Endodontic Files Market Research, 2032

The global endodontic files market size was valued at $283.5 million in 2022, and is projected to reach $517.7 million by 2032, growing at a CAGR of 6.2% from 2023 to 2032. The global endodontic files market was valued at $283.51 million in 2022 and is expected to reach $517.67 million by 2032, registering a CAGR of 6.2% from 2023 to 2032. Endodontic file is an essential surgical instrument employed by dentists during root canal treatments. During a root canal procedure, the dentist carefully accesses the infected or damaged pulp inside the tooth. The endodontic files are then inserted into the root canal to remove the infected tissue, debris, and any remaining nerve fibers. By using a series of progressively larger files, the dentist gradually enlarges the canal, ensuring proper cleaning and shaping. The primary purpose of an endodontic file is to cleanse and shape the root canal.

Various types of endodontic files are available in the market, each serving a specific purpose. Some common types include K-files, H-files, reamers, hedstrom files, and rotary files. Each file type has unique characteristics in terms of taper, tip size, flexibility, and cutting efficiency. Dentists use endodontic files in a controlled and precise manner. The files are inserted into the root canal, rotated, or reciprocated, and gently moved in an apical-coronal direction to remove the infected tissue and shape the canal walls.

The growth of the endodontic files market declined during the lockdown period owing to decrease in demand for endodontic files. In addition, cancellation of appointments for routine dental checkups and decrease in several dental procedures restrained the growth of the endodontic files market size.

Market Dynamics

Increase in the number of root canal procedures and rise in awareness about oral health and early diagnosis are the key factors driving the demand for endodontic files. Moreover, rise in prevalence of dental diseases, such as tooth decay and root canal infections, is a significant factor driving the growth of the endodontic files market share. As the need for root canal treatments and other endodontic procedures grows, the demand for endodontic files increases simultaneously.

In addition, continuous advancements in endodontic file designs, materials, and technologies have improved treatment outcomes and efficiency. These advancements, such as the introduction of nickel–titanium (NiTi) files and rotary systems, enhanced the performance and durability of endodontic files, leading to increased adoption of files in the market.

Furthermore, growing emphasis on oral healthcare has led to increased dental expenditure worldwide. This includes investments in advanced endodontic procedures and the use of high-quality endodontic files, which contribute toward the endodontic files market growth. In addition, rise in dental expenditures resulted in a higher demand for quality dental care services, which has led to an increased demand for endodontic files, thus boosting the market growth in this region. For instance, according to the American Dental Association (ADA), national dental expenditures increased by 11% in 2021, from $146 billion in 2020 to $162 billion in 2021.

The growing number of dental clinics and hospitals, especially in emerging economies, is expected to drive the demand for endodontic files. Moreover, the availability of dental endodontic files in these clinics and hospitals is expected to attract more patients and increase the demand for these devices. In addition, rise in the number of dental visits supports the growth of the endodontic files market share. For instance, according to the Express Dentist in 2022, approximately 64% of children aged 2–4 years, 92% of children aged 5–11 years, and 90% of adolescents aged 12–17 years had dental visits in U.S.

The growth of the endodontic files market is expected to be driven by high potential in untapped, emerging markets due to availability of improved healthcare infrastructure, rise in oral health issues, and surge in demand for rotary endodontics files.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure and development of the dental tourism industry in emerging countries. The demand for endodontic files is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuels the growth of the market.

However, dearth in dental experts can be a significant restraining factor of the endodontics files market. In many areas, there is a shortage of qualified dentists and dental hygienists, which limits the adoption and usage of endodontic files. This is attributed to the fact that shortage of dental experts results in longer waiting times for appointments, which can cause patients to delay or forego dental treatments altogether. Thus, shortage of dental experts limits the availability of training and education programs for endodontic treatment, which impedes their adoption and use by dental professionals.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The temporary closures of dental practices and the postponement of non-emergency appointments resulted in decrease in the number of procedures, impacting the dental industry as a whole. With routine care and preventive services limited to emergency and urgent cases, the demand for endodontic files has been affected. Therefore, the growth of the endodontic files market was negatively impacted by the COVID-19 pandemic. In addition, the COVID-19 pandemic had a widespread impact globally, leading to the cancellation and postponement of non-emergency medical procedures, including dental treatments and cataract surgeries, in numerous medical institutions further restraining the market growth.

On the contrary, the market for endodontic files is recovering after pandemic, and is showing stable growth. This is attributed to increase in adoption endodontic treatments due to rise in cases of dental problems. In addition, advancements in endodontics files led to an increase in the demand for endodontic files, which is anticipated to support the market growth.

