Europe Electric Vehicle Market Insights, 2027

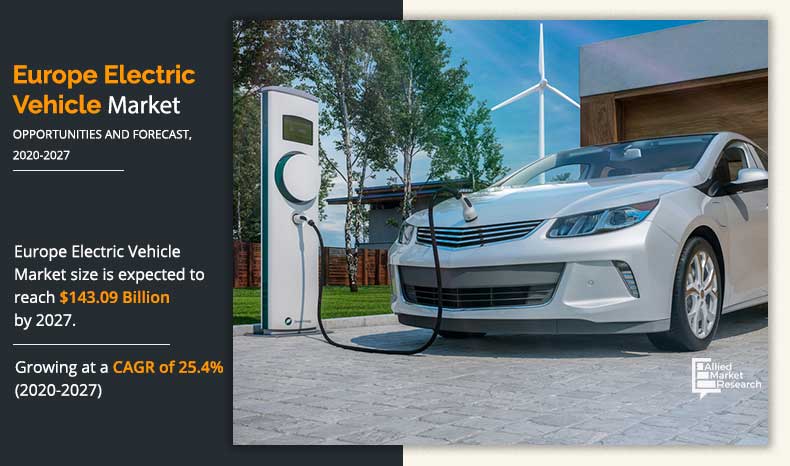

The Europe electric vehicle market was valued at $25,489.81 million in 2019, and is projected to reach $143,084.57 million by 2027, registering a CAGR of 25.4% from 2020 to 2027.

An electric vehicle operates on electricity unlike its counterpart, which runs on fuel (internal combustion engine powered vehicles). Instead of internal combustion engine, these vehicles run on an electric motor that requires constant supply of energy from batteries to operate. A variety of batteries, such as lithium-ion, molten salt, zinc-air, and various nickel-based designs, is used in these vehicles. An electric vehicle was primarily designed to replace conventional ways of travel as they lead to environmental pollution. It has gained popularity, owing to numerous technological advancements. It outperforms the conventional vehicle providing higher fuel economy, low carbon emission & maintenance, convenience of charging at home, smoother drive, and reduced sound from engine. Majorly, there are three types of electric vehicles—battery, hybrid, and plug-in hybrid electric vehicles. In addition, electric vehicles require no engine oil changes but are slightly expensive than their gasoline equivalents.

Factors, such as increase in demand for fuel-efficient, high-performance, & low-emission vehicles and stringent government rules & regulations toward vehicle emission, supplement the growth of the electric vehicle market in Europe. However, high manufacturing cost and insufficient electric vehicles charging infrastructure in Europe are the factors that are expected to hamper the growth of the electric vehicle market. Moreover, technological advancements and proactive government initiatives supplement the growth of the Europe electric vehicle market during the forecast period.

Battery electric vehicles (BEVs) are gaining immense traction in the Europe electric vehicle industry, owing to advantages such as changing perception toward the adoption of electric vehicles. For instance, battery electric vehicles accounted for the majority of electric vehicle registrations in 2019 for cars and vans (as per data provided by the European Environment Agency (EEA)). In addition, simple technology usage and low maintenance of battery electric vehicle as compared to other electric vehicles supplement the growth of battery electric vehicles (BEVs).

Developments carried out by different vehicle manufacturers related to electric vehicles supplement the growth of the electric car market in Europe. Companies, such as Tesla and Renault, have launched efficient products in the Europe market. Renault Zoe managed to secure the first spot for electric passenger cars sold in Europe in 2020. By the end of September 2020, Renault Zoe, Nissan Leaf, and Tesla Model 3 were the most-selling BEVs in Europe.

Netherlands is leading the Europe market, in terms of electric bikes. Owing to the strong cycling infrastructure, two out of five new bikes sold in the Netherlands are e-bikes. For instance, according to the data by Rai Association and Bovag, 420,000 new e-bikes were bought in 2019, accounting 41.7% of total new bicycle sales in the Netherlands. Conversely, 34% and 12% of the bike sales were normal tour/city bicycles and children’s bikes, respectively. Thus, such factors driving the growth of electric vehicle market primarily in two-wheeler segment across Netherlands.

The Europe electric vehicle market is segmented on the basis of type, vehicle type, and country. By type, it is divided into battery electric vehicle (BEV), hybrid electric vehicle (HEV), plug-in hybrid electric vehicle (PHEV), mild hybrid electric vehicle (MHEV), and extended range electric vehicle (E-REV). By vehicle type, it is classified into passenger car and commercial vehicle. By country, the market is analyzed across Germany, France, the UK, The Netherlands, Spain, Portugal, Italy, Belgium, and the rest of Europe.

Based on country, the market is studied across Germany, France, UK, Netherlands, Spain, Portugal, Italy, Belgium, and Rest of Europe. The major companies profiled in the Europe electric vehicle market include Renault, Tesla, Mitsubishi, Nissan, BMW, Hyundai, Volvo, Volkswagen, Peugeot, and Audi.

