Esports Industry Statistics:

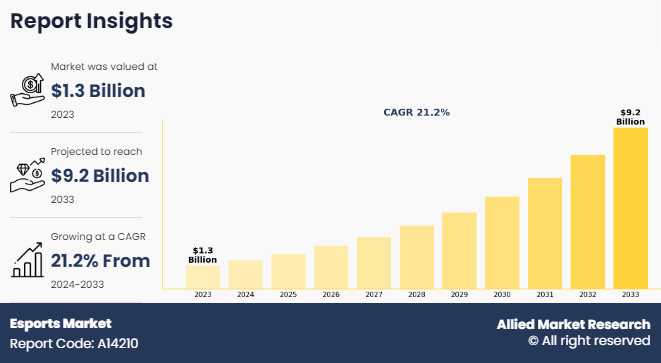

The global esports market size was valued at USD 1.3 billion in 2023, and is projected to reach USD 9.2 billion by 2033, growing at a CAGR of 21.2% from 2024 to 2033.

Rise in the number of live streaming platforms such as Twitch and YouTube gaming has expanded audience reach, making Esports industry growth more accessible to a global audience. Mobile gaming is also becoming a dominant force, particularly in regions such as Asia-Pacific, due to increased smartphone penetration. Another significant trend is the professionalization of esports, with growing investments from traditional sports teams, media companies, and brands. In addition, advancements in virtual reality (VR) and augmented reality (AR) are creating new immersive gaming experiences, enhancing player engagement and spectator interaction.

The esports industry insights show that several key factors, such as increase in popularity of online video games, rise in mobile gaming penetration, and technological advancements. However, data privacy and security concerns and regulatory and legal challenges are expected to hamper the global Esports industry growth. Furthermore, growing sponsorship and investment strategies are expected to provide numerous opportunities for the future of esports industry.

Electronic sports, also referred to as eSports or eGames, are organized competitive video gaming. Teams mostly compete against one another in tournaments with the goal of winning money and prizes. It functions in the same way as traditional sports. Top-level athletes are constantly competing for the top spots in their sport, or game, of choice. Furthermore, rise in the number of mobile users has made it possible for consumers to access these games from any location. They are no longer limited to sitting in front of their computers at home to play or watch online sports.

Market Trends Insights:

The esports market research outlines several noteworthy trends in the market. Over the past decade, it has become a multi-billion-dollar industry driven by competitive gaming, game developers, sponsorships, and advertising. Esports tournaments are the cornerstone of this thriving market, attracting millions of viewers and participants globally. Games like League of Legends, Counterstrike: Global Offensive, and Fortnite have transformed competitive gaming into a mainstream spectacle, with top players and teams competing for substantial prize pools.

Game developers, especially organizations such as Riot Games, have been instrumental in influencing the esports environment. Riot Games, recognized for its legendary game League of Legends, has raised the standard for esports events by hosting some of the biggest and most profitable tournaments globally. Their commitment to building infrastructure, which includes specialized esports leagues and international championships, has contributed to making esports more attractive to a wider audience.

For instance, on December 14, 2024, Tata Communications made an investments in the gaming and esports market. The company has developed new products and strengthening partnerships with sports federations to capitalize on the rapid growth in this sector. Their media and entertainment revenue has seen substantial growth, driven by their expanding global footprint and involvement in broadcasting major sports events. This aims to enhance the gaming and esports experience through advanced technology and strategic partnerships.

Prize pools for significant tournaments have soared, presenting competitors with the chance to win millions. These extensive competitions allow players to demonstrate their talents while giving brands and sponsors an opportunity to connect with the swiftly expanding esports audience. The financial support from sponsors is crucial for the continuity of esports tournaments, allowing them to provide considerable prize money and enhance the overall production quality of the events.

Sponsorships and advertising have emerged as crucial sources of income for esports organizations and event planners. Major brands, ranging from technology firms to beverage manufacturers, are increasingly pouring money into esports to reach the young, engaged audience. As the market keeps growing, the collaboration among game developers, tournament organizers, and sponsors will promote additional innovation and growth in the esports sector.

The report focuses on growth prospects, restraints, and trends of the esports market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, the threat of substitutes, and bargaining power of buyers, on the esports market forecast.

