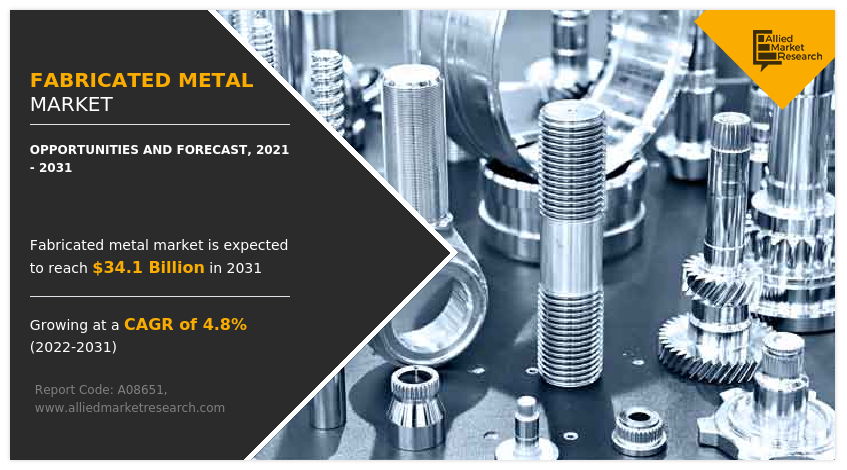

Fabricated Metal Market Research, 2031

The global fabricated metal market size was valued at $21.4 billion in 2021, and is projected to reach $34.1 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

Metal fabrication is the manufacturing process used to convert raw metal into parts or other end products. Fabricated metal products include hand tools, bolts, nuts, screws, cans, pipe & pipe fittings, and others.

The machinery manufacturing and fabricated metal production industry have seen an upsurge in employment since 2020. For instance, according to a report by the U.S. Bureau of Labor Statistics, the number of employments in metal fabrication sector is increasing yearly. In addition, technological developments and growth in R&D activities are anticipated to further foster the growth of the fabricated metal market. Key-players in metal fabrication use advanced production technologies in order to widen the use of fabricated metal parts across different industrial sectors.

For instance, CAD software plays crucial role in design of metal fabrication projects. Technological advancement in CAD software has allowed sheet metal fabricators to design and manufacture fine-tuned parts for demanding applications across aerospace and marine end-use industries. Other factors such as the implementation of automation, emerging market, and growth in demand for additive manufacturing technology is further expected to drive the demand for the fabricated metal market.

Aluminum metal is a widely preferred fabrication metal owing to its lightweight and malleability. In addition, high strength-to-weight ratio of aluminum makes it easy to fabricate into different shapes depending upon its intended application. Fabricated aluminum is gaining importance in the aerospace end-use industry in the key market trend. Strength to weight ratio and corrosion resistance properties of aluminum makes it viable to be used for the fabrication of wings, fuselage, and other aerospace parts. On the other hand, it can also be used in packaging end-use industry for manufacturing cans and foil, owing to its easy workability, softness, and durability of fabricated aluminum. All these factors drive the demand for the global fabricated metal market.

However, the high cost associated with setting up of metal fabrication business restrains market growth. New key entrants are anticipated to step back on setting up fabrication facilities. Tools and equipment used for metal fabrication are generally expensive. In addition, metal fabrication is a cost-associated technique due to the requirement of a post-fabrication process for the manufactured metal parts. For instance, fabricated metal parts require additional fabrication processes such as de-burring, finishing, and painting that further tend to increase production time and cost.

Fabricated metal parts such as high-precision tubes, channels, beams, and angles are used across building and construction industry. In addition, fabricated metal also finds application across interior and exterior buildings. Fabricated metal can also be used in applications such as commercial buildings, residential buildings, production halls, logistical buildings, and others. The efficiency, durability, versatility, and toughness of steel make it ideal for the fabrication of parts used in commercial buildings. Other applications of fabricated metal in commercial buildings include training centers, showrooms, supermarkets, departmental stores, office premises, sports halls, parking lots, and others. This factor is anticipated to offer new growth opportunities in the global fabricated metal market.

