Equity Indexed Life Insurance Market Research, 2032

The global equity indexed life insurance market was valued at $3.9 billion in 2022, and is projected to reach $14.9 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032.

Equity indexed life insurance (EILI) is a form of life insurance plan that combines components of standard life insurance with characteristics generally associated with investment or savings accounts. This insurance product is intended to pay a death benefit to beneficiaries upon the death of the policyholder while simultaneously providing the possibility of cash value accumulation depending on the performance of a specific stock index. Furthermore, EILI, like standard life insurance policies, pays a death payment to the beneficiaries of the policyholder. If the policyholder dies, the beneficiaries receive a tax-free payout, which is often a multiple of the policy's face value or a predetermined sum.

Moreover, the special feature of EILI is the potential for growth linked to the performance of a specified equity index. The insurance company credits interest to the cash value based on the index's performance, subject to a cap rate, participation rate, or other limitations outlined in the policy. When the index performs well, the cash value may increase, providing the policyholder with additional savings potential. In addition, policyholders frequently can modify premium payments, death benefit amounts, and the allocation of funds between the cash value and the indexed account, allowing for customization to meet their financial objectives.

Investor interest and market performance are driving the growth of the equity indexed life insurance market share by increasing desire for financial products that offer the potential for higher returns than traditional savings accounts and fixed-income investments, as interest rates remain historically low. Equity indexed life insurance industry with its indexed-linked growth potential, corresponds with this desire for higher returns.

Furthermore, consumer awareness and education are driving the growth of the equity indexed life insurance market by empowering individuals to make informed financial decisions, understand the potential benefits and risks of these policies, and recognize them as viable options for both life insurance protection and potential investment growth. However, the complexity and lack of transparency of EILI policies, which include insurance and investing features, is a severe obstacle equity indexed life insurance market growth. Many consumers are confused and overwhelmed by complicated aspects like as premium allocation, interest crediting connected to equity indexes, and the complex effects of covers and participation rates, as the lack of transparency increases the problem as insurance companies frequently neglect to explain the fundamental workings of their plans. This lack of transparency makes it difficult for customers to make informed product comparisons and appropriately assess the associated risks and advantages.

Moreover, competing insurance products are major factors that hamper the growth of equity indexed life insurance market. On the contrary, a long-term investing perspective must be extremely beneficial to the expansion of the equity indexed life insurance market. EILI policies are intended to provide not only a death benefit but also the possibility of accumulating monetary value over time based on the performance of a selected equity index, this investment component grows when the time horizon is extended. Policyholders who commit to EILI insurance for the long term might profit from the compounding impact as their cash value grows over time. Thus, it is expected to provide major lucrative opportunities for the equity indexed life insurance market growth.

The report analyses the profiles of key players operating in the equity indexed life insurance market such as American International Group, Inc., AXA, John Hancock, MetLife Services and Solutions, LLC., Mutual of Omaha Insurance Company, Penn Mutual, Progressive Casualty Insurance Company, Protective Life Corporation, Prudential Financial, Inc., Symetra Life Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the equity indexed life insurance market.

Segment Review

The equity indexed life insurance market is segmented on the basis of type, mode, distribution channel, and region. By type, the market is segmented into whole life insurance, universal life insurance, variable universal life insurance, indexed universal life insurance, and others. By mode, it is segmented into online, and offline. On the basis of distribution channel, it is segmented into insurance companies, agency and brokers, and banks. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

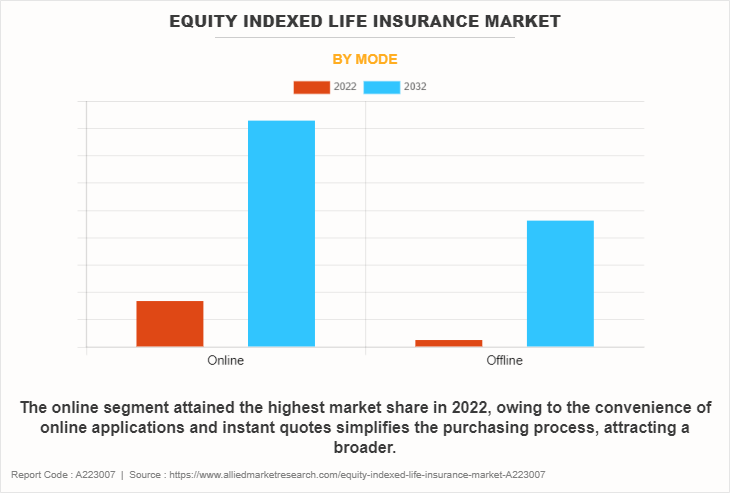

On the basis of mode, the online segment attained the highest market share in 2022 in the equity indexed life insurance market. This can be attributed to the internet, which has transformed the way people receive information and make financial decisions. With a multitude of information at their fingertips, consumers can now quickly educate themselves on EILI policies, compare offerings from various insurance companies, and access reviews and testimonials from other policyholders. This transparency and accessibility have enabled consumers to make better-educated decisions, making online channels the go-to source for studying insurance products.

