Ethanol Vehicle Market Overview

The global ethanol vehicle market size was valued at USD 564.3 billion in 2021, and is projected to reach USD 1,317.6 billion by 2031, growing at a CAGR of 9.1% from 2022 to 2031. The factors such as exhausting fossil-fuel reserves, less CO2 emission from vehicles, stringent environmental guidelines and vehicle emission models supplement the growth of the ethanol vehicle market. However, scarcity of ethanol-based fuel stations and engine damage concerns are the factors expected to hamper the growth of the market. In addition, integration of sustainable automotive technologies and rising automotive performance on higher ethanol blends creates market opportunities for the key players operating in the market.

Key Market Trend & Insights

- Cellulosic ethanol offers even greater greenhouse gas reduction benefits.

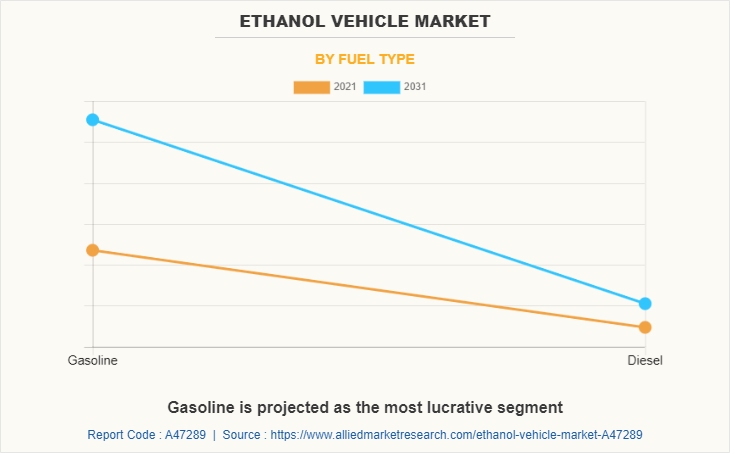

- Gasoline segment dominates ethanol vehicle market growth by fuel type.

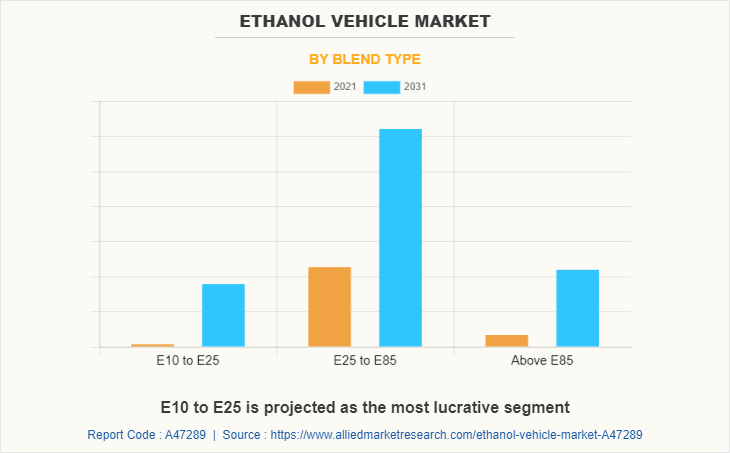

- E10 to E25 blend type records highest growth rate in ethanol vehicle market.

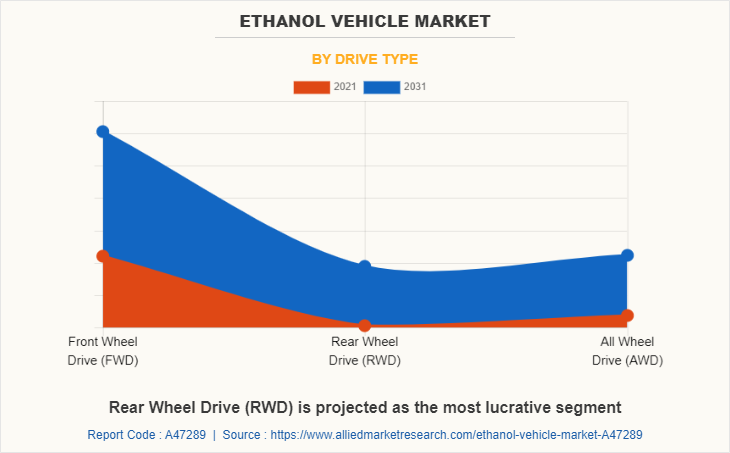

- Rear wheel drive (RWD) segment dominates market growth by drive type.

