Esophagoscopes And Gastroscopes Market Research, 2031

The global Esophagoscopes and Gastroscopes Market Size was valued at $1,643.79 million in 2021, and is projected to reach $2,880.36 million by 2031, growing at a CAGR of 5.7% from 2022 to 2031. Esophagoscopes and gastroscopes are the types of medical devices used for esophagoscopy and gastroscopy procedures. Esophagoscopy is helpful in the early detection of developing ulcers, cancer cells, and Barrett’s esophagus. On the other hand, gastroscopy is done to check digestive abnormalities such as dysphagia and gastroesophageal reflux disease. There are various types of gastroscopes and esophagoscopes available in the market such as flexible, rigid, and dual channels. Furthermore, the advantages of esophagoscopes and gastroscopes include more accurate for disease detection, easy to push through scope channel and pull out, painless, low risk, accurately visualizing suspicious lesions, and cost-effective. Therefore, these endoscopic procedures are adopted in primary disease diagnosis. Gastroscopes and esophagoscopes have three parts such as the control section, insertion section, and connector section.

Historical overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The esophagoscopes and gastroscopes market grew at a CAGR of around 5.7% during 2022-2031. Most of the growth during this period was derived from the Asia-Pacific owing to the improving health awareness, rising disposable incomes, as well as the well-established presence of domestic companies in the region.

Market dynamics

Growth & innovations in the medical device industry for the manufacturing of innovative gastroscopes and esophagoscopy, owing to a massive pool of health-conscious consumers, creates an Esophagoscopes and Gastroscopes Market Opportunity. The rise in the launch of gastroscopes by various key players across the globe is set to affect the market growth positively. For instance, in February 2022, Ambu A/S a Danish medical device company announced the FDA clearance of the Gastroscope. This is the first sterile single-use gastroscope with advanced imaging and design features.

Furthermore, the Esophagoscopes and Gastroscopes Market Growth is expected to be driven by an increase in the prevalence rate of gastroesophageal reflux disease and Barrett’s esophagus. For instance, according to National Library of Medicine, in September 2020, the prevalence of Barrett’s esophagus was estimated to be 1.6% in the general population. In addition, the availability of improved healthcare infrastructure, an increase in unmet healthcare needs, a rise in the prevalence of chronic diseases, and a surge in demand for esophagoscopes and gastroscopes further contribute towards market growth. Furthermore, the medical device industry in emerging economies is developing at a significant rate, owing to the rise in demand for enhanced healthcare services, and significant investments by the government to improve healthcare infrastructure. The demand for esophagoscopes and gastroscopes is not only limited to developed countries but is also being witnessed in developing countries, such as China, Japan, and India, which fuel the growth of the market.

Moreover, a rise in awareness related to prevention and early diagnosis of chronic diseases such as cancer and ulcers among the general population and ease of accessibility boost the adoption of esophagoscopes and gastroscopes.

Though the use of esopahgoscopes and gastroscopes has increased in recent years there are some disadvantages that negatively impact the market growth. For instance perforation of organs, risk of infection due to contaminated gastroscope, and allergic reaction to the anesthesia are some of the disadvantages limiting the adoption of esophagoscopes and gastroscopes. In addition, the high cost of advanced flexible endoscopes owing to their specialized components and manufacturing process is anticipated to hamper the market growth of esophagoscopes and gastroscopes.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global esophagoscopes and gastroscopes market experienced a decline in 2020 due to the global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries like healthcare, food & beverage, and industrial. However, the market is anticipated to witness recovery in 2022, and show stable growth for the esophagoscopes and gastroscopes market in the coming future. This is attributed to the increase in the adoption of advanced esophagoscopes and gastroscopes in ambulatory surgical centers to improve healthcare facilities coupled with the benefits offered by esophagoscopes and gastroscopes.