Segmental Overview

The global endodontic files market is segmented into product, type, end user, and region. By product, the market is categorized into nickel–titanium endodontic file and stainless-steel endodontic file. Depending on the type, the market is bifurcated into manual and rotary. On the basis of end user, it is classified into hospitals, dental clinics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

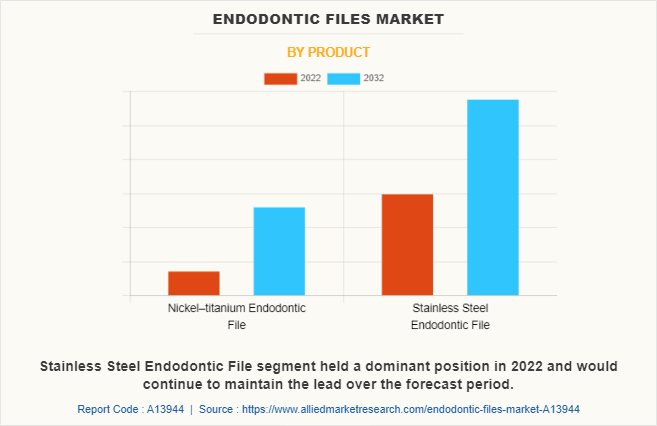

By Product

The stainless-steel endodontic file segment dominated the global market in 2022 and is expected to remain dominant throughout the forecast period. This is attributed to the strength and resistance to corrosion of stainless steel, making it suitable for rigorous demands of root canal procedures. In addition, dentists prefer stainless steel files due to their reliability, high effectiveness, superior mechanical properties, cost-effectiveness, versatility in design, and a long history of successful use, which drives the segment growth.

However, the nickel–titanium endodontic file segment is expected to register the fastest CAGR during the endodontic files market forecast period. This is attributed to rise in demand for nickel–titanium endodontic files as they are widely used in root canal treatments due to their unique properties such as greater flexibility, resistance to fracture, minimal procedural errors, and efficient cleaning and shaping of the root canal.

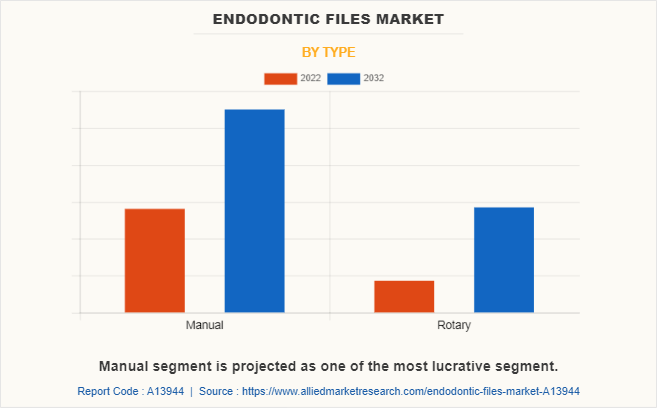

By Type

The manual segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to a rise in adoption of manual endodontic files as dentists prefer a controlled method to perform root canal treatment and they are easier to use. However, the rotary file segment is expected to register the fastest CAGR during the forecast period due to evolving technology in rotary endodontic files with varying designs, materials, applications, and manufacturing processes.

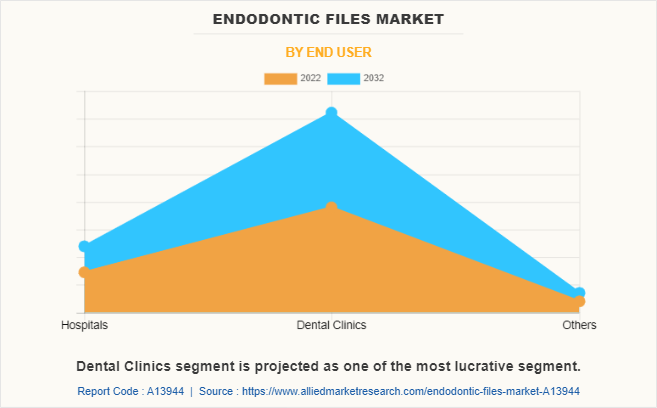

By End User

The dental clinics held the largest market share in 2022 and is expected to remain dominant throughout the forecast period, owing to increase in number of dental procedures, availability of advanced endodontics files, and rise in awareness about the importance of dental health.

By Region

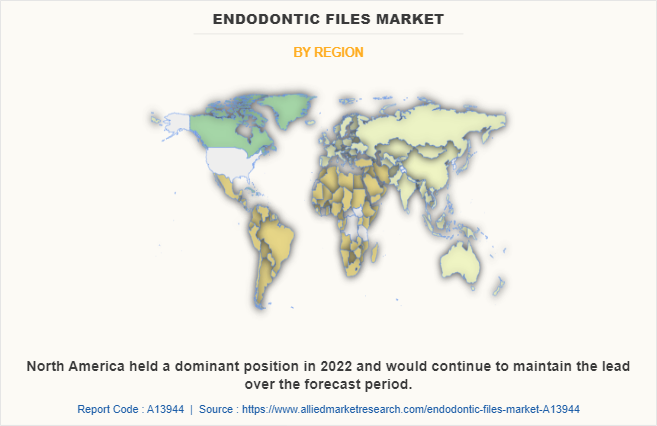

The endodontic files market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the endodontic files market in 2022 and is expected to maintain its dominance during the forecast period.

