Esoteric Testing Market Research, 2032

The global esoteric testing market was valued at $24.2 billion in 2022, and is projected to reach $68.5 billion by 2032, growing at a CAGR of 11% from 2023 to 2032. Esoteric tests are the specialist laboratory procedures that are not frequently offered in regular clinical labs. Due to their intricacy, the rarity of the disorders they diagnose, or the specialist knowledge needed to interpret the data, are frequently carried out in specialized labs. Esoteric diagnostics include advanced biomarker assays, specific tests for unusual infections, and genetic tests for rare disorders. In contrast to routine blood or urine testing, esoteric diagnostics are frequently contracted out to reference labs with the required tools and training. Although there is typically less demand for these tests, they can be extremely useful in certain therapeutic settings or for scientific investigations. Advanced technologies such as next-generation sequencing, real-time polymerase chain reaction, and others are used for esoteric testing.

Market Dynamics

Growth & innovations in the diagnostic industry to develop advanced esoteric tests, owing to rise in prevalence of chronic diseases, creates an opportunity for the esoteric testing market. Increase in demand for esoteric testing and rise in research activities in the diagnostics are the key factors contributing toward the market growth. The growth of the market is expected to be driven by emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, and rise in prevalence of infectious diseases and other diseases where esoteric tests are essential. For instance, according to the World Health Organization, in 2021, about 2.26 million and 2.21 million people worldwide were diagnosed with breast cancer and lung cancer, respectively. As per the same source, in 2021, approximately 36.3 million people live with HIV across the globe.

In addition, technological advancements, such as the development of faster and more accurate esoteric testing methods, and instruments are driving the growth of the esoteric testing market. For instance, in July 2023, Novatein Biosciences, a leading provider of innovative research tools and solutions, launched its Human Anti-Carbamylated Protein Antibody (Anti-CarP) ELISA Kit. This kit is designed to facilitate groundbreaking research in the field of protein carbamylation and its implications in various pathophysiological conditions.

Furthermore, increase in the number of diagnostic testing and surge in demand for personalized medicine are the major factors that drive the global esoteric testing market. Moreover, increase in prevalence of genetic disease significantly contributes toward the market growth, as esoteric testing, such as genetic testing, is used for monitoring vital signs for early diagnosis and proper treatment of patients. Rise in demand for early diagnosis of disease for effective treatment acts as a key driving force of the global market.

In addition, technological advancements in esoteric testing in emerging nations are anticipated to provide lucrative opportunities for the market expansion. Moreover, initiatives taken by governments for development of the diagnostic service center and increase in number of medical laboratories are the key factors that boost the esoteric testing market growth.

On the other hand, high cost of esoteric testing and scarcity of skilled lab technicians limit the adoption of esoteric testing products and negatively affect the market growth. However, rise in number of diagnostic testing, advancement of esoteric DNA sequencing technologies in precise medicine, and increase in awareness among the population for early disease diagnosis led to the enhancement of the esoteric testing sector, thereby providing esoteric testing market opportunity.

An economic recession is a significant decline in economic activity across the economy that lasts for an extended period of time. The global recession has increased the operational and manufacturing expenses, which created a lack of raw materials, and negatively impacted transportation prices. Additionally, according to Laboratory Corporation of America Holdings, the market for esoteric testing has challenges from inflation because it has a negative impact on consumers' ability to pay for services, demand for diagnostic testing, and the price of goods and services. Additionally, changes in interest rates may increase the price of goods, limiting consumer demand during recession.

Segmental Overview

The esoteric testing market is segmented into type, technology, end user, and region. By type, the market is categorized into infectious disease testing, oncology testing, endocrinology testing, genetic testing, toxicology testing, immunology testing, neurology testing, and other testing. By technology, the market is divided into enzyme-linked immunosorbent assay, chemiluminescence immunoassay, mass-spectrometry, real time polymerase chain reaction, DNA sequencing, flow cytometry, and other technologies. By end user, the market is bifurcated into hospital-based laboratories and independent & reference laboratories. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

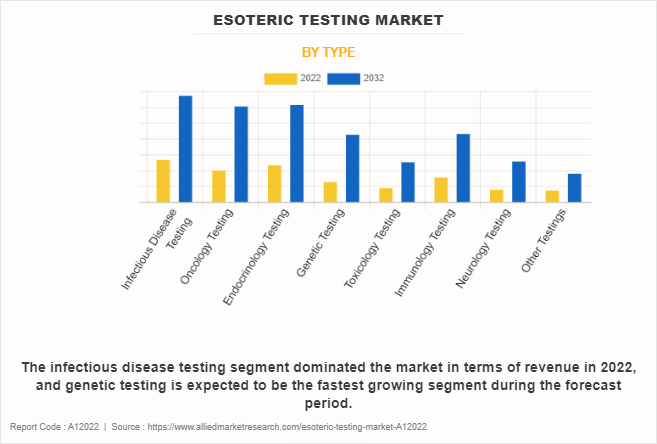

By Type

The market is segmented into infectious disease testing, oncology testing, endocrinology testing, genetic testing, toxicology testing, immunology testing, neurology testing, and other testing. The infectious disease testing segment dominated the esoteric testing market size in 2022. This is attributed to surge in the prevalence of infectious diseases and development of advanced esoteric tests for the diagnosis of respiratory diseases, HIV, and others. However, genetic testing is expected to be the fastest growing segment during the forecast period, owing to advancement in genomic techniques, growth in awareness about personalized medicine, and increase in number of people undergoing genetic testing.