Segmental Overview

The Esophagoscopes Industry is segmented into type, application, end-user, and region. By type, the market is categorized into flexible, transnasal, rigid, and others. On the basis of application, the market is segregated into gastroesophageal reflux disease, ulcers, Barrett’s esophagus, celiac disease, and others. By end user, the market is classified into hospitals & clinics, diagnostic laboratories, and ambulatory surgical centers. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

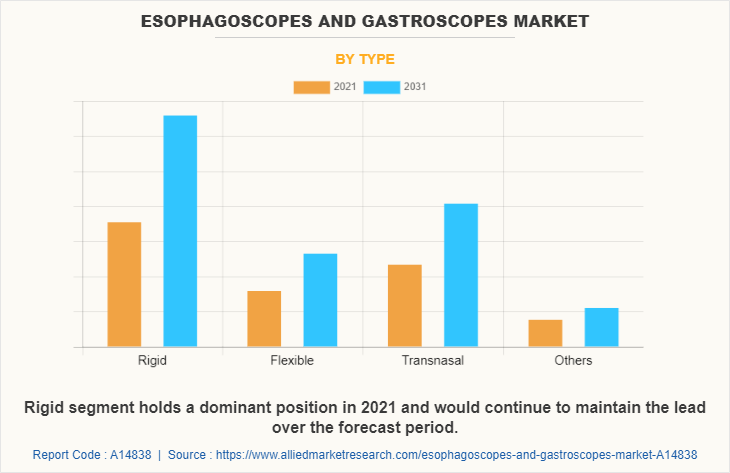

Based on type, the market is segmented into flexible, transnasal, rigid, and others. The others segment include dual channels and therapeutics. The rigid segment dominated the global market in 2021 and is expected to remain dominant throughout the forecast period, owing to the increase in the adoption of rigid esophagoscopes and gastroscopes for diagnosis and biopsy and the availability of rigid gastroscopes in the market by various key players.

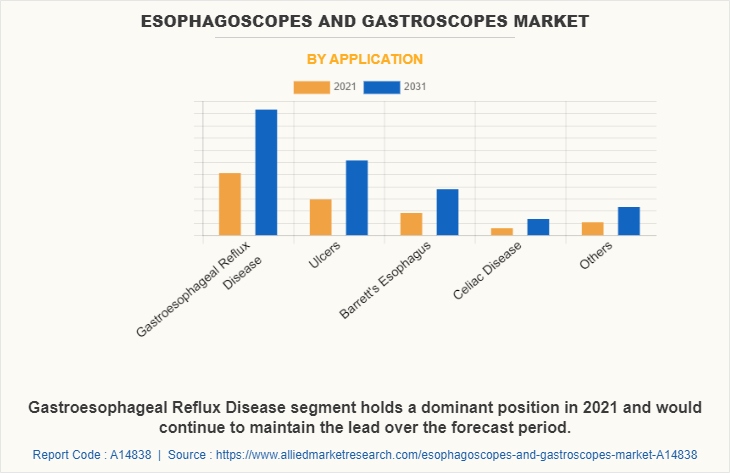

Based on application esophagoscopes and gastroscopes market is segregated into gastroesophageal reflux disease, ulcers, Barrett’s esophagus, celiac disease, and others. The others segment include stomach ulcers, esophageal cancer, and others. Furthermore, the gastroesophageal reflux disease segment has the largest Esophagoscopes and Gastroscopes Market Share in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to increase in the rise in the number of people suffering from gastroesophageal reflux disease, and the lack of awareness regarding the causes of gastrointestinal diseases in underdeveloped countries such as Saudi Arabia.

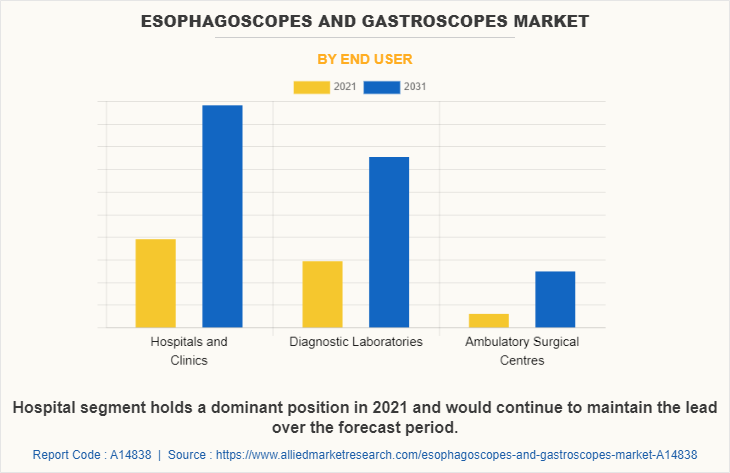

By end user, the Gastroscopes Industry is classified into hospitals & clinics, diagnostic laboratories, and ambulatory surgical centers. The hospitals and clinics segment held the largest market share in 2021, and is expected to remain dominant throughout the forecast period, owing to hospitals is the most conventional place for diagnosis and treatments of diseases and the availability of these products at clinics at a discounted price.