The presence of several major players such as EdgeEndo, Envista Holding Corporation, Brasseler USA, and DiaDent Group International as well as advancements in manufacturing technology of endodontic files in the region drive the growth of the endodontic files industry. Moreover, increase in cases of oral health problems drives the demand for endodontic files. For instance, according to the Express Dentist, more than 80% of the U.S. people had at least one cavity in their mouth by age 34 in 2022. As the number of dental cavity cases increases, there is a corresponding rise in the need for root canal treatments, which directly drives the demand for endodontic files.

Furthermore, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption of advanced endodontic files are expected to drive the market growth. In addition, significant increase in awareness and focus on oral health foster the market growth in North America. Moreover, dental professionals and organizations actively promote regular dental check-ups and emphasize the importance of early detection and treatment of dental problems. This heightened awareness among the population leads to a higher demand for endodontic treatments, thus fostering the endodontic files industry growth.

Asia-Pacific is expected to grow at the highest rate during the forecast period due to increase in the purchasing power of populated countries, such as China and India. Moreover, rise in adoption of high-tech processing to improve the production of endodontics files drives the growth of the market.

Furthermore, Asia-Pacific offers profitable opportunities for key players operating in the endodontic files market, owing to the growing infrastructure of industries as well as well-established presence of domestic companies.

Competition Analysis

Competitive analysis and profiles of the major players in the endodontic files, such as Brasseler Holdings, LLC, Coltene Dentsply Sirona Inc., DiaDent Group International, EdgeEndo, Envista Holdings Corporation, FKG Dentaire Sàrl, MANI, INC., META-BIOMED CO., LTD., and Planmeca OY. Are provided in this report. Major players have adopted product launch and agreement as key developmental strategies to improve the product portfolio of the endodontic files market.

Recent Product Launch in the Endodontic Files Market

In September 2022, FKG Dentaire Sarl introduced the new XP-endo Rise product, which involves a single shaping file that replaces up to five others. It is proven to make procedures faster, safer, and more efficient.

Recent Agreement in the Endodontic Files Market

In January 2023, Dentsply Sirona, Inc. signed a new partnership with the National Dental Association to promote diversity in dental education.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the endodontic files market analysis from 2022 to 2032 to identify the prevailing endodontic files market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the endodontic files market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global endodontic files market trends, key players, market segments, application areas, and market growth strategies.

Endodontic Files Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 517.7 million |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 231 |

| By Product |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | DiaDent Group International, Brasseler USA, Dentsply Sirona Inc., META-BIOMED CO., LTD., Coltene , Planmeca Oy, EdgeEndo, MANI, INC., FKG Dentaire Srl, Envista Holdings Corporation |

Analyst Review

This section provides various opinions of top-level CXOs in the global endodontic files market. According to the insights of CXOs, the global endodontic files market is expected to exhibit high growth potential attributable to development of advanced endodontic files. Moreover, rise in awareness regarding oral health and the availability of various endodontic files in different sizes have piqued the interest of numerous companies to create endodontic files. However, shortage of skilled dental professionals in some regions limit the growth of the endodontic files market.?

CXOs further added that rise in number of dental procedures such as root canal treatment drives the demand for endodontic files, thereby propelling the market growth.??Furthermore, North America is expected to witness largest growth, in terms of revenue, owing to rise in adoption of advanced endodontic files such as NiTi and heated files and surge in awareness regarding oral health. However, Asia-Pacific is anticipated to witness notable growth owing to rise in aging population with increased need for dental procedures, surge in incidence of dental caries, and increase in awareness regarding oral health.?

Endodontic files are specialized instruments used in endodontic (root canal) procedures to clean, shape, and prepare the root canals of teeth.

Asia-Pacific is expected to experience the growth rate of 7.9% during the forecast period, owing to rise in awareness about early diagnosis and treatment, rise in dental procedures such as root canal procedure, and surge in oral problems has increased the demand for endodontic files in the region.

Top companies such as Dentsply Sirona Inc., Envista Holdings Corporation, Coltene, and EdgeEndo held high market share in 2022.

The estimated industry size of endodontic files was valued at $283.51 million in 2022 and is projected to reach $517.67 million by 2032, registering a CAGR of 6.2% from 2023 to 2032.

North America is the largest regional market for Endodontic Files.

Endodontic is the leading application of Endodontic Files Market.

Rise in cases of untreated tooth decay, surge in number of root canal therapy, increase in awareness about oral health and early diagnosis among the general population and healthcare professionals, and rise in demand for endodontic files are the factors responsible for the market growth.

Loading Table Of Content...

Loading Research Methodology...