Europe Pentane Market Research, 2033

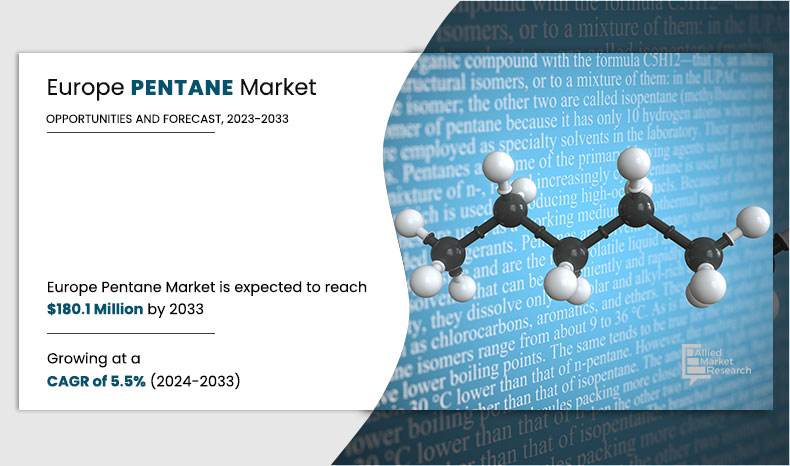

The Europe pentane market size was valued at $105.6 million in 2023 and is projected to reach $180.1 million by 2033, registering a CAGR of 5.5%. The pentane market in Europe is influenced by several key drivers. One major factor is the growing demand for energy-efficient and sustainable insulation materials. Pentane is extensively used as a blowing agent in the production of polystyrene and polyurethane foams, which are critical for building insulation and refrigeration applications. As energy efficiency regulations become stricter across Europe, the need for high-performance insulation materials continues to rise, thereby boosting the demand for pentane. Another significant driver is the expanding packaging industry. With the increase in number of e-commerce and food delivery services, there is a heightened demand for protective and insulating packaging solutions. Pentane-blown foams provide lightweight and effective packaging, which is crucial for the safe transportation of goods.

Introduction

Pentane is an organic compound belonging to the alkane series. It is a volatile, colorless liquid with a characteristic gasoline-like odor. It exists in three isomeric forms: n-pentane (a straight-chain alkane), isopentane (2-methylbutane), and neopentane (2,2-dimethylpropane). This compound is commonly used as a solvent in laboratories and industries, as a blowing agent in the production of polystyrene foam, and occasionally as a specialty fuel.

Key Takeaways

- The Europe pentane industry is highly fragmented, with several players including Air Liquide, Chevron Phillips Chemical Company LLC., ExxonMobil Corporation, Balchem Corp., HCS Group GmbH., Isolab Laborgeräte GmbH, MOL GROUP, Petr Švec - PENTA s.r.o., Phillips 66 Company, and Shell Plc.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The segment analysis of Europe in terms of value ($ million) and volume (kilotons) during the forecast period 2023-2033 is covered in the Europe Pentane market report.

Market Dynamics

Key growth drivers for pentane market include increase in use of pentane as a blowing agent in the production of expanded polystyrene (EPS) foam, which is widely used in packaging materials and construction. The rise in number of e-commerce activities and construction projects significantly contribute to the demand for EPS foam. The automotive industry also plays a pivotal role, with pentane being used in the manufacturing of polyurethane foams for automotive seating, insulation, and interior components. The shift toward lightweight materials for fuel efficiency and reduced emissions further fuels the demand for pentane-based products. However, the Europe pentane market growth faces several restraints despite its growth potential. One of the primary challenges is the stringent government regulations concerning the use of pentane due to its high volatility and hazardous effects on human health and the environment. These regulations limit the adoption and production of pentane across various industries.

Segments Overview

The Europe pentane market is segmented on the basis of isomer type, application, and country. By isomer type, the market is classified into n-pentane, isopentane, and neopentane. n-pentane segment was the highest revenue contributor in 2023. The surge in demand for n-pentane across Europe is driven by several factors such as the push for energy-efficient buildings and stringent EU energy regulations, and the automotive industry's need for lightweight materials to improve fuel efficiency and reduce emissions.