Key Findings:

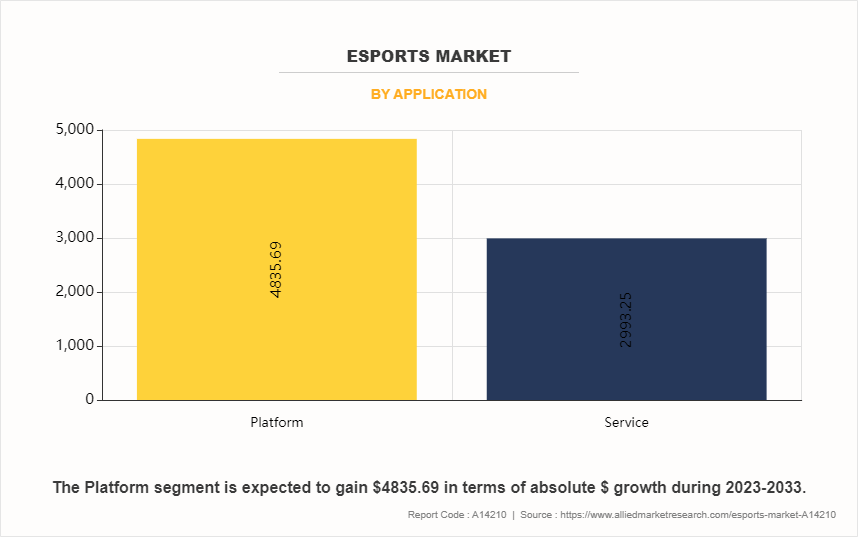

By application, the platform segment accounted for the largest market share in 2023.

By streaming type, the on demand segment accounted for the largest market share in 2023.

By device type, the smart phone segment accounted for the largest esports market share in 2023.

By revenue stream, the sponsorship segment accounted for the largest market share in 2023.

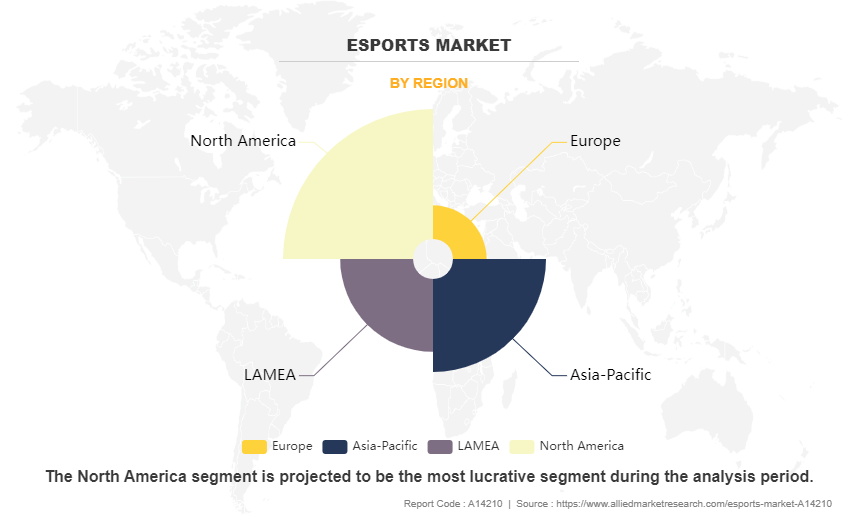

Region-wise, North America generated the highest revenue in 2023.

Segment Review:

The esports market size is segmented on the basis of application, streaming type, device type, revenue stream, and region. By application, it is bifurcated into platform and service. By streaming type, it is divided into live and on demand. By device type, it is categorized into smart phone, smart TV, desktop-laptop-tablets, gaming console. By revenue stream, it is classified into media rights, game publisher fee, sponsorship, digital advertisement, tickets, and merchandise. Region-wise, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, the platform segment dominated the esports market in 2023. The platform segment includes various online platforms that enable gamers, audiences, and organizers to engage with esports events. These platforms facilitate live streaming, player communication, tournament hosting, and audience interaction, making them integral to the growing popularity and commercialization of esports market demand. However, the¯services segment is projected to attain the highest CAGR during the forecast period, owing to rise in demand for professional esports services such as event management, talent acquisition, marketing, and player training.

By region, North America dominated the esports market share in 2023, driven by the region's well-established gaming infrastructure, widespread adoption of digital technologies, and a large base of esports enthusiasts. The region has seen significant investments from media companies, gaming firms, and brands looking to capitalize on the rapidly growing esports ecosystem. However, the Asia-Pacific is projected to attain the highest CAGR during the forecast period. This growth is driven by the increasing popularity of esports in countries like China, South Korea, and Japan, where gaming culture is deeply embedded. The region is also witnessing significant investments in esports infrastructure, tournaments, and sponsorships.

