Enterprise Search Market Statistics, 2032

The global enterprise search market size was valued at $5 billion in 2022, and is projected to reach $12.2 billion by 2032, growing at a CAGR of 9.6% from 2023 to 2032.

The growing trend of digital transformation initiatives that accelerate across industries is one of the major factors driving the global enterprise search market forecast. In addition, diversity of data, increase in adoption of document management solution in e-commerce sectors, and increase in usage of chatbots and virtual assistants are expected to propel the growth of the market during the forecast period.

Furthermore, organizations face many challenges in businesses that require swift, data-driven decision-making solution. Without access to accurate information, workers are unable to move freely and may even perform worse, which has a detrimental impact on the industry. These enhanced factors are expected to fuel the global enterprise search market trends in the upcoming years. For instance, in October 2023, OpenText Corporation enhanced its enterprise search solutions and announced its new unified OpenText partner network to offer cohesive support and greater opportunities to the entire network consisting of more than 30,000 partners.

Enterprise search refers to the process of querying digital content from multiple data sources via a single search bar. It is typically used for web, ecommerce, customer service, and knowledge access. An enterprise search tool lets employees search across many enterprise content sources including Salesforce, blogs, Google Drive, SharePoint, Slack, and others to find the most relevant content. However, an enterprise search engine has become the primary search solution trusted across the organization. It needs to harness search technology that can scale across millions of documents, and multiple data types. Such a benefit of enterprise search is to provide digital workers with the most relevant information as quickly as possible. This helps improve proficiency, productivity, employee satisfaction and can lead to greater profitability. Furthermore, increasing demand for seamless data accessibility in several businesses for handling vast amounts of data boosts the enterprise search market growth.

Moreover, increasing availability of cloud-based solution & services and the growing usage of mobile devices are the factors driving the growth of global enterprise search market. In addition, a surge in technological advancements is expected to create numerous opportunities for the growth of the market. However, data privacy and security concerns hamper the growth of the market. Furthermore, the rise in demand of knowledge graph-based search solution creates opportunities for enterprise search industry to optimize resources. For instance, in August 2022, OpenText Corporation acquired Micro Focus International plc to create stronger operations and significant cash flows by providing enhanced enterprise search services.

Segment Review

The enterprise search market is segmented into component, type, deployment mode, enterprise size, industry vertical, and region. The report provides information on various components including solution and service. By type, it is categorized into conversational search, multimedia search and multilingual search. Based on deployment mode, it is divided into on-premise and cloud. On the basis of enterprise size, it is categorized by large enterprises and small & medium-sized enterprises.

The details of the industry vertical- namely BFSI, healthcare, government, retail and e-commerce, travel and hospitality, media & entertainment, and others are also provided in the report. In addition, it analyzes the current enterprise search market trends across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

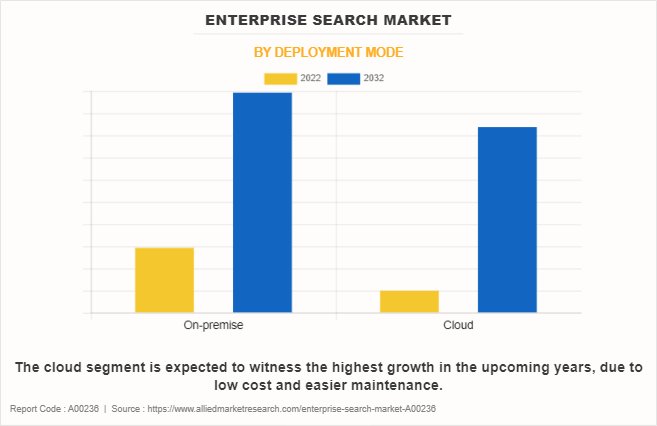

On the basis of deployment mode, the on-premise segment captured the largest enterprise search market share in 2022 and is expected to continue this trend throughout the forecast period. This is attributed due to the numerous advantages offered by the on-premise deployment such as a high level of data security and safety. Industries prefer on-premise model owing to high data security and less data breach as compared to cloud based deployment models, which further drive the demand for on-premise deployment model within the sectors. However, cloud segment is expected to exhibit highest growth during the forecast period. Factor such as rise in the adoption of cloud-based Enterprise search due to low cost and easier maintenance drives the growth of the enterprise search market.