Key Developments:

- In January 2021, Volkswagen AG Components opened the group’s first plant for recycling electric car batteries in Salzgitter. Volkswagen AG took another committed step toward sustainable end-to-end responsibility for the entire value chain of the electric vehicle battery. The aim is the industrialized recovery of valuable raw materials, such as lithium, nickel, manganese, and cobalt, in a closed loop together with aluminum, copper, and plastics, achieving a recycling rate of more than 90% over the long term.

- In November 2020, Nissan introduced e-POWER electrified powertrain in Nissan Note. It features large armrests and zero-gravity seats for increased comfort for longer trips and deliver fast, safe, & informative journey for its passengers.

- In October 2020, Spring Electric, an all-electric car, was launched by Dacia (subsidiary of Groupe Renault). The car is aimed to be economical, practical, and versatile. It also provides ample storage space of 300 liters and a range of up to 183 miles.

- In July 2020, The BMW Group is driving the expansion of electromobility and has signed a long-term supply contract worth $2.41 billion for battery cells with the Swedish company Northvolt. The battery cells will be produced in Europe at the Northvolt gigafactory currently under construction in Skellefteå in northern Sweden (series plant Northvolt Ett) from 2024.

By Type

HEV segment is projected as the most lucrative segments

Increase in demand for fuel-efficient, high-performance, and low-emission vehicles

Presently, most vehicles run on fossil fuels such as petrol and diesel. The reserves of crude oil are anticipated to become dry over the years; hence, there is increased demand to search for a viable, economical, and clean source to power the automobile. Electric vehicles are the solution for a carbon-neutral, high performance, economic, and practical transportation system.

European countries have very well accepted electric vehicles. According to the Guardian, in 2020, car manufacturers sold more than 500,000 electric cars in Europe. The sales of electric vehicles have increased progressively since 2010, with a yearly growth of around 50% over the past 5 years. As per the statistics published in the European Electric Vehicle Fact book 2019/2020, electric vehicles represented 3.6% of new passenger car registrations in 2019, a growth of 2.5% as compared with 2018. Electric vehicles have witnessed a growing trend of acceptance in Europe as charging infrastructure is being improved, the production cost falls, and governments take efforts to bring down the carbon emission generated by the transportation sector. According to the International Council on Clean Transportation report, Europe is now the second-largest electric vehicle market in the world by volume, behind China and ahead of the U.S. This tremendous growth in demand for electric vehicles in Europe is expected to drive the growth of the Europe electric vehicle market over the forecast timeframe.

By Vehicle Type

Commercial Vehicles segment is projected as the most lucrative segments

Stringent government rules & regulations toward vehicle emission

The European Union has imposed strict rules and regulations over the years for carbon emissions generated by automobile. These regulations forced the manufacturers in Europe to come up with low-emission vehicles and ultimately led to the large-scale adoption of electric vehicles in Europe.

The regulation 443/2009 fixed the compulsory reduction of carbon emission targets for new cars. The very first target was fully realized from 2015 onwards. Following an upward trend from 2012 onwards, a goal of 130 grams of CO2 per kilometer was set for the EU fleet-wide standard emanation of new passenger cars between 2015 and 2019. The maximum permitted emissions released from the new cars registered in 2019 in Norway, Iceland, and EU28were 122.4 grams CO2/km. From 2021, the EU fleet-wide average emission goal for new cars is set to be just 95 grams CO2/km. In any case, if the CO2 emissions of a company's products surpass its maximum emission’s goal in a given year, the company has to pay a surplus emissions charge for every car registered. Since 2019, the fine is around $106.7 for each gram/km of passing the set target. Therefore, strict implementation of stringent government rules and regulations to limit carbon emissions of an automotive is anticipated to drive the growth of electric vehicles in Europe over the forecast period

By Region

LAMEA by region segment is projected as the most lucrative segments

Key Benefits For Stakeholders

- This study presents analytical depiction of the Europe electric vehicle market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current Europe electric vehicle market size is quantitatively analyzed from 2019 to 2027 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the Europe electric vehicle industry.

Europe Electric Vehicle Market Report Highlights

| Aspects | Details |

| By Type |

|

| By VEHICLE TYPE |

|

| By COUNTRY |

|

| Key Market Players | Mitsubishi, BMW, Audi, Volvo, Peugeot, Nissan, VOLKSWAGEN AG, Renault, Hyundai, TESLA, INC |

Analyst Review

According to the insights of leading CXOs in the Europe electric vehicle market, the market is expected to witness a steady growth due to stringent vehicle emission norms and an increase in demand for fuel-efficient & low-emission vehicles. In countries, such as the UK, Germany, France, Italy, and Spain, the market is projected to report a rapid growth rate, owing to the introduction of incentives on the purchase of electric cars and strict regulations regarding carbon emissions of automobiles. To be in line with the emission norms across various countries in Europe, a rising number of manufacturers are focusing on the production of smart, efficient, and low-maintenance electric vehicles. Companies, such as Renault, Volkswagen, BMW, Tesla, and others, have launched several products in the Europe market to cater to the rising demand for electric vehicles.

Usage of electric vehicles has increased in a wide range of cars such as compact hatchbacks, SUVs, and two-wheelers. Countries, such as Germany and France, have set their goals to accomplish similar levels of EV adoption. This further enhances the growth of the electric vehicle industry in Europe.

Loading Table Of Content...