Engineered Wood Market Research, 2033

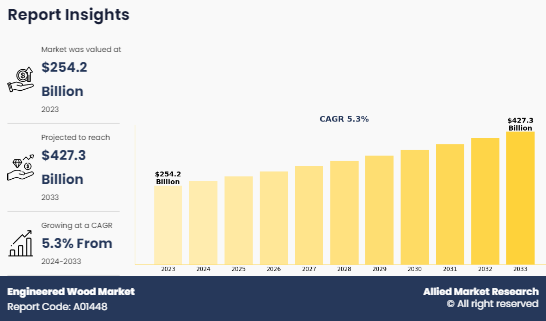

The global engineered wood market size was valued at $254.2 billion in 2023, and is projected to reach $427.3 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033. Engineered wood, also known as composite wood, consists of various wood products made by joining veneers, particles, fibers, and strands of wood with adhesives to form a man-made composite material. They include a variety of products ranging from plywood to roof trusses.

Report Key Highlighters

- The Engineered wood market 16 countries across the world. The analysis includes a country-by-country breakdown analysis in terms of value ($ billion) available from 2023 to 2033.

- The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the engineered wood market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 1500 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the Engineered wood market.

- The Engineered wood market share is marginally fragmented, with players such as Boise Cascade Company, Celulosa Arauco Y Constitucion SA, Huber Engineered Woods LLC, Louisiana-Pacific Corporation (LP), Norbord Inc., Patrick Industries, Inc., Raute Group, Shenzhen Risewell Industry Co., Ltd, Universal Forest Products, Inc., and Weyerhaeuser Company. Major strategies such as product Launch, partnerships, expansion, and other strategies of players operating in the engineered wood market are tracked and monitored.

Market dynamics

There is a rise in need of houses due to surge in population of the world. This has led to rise in construction of new houses, especially in the developing countries where urbanization is growing at a higher rate. Thereby, increasing the need of building materials such as concrete, steel, and aluminum which produce greenhouse gases while manufacturing. However, compared to these building materials engineered wood is environmentally stable and does not produce greenhouse gases, and therefore, is environment friendly. Some of the engineered wood is prepared from wood waste. Moreover, this is renewable, biodegradable, nontoxic, energy efficient, and recyclable. Engineered wood also has substantial advantage over the use of cement, which contributes around 7% of worldwide CO2 emissions. Growth in adoption of green buildings in countries such as the U.S., Germany, and France has led to rise in requirement of eco-friendly building materials such as engineered wood. It is expected that around 60% of the new construction projects are being planned according to the green building norms. Further, the engineered wood is low cost compared to other wood and cement products. Thus, it also reduces the project cost of the buildings, which encourages the builders and architects to opt for engineered wood over traditional building material. These factors currently drive the growth of the engineered wood market in the world..

Moreover, Growth in urbanization is increasing the need for efficient utilization of the existing land in the cities. Old infrastructures are being demolished to build new and modern structures. In addition, several old building and structures have completed their life cycle and are unsafe to live in. The owner or the government thus demolishes the building to build a new building. Further, there is an ongoing trend to renovate or remodel old houses with advanced new materials to enhance the beauty of the buildings. These renovation and remodel of houses or buildings need engineered wood for flooring, walls, and roofs. For instance, according to the report, ˜2023 U.S. Houzz & Home Study, nearly 60% of homeowners remodeled or decorated their homes in 2022, and nearly half made repairs. Moreover, 72% renovation was in interior of the homes.The Engineered Wood Market Opportunity lies in the growing demand for sustainable, durable, and cost-effective building materials, driven by advancements in technology and increasing environmental awareness.

However, the major constraint in the engineered wood market is the threat of substitutes that provide similar functionality to engineered wood such as plastic laminates and foils. These substitutes are likely to intensify the threat to engineered wood. The non-wood flooring sector is also gaining popularity owing to the non-changeable nature of ceramic flooring. Thus, alternatives such as vinyl flooring are in demand. Raw materials used to manufacture composite wood are also less available due to strict regulations on cutting of trees, which leads to an increase in the price of engineered wood products. This eventually leads to end users opting for cheaper alternative material, which is the major factor that limits the engineered wood market growth.