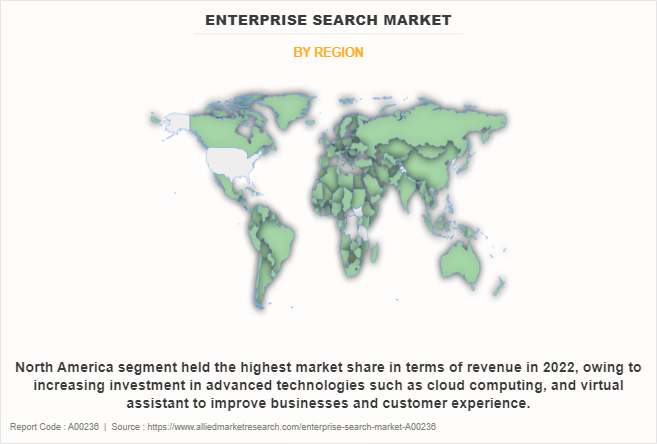

By region, North America dominated the market share in 2022 for the market. The increasing investment in advanced technologies such as AI and IoT to improve businesses and the customer experience are anticipated to provide lucrative growth opportunities for the enterprise search market in North America. For instance, in June 2023, Search engine developer Glean Technologies Inc. launched the Glean Chat, an artificial intelligence assistant that can summarize business documents and generate text. The enterprise search platform enables workers to sift through their company’s internal business data using natural language queries.

However, Asia-Pacific is expected to exhibit highest growth during the forecast period. This is attributed to increase in penetration of digitalization and higher adoption of cloud-based services that propel the growth of the enterprise search market in this region. For instance, in June 2023, search engine developer Glean Technologies Inc. launched the Glean Chat, an artificial intelligence assistant, that can summarize business documents and generate text. Workers can use the tool to summarize recent business developments. The AI assistant can not only specify whether the update was implemented successfully, but also fetch related technical details.

Top Impacting Factors

The Growing usage of Smartphone and Mobile Devices:

The rising usage of smartphones and mobile devices is a significant driver for the enterprise search market. As more users rely on their smartphones & tablets for work and personal tasks, businesses are recognizing the need to provide a seamless and efficient search experience on these devices. This demand has pushed the enterprise search industry to adopt and optimize mobile platforms. Moreover, the shift toward remote and mobile workforces, accelerated by global events such as the COVID-19 pandemic, has made mobile enterprise search even more critical. Employees need to access and collaborate on information from diverse locations and mobile devices are their primary tools. Mobile-optimized enterprise search solutions improve productivity and foster better communication and knowledge sharing among remote teams.

For instance, in April 2021, WalkMe, the digital adoption leader, acquired the Zest firm, that offers a fast and efficient mechanism for retrieving any document, file, contact, or record from the cloud. Through this acquisition, Zest's AI-driven search will leverage natural language processing (NLP) to create an on-demand, graph database. This increases the predictability of user search for faster, more relevant results.

Furthermore, the integration of mobile technology with enterprise search often incorporates voice search and personalization features, making it even more user-friendly and efficient. This aligns with the expectations of modern workers who are accustomed to the convenience of voice-activated assistants and personalized content recommendations in their personal lives.

COVID-19 Impact Analysis

The enterprise search market has witnessed significant growth in the past few years; due to the outbreak of the COVID-19 pandemic, the market witnessed a sudden increase in demand during the period. This was attributed to an increase in demand in businesses, as industry was moving to capitalize on the increased automation and digitalization in the sector. Furthermore, the rise in the number of COVID-19 cases influenced governments and local authorities to enforce strict measures such as social distancing and self-isolation policies to the closing of physical shops and businesses. This was intended to help slow the spread of COVID-19 cases, which further caused a growing number of businesses to depend on digital technologies. Such trends accelerated the digital transformation of physical businesses during the period of the pandemic.

On the other hand, the economic uncertainties caused by the pandemic prompted organizations to seek cost-efficient solutions. Consequently, organizations could quickly scale up their business solutions deployments in the cloud to accommodate many remote users without the need for significant infrastructure investments. Moreover, many players were invested in advanced technologies and adopted various strategies such as partnership, acquisition, product launch and others to cater for the business competition.