Meanwhile, the offline segment is projected to be the fastest-growing segment during the forecast period in the equity indexed life insurance market. This is due to the sale of insurance products, especially highly complex ones like EILI policies, frequently necessitating a high level of human engagement and trust-building between the insurance agent and the prospective policyholder. Offline methods, including as face-to-face meetings, provide for direct communication, allowing insurance brokers to explain the complexities of EILI products, answer questions, and make customized recommendations based on an individual's financial condition and goals. This personalized approach generates a sense of comfort and confidence among potential policyholders, which is especially important when considering long-term financial obligations.

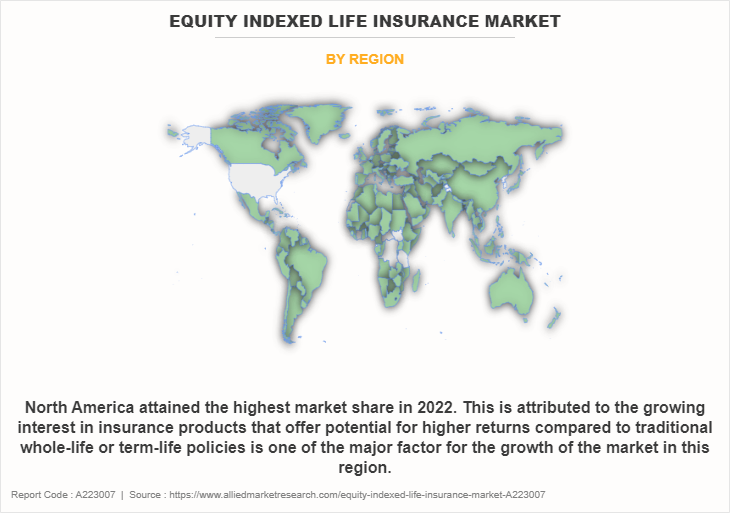

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the equity indexed life insurance market. This is attributed to the insurance market in North America is highly developed and competitive. The region's insurance businesses have a long history of innovation, which has resulted in the invention and effective marketing of EILI products. These businesses have successfully capitalized on the demand for financial products that provide both security and the possibility for wealth building. On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the equity-indexed life insurance market during the forecast period. This growth is attributed to the fact that Asia-Pacific economies have a tradition of powerful economic growth, encouraging consumer trust in insurance policies that connect their returns to the performance of financial markets. This connection with equity indexed life insurance market performance allows policyholders to possibly benefit from the region's powerful stock markets while maintaining the security of life insurance coverage.

The report focuses on growth prospects, restraints, and trends of the equity indexed life insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the equity indexed life insurance market.

Market Landscape and Trends

The equity-indexed life insurance market has evolved dramatically in recent years, driven by a combination of causes and reflecting numerous major trends. One prominent trend is the increased popularity of equity-indexed life insurance plans, particularly in North America and Asia-Pacific. Consumers are increasingly looking for investment-linked insurance options that can provide higher returns than typical whole-life or term insurance plans. Furthermore, technology has played an important role in developing this market, with insurers using data analytics and digital platforms to better customize plans and communicate with clients. Consumers can now research, compare, and buy equity-indexed life insurance more easily because of online platforms, which have contributed to market expansion. In addition, another important trend is the diversification of investment alternatives available inside equity-indexed life insurance contracts. Insurers are now offering a greater selection of index-linked strategies, including specialized and theme indexes along with typical stock market indexes. This variety enables policyholders to match their investments to their unique financial objectives and risk tolerance.

Top Impacting Factors

Investor Interest and Market Performance

Many investors are attracted to equity-indexed life insurance policies because they allow them to participate in stock market gains while avoiding the risks associated with direct stock market investing. Individuals who desire to diversify their portfolio and potentially profit from market growth while having downside protection would find this appealing. Furthermore, as EILI policies often have a guaranteed minimum interest rate, assuring policyholders that they will not lose money even if the market performs poorly. This feature appeals to risk-averse investors because it provides a sense of security. In addition, the stock market's general performance can influence the merits of EILI policies. When the stock market performs properly, policyholders may enjoy larger returns on cash value, which may increase interest in these products. Moreover, insurers have continued to innovate and develop new EILI policies with varying features and benefits. These developments have the potential to attract a broader variety of investors looking for customized solutions that correspond with their financial objectives. Therefore, insurance industry innovation, and desire for market participation of investor interest and market performance are driving the growth of equity indexed life insurance industry.

Complexity and Lack of Transparency

Complexity and a lack of transparency may hamper the expansion of the Equity Indexed Life Insurance industry. These difficulties can make it difficult for customers to understand the products and their possible benefits and risks. EILI policies can be complex, with multiple components, including participation rates, caps, spreads, and indexing methods. This complexity can make it challenging for potential policyholders to understand how the policies work and how they might perform under different market conditions. Furthermore, policyholders may have unrealistic expectations about the profits they can achieve if they do not fully understand the mechanics of EILI policies. If their real returns do not exceed their expectations, this might lead to disappointment. Moreover, the EILI rules frequently include a variety of fees and charges that can reduce the possible profits. These costs are not always clear, making it difficult for consumers to determine the full cost of the policy. Therefore, hidden fees and costs, difficulty in understanding, and misaligned expectation are hampering the growth of equity indexed life insurance market demand.