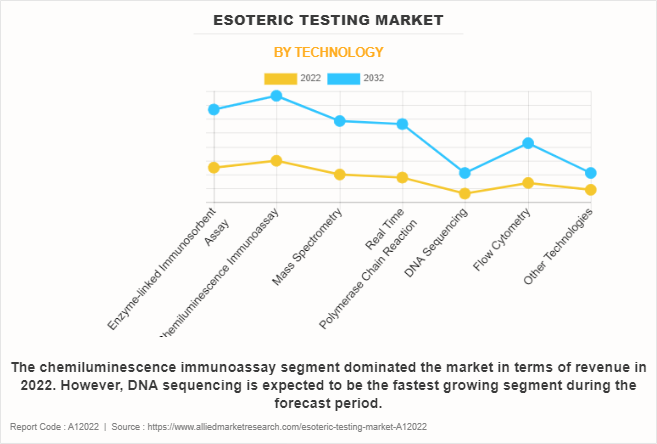

By Technology

The esoteric testing industry is segregated into enzyme-linked immunosorbent assay, chemiluminescence immunoassay, mass-spectrometry, real time polymerase chain reaction, DNA sequencing, flow cytometry, and other technologies. The chemiluminescence immunoassay segment dominated the esoteric testing market size in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to high versatility of chemiluminescence immunoassay in detecting hormones, proteins, antibodies, and nucleic acids. In addition, this assay supports multiplexing, that enables the simultaneous measurement of multiple analytes. Thus, all aforementioned factors boost the growth of this segment. However, DNA sequencing is expected to be the fastest growing segment during the forecast period, owing to advancement in DNA sequencing technology and rise in prevalence of rare genetic disorders.

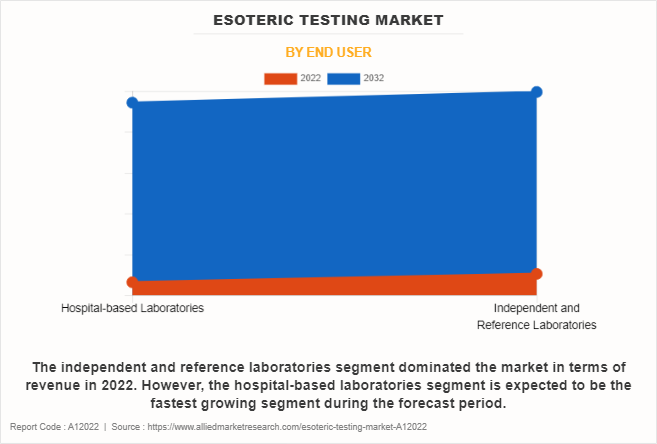

By End User

The esoteric testing market is bifurcated into hospital-based laboratories and independent & reference laboratories. The independent and reference laboratories segment held the largest esoteric testing market share in 2022, owing to availability of advanced esoteric testing technologies in independent and reference laboratories. However, the hospital-based laboratories segment is expected to be the fastest growing segment during the forecast period, owing to the development of hospital-based facilities and rise in number of people undergoing esoteric tests.

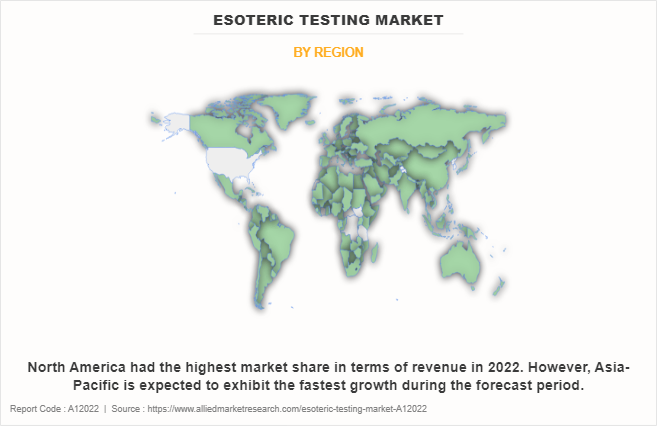

By Region

The market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major esoteric testing market share in 2022 and is expected to maintain its dominance during the forecast period. Presence of several major players, such as Laboratory Corporation of America Holdings, ARUP Laboratories, and Quest Diagnostics in the region drives the growth of the market. In addition, rise in prevalence of chronic and rare diseases has increased the demand for esoteric testing in the region, which propels the market growth. In addition, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of esoteric testing are expected to drive the market growth. Furthermore, product launches adopted by the key players in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest CAGR during the esoteric testing market forecast. The market growth in this region is attributable to presence of medical technology companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, rise in demand for esoteric testing due to surge in prevalence of chronic diseases and adoption of high-tech esoteric testing, drives the growth of the market. Furthermore, Asia-Pacific offers profitable opportunities for key players operating in the esoteric testing market, thereby registering the fastest growth rate during the forecast period, owing to the rise in infrastructure of industries and surge in healthcare expenditure.

