Exchange-traded Fund Market Research, 2031

The Global Exchange-traded Fund Market was valued at $13828.9 billion in 2021, and is projected to reach $108234.7 billion by 2031, growing at a CAGR of 23.2% from 2022 to 2031.

Exchange traded fund (ETF) is a sort of investment fund and exchange-traded product, which is typically listed on a stock exchange. Further, these funds are often similar to mutual funds in terms of risks, investment avenues, and fund management, however with a specific distinction like the impact of market volatility, affordability, and involvement of transaction costs. For instance, ETFs are generally more affordable than mutual funds, as ETF involves only expenses required to pay to brokers, and excludes management fees, account fees, exchange fees, and redemption fees. Moreover, an ETF often utilizes an exchange mechanism to keep its trading close to its Net Asset Value (NAV), however, deviations can occasionally occur in particular cases. In addition, ETFs focus on following the market trend, and a large share of them are index funds. Therefore, these fund portfolios imitate the holdings of a specific bond, stock, or commodity market segment.

Increase in the role of passive investment strategies is driving the growth of the market. In addition, growing government support for the exchange-traded fund market and a surge in demand for physical ETFs are fueling the growth of the exchange-traded fund market. However, increased risk to financial market stability as well as the availability of alternative trading funds limits the growth of this market. Conversely, the advent of the computer-built ETF is anticipated to provide numerous opportunities to exchange traded fund industry during the forecast period.

The report focuses on growth prospects, restraints, and analysis of the global exchange-traded fund market trend. The study provides Porters five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and the bargaining power of buyers on the global exchange-traded fund market share.

The exchange traded fund market is segmented into Type, Distribution Channel, and Investor Type.

Segment Review

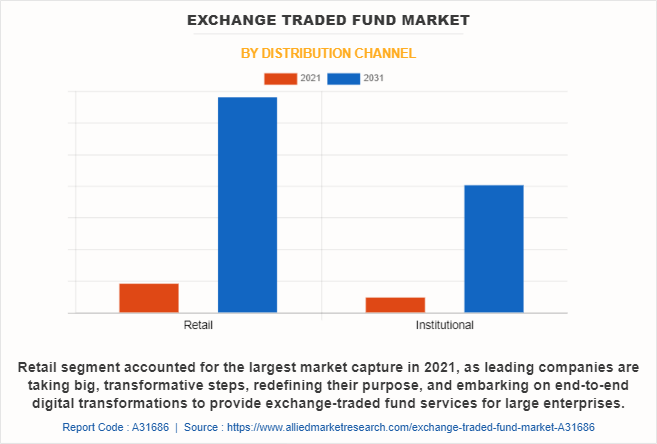

The exchange traded fund market is segmented on the basis of type, distribution channel, investor type, and region. By type, it is categorized into fixed income/ bonds ETFs, equity ETFs, commodity ETFs, currency ETFs, specialty ETFs, and others. By distribution channel, it is bifurcated into retail and institutional. By investor type, it is segregated into individual investors and institutional investors. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on the distribution channel, the retail segment dominated the exchange-traded fund market share in 2022 and is expected to continue this trend during the forecast period, owing to the rapid adoption of trading services among retail organizations, which focuses on enhancing organizational management. However, the institutional segment is expected to witness the highest growth in the upcoming years, owing to the rise in the adoption of ETF solutions by the institutes in order to sustain itself in the market and remain productive.

Region-wise, the exchange traded fund market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to implementation of value-based revenue models and other strategies is the primary aspect supporting the growth of the market. In addition, rise in usage of ETFs in portfolios to seek outcomes diverging from the general market, further aids the growth of the exchange-traded fund market in this region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the rising demand for exchange-traded funds for improving security in trading across the commercial facilities and banking verticals, which are expected to fuel the exchange traded fund market trends in this region.

The global exchange-traded fund market is dominated by key players such as BlackRock, Inc., Charles Schwab & Co., Inc., First Trust Portfolios L.P., Goldman Sachs, Invesco Mutual Fund, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., State Street Corporation, The Vanguard Group, Inc., and WisdomTree. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

COVID-19 Impact Analysis

The exchange traded fund market has witnessed growth in the past few years; however, due to outbreak of the COVID-19 pandemic, the market has witnessed a decline in growth in 2020. This is a result of an increase in social isolation and distant labor, which makes it challenging for exchange-traded funds in financial organizations to gather data from a variety of areas and sources. These aspects have enhanced the possibility of risk in the form of unregistered channels to transmit false trade reports, which provide a significant attribute for exchange traded fund market analysis.