For instance, on March 19, 2025, ExitLag partnered with Talon Esports to enhance esports connectivity across Asia. This collaboration aims to provide Talon's teams with optimized network performance, reducing lag and ensuring a stable gaming experience. ExitLag's technology support Talon's competitive lineups in games like League of Legends, Valorant, Dota 2, and Arena of Valor. This partnership focused on improving the performance and experience of professional esports players.

Report Coverage & Deliverables:

The esports market report covers an in-depth analysis, covering global and regional statistics on esports estimations, growth forecasts, and emerging industry trends. It delves into the main drivers, challenges, and opportunities shaping the esports sector, with a deep focus on shifting consumer behavior, technological advancements, and the impact of evolving regulatory frameworks. The report highlights critical aspects of the industry, including the rise of mobile esports, the growing influence of streaming platforms, and the increase in the integration of esports into mainstream media.

Key deliverables include robust market projections, offering both short-term and long-term forecasts, along with a deep dive into competitive strategies adopted by major market players. The report also provides valuable insights into strategic alliances, sponsorship deals, and investments driving market consolidation, along with mergers and acquisitions that are reshaping the competitive landscape. A central focus is on the market share distribution of leading players, the increasing role of cross-platform gaming, and regional variations in market performance.

Competition Analysis:

Competitive analysis and profiles of the major players in the esports market share include Tencent, Activision Blizzard, Inc., Modern Times Group, NVIDIA Corporation, Electronic Arts, Gameloft SE, FACEIT, CJ Corporation, Kabam, and Gfinity. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the future of esports industry.

Recent Developments in the Esports Industry

In September 2024, Ant Esports launched an inauguration of their new manufacturing facility in Okhla Phase II, New Delhi. The first product to roll out of this state-of-the-art facility is the Value Series Power Supply (VS650L), a notable achievement under the Government of India’s “Make in India” initiative.

In October 2024, DHL Group partnered with ESL FACEIT Group (EFG), to build visibility and relevance of the DHL brand amongst the esports and gaming community.

Top Impacting Factors:

Increase in popularity of online video games

Increase in popularity of online video games is a major factor driving the growth of the esports market. As more players engage with competitive multiplayer games, especially on digital platforms, the demand for organized tournaments and esports events has surged. The accessibility of online gaming, coupled with advancements in internet connectivity and gaming technologies, has allowed a broader audience to participate in and view esports events. Popular games like League of Legends, Fortnite, and Dota 2 have contributed significantly to the video gaming trend. This in turn is expected to propel the growth of active esports communities, global audience, sponsorship, and investment. Surge in online gaming popularity is creating a robust ecosystem for esports, driving its continuous expansion of the global esports market growth.

Data privacy and security concerns

Data privacy and security concerns are significant factors hampering the growth of the global esports market. As more businesses and consumers rely on digital platforms, the risk of data breaches, cyberattacks, and unauthorized access to sensitive information has increased. These concerns create hesitation among users and organizations in adopting new technologies, especially in sectors like financial services, healthcare, and e-commerce, where data privacy is critical. Government regulations, such as GDPR and CCPA, further complicate compliance, adding costs and complexity to operations. As a result, data security challenges are acting as a barrier to the adoption and growth of the global esports market trends.

Opportunity:

Growing sponsorship and investment strategies

The esports market report shows that the market is expected to offer several opportunities for new players in esports market.

The increase in the sponsorship landscape within esports presents a tremendous opportunity for companies looking to tap into a highly engaged and dynamic audience. Esports viewership has experienced tremendous growth, with millions of fans around the globe engaging with live events, tournaments, and content on various platforms. This surge has made esports an appealing option for brands aiming to reach younger, tech-savvy audiences. Sponsorship opportunities within the esports realm can manifest in various ways, including event sponsorships, team partnerships, and branded content along with digital activations. Businesses in industries like technology, gaming, consumer products, and energy drinks have already started to invest significantly in esports sponsorships, tapping into the increasing popularity of competitive gaming.