Competition Analysis

Competitive analysis and profiles of the major players in the esoteric testing industry, such as Laboratory Corporation of America Holdings, ARUP Laboratories, Opko Health, Inc., Quest Diagnostics Inc., F. Hoffmann-La Roche Ltd., Mayo Foundation for Medical Education and Research, Stanford Health Care, Healius Limited, Athena Esoterix, LLC, and Sonic Healthcare Limited are provided in this report. Major players have adopted product launch, collaboration, and product approval as key strategies to expand their market share and product portfolio.

Recent Product Launches in the Esoteric Testing Market

In July 2023, Quest Diagnostics, a global leader in diagnostic information services, launched its first consumer-initiated genetic test. This test will help people to understand their potential risk of developing certain inheritable health conditions with advanced technology. The launch of this genetic test will help the company to gain a strong foothold in the esoteric testing market.

In July 2022, Laboratory Corporation of America Holdings, a leading global life sciences company, launched its new Neurofilament Light Chain (NfL) blood test. This test will allow doctors to identify and verify signs of neurodegenerative disease, enabling physicians to provide a more effective and efficient path to diagnosis and treatment for patients.

In May 2022, Laboratory Corporation of America Holdings launched its new test that measures Lymphocyte-activation gene 3 (LAG-3) expression levels by immunohistochemistry (IHC) in tumor tissue.

Recent Collaboration in the Esoteric Testing Market

In January 2023, The Enhanced Liver Fibrosis (ELF) Test from Siemens Healthineers is now available in the U.S., providing broad clinical access to the minimally invasive prognostic tool. Currently, the ELF Test is exclusively available through collaborations with Labcorp and Quest Diagnostics, providing access across the country.

Recent Agreement in the Esoteric Testing Market

In February 2021, GRAIL, Inc. entered into an agreement with Quest Diagnostics, the leading provider of diagnostic information services, to provide phlebotomy services to support Galleri, GRAIL’s multi-cancer early detection blood test.

In October 2021, Pillar Biosciences, an innovative, in-vitro diagnostics company, entered into an agreement with LabCorp, a leading global life sciences company, to provide genomic testing for people with cancer.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the esoteric testing market analysis from 2022 to 2032 to identify the prevailing esoteric testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the esoteric testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global esoteric testing market trends, key players, market segments, application areas, and market growth strategies.

Esoteric Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 68.5 billion |

| Growth Rate | CAGR of 11% |

| Forecast period | 2022 - 2032 |

| Report Pages | 307 |

| By Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Stanford Health Care, Sonic Healthcare Limited, Athena Esoterix, LLC., ARUP Laboratories, Healius Limited, Mayo Foundation for Medical Education and Research, Laboratory Corporation of America Holdings, Opko Health, Inc., Quest Diagnostics Inc., F. Hoffmann-La Roche Ltd. |

Analyst Review

The growth of the esoteric testing market is attributed to factors such as rise in demand for specialty diagnostic testing due to increase in prevalence of chronic diseases and infectious diseases such as hypertension, cancer, and HIV. In addition, advancements in esoteric testing technologies such as next generation sequencing enhancement in polymerase chain reaction, and multiplex assays making it an essential method in clinical decision-making are the factors expected to propel the market growth. Further, the surge in demand for early disease diagnosis also drives the demand for esoteric testing, which further boosts the market growth. However, lack of skilled laboratory technologists and high cost of esoteric testing restrain the growth of the market.

Furthermore, North America witnessed the highest growth in 2022, in terms of revenue, owing to surge in chronic diseased population, increase in diagnostic testing, and approval of new tests by the U.S. Food and Drug administration. However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period owing to, development of healthcare settings, and surge in prevalence of chronic diseases.

The total market value of esoteric testing market is $24,171.86 million in 2022.

The market value of esoteric testing market in 2032 is $68,454.36 million.

The forecast period for esoteric testing market is 2023 to 2032.

The base year is 2022 in esoteric testing market.

Top companies such as Laboratory Corporation of America Holdings, Quest Diagnostics, ARUP Laboratories, Opco Health Inc., and Sonic Healthcare Limited, held a high market position in 2022. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The infectious disease testing segment is the most influencing segment in esoteric testing market owing to increase in number of specialty testing for infectious diseases and launch of new esoteric tests for infectious disease diagnosis.

The major factors driving the growth of esoteric testing market are increase in geriatric population, surge in incidences of infectious diseases and rare diseases, and increase in demand for real time polymerase chain reaction (RT-PCR) testing.

Esoteric testing is conducted when a doctor requires additional detailed information about patient health to complete a diagnosis and monitor a therapeutic regimen.

Loading Table Of Content...

Loading Research Methodology...