By region, the esophagoscopes and gastroscopes market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the esophagoscopes and gastroscopes market in 2021 and is expected to maintain its dominance during the forecast period. This is attributed to the presence of several major players, such as B Braun Melsungen AG and Stryker Corporation, and advancement in the manufacturing technology of gastroscopes in the region drives the growth of the market.

In addition, the surge in the old age population drives the growth of esophagoscopes and gastroscopes market in the region. Furthermore, the presence of well-established healthcare infrastructure, high purchasing power, and a rise in the adoption rate of advanced esophagoscopes and gastroscopes in hospitals and diagnostic laboratories are expected to drive market growth. Furthermore, product launches, product approvals, and collaborations adopted by the key players in this region boost the growth of the market. For instance, in September 2020, Pantax Medical announced the launch of a new video gastroscope.

However, Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to the presence of medical device companies in the region such as Pantax Medical, Fujifilm Holdings Corporation, and Olympus Corporation as well as growth in the purchasing power of populated countries, such as China and India. Moreover, the rise in the prevalence rate of gastrointestinal diseases and the adoption of advanced esophagoscopes and gastroscopes drive the growth of the market. Moreover, Asia-Pacific offers profitable opportunities for key players operating in the esophagoscopes and gastroscopes market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rising disposable incomes, as well as an increase in healthcare infrastructure.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the esophagoscopes and gastroscopes market analysis from 2021 to 2031 to identify the prevailing esophagoscopes and gastroscopes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the esophagoscopes and gastroscopes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global esophagoscopes and gastroscopes market trends, key players, market segments, application areas, and market growth strategies.

Esophagoscopes and Gastroscopes Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.9 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 241 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | KARL STORZ, HOYA GROUP, Stryker Corporation, Olympus Corporation, Smart Medical Systems, Aohua Endoscopy Co., Ltd., , Medtronic Plc, , B Braun Melsungen AG, FUJIFILM Corporation, CONMED Corporation |

Analyst Review

This section provides various opinions of the top-level CXOs in the global esophagoscopes and gastroscopes industry. In accordance to several interviews conducted, the esophagoscopes and gastroscopes market is expected to witness healthy growth with the rise in the demand for minimally invasive surgical procedures. In addition, favorable FDA approvals and reimbursement policies pertaining to endoscopy devices in develop courtiers such as U.S. and Germany, and surge in patient preference for minimally invasive surgeries drive growth of the global esophagoscopes and gastroscopes market.

According to perspective of CXOs, of leading companies in the market, the global esophagoscopes and gastroscopes market is expected to exhibit high growth potential attributable to factor such as increase in awareness regarding technologically advanced esophagoscopes and gastroscopes. For instance, presently flexible gastroscopes and esophagoscopes are the most preferred endoscopes in the market.

The CXOs further added that North America is expected to witness the highest growth, in terms of revenue, owing to increase in the knowledge about novel devices are expected to boost the demand for esophagoscopes and gastroscopes in this region. However, Asia-Pacific is expected to register the fastest CAGR during the forecast period due to rise in demand for minimally invasive surgical procedure and the development of healthcare infrastructure

The upcoming Trends of Esophagoscopes and Gastroscopes Market are rise in technological advancement and increase in prevalence of diseases that require gastroscopy devices are the major factors that boost the market growth. On the other hand, increased medical demands in the developing countries such as India and China and growth opportunities in emerging markets are expected to create immense opportunities for esophagoscopes and gastroscopes market during the forecast period.

The forecast period in the report is from 2022 to 2031

North America is the Largest Regional Market for Esophagoscopes and Gastroscopes Market

$2,880.36 million is the Estimated Industry Size of Esophagoscopes and Gastroscopes Market

Aohua Endoscopy Co., Ltd., B Braun Melsungen AG, HOYA GROUP, KARL STORZ, Medtronic plc, Olympus Corporation, CONMED Corporation, FUJIFILM Corporation, Smart Medical Systems, and Stryker Corporation are the top Companies to Hold the Market Share in Esophagoscopes and Gastroscopes Market

The base year for the report is 2021

Yes, esophagoscopes and gastroscopes market companies are profiled in the report

No, there is value chain analysis provided in the esophagoscopes and gastroscopes market report

Loading Table Of Content...