By Isomer Type

n-pentane is projected as the most lucrative segment.

Furthermore, there is a significant push for energy-efficient buildings across Europe, largely driven by stringent EU energy regulations. These regulations aim to reduce energy consumption and carbon emissions from buildings. n-Pentane is used as a blowing agent in the production of insulating materials such as expanded polystyrene (EPS) and extruded polystyrene (XPS) foams. These materials are crucial for effective thermal insulation in buildings, helping to meet the EU's energy efficiency targets.

The automotive industry is increasingly focused on developing lightweight materials to improve fuel efficiency and reduce emissions. n-Pentane-based foams are used to create lightweight, energy-absorbing structures within vehicles. This helps in reducing the overall weight of the vehicle, thereby improving fuel efficiency, and contributes to meeting emission standards. In addition, n-Pentane is used in renewable energy applications, such as in Organic Rankine Cycle (ORC) systems in geothermal power plants.

These systems convert low-temperature geothermal heat into electricity, aligning with Europe's sustainability initiatives and goals for increasing the share of renewable energy in the energy mix. This combination of regulatory compliance, environmental benefits, and industrial versatility fuels the increase in demand for n-pentane in the European market.

By application, the market is divided into blowing agent, chemical solvent, electronic cleansing, aerosol propellants, and others. The blowing agent segment was the highest revenue contributor, growing with a CAGR of 5.4%. Pentane serves as a crucial blowing agent in various industries across Europe, particularly in the production of foam-based materials. Its role in this context is paramount, especially in the manufacturing of insulation materials, packaging foams, and construction materials.

By Application

Blowing Agent is projected as the most lucrative segment.

In the construction sector, pentane is extensively used in the production of polyurethane (PU) foam insulation panels, which are integral for enhancing energy efficiency in buildings. These panels effectively reduce heat loss and provide thermal insulation, thereby contributing to sustainable building practices. Its low thermal conductivity makes it an ideal choice for ensuring optimal insulation performance.

Furthermore, application of pentane extends to the packaging industry, where it plays a vital role in the production of expanded polystyrene (EPS) foam. EPS foam is widely utilized for packaging fragile goods due to its lightweight nature and excellent cushioning properties. Pentane facilitates the expansion of polystyrene beads during the manufacturing process, resulting in the formation of lightweight foam structures with high impact resistance. Moreover, its use as a blowing agent aligns with the European Union's stringent regulations aimed at reducing the environmental impact of chemical substances. It is favored for its relatively low ozone depletion potential (ODP) and global warming potential (GWP) compared to alternative blowing agents, making it a more environmentally sustainable choice. Depending on country, the Europe pentane market share is analyzed across the Germany, France, Spain, Italy, UK, and rest of Europe.

Competitive Analysis

The key players analyzed and profiled in this report are Air Liquide, Chevron Phillips Chemical Company LLC., ExxonMobil Corporation, Balchem Corp., HCS Group GmbH., Isolab Laborgeräte GmbH, MOL GROUP, Petr Švec - PENTA s.r.o., Phillips 66 Company, and Shell Plc. These players have adopted business expansion, partnership, and product launch as their key strategies to increase their market shares. For instance, in 2023, HCS Group GmbH's introduction of ISCC Plus certified mass balance n-pentanes, iso-pentanes, and cyclopentanes marks a significant step towards sustainability in the chemical industry. These new materials, essential in applications such as insulation, feature a significantly lower carbon footprint compared to traditional pentanes due to their sustainable production processes and adherence to ISCC Plus certification standards. This certification ensures the materials are derived from bio-based or recycled resources, supporting the insulating industry’s efforts to advance towards a circular economy by minimizing waste and maximizing resource efficiency. Consequently, this innovative product launch has increased the demand for pentanes in the European market, where stringent environmental regulations and strong sustainability commitments drive the need for eco-friendly industrial solutions.

Key Market Trends

- As per Europe Pentane market analysis, by isomer type, the n-pentane segment was the highest revenue contributor in 2023.