- North America leads the market in revenue, followed by LAMEA, Europe, and Asia-Pacific.

- Asia-Pacific is expected to dominate the forecast period due to automotive innovations

Market Size & Forecast

- 2031 Projected Market Size: USD 1,317.6 billion

- 2021 Market Size: USD 564.3 billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 9.1%

Introduction

Ethanol vehicles are the vehicles that have an internal combustion engine specifically designed to operate on more than one kind of fuel and are referred to as dual-fuel vehicles or flex-fuel vehicles. Most of the components in an ethanol fuel vehicle are the same as those in a conventional gasoline vehicle. However, some unique ethanol-compatible components, such as modifications to the fuel pump and fuel injection system of the vehicle, are required to compensate for ethanol's different chemical properties and energy content. The engine control module (ECM) is also calibrated to accommodate the higher oxygen content of ethanol. The ethanol blend enhances the vehicle’s performance and makes the engine efficient to give the best performance. Basically, ethanol is a high-octane fuel produced from crops and other renewable resources. It is also known by several names, such as ethyl alcohol, pure alcohol, and grain alcohol.

Market Dynamics

Currently, modern flex-fuel vehicle engines can burn any percentage of the resulting mixture of gasoline with ethanol in the combustion chamber along with spontaneous adjustments in the fuel injection system by an added fuel mixture composition sensor. For instance, in April 2022, ClearFlame Engine Technologies demonstrated a heavy-duty truck running on 98% ethanol. The new technology is introduced in Class 8 diesel trucks, running on a Cummins X15 500hp 15L heavy-duty engine, commonly used for long-haul truck and off-highway applications, and converting it to run on renewable E98 ethanol.

However, most of the vehicles running nowadays are fueled using conventional fossil fuels. Hence, the increased demand for carbon-neutral automobiles around the world to counter the rise in global pollution levels are expected to propel the ethanol vehicles market forward during the forecast period. For instance, in September 2021, a group of 21 state attorneys general, the District of Columbia, and several large U.S. cities encouraged the U.S. government to implement stringent automobile emission laws. Furthermore, the Environmental Protection Agency (EPA) finalized federal greenhouse gas (GHG) emissions standards for passenger cars and light trucks in the U.S. through 2026. Therefore, to match stringent vehicular emission regulations, automotive OEMs focusing on the adoption of ethanol vehicles as consumers become increasingly aware of the impact of vehicular emissions on the environment, thereby foster the ethanol vehicle market.

Also, the automotive sector has faced significant pressure from governments and society in recent decades to adopt a more sustainable growth model. For instance, in April 2019, Ford Motor Company reintroduced the Ford Kuga EcoBoost E85 in both France and Sweden. This flex fuel model is based on the 1.5 Ecoboost 150-hp model. Instead of 156 g of CO2 per km, the adapted model sees its official CO2 rating cut by 40% to just 94 g/km, which overwhelms the fiscal penalty. Similarly, government agencies have expanded the adoption of sophisticated technology and R&D operations to lower car emissions, boosting the demand for ethanol vehicles. For instance, in May 2020, the Indonesian government lifted the ethanol restriction, allowing ethanol to be used as a component of flex-fuel at a blend percentage of up to 3%. The Vietnamese government announced a 5% reduction in ethanol import tariffs in June 2020 to meet its aim of increasing the national fuel blend mandate to 10%.