In addition, structural properties and compressive strength of steel make it the most wide use fabricated metal in the construction industry. Affordability of fabricated steel makes it viable to be used for construction of large warehouses. The mining industry majorly uses fabricated steel for applications such as shovels, trucks, loading machines, and other mining industry equipment. Pipes, graters, and fittings are other applications that use fabricated steel. Energy industry also uses fabricated steel for applications across pipelines, transmission towers, oil & gas wells, solar panels, and electric-powered turbines. In addition, fabricated steel is widely used and produced by fabricated metal owing to its reliability, cost, mechanical properties, and flexibility.

Other end-use industries of fabricated steel include aerospace, automobile, manufacturing, and shipping. Fabricated steel application includes handrails, sub-assembly products, process modules, skids, trusses, and others. The automotive industry and fabricated steel sector are interconnected. Metal stamping is the most widely used steel fabrication technology in automotive industry for producing car frames, car customization services, vintage car restoration, and roll cages. This factor is anticipated to offer lucrative growth opportunities during the forecast period.

Growth in demand for fabricated copper metal

Copper fabrication is the process of converting raw copper into sheet metal. Fabricated copper is used across several industrial sectors such as construction, automotive, renewable energy, electrical, and others. The demand for copper sheet metal fabrication has skyrocketed owing to its wide industrial applications is the key market trend. The malleability, conductivity, corrosion resistance, and affordability of copper make it an ideal choice for fabrication of roofing, electrical wirings, telecommunication cables, and the renewable energy industry. Copper can be molded into different customizable shapes owing to its malleability, thus extending use of fabricated copper across industrial applications.

In addition, conductivity of copper allows proper electrical and heat conduction, thus making it a top priority in equipment electrical wiring applications, which drives the demand for the fabricated metal market. In addition, fabricated copper finds application across bus bars or assemblies, copper connectors, 3-phase delta, furnace electrode arms, and electrode holders. On the other hand, copper can be alloyed with nickel to widen its application. All these factors have escalated the demand for the global fabricated metal market.

The fabricated metal market is segmented on the metal type, application, end-use industry, and region. On the basis of metal type, the market is divided into aluminum, steel, copper, magnesium, and others. On the basis of application, covered in the report include hand tools, bolts, nuts & screws, cans, pipes & pipe fittings, metal windows & doors, and others. On the basis of end-use industry, the global fabricated metal market is divided into manufacturing, building & construction, energy & power, automotive, aerospace, electrical & electronics, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players in the fabricated metal industry include Metals Fabrication Company, Stanley Black & Decker Inc., Illinois Tool Works Inc., Unites States Steel Corp., Arconic, Levestal, The Federal Group USA, Veriform Inc., Alusite Precision Co. Ltd., and Klockner Metals Corporation.

Fabricated metal market, by metal type

On the basis of metal type, the market is divided into aluminum, steel, copper, magnesium, and others. The copper segment accounted for the largest market share of 50% in 2021 and is expected to maintain its dominance during the forecast period. The malleability, conductivity, corrosion resistance, and affordability of copper make it an ideal choice for fabrication of roofing, electrical wirings, telecommunication cables, and renewable energy industry. The malleability of copper allows it to be molded into different customizable shapes, thus extending its use across industrial applications. In addition, the conductivity of copper allows proper electrical and heat conduction, thus making it a top priority in equipment electrical wiring applications.

Fabricated metal market, by application

On the basis of application, it is divided into hand tools, bolts, nuts & screws, cans, pipes & pipe fittings, metal windows & doors, and others. Bolts, nuts & screws application accounted for the largest revenue share of 28% in 2021. Bolts such as eye bolts, hook bolts, J-bolts, and U-bolts are used for the attachment of ropes, cables, and others. All these factors drive the demand for the fabricated metal market. Foundation bolts are the type of fabricated metal bolts that are used in pre-engineered buildings, attachment of large equipment or machinery to their respective foundation, and construction applications that drive the demand for the market.

