Corporation, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Embedded Processor Market is segmented on the basis of type, application, and region.

The key growth strategies of Embedded Processor Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

eFPGA segment would grow at a highest CAGR of 11.3% during the forecast period.

Consumer Electronics segment will dominate the market by the end of 2028.

Loading Table Of Content...