Market Segmentation

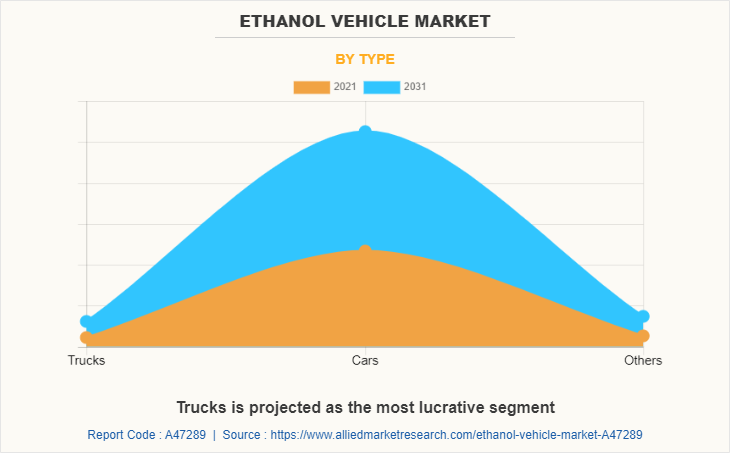

The global ethanol vehicle market is segmented on the basis of type, fuel type, blend type, drive type, and region. By type, the market is divided into trucks, cars, and others. By fuel type, it is fragmented into gasoline and diesel. By blend type, it is categorized into E10 to E25, E25 to E85, and above E85. By drive type, it is categorized into front wheel drive (FWD), rear wheel drive (RWD), and all-wheel drive (AWD). By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Which are the Top Ethanol Vehicle companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the ethanol vehicle industry.

- AB Volvo

- BMW AG

- Daimler AG

- Deere & Company

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- Scania

- Toyota Motor Corporation

- Volkswagen AG

What are the Top Impacting Factors

Key Market Driver

Exhausting fossil-fuel reserves

The International Energy Agency claims that fossil fuels continue to dominate the world's energy system, making up 81% of all primary energy usage. The volume of conventional oil extracted, which accounts for three-quarters of all liquid oils, has been declining since last decade. The volume of energy per barrel of oil has fallen dramatically in recent years, as have the rates of energy return from oil exploration &extraction, resulting in stagnation in the quantity of energy delivered to the world population for use each year from all liquid oil in recent years. The amount of energy accessible per person has already declined internationally due to the rapid rise of the human population. Since exporting countries' domestic consumption has increased, the volume of oil placed on the world market, which is currently around half of total production, has already declined.

Furthermore, as fossil fuel supplies have depleted, the cost of fuels has risen, increasing the country's overall import expenditure by relying on petroleum goods from neighboring countries. For instance, in September 2022, Toyota announced to launch Toyota Corolla flex-fuel model at an event in India (Delhi), as the country is the sugar as well as corn surplus nation, both of which can be used to produce ethanol. Thus, such concerns about fossil fuel depletion propel the growth of the ethanol vehicle market in the anticipated timeframe.

Less CO2 emission from vehicles

Engine encapsulation enhances the fuel economy of the vehicle by providing higher initial temperature to the engine and oils & lubricants while enhancing the quality of exhaust coming out of the vehicle. The ethanol vehicles can offer some emissions benefits depending on vehicle type, engine calibration, and blend level. As with conventional fuels, the use and storage of ethanol blends can result in emissions of regulated pollutants, toxic chemicals, and greenhouse gases (GHGs).

For instance, in 2020, according to analysis by Argonne National Laboratory, it has been found that using corn-based ethanol in place of gasoline reduces life cycle GHG emissions on average by 40%. Using cellulosic ethanol provides an even greater benefit. In addition, the growth of the automotive industry in India is another vital factor that is expected to enhance the consumption of the product over the years. Therefore, manufacturers are providing this addition in most of their vehicles, which is anticipated to propel the global ethanol vehicle market during the forecast period.

Restraints

Scarcity of ethanol-based fuel stations

Ethanol is not widely available at gas stations. To lower ethanol shipping costs, most stations that keep the fuel (ethanol) in the store are located near large corn-producing states. Owing to the high costs associated with the manufacture and distribution of ethanol, there are currently a limited number of ethanol stations around the world, despite the expanding use of biofuels. Furthermore, ethanol is more expensive than gasoline initially, as gas stations are less inclined to stock it. According to the Renewable Fuels Association, just 5,214 stations sold E85, and 2102 stations sold E15 in the U.S. in 2021. In fact, only a small proportion of gas stations worldwide sell ethanol, though this is likely to change as more consumers acquire ethanol vehicles. Thus, owing to the scarcity of ethanol-based fuel stations, the market's expansion is hampered.