Fabricated metal market, by end-use industry

On the basis of end-use industry, it is divided into manufacturing, building & construction, energy & power, automotive, aerospace, electrical & electronics, and others. The building & construction end-use industry is anticipated to grow at the fastest CAGR of 5.3% in the forecast period. There is an increase in demand for fabricated steel across residential buildings owing to its cost-effectiveness which drives the demand for the global fabricated metal market. In addition, the use of fabricated steel cuts down construction time and various contemporary designs can be made using fabricated steel parts. Industrial facility construction mainly uses fabricated steel to cut down the cost associated with building the facility. For instance, fabricated steel parts such as sectional angles and beams can be used to construct large industrial facilities with minimal cost as compared with other construction materials.

Fabricated metal market, by region

On the basis of region, Asia-Pacific accounted for 44% fabricated metal market share in 2021 and is expected to maintain its dominance during the forecast period. Application of fabricate metal in commercial building includes training centers, showrooms, supermarkets, departmental stores, office premises, sports hall, parking lots, and others. All these factors boost the demand for the fabricated metal market in Asia-Pacific. The manufacturing sector is further foreseen to augment the growth of metal fabrication industry in India.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fabricated metal market analysis from 2021 to 2031 to identify the prevailing fabricated metal market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fabricated metal market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fabricated metal market trends, key players, market segments, application areas, and market growth strategies.

Fabricated Metal Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 34.1 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 420 |

| By Metal Type |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Kloeckner Metals Corporation, Levstal, Metals Fabrication Company, Alusite Precision Co., Ltd., Illinois Tool Works Inc., United States Steel Corp., Arconic, Veriform Inc., The Federal Group USA, Stanley Black and Decker Inc. |

Analyst Review

Fabricated metal is used to produce diverse hand tools such as stainless steel rulers, end-cutting nippers, metal markers, tape measures, precision squares, and others. In addition, other hand tools manufactured using fabricated metal include pocket scribers, center punches, combination spanners, paint markers, and others. Fabricated bolts are used in applications such as boilers, bridges, construction machinery, engineered plumbing, hydraulics, machine tools, and others is the key market trend. On the other hand, fabricated bolts are used across different industrial sectors such as agricultural equipment, automotive, construction, marine, mining, and oil & gas, which drive the demand for the fabricated metal market. Growth in demand for safe and hygienic packaging of food products has escalated the demand for general-line cans. General line cans are safe, reliable, and offer an aesthetic look thus there is growing demand for these cans across food packaging is the key market trend. There are several factors that determine the shelf life of packaged food in cans. Fabricated general line cans offer high barrier capacity to oxygen, moisture, bacteria, sunlight, and other environmental factors that in turn extend the shelf life of the food products. Baby food, protein powder, coffee or tea powder, and other powdered products are generally packed using general line cans. Stainless steel fabricated metal is used to produce custom electrical metal boxes, instrumentation boxes, and other electrical enclosers is the key market trend. The growth of electronic sector is huge and fabricated sheet metal products are crucial choice in electronics industry. Application of metal fabricated parts in electronic industry includes sheet metal enclosures, housings, chassis, brackets, and cabinets. All these factors boost the growth of the fabricated metal market.

Reshoring, automation of metal fabrication, digitization for metal fabrication, and cybersecurity for metal fabrication are the upcoming trends of fabricated metal market in the world

Bolts, nuts and screws is the leading application of fabricated metal market.

Asia-Pacific is the largest regional market for fabricated metal

The global fabricated metal market was valued at $21.4 billion in 2021, and is projected to reach $34.1 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

Unites States Steel Corp., Arconic, Levestal, The Federal Group USA, Veriform Inc., Alusite Precision Co. Ltd., and Klockner Metals Corporation are the top companies to hold the market share in Fabricated Metal

Loading Table Of Content...