Long-term Investment Perspective

The growth of the equity index life insurance market can indeed be influenced by various factors, including the long-term investment perspective. Long-term investors often prioritize stability and consistent returns over short-term gains. EILI policies typically offer returns linked to stock market indices, which can be volatile in the short term. This can discourage long-term investors who are risk-averse and prefer safer, more predictable investments. Furthermore, many long-term investors, especially those approaching or in retirement, are risk-averse. They may favour fixed-income or conservative investing options that provide more predictable returns while posing less risk. EILI policies may not correspond to their risk tolerance, making these products less appealing to them. Moreover, as EILI policies are typically intended to be carried for a lengthy period of time. In the early years, they may have restrictions on accessing monetary value or surrendering the insurance. Long-term investors that value liquidity may find these constraints unappealing and prefer more liquid investing options. Therefore, long-term investment perspective are lucrative growth of equity indexed life insurance market size.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the equity indexed life insurance market forecast from 2022 to 2032 to identify the prevailing equity indexed life insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the equity indexed life insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global equity indexed life insurance market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the equity indexed life insurance market players.

- The equity indexed life insurance market report includes the analysis of the regional as well as global equity indexed life insurance market trends, key players, market segments, application areas, and market growth strategies.

Equity Indexed Life Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.9 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 415 |

| By Type |

|

| By Mode |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | MetLife Services and Solutions, LLC., American International Group, Inc., Progressive Casualty Insurance Company, Protective Life Corporation, Prudential Financial, Inc., Symetra Life Insurance Company, AXA, John Hancock, Penn Mutual, Mutual of Omaha Insurance Company |

Analyst Review

Equity Indexed Life Insurance (EILI) is becoming increasingly popular among people looking for life insurance with the potential for a cash value increase. The combination of life insurance protection and the possibility to participate in the stock market's potential upside increase demand for EILI products. Furthermore, insurance firms are launching innovative EILI products with a variety of features and possibilities. These developments intend to reach a large number of consumer and respond to changing market conditions. In addition, the performance of the stock market has a major effect on EILI products because they are related to stock market indexed, as customers may be persuade to EILI items if the stock market is strong and stable. Furthermore, the appeal of EILI is influenced by the current interest rate environment. When interest rates are low, the possibility of higher returns from EILI may make it more appealing than typical fixed-rate life insurance policies. Moreover, regulatory updates and changes can have a major effect on the EILI market, insurers are closely monitoring and adapting their products to meet changing rules, particularly those related to interest crediting and indexing systems. In addition, the level of risk avoidance among consumers can influence EILI demand, some people may be more motivated to choose classic, guaranteed life insurance products during times of economic crisis.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in November 2022, according to PR newswire Penn Mutual has launched survivorship indexed universal life (SIUL). A permanent life insurance policy that covers two people in a single policy, the insurance offers security and the possibility for cash value accumulation, backed by more than 175 years of financial strength. Furthermore, as SIUL provides death benefit protection paid to beneficiaries following the death of the second covered individual whether that is a spouse, domestic partner, or even business partner and is well suited to support a variety of estate planning and preservation strategies at a cost that may be less than the cost of two comparable individual policies. Moreover, in July 2022, according to PR newswire Penn Mutual has launched accumulation indexed universal life (AIUL) a permanent life insurance product with cash accumulation potential and more than 175 years of financial strength. AIUL provides clients with significant upside accumulation potential as well as downside protection against market losses. These strategies by the market players operating at a global and regional level is expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include American International Group, Inc., AXA, John Hancock, MetLife Services and Solutions, LLC., Mutual of Omaha Insurance Company, Penn Mutual, Progressive Casualty Insurance Company, Protective Life Corporation, Prudential Financial, Inc., Symetra Life Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the equity indexed life insurance.

The equity-indexed life insurance (EILI) market has evolved dramatically in recent years, driven by a combination of causes and reflecting numerous major trends. One prominent trend is the increased popularity of equity-indexed life insurance plans, particularly in North America and Asia-Pacific.

This insurance product is intended to pay a death benefit to beneficiaries upon the death of the policyholder while simultaneously providing the possibility of cash value accumulation depending on the performance of a specific stock index.

North America is the largest regional market for Equity Indexed Life Insurance

The global equity indexed life insurance market was valued at $3,892.74 billion in 2022, and is projected to reach $14,906.23 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032.

American International Group, Inc., AXA, John Hancock, MetLife Services and Solutions, LLC., Mutual of Omaha Insurance Company, Penn Mutual, Progressive Casualty Insurance Company, Protective Life Corporation, Prudential Financial, Inc., Symetra Life Insurance Company

Loading Table Of Content...

Loading Research Methodology...