Enteral Syringes Market Research, 2033

The global enteral syringe market size was valued at $383.6 million in 2023, and is projected to reach $643.6 million by 2033, growing at a CAGR of 5.3% from 2024 to 2033. The rise in the incidence rate of malnutrition cases serves as a significant driver for the enteral syringe market growth.

Market Introduction and Definition

Market Introduction and Definition

An enteral syringe is a specialized medical device used for administering liquid medications, nutrients, or fluids directly into the gastrointestinal tract, typically through a feeding tube. These syringes are specifically designed with features such as accurate volume measurement, compatibility with enteral feeding tubes, and safety mechanisms to prevent accidental disconnection or leakage.

The primary application of enteral syringes is in enteral nutrition, where patients who are unable to swallow or consume food orally receive essential nutrients directly into their stomach or intestines via feeding tubes. This method of feeding is commonly used in individuals with conditions such as dysphagia, neurological disorders, gastrointestinal disorders, or those recovering from surgery. Enteral syringe industry play a crucial role in delivering medications, liquid diets, or specialized nutritional formulas to meet the nutritional needs of patients who cannot tolerate or obtain sufficient nourishment through oral intake.

Key Takeaways

- The enteral syringe market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major enteral syringe industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Malnutrition is a prevalent issue globally, affecting individuals of all ages and demographics. Factors such as poverty, inadequate access to nutritious food, chronic illnesses, and aging populations contribute to the rising incidence of malnutrition cases. Enteral syringes play a crucial role in delivering essential nutrients directly into the gastrointestinal tract, ensuring patients receive adequate nutrition when oral intake is insufficient or not feasible. As healthcare providers prioritize nutrition management to improve patient outcomes, the demand for enteral syringes increases, driving the enteral syringe market size.

However, stringent governmental regulations pose a restraint to market growth. Regulatory authorities impose strict standards and approval processes for medical devices, including enteral syringes, to ensure safety, efficacy, and quality. Compliance with these regulations requires significant investments in research, development, and regulatory affairs, leading to prolonged product approval timelines and increased manufacturing costs. As a result, market players face challenges in navigating complex regulatory landscapes and may experience delays in product launches, thus hindering market expansion.

Nevertheless, the development of advanced feeding devices with lesser side effects presents an opportunity for market growth. Innovations in enteral syringe design, materials, and functionalities aim to enhance patient comfort, reduce complications, and improve treatment outcomes. For example, the development of enteral syringes with ergonomic designs, precise dosage control mechanisms, and anti-reflux features can minimize the risk of aspiration and tube-related complications, making enteral feeding safer and more efficient. As healthcare providers seek innovative solutions to address patient needs and improve clinical outcomes, the demand for advanced enteral syringes with enhanced safety profiles is expected to drive market growth during the enteral syringe market forecast period.