Despite these, in developing countries the growth potential is very high. For example, in the current times, the penetration of MDF in India wood panel industry is only 20% as compared to plywood which has a penetration of 80%. It is expected that by 2030, the share of both materials will be 50% for each. Such factors open growth opportunities for the key players in the engineered wood market.

Segmental Overview

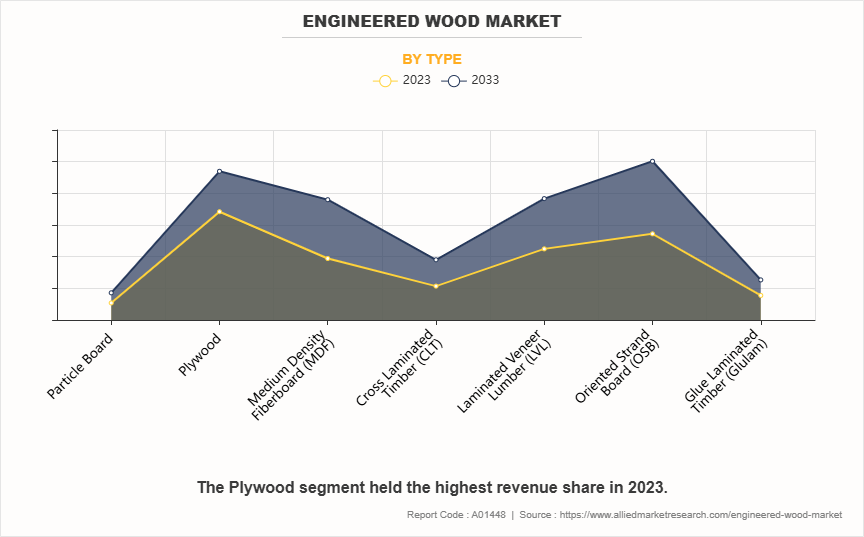

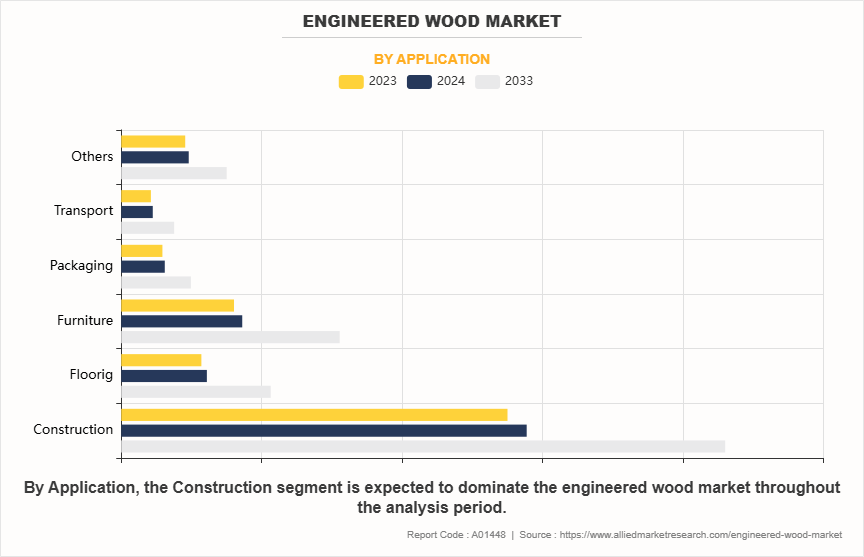

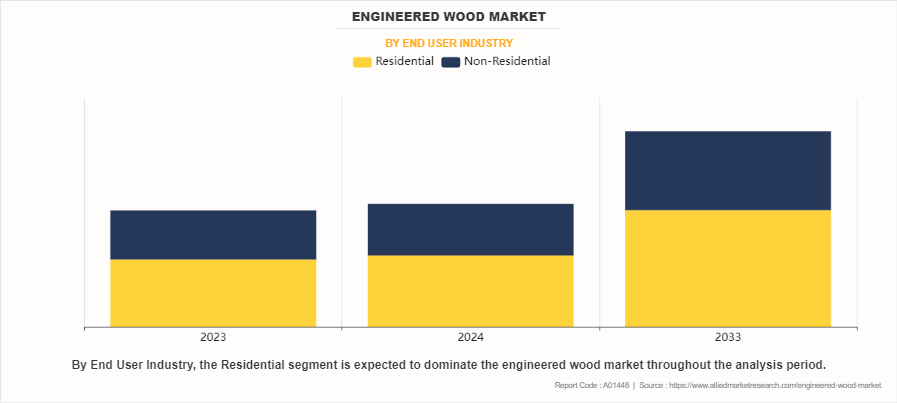

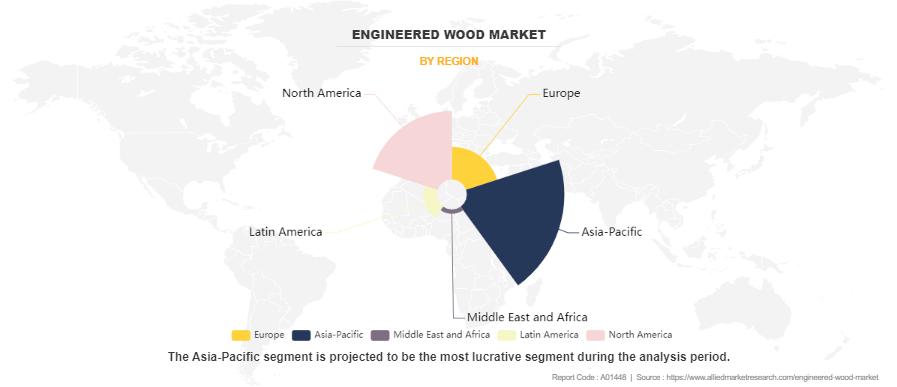

The Engineered wood market is segmented on the basis of type, application, and region. Depending on type, the market is segregated into particle board, plywood, medium density fiberboard (MDF), cross laminated timber (CLT), laminated veneer lumber, oriented strand board, and glue laminated timber. By application, it is categorized into construction, flooring, furniture, transport, packaging, and others. By end user industry, it is bifurcated into residential, and non-residential. By region, it is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East & Africa.

By type, the engineered wood market is divided into particle board, plywood, medium density fiberboard (MDF), cross laminated timber (CLT), laminated veneer lumber, oriented strand board, and glue laminated timber (glulam). In 2023, the Plywood segment held the largest market share in terms of revenue. On the other hand, the medium density fiberboard (MDF) segment is anticipated to grow with a higher CAGR during the forecast period. Plywood holds the largest market share due to its strength, versatility, and higher price point, while MDF is expected to grow at a higher CAGR because of its affordability, increasing use in furniture, and advancements in manufacturing.

By application, the engineered wood market is categorized into construction, flooring, furniture, transport, packaging, and others. In 2023, the construction segment held the largest market share in the engineered wood market due to the high demand for building materials like beams, panels, and framing used in both residential and commercial projects. Additionally, the shift toward sustainable construction practices and the rise in global infrastructure projects have fueled the use of engineered wood in the construction sector, making it a dominant application in terms of revenue. On the other hand, the furniture segment