Top Impacting Factors

Increase in the Role of Passive Investment Strategies

The growing popularity of passive investing strategies through index mutual funds and exchange-traded funds (ETFs) has grown substantially over recent years, displacing higher-cost active investment styles. Due to a larger correlation of returns and less security-specific pricing information, a move towards passive investing might have an impact on the securities markets. In addition, it could also affect aggregate investment fund flows and market price dynamics, which can boost the acceptance of exchanges trade funds market. Furthermore, a passive mutual fund is preferred as strategies as it offers stable flows as compared to active mutual funds which exhibited persistent outflows. thus, this is also acting as the driving factor for market growth.

Moreover, a passive investment approach follows the performance of an index of prices, such as a recognized market benchmark. Typically, it is accomplished by owning each of the index's component securities in accordance with their representation in the index. Maintaining a passive investment strategy requires no trading in the absence of changes in index composition, creating considerable demand for passive ETFs among the end-user base. Moreover, passively managed funds are investment methods that offer diversified and low-fee portfolios, which is attracting customers. This factor is also driving the growth of the market.

Growth in Government Support for the Exchange-traded fund Market

Increased investor money is flowing into capital markets through mutual funds across the globe. In order to diversify its holdings, the government is planning to use an exchange-traded fund, thus investors are looking to purchase shares of public sector companies (PSEs) (ETF). Many regional governments, particularly those in developed and emerging nations like India, are embracing the ETF route to meet their divestment goals. ETF investment is assisting in raising the proportion of commodities and equities, which has further contributed to preparation for new ETF categories including debt and smart beta ETFs. As a consequence, there is a sharp growth in the market's demand for ETFs.

Furthermore, the government endeavors to introduce Bharat Bond ETF, India's first corporate bond Exchange Traded Fund (ETF), to serve to assure a larger investor base by attracting retail and High Net worth Individuals (HNI). This led to an increase in the demand for bonds, thus reducing the cost of borrowing for borrowers i.e., government organizations. The Bond ETF is anticipated to gradually enhance the size of bond ETFs in India by offering security, liquidity, and predictable tax-efficient returns. As a consequence, it is anticipated that this factor would increase the growth share in the Indian ETF industry.

Digital Capabilities

Exchange trade finance is focusing on increasing liquidity and mitigating credit risk in both domestic and international trade transactions. Trade finance usually involves a seller or exporter of goods and services, a buying organization or importer, and various intermediaries, including banks, financial institutions, and service providers. Sellers and buyers are constantly looking to improve their working capital and cash flow while mitigating the risk of supply chain disruptions.

Furthermore, the utilization of new-age technologies such as blockchain, artificial intelligence, big data, Optical Character Recognition (OCR) and machine learning, Distributed Ledger Technologies (DLT), and others in the exchange-traded fund market create lucrative opportunities for market players in the trade finance market. Moreover, the primary benefits of blockchain technology in exchange-traded finance can be summarized as efficiency, traceability, auditability, transparency, and security. It provides convenience to stakeholders to digitally share real-time, accurate, and reliable trade information. These benefits are likely to support the growth of the exchange-traded fund market worldwide. In addition, the utilization of DLT provides trade finance providers real-time visibility on trade and finances, which in turn, decreases the overall financing risk and contributes to exchange traded fund market growth.

On the other hand, consecutive lockdowns, social distancing norms, stay-at-home strategy, and an increased number of COVID-19-positive cases have increased the demand for various new technologies such as electronic invoicing, mobile internet access, blockchain, artificial intelligence, and big data for protecting the interest of the parties involved in the transactions. Financial firms have started adopting holistic trade finance systems such as electronic bills of lading and other e-documents to overcome the challenges. It enhances process efficiency by reducing paperwork and facilitating transactions with customs. These factors are anticipated to provide potential growth opportunities in the coming years.

End-User Adoption

Increase in investments in exchange trade finance tools for monitoring pre-trade, post-trade, and examination of cross-asset and cross-market trades among the small number of organizations that drives the growth of the market. In addition, various fintech organizations are adopting trade finance systems to drive their revenue growth opportunity and to improve service efficiencies, which fuels the adoption of an exchange traded fund industry.