For instance, January 2023, Glean partnered with Google Cloud to deliver and scale leading intelligent search. This partnership will enable Glean to better service its customers and fulfill its mission by harnessing the limitless potential of Google’s partner ecosystem and network of specialized providers. Google Cloud customers can now also readily leverage Glean to harness the benefit of real-time knowledge discovery and innovative indexing to instantly search across all their applications, while empowering their teams to find the answers and information they need to deliver their best work.

Competition Analysis

The key market players operating in the enterprise search market are OpenText Corporation, Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., Oracle Corporation, Google LLC, SAP SE, EMC Corporation, Attivio, and X1 Discovery, Inc. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the market globally.

Recent Partnership in the Enterprise Search Market

In January 2023, Microsoft Corporation's Azure and OpenAI partnered to accelerate AI, deploy OpenAI's models across consumer and enterprise products and upgrade enterprise search products..

Recent Product Launch in the Enterprise Search Market

In May 2023, Amazon Web Services, Inc. enhanced its enterprise search service and enabled it to build an image search engine with Amazon Kendra and Amazon Rekognition.

In December 2022, SAP SE enhanced its enterprise search solutions with new features available in 2208 cloud edition that allows key users to create their own search models.

In January 2021, Amazon Web Services, Inc's has updated the existing search solution with new instances that provide better availability and performance at the same pricing. The new instances are one to one replacement, but leverage newer generation EC2 instances underneath, thereby improving the overall stability of domain.

Key Benefits for Stakeholders

- The study provides an in-depth enterprise search market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the enterprise search market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the enterprise search industry.

- The quantitative analysis of the global enterprise search market for the period 2022–2032 is provided to determine the Enterprise search market potential.

Enterprise Search Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.2 billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 268 |

| By Component |

|

| By Type |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Google LLC, OpenText Corporation, Oracle Corporation, EMC Corporation, Attivio, X1 Discovery, Inc., SAP SE, Amazon Web Services, Inc., Microsoft Corporation, IBM Corporation |

Analyst Review

In the vastly evolving enterprise search industry, several key trends are shaping the way businesses access, manage, and utilize information. One major trend is the increasing focus on AI and machine learning. These technologies are becoming integral to search solutions, making them smarter and more accurate. As artificial intelligence (AI) and machine learning (ML) play a crucial role in predictive search, assisting enterprises anticipate user needs and streamline the search process.

Moreover, the industry is witnessing a move towards personalization. Users increasingly expect search solutions to provide tailored results based on their preferences and behaviors. To meet this demand, enterprise search is becoming more user-centric, delivering personalized content and recommendations. This not only enhances the user experience but also improves productivity by ensuring individuals find the information they need quickly. For instance, June 2023, search engine developer Glean Technologies Inc. launched the Glean Chat, an artificial intelligence assistant, that can summarize business documents and generate text. Workers can use the tool to summarize recent business developments. The AI assistant can not only specify whether the update was implemented successfully, but also fetch related technical details.

With the growing concern about data breaches and regulations like GDPR, businesses are placing a high premium on securing their search systems. This includes encryption, access controls, and compliance with data protection laws to safeguard sensitive information while maintaining transparency and user trust. In addition, enterprise search is extending its capabilities to support remote work and collaboration. With the rise of remote and hybrid work models, search solutions are being designed to facilitate seamless information sharing and collaboration across distributed teams

Moreover, the industry is moving towards greater integration and interoperability. Organizations are looking for search solutions that can seamlessly connect with their existing software and data repositories, ensuring a unified search experience. For instance, in June 2020, The Netherlands based firm Elastic N.V. (the company behind Elasticsearch and the Elastic Stack), launched the Elastic Enterprise Search on Elastic Cloud. Elastic Enterprise Search is a suite of search products that dramatically simplifies the process of creating enterprise-grade search experiences for both customer and employee-facing search applications. The new offering enables users to deploy both Elastic Workplace Search and App Search with ease and flexibility across platforms and global regions.

North America is the largest market for the Enterprise Search.

The growing trend of digital transformation initiatives that accelerate across Industries is one of the major factors driving the global market growth.

Enterprise search Market is expected to reach $12,146.83 Million, by 2032.

The key growth strategies for Enterprise Search include product portfolio expansion, acquisition, partnership, merger, and others.

The market players operating in the enterprise search market are OpenText Corporation, Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., Oracle Corporation, Google LLC, SAP SE, EMC Corporation, Attivio, and X1 Discovery, Inc.

Loading Table Of Content...

Loading Research Methodology...