Embolic Protection Devices Market Research, 2033

The global embolic protection devices market was valued at $0.6 billion in 2023, and is projected to reach $1.4 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033. The growth of the embolic protection devices market is driven by the rising prevalence of cardiovascular diseases, which increases the demand for minimally invasive procedures like angioplasty. Advancements in technology, including the development of more efficient filter-based and distal occlusion devices, are enhancing procedural safety and effectiveness. Additionally, the aging population and growing awareness of stroke prevention are contributing to market expansion. Increased healthcare spending and favorable reimbursement policies in developed regions also support the market. Emerging markets, with improving healthcare infrastructure, offer growth opportunities for manufacturers seeking to expand their presence globally

Market Introduction and Definition

Embolic protection devices are specialized medical instruments designed to prevent debris or emboli from traveling through the bloodstream during cardiovascular procedures, such as angioplasty and stenting. They capture and remove potential blockages that could lead to serious complications, including strokes and heart attacks. These devices are categorized into distal protection devices, which capture debris downstream, and proximal protection devices, which block it upstream. The increasing adoption of these devices is driven by technological advancements and a growing emphasis on patient safety, making them essential tools for minimizing risks associated with minimally invasive cardiovascular interventions.

Key Takeaways

- The embolic protection devices market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major embolic protection devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

According to embolic protection devices market forecast analysis, the key factors driving the growth of the market are rise in prevalence of chronic diseases, growing geriatric population, developing healthcare infrastructure, and technological advancement in embolic protection devices.

The rise in the prevalence of chronic diseases, particularly cardiovascular diseases, neurovascular diseases, and peripheral vascular diseases, is significantly driving the embolic protection devices market growth. Cardiovascular diseases, which include conditions like coronary artery disease and stroke, are among the leading causes of morbidity and mortality globally. According to 2021 article by National Library of Medicine, the incidence of coronary artery disease increased annually by 2.7% and 1.2% in men and women, respectively. This surge in cardiovascular incidents has led to an increased demand for advanced medical devices designed to prevent the migration of emboli during surgical interventions, such as angioplasty and stenting.

Similarly, the increasing incidence of neurovascular diseases, including ischemic stroke and transient ischemic attacks, necessitates the use of embolic protection devices to enhance patient safety during endovascular procedures. Furthermore, the prevalence of peripheral vascular diseases, characterized by narrowed arteries reducing blood flow to the limbs, has prompted healthcare providers to seek effective solutions to manage these conditions while minimizing complications. As more patients require interventions for these chronic diseases, the need for embolic protection devices is expected to rise, thereby driving embolic protection devices market growth.

Furthermore, according to embolic protection devices market analysis, growing geriatric population significantly drives the expansion of the embolic protection devices market. According to United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion in 2050. As individuals age, they become increasingly susceptible to cardiovascular diseases and procedures such as transcatheter aortic valve replacement (TAVR) and carotid artery stenting, which heightens the risk of embolic events. Embolic protection devices, designed to capture and remove debris during these procedures, are crucial for safeguarding patients from potential complications. The rising prevalence of age-related conditions, such as atherosclerosis and heart failure, necessitates the use of these devices to ensure safer interventions.

Additionally, healthcare systems are increasingly recognizing the importance of mitigating risks associated with surgical procedures for elderly patients, leading to enhanced investment in embolic protection technology. As the geriatric population continues to expand, the demand for effective embolic protection solutions is anticipated to grow, driving market growth.

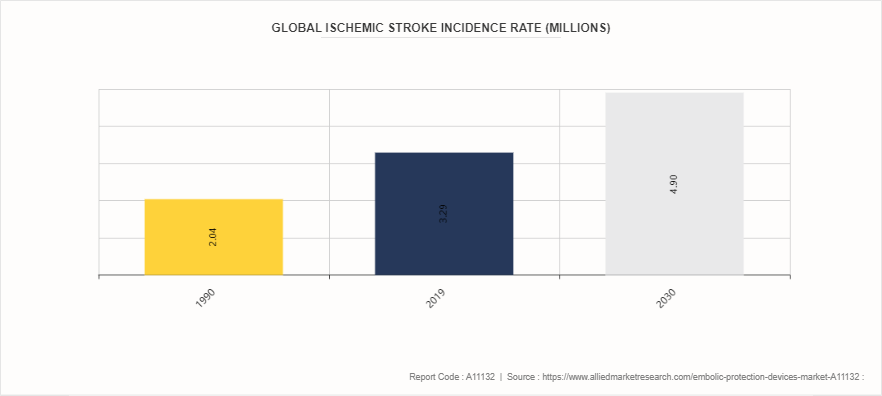

Growing Prevalence of Ischemic Stroke Incidence Rate

The rising global incidence of ischemic stroke is a significant factor driving the growth of the embolic protection devices market. As the global population ages, the prevalence of risk factors such as hypertension, diabetes, and atrial fibrillation increases, leading to a higher incidence of ischemic strokes. This growing patient population necessitates effective interventions, thereby boosting the demand for embolic protection devices designed to safeguard the brain during surgical procedures, such as transcatheter aortic valve replacement (TAVR) and percutaneous coronary interventions (PCIs) . Furthermore, advancements in technology enhance the efficacy of these devices, contributing to their widespread adoption in clinical settings. Consequently, the alarming rise in ischemic stroke cases underscores the critical need for embolic protection devices, propelling market growth.