is expected to grow at a higher CAGR during the forecast period. This growth is driven by increasing demand for affordable, customizable furniture, particularly in urban areas where space-efficient designs are preferred. Engineered wood versatility, cost-effectiveness, and aesthetic appeal make it an ideal material for modern furniture, contributing to its strong growth outlook.

By end user industry, the engineered wood market is categorized residential and non-residential. In 2023, the residential segment held the largest market share in the market due to the high demand for building materials in housing projects. The increasing focus on sustainable housing, coupled with the rising construction of residential units globally, especially in urban areas, has driven the adoption of engineered wood products in this segment. Furthermore, the residential segment is expected to grow at a higher CAGR during the forecast period. This growth is fueled by increasing urbanization, rising disposable incomes, and the growing preference for eco-friendly, cost-effective building materials in residential construction. The demand for modern, sustainable homes continues to push the adoption of engineered wood in this sector.

By region, Asia-Pacific held the highest engineered wood market share in 2023, primarily due to the rapid urbanization, industrial growth, and increasing construction activities in countries like China, India, and Southeast Asia. The region's large population, coupled with a growing demand for affordable housing and infrastructure projects, has significantly driven the consumption of engineered wood products. Moreover, Asia-Pacific is expected to grow with a higher CAGR during the forecast period. The region strong economic growth, expanding real estate sector, and increasing awareness of sustainable building materials are key factors driving this growth. Additionally, government initiatives supporting eco-friendly construction and urban development further bolster the demand for engineered wood in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the report include Boise Cascade Company, Celulosa Arauco Y Constitucion SA, Huber Engineered Woods LLC, Louisiana-Pacific Corporation (LP), Norbord Inc., Patrick Industries, Inc., Raute Group, Shenzhen Risewell Industry Co., Ltd, Universal Forest Products, Inc., and Weyerhaeuser Company. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Engineered wood market.