For instance, on January 14, 2025, a America partnered with Cloud9 to become the naming partner for their League of Legends team. The team now competes as Cloud9 Kia, reflecting the shared values of excellence, resilience, and innovation between the two brands. This partnership includes dynamic integrations of the Kia EV9 within the team's branding, content creation, and live events. This development enhances the visibility and engagement of both Kia and Cloud9 within the esports community.

One significant opportunity exists in the partnership between esports organizations and traditional brands. As esports continues to gain recognition, many well-established companies are beginning to see the advantages of engaging with the gaming audience. Sponsorship arrangements can vary from jersey sponsorships to joint content creation, boosting a brand’s visibility and aligning it with the values and culture of the gaming community. Furthermore, the digital nature of esports allows sponsors to monitor engagement metrics and customize their campaigns to enhance both reach and effectiveness, ultimately improving the return on investment for brands.

For instance, on October 21, 2024, Sony Electronics partnered with Cloud9 to enhance Call of Duty performance using cutting-edge technology. As part of this collaboration, Sony provided Cloud9's New York Call of Duty team with state-of-the-art INZONE monitors, designed specifically for competitive gaming. These monitors offer exceptional visual clarity, responsiveness, and performance, giving Cloud9 a competitive edge. This partnership aimed to improve the gaming experience and performance of professional esports players.

Investment in esports also presents significant opportunities. As the industry matures, investors are eager to fund esports organizations, tournament platforms, game developers, and content creators. The financial backing helps these entities scale operations, improve infrastructure, and deliver more engaging experiences to fans. Esports investment can take various forms, including equity investments, venture capital, and even private equity, with some major investors also showing interest in esports media rights and broadcasting deals.

For instance, on January 16, 2025, Logitech partnered with Gen.G to develop an optimal gaming environment for professional play. This collaboration aims to enhance the gaming experience for Gen.G's professional players, academy students, and fans by providing innovative products like the PRO X SUPERLIGHT 2 DEX wireless gaming mouse and customized solutions tailored to each team. This partnership focused on improving the performance and experience of competitive gamers. Moreover, as esports becomes a mainstream phenomenon, the development of new markets and regions, especially in Asia, Europe, and North America, offers further opportunities. Investors and sponsors can capitalize on emerging esports ecosystems, bringing innovative gaming experiences to new audiences and creating sustainable, long-term growth.

For instance, on July 29, 2024, Talon Esports partnered with Certified Saudi Arabia to launch a limited-edition streetwear collection for the 2024 Esports World Cup in Riyadh. This collaboration featured designs inspired by Talon's bird logo and Saudi Arabia's national bird, the falcon, symbolizing strength and national pride. This enhances the visibility and branding of both Talon Esports and Certified Saudi Arabia within the esports community.

Technological Advancements

Technological advancements, particularly the rise of smart technologies, are transforming the esports industry by reducing risks and offering innovative solutions for both players and audiences. Smart games like security systems, and motion detectors, provide real-time monitoring and alerts, allowing players to experience real-time gaming activities. Rise in advancements in technologies such as AR and VR in digital gaming is further creating lucrative opportunities for the growth of the global esports market opportunities.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ai in insurance market analysis from 2021 to 2031 to identify the prevailing ai in insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ai in insurance market outlook segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global ai in insurance market opportunity.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the players.

- The report includes the analysis of the regional as well as global ai in insurance market trends, key players, market segments, application areas, and ai in insurance market forecast strategies.

Esports Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Revenue Stream |

|

| By Application |

|

| By Streaming type |

|

| By Device Type |

|

| By Region |

|

| Key Market Players | Gameloft SE, FACEIT Ltd., FACEIT, Kabam Inc., Nintendo Co. Ltd., CJ Corporation, NVIDIA Corporation, Electronic Arts, Gfinity, Modern Times Group, Activision Blizzard, Inc. |

The global esports market size was valued at USD 1.3 billion in 2023, and is projected to reach USD 9.2 billion by 2033

The global esports market is projected to grow at a compound annual growth rate of 21.2% from 2024-2033 to reach USD 9.2 billion by 2033

The key players in the esports market are Electronic Arts, Gfinity, Modern Times Group, Nintendo Co. Ltd., FACEIT, CJ Corporation, FACEIT Ltd., Activision Blizzard, Inc., NVIDIA Corporation, Gameloft SE, Kabam Inc.

The Asia-Pacific is projected to attain the highest CAGR during the forecast period.

Increase in popularity of online video games , Data privacy and security concerns & Technological Advancements

Loading Table Of Content...

Loading Research Methodology...