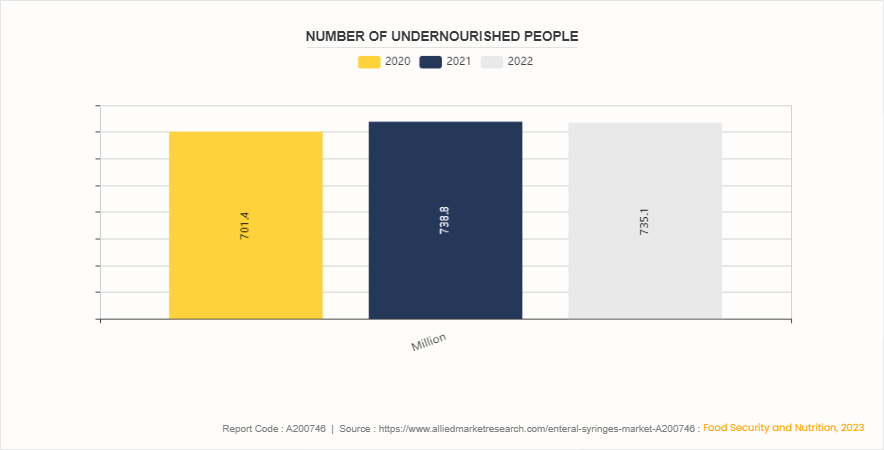

Global Undernourishment Trends and Implications for Enteral Syringe Market

According to data from the Food and Agriculture Organization of the United Nations (FAO) , the number of undernourished people globally has seen a worrying increase over recent years. In 2020, there were approximately 701.4 million undernourished individuals worldwide. This number rose to 738.8 million in 2021 and slightly decreased to 735.1 million in 2022. These figures highlight the persistent and significant challenge of food insecurity and malnutrition on a global scale. This increasing prevalence of undernourishment highlights the critical need for effective nutritional interventions and support mechanisms, including the use of enteral feeding solutions. Enteral syringes play a vital role in administering precise doses of nutrition directly into the gastrointestinal tract, especially for those unable to consume food orally due to illness, surgery, or severe undernourishment.

Market Segmentation

The enteral syringe market analysis is segmented into type, age group, end user, and region. On the basis of type, the market is bifurcated into reusable and disposable. On the basis of age group, the market is divided into adults, and pediatrics. On the basis of end user, the market is divided into hospitals, ambulatory surgical centers (ASCS) , and home care. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The regional outlook for the enteral syringe market opportunity varies across different regions. Developed regions such as North America and Europe dominate the market due to well-established healthcare infrastructure, high prevalence of chronic diseases, and favorable reimbursement policies. In contrast, emerging economies in Asia-Pacific and Latin America are experiencing rapid enteral syringe market trends such as improvement in healthcare infrastructure, rise in awareness about enteral nutrition therapy, and increase in investments in healthcare. Additionally, the Middle East and Africa region show promising growth opportunities fueled by expanding healthcare access and government initiatives to improve healthcare services.

- In March 2024, the World Health Organization announced that neurological conditions are now the leading cause of ill health and disability, and more than 3 billion people worldwide were living with neurological conditions.

- According to data obtained from the Population Reference Bureau, it was estimated that the number of Americans aged 65 and above is projected to nearly double from 52 million in 2018 to 95 million by 2060.

Industry Trends

- In February 2024, The FDA issued a safety communication warning against using certain Cardinal Health Monoject luer-lock and enteral syringes, due to dimensional changes that may lead to compatibility issues and pump performance problems, potentially causing overdose, underdose, or delays in therapy.

- In October 2021, the U.S. Food and Drug Administration (FDA) has taken initiative in preparing guidelines and informing patients and health care providers about the potential for overdose, under certain clinical use conditions, when using ENFit low dose tip (LDT) syringes.

Competitive Landscape

The major players operating in the enteral syringe market include Fresenius SE & Co. KGaA, Boston Scientific Corporation, Danone, Cook Medical, Inc., Cardinal Health Inc., Becton, Dickinson and Company, Moog Inc., B. Braun Melsungen AG, Owens & Minor, Inc., and Nestlé S.A.

Other players in the enteral syringe market include Medtronic PLC, Medline Industries LP, Kentec Medical Inc., Thermo Fisher Scientific Inc, Baxter International Inc., and so on.

Recent Key Strategies and Developments

- In February 2021, Department of Health and Aged Care of the Therapeutic Goods and Administration, enrolled Abbvie Pty Ltd - Oral/enteral syringe, for the oral liquid medication. The Australian Register of Therapeutic Goods (ARTG) is subject to compliance with all conditions placed or imposed on the ARTG entry.

Key Sources Referred

- World Health Organization (WHO)

- Brain Injury Association of America (BIAA)

- Centers for Medicare & Medicaid Services (CMS)

- Cardinal Health Inc

- National Health Service (NHS)

- Government of Canada's Health and Wellness

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the enteral syringes market analysis from 2024 to 2033 to identify the prevailing enteral syringes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the enteral syringes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global enteral syringes market trends, key players, market segments, application areas, and market growth strategies.

Enteral Syringe Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 643.6 Million |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 251 |

| By Type |

|

| By Age Group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Boston Scientific Corporation, Becton, Dickinson and Company, B. Braun Melsungen AG, Owens & Minor, Inc., Moog Inc., Cardinal Health Inc., Nestlé S.A., Cook Medical, Inc., Fresenius SE & Co. KGaA, Danone |

Loading Table Of Content...