Recent Development in the Engineered Wood Market

- In December 2022, Boise Cascade expanded its distribution network by acquiring two major land parcels: a 45-acre site in Walterboro, South Carolina, and a 34-acre parcel in Hondo, Texas. These acquisitions are aimed at enhancing the company's service capabilities in key regions, including South Carolina and Texas.

- In February 2021, West Fraser acquired Norbord Inc., a major producer of engineered wood products like OSB, MDF, and LVL. This acquisition expanded West Fraser production footprint across Canada and the southern U.S., boosting its capacity in the engineered wood market.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging Engineered wood market trends and dynamics.

- In-depth engineered wood market analysis is conducted by constructing market estimations for the key market segments between 2023 and 2033.

- Extensive analysis of the Engineered wood industry is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The Engineered wood market forecast analysis from 2024 to 2033 is included in the report.

- The key market players within the engineered wood market Outlook are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the Engineered wood industry.

Engineered Wood Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 427.3 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 197 |

| By Application |

|

| By End User Industry |

|

| By Type |

|

| By Region |

|

| Key Market Players | PFEIFER GROUP, Louisiana-Pacific Corporation (LP), Celulosa Arauco Y Constitucion SA, Boise Cascade Company, Huber Engineered Woods LLC, Lamiwood™ Designer Floor, Weyerhaeuser Company, Universal Forest Products, Inc., Raute Group, Norbord Inc. |

Analyst Review

The global engineered wood market is gaining popularity worldwide owing to its exquisite design, eco-friendly nature, greater wood strength, and molding capabilities. In addition, growth in awareness about the benefits of engineered wood, its technological advantage over other products, and rise in disposable income further boost the market growth.

Non-residential construction spendings gained impetus in 2015, leading to the growth of engineered wood usage in commercial buildings. In addition, new housing development and lodging further propelled the market growth, thereby highlighting the recovery in residential construction market. For instance, in 2014, mortgage rates declined in the U.S., thus leading to growth in new home sales.

The market is dominated by Europe and especially Western Europe and Scandinavian countries, such as Germany, Austria, Finland, Denmark and UK, owing to the widespread forest area coupled with rise in demand for engineered wood. Although, Brazil, Chile, and South Africa in LAMEA region possess huge growth potential owing to large untapped rainforest cover.

North America possesses second highest growth potential market due to vast forest availability, better technology and utilization of resources, and higher awareness among population. Major engineered wood companies are present in the U.S. and Canada.

Countries such as India, Japan, and China are anticipated to be major exporters to North American and European countries owing to the high raw wood production.

Market players, such as Weyerhaeuser and Arauco, have established retail outlets worldwide and have adopted latest technologies such as timberland LSL floor joists and easy pack to maintain their foothold. In addition, intensive marketing campaigns and attractive designs and product type by prominent companies have increased brand awareness in the global market among consumers, thus leading to the growth of the engineered wood market.

Increased use of engineered wood over other building materials, rise in reconstruction, renovation, and remodeling of old buildings, and surge in focus on affordable homes drive the growth of the global Engineered wood market.

The latest version of the Engineered wood market report can be obtained on demand from the website.

The Engineered wood market size was valued at $254.2 billion in 2023.

The Engineered wood market size is estimated to reach $427.2 million by 2032, exhibiting a CAGR of 5.3% from 2024 to 2033

The forecast period considered for the Engineered wood market is 2024 to 2033, wherein, 2023 is the base year, 2024 is the estimated year, and 2033 is the forecast year.

Plywood segment is the largest market for Engineered wood market.

The key players profiled in the report include Boise Cascade Company, Celulosa Arauco Y Constitucion SA, Huber Engineered Woods LLC, Louisiana-Pacific Corporation (LP), Norbord Inc., Patrick Industries, Inc., Raute Group, Shenzhen Risewell Industry Co., Ltd, Universal Forest Products, Inc., and Weyerhaeuser Company.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...