- By application, the blowing agent segment was the highest revenue contributor, growing with a CAGR of 5.4%.

- By country, Germany was the highest revenue contributor, growing with a CAGR of 6.3%.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Europe Pentane market analysis from 2023 to 2033 to identify the prevailing Europe Pentane market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Europe Pentane market segmentation assists to determine the prevailing market opportunities.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the Europe Pentane market trends, key players, market segments, application areas, and market growth strategies.

Europe Pentane Market Report Highlights

| Aspects | Details |

| By Isomer type |

|

| By Application |

|

| By Country |

|

| Key Market Players | Shell Plc., ExxonMobil Corporation, Phillips 66 Company, Balchem Corp., Air Liquide, Petr Švec - PENTA s.r.o., Isolab Laborgeräte GmbH, Chevron Phillips Chemical Company LLC., HCS Group GmbH., MOL GROUP |

Analyst Review

According to the insights of CXOs of the leading companies, the Europe pentane market is anticipated to grow at a notable growth rate in the coming years owing to rise in demand for pentane. In addition, it is used as a transportation fuel and improves shale gas production activities, which boosts market growth. The Europe pentane market is expected to grow at the highest growth rate owing to increased support by the European government to encourage the production of gasoline.

Pentane is used as a component in transportation fuels, offering an alternative to traditional fuels. Its properties make it suitable for blending with gasoline, enhancing fuel performance and efficiency. The use of pentane in transportation fuels supports the diversification of energy sources and contributes to the reduction of dependence on conventional fossil fuels. In addition, pentane plays a role in enhancing shale gas production activities. It is used in hydraulic fracturing (fracking) fluids to improve the extraction process by reducing the viscosity of the fluid and facilitating the release of gas from shale formations. As shale gas production continues to be a significant part of the energy landscape in Europe, the demand for pentane in this sector is expected to rise.

Moreover, technological advancements in pentane have significantly enhanced its applications, particularly in insulation, solvents, and energy sectors. Enhanced purification processes now allow for the production of high-purity pentane, minimizing impurities that affect performance in critical applications such as pharmaceutical synthesis and high-performance insulation materials. In addition, improvements in pentane-based blowing agents have led to better insulation foams with higher efficiency and lower thermal conductivity, which are crucial for energy-saving applications. These advancements contribute to pentane's increased effectiveness and broader utility in various industrial processes.

The pentane market in Europe is predominantly fueled by increasing demand from the construction and insulation sectors, where pentane serves as a crucial blowing agent in manufacturing polyurethane and polystyrene foams. However, the market encounters challenges due to environmental apprehensions and regulatory limitations concerning volatile organic compounds (VOCs), which may influence pentane's utilization and production. Despite these obstacles, there exist substantial growth prospects. These include advancements in environmentally friendly pentane production technologies and the rising need for energy-efficient insulation materials, which present promising opportunities for market expansion in the region.

The Europe pentane market was valued at $105.6 million in 2023 and is projected to reach $180.1 million by 2033, registering a CAGR of 5.5%.

The key players analyzed and profiled in this report are Air Liquide, Chevron Phillips Chemical Company LLC., ExxonMobil Corporation, Balchem Corp., HCS Group GmbH., Isolab Laborgeräte GmbH, MOL GROUP, Petr Švec - PENTA s.r.o., Phillips 66 Company, and Shell Plc.

Rising demand for sustainable building practices is the main opportunity of Europe pentane market.

The Europe pentane market is segmented on the basis of isomer type, application, and country. By isomer type, the market is classified into n-pentane, isopentane, and neopentane. Based on application, the market is divided into blowing agent, chemical solvent, electronic cleansing, aerosol propellants, and others. Depending on country, the market is analyzed across the Germany, France, Spain, Italy, UK, and Rest of Europe.

The availability of pentane and its price are affected by fluctuations in crude oil prices, as it is derived from petroleum. Supply chain disruptions or geopolitical tensions lead to price volatility and supply issues, affecting market stability.

By application, the blowing agent segment was the highest revenue contributor in 2023.

Loading Table Of Content...