Market Segmentation

The embolic protection devices market is segmented on the basis of product, application, material, end user, and region. By product, the market is classified into in distal occlusion devices, proximal occlusion devices, and distal filters. By applications, the market is classified into cardiovascular diseases, neurovascular diseases, and peripheral vascular diseases. By material, the market is classified into nitinol and polyurethane. By end user, the market is divided into hospitals & clinics, ambulatory surgical centers, and specialty centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the embolic protection devices market share in 2023. This is attributed to well-established healthcare facilities, growing prevalence of cardiovascular diseases, including coronary artery disease and peripheral artery disease, and high healthcare spending in North America. However, Asia-Pacific region is expected to register highest CAGR. The region is experiencing a rising incidence of cardiovascular diseases due to lifestyle changes, urbanization, and an aging population.

This trend is leading to a greater demand for interventional procedures, thereby driving the need for embolic protection devices. Countries like India and Thailand are becoming popular destinations for medical tourism, particularly for cardiac procedures. The influx of international patients seeking advanced medical care is boosting the demand for embolic protection devices in these markets.

- According to Australian Institute of Health and Welfare, 6.7% of adults (1.3 million) in Australia had 1 or more conditions related to heart, stroke or vascular disease in 2022.

- The prevalence of PAD in the U.S. is estimated to be ≈7%, affecting 8.5 million adults.

- According to European Commission, as of January 1, 2023, around 21.3% of European population was aged 65 years and over.

Industry Trends

- According to 2023 report by National Library of Medicine, the worldwide prevalence of cerebral aneurysms is approximately 3.2%.

- According to the 2023 Brain Aneurysm Statistics & Facts Awareness published by Brain Aneurysm Foundation, an estimated 6.7 million people in the U.S. have an unruptured brain aneurysm.

- According to 2023 article by National Library of Medicine, the incidence rate of Ischemic stroke has increased by 61.27% from 1990 to 2019.

- According to 2022 article by National Library of Medicine, stroke and ischemic heart disease are the most common causes of death and disability worldwide.

- According to 2021 article by American Heart Association, atherosclerotic lower extremity peripheral artery disease is increasingly recognized as an important cause of cardiovascular morbidity and mortality that are affecting more than 230 million people worldwide.

Competitive Landscape

Embolic Protection Devices market report summarizes top key players overview as Boston Scientific Corporation, Edwards Lifesciences Corporation., Abbott, Medtronic, Cardinal Health, Innovative Cardiovascular Solutions, LLC, Transverse Medical, Inc., W. L. Gore & Associates, Inc., Siemens Healthcare GmbH, Hologic, Inc., and Sinduri Biotec. Other players in the embolic protection devices market are Bio-Rad Laboratories Inc. and Enzo Biochem Inc.

Recent Key Strategies and Developments

- In April 2024, Emboline, Inc., announced the acquisition of SWAT Medical’s Intellectual Property Portfolio of embolic protection. This acquisition is expected to expand Emboline’s existing portfolio of platform technologies to reduce the risk of stroke caused due to the release of embolic debris in the bloodstream during procedures such as Transcatheter Aortic Valve Replacement (TAVR) .

- In October 2021, the Neuroguard IEP three-in-one Carotid Stent and Post-Dilation Balloon System with Integrated Embolic Protection (Neuroguard IEP System) received CE Mark clearance from Contego Medical Inc., a cardiovascular device developer. The Neuroguard IEP System is a patented system with a revolutionary next-generation nitinol stent, a pre-positioned post-dilation balloon, and an integrated microembolic filter with 40 m pores.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the embolic protection devices market analysis from 2024 to 2033 to identify the prevailing embolic protection devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the embolic protection devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global embolic protection devices market trends, key players, market segments, application areas, and market growth strategies.

Embolic Protection Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.4 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product |

|

| By Application |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Cardinal Health, Siemens Healthcare GmbH, Edwards Lifesciences Corporation, Transverse Medical, Inc, Innovative Cardiovascular Solutions, LLC., Hologic, Inc., Boston Scientific Corporation, Medtronic plc, W. L. Gore & Associates, Inc., Sinduri Biotec, Abbott Laboratories |

| Other Players | Boston Scientefic, Inc |

The global embolic protection devices market was valued at $0.6 billion in 2023

The market value of embolic protection devices market is projected to reach $1.4 billion by 2033

The forecast period for embolic protection devices market is 2024-2033.

The base year is 2023 in embolic protection devices market

Major key players that operate in the embolic protection devices market are Boston Scientific Corporation, Edwards Lifesciences Corporation., Abbott, and Medtronic Plc

Loading Table Of Content...