Opportunity

Integration of sustainable automotive technologies

With increased concerns about climate change and environmental degradation, automotive companies have made sustainability a strategic goal. Governments, consumers, and investors put pressure on automakers to modify their working practices, culture, and products. This is expected to have far-reaching consequences for the sector, which, despite making significant progress, still needs to increase its sustainability efforts. Also, the automotive sector has faced significant pressure from governments and society in recent decades to adopt a more sustainable growth model.

For instance, in April 2019, Ford Motor Company reintroduced the Ford Kuga EcoBoost E85 in both France and Sweden. This flex fuel model is based on the 1.5 Ecoboost 150-hp model. Instead of 156 g of CO2 per km, the adapted model sees its official CO2 rating cut by 40% to just 94 g/km, which overwhelms the fiscal penalty.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global ethanol vehicle market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall ethanol vehicle market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global ethanol vehicle market with a detailed impact analysis.

- The current ethanol vehicle market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Ethanol Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1317.6 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 310 |

| By Type |

|

| By Blend Type |

|

| By Fuel Type |

|

| By Drive Type |

|

| By Region |

|

| Key Market Players | Nissan Motor Corporation, Daimler AG, TOYOTA MOTOR CORPORATION, BMW AG, Honda Motor Co., Ltd., Volkswagen AG, Deere & Company, Scania, Mitsubishi Motors Corporation, Ford Motor Company, AB Volvo, General Motors |

Analyst Review

Depleting natural sources of petroleum, as well as rising car emission standards, are two significant factors impacting the ethanol vehicle market. Furthermore, the market is expected to develop owing to the need to minimize reliance on non-renewable energy sources and tight emission regulations. According to the U.S. Energy Information Administration (EIA), ethanol vehicles are expected to account for 11% of all light-duty vehicle sales by 2040, making ethanol the single largest alternative fuel technology. Global automobile production, on the other hand, has decreased in recent years, and the COVID-19 pandemic has pushed back global automotive output till 2020. In the foreseeable future, higher passenger vehicle sales are expected to boost the ethanol vehicles demand.

However, market participants constantly concentrating on product development to fulfill the changing end-user demands and improve vehicle operational efficiency. For instance, in March 2022, Stellantis NV (STLA.MI) is considering manufacturing and selling of a hybrid vehicle powered by electricity and ethanol which is to be launched by 2025 in Brazil, with the launch of 16 new models and seven electric & hybrid models. Moreover, increasing crude oil import costs have prompted the governments to investigate different fuel alternatives such as ethanol and biodiesel. For instance, in October 2021, Maruti Suzuki announced plans to explore the potential of ethanol-based engines in India. Thus, the growth in the number of government & commercial initiatives to develop & implement cleaner automobile technology creates a potential growth opportunity for the ethanol vehicle market during the forecast period.

In addition, the availability of large ethanol manufacturing facilities aids to promote the usage of ethanol in gasoline to diversify away from fossil fuels. For instance, Argentina's nineteen bioethanol plants have a production capacity of 1.4 billion liters as of 2019. Sugarcane is used as a feedstock in thirteen plants, while corn is used in six others. With production capacity at around 80%, the 2019 blend mix is expected to be 11.6 %, close to the present E12 standard. Furthermore, high disposable income, rapid technological advancements, and the presence of automotive manufacturers all contribute to the growth of the ethanol vehicle market.

Among the analyzed regions, North America is the highest revenue contributor, followed by LAMEA, Europe, and Asia-Pacific. On the basis of forecast analysis, Asia-Pacific is expected to lead during the forecast period, due to surge in technological innovations in automobile industry, increase in focus by manufacturers in significant pressure from governments and society to modify their working practices, culture, and products.

The global ethanol vehicle market was valued at $564.31 billion in 2021, and is projected to reach $1,317.63 billion by 2031.

The leading players operating in the ethanol vehicle market are AB Volvo, BMW AG, Daimler AG, Deere & Company, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Mitsubishi Motors Corporation, Nissan Motor Corporation, Scania, Toyota Motor Corporation, and Volkswagen AG.

North America is the largest regional market for ethanol vehicles.

The E25 to E85 ethanol fuel blend type is the leading application of ethanol vehicle market.

The integration of sustainable automotive technologies and rising automotive performance on higher ethanol blends are the upcoming trends of ethanol vehicle market in the world.

Loading Table Of Content...