Smaller businesses often have very limited access to loans and other forms of interim financing to cover the cost of goods they plan to buy or sell. It will bridge the financial gap between importers and exporters and provide short to medium-term working capital, providing security of the stock or service being exported or imported with supporting products or structures that allow risk mitigation. Furthermore, exchange trade finance mitigates the credit, payment risks, or default risk that suppliers hold with banks or financial institutions and provide additional security that assures that larger orders can be fulfilled. Therefore, small businesses can trade larger volumes more easily as they work with a stronger credit of end customers. Hence, resolving business constraints such as detecting anomalous behavior, enabling risk-based discovery, and others due to the emerging importance of the trading system will boost the exchange traded fund market size.

Government Initiatives

New trade agreements between cross-border countries provide major opportunities and driving forces in terms of productivity of labor, permits greater use of machinery, overcome technical support, stimulate innovations, and enable trading countries to enhance their economic development. Moreover, increased competition in foreign trade also drives niche opportunities for the market. Such trade agreements improve local credit, by lowering the cost of borrowing or financing expansion and empowering domestic and small & medium-sized enterprises in the market. Furthermore, an increase in support from governments for strengthening international trade and enhanced support for SMEs by facilitating regulatory and financial support traders drive the exchange-traded fund market growth.

Moreover, governments in developed and developing countries allow international businesses to set up operations in their countries and encourage foreign investments to enhance trade finance. Therefore, these are the major growth factors for the exchange traded fund market opportunity.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global exchange traded fund market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on exchange traded fund market trends is provided in the report.

- Porters five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the exchange traded fund market outlook.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global exchange traded fund market share, key players, market segments, application areas, and market growth strategies.

Exchange Traded Fund Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 108.2 trillion |

| Growth Rate | CAGR of 23.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 173 |

| By Type |

|

| By Distribution Channel |

|

| By Investor Type |

|

| By Region |

|

| Key Market Players | BlackRock, Inc., The Vanguard Group, Inc., WisdomTree , Charles Schwab & Co., Inc., First Trust Portfolios, L.P., State Street Corporation, JPMorgan Chase & Co. , Invesco Mutual Fund, Goldman sachs, Mitsubishi UFJ Financial Group, Inc. |

Analyst Review

The global demand for exchange-traded funds has been on the rise for the past few years and the market is expected to continue this trend in the coming years as well. This is attributed to the significant advantages of exchange-traded funds, such as low expense ratios, and fewer broker commissions and ETF does risk management through diversification. In addition, the growing demand for higher flexibility and reliability in many regions of the globe is promising new opportunities for the growth of the exchange-traded fund market.

Key providers of the exchange-traded fund market such as Black Rock, State Street, Invesco, and Vanguard group account for a significant market share. With larger requirements for scalability and security, various companies have launched enhanced versions of their products to provide greater flexibility in terms of consulting. For instance, in October 2021, Vanguard completed the acquisition with Just Invest, a provider of tax-managed, tailored wealth management technology. The acquisition adds direct indexing, or personalized indexing, capabilities to bolster Vanguard’s world-class investment product lineup and service offering for investment advisors. Such strategic developments will further drive the growth of the market.

In addition, with the surge in demand for exchange-traded fund solutions, various companies have expanded their current services to continue with the rising demand in the market. For instance, in June 2022, State Street and FundGuard announced a strategic partnership to deliver accounting solutions for State Street Alpha. FundGuard is a highly scalable cloud-native investment accounting, fund accounting, and contingency NAV solution. The FundGuard accounting solution will be integrated for straight-through processing from portfolio management and trading. Furthermore, this strategic launch and partnership are expected to drive market growth.

Moreover, market players are expanding their business operations and customers by increasing their product range. For instance, in November 2021, Goldman Sachs Asset Management announced the launch of three new actively managed, fully transparent equity ETFs, including the Goldman Sachs Future Consumer Equity ETF (GBUY), the Goldman Sachs Future Health Care Equity ETF (GDOC), and the Goldman Sachs Future Real Estate and Infrastructure Equity ETF (GREI), collectively the “Funds”. Such market trends are significantly expanding the growth potential of the global exchange-traded funds market.

The exchange traded fund market is estimated to grow at a CAGR of 23.2% from 2022 to 2031.

The exchange traded fund market is projected to reach $ 108,234.65 billion by 2031.

Increase in role of passive investment strategies, growing government support for the exchange-traded fund market and a surge in demand for physical ETFs contribute toward the growth of the market.

The key players profiled in the report include BlackRock, Inc., Charles Schwab & Co., Inc., First Trust Portfolios L.P., Goldman Sachs, Invesco Mutual Fund, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., State Street Corporation, The Vanguard Group, Inc., and WisdomTree.

The key growth strategies of exchange traded fund market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...