Feminine Hygiene Products Market Research, 2030

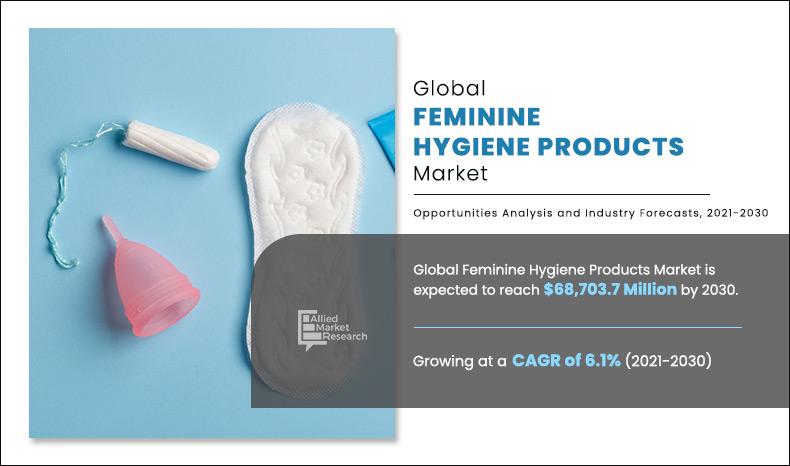

The global feminine hygiene products market size was valued at $38.9 billion in 2020, and is projected to reach $68.7 billion by 2030, registering a CAGR of 6.1% from 2021 to 2030.Feminine hygiene products are used to maintain personal hygiene during the time of menstruation, to clean vaginal discharge, remove unwanted hair, and keep internal body parts clean. Sanitary pads, tampons, internal cleaners & sprays, panty liners & shields and disposable razors & blades are collectively termed as feminine hygiene products.

Innovative product launches along with increasing health concerns amongst women drive the growth of the market. Moreover, increase in number of working women across the globe has fueled the growth of the market. Furthermore, these feminine hygiene products are easily available through various sales channels including online stores, supermarkets, hypermarkets, specialty stores, pharmacy and others, which, in turn, contributes towards the feminine hygiene products market growth.

Surge in awareness towards maintaining personal hygiene is one of the major factors accelerating the growth of the feminine hygiene industry especially in developing countries.

Currently, the awareness regarding personal hygiene in women is increasing due to various government initiatives and number of campaigns carried out on social media. These initiatives and campaigns contribute to better understanding and acceptance of female hygiene products. Therefore, rise in awareness towards personal hygiene is propelling the growth of feminine hygiene products market.

The feminine hygiene products market segment are categorized into nature, product type, distribution channel, and region. By nature, it is classified into disposable and reusable. By product type, it is divided into sanitary pads, tampons & menstrual cup, panty liners & shields, internal cleansers & sprays, and disposable razors & blades. By distribution channel, it is segregated into supermarkets/hypermarkets, pharmacy, online stores, and others.

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, India, Australia & New Zealand, Japan, South Korea, ASEAN, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Argentina, and Rest of LAMEA).

By nature, the disposable segment accounted for the highest feminine hygiene products market share in 2020. This is due to the fact that disposable feminine hygiene products are easily available in the market through various retail stores including online store, supermarket, hypermarket, discount store, and others. However, the reusable segment is expected to be the fastest growing segment during the forecast period.

By Nature

Reusable segment is expected to grow at highest CAGR of 7.2% during the forecast period

By product type, the sanitary pads segment accounted for the highest market share in the global feminine hygiene products market in 2020. Increase in awareness about personal hygiene is a major factor propelling the growth of the sanitary pads across the globe.

Furthermore, increasing disposable income, large number of promotional activities adopted by marketers, education and government initiatives have led to rising demand for sanitary pads. However, tampons and menstrual cup segment is expected to be the fastest growing segment during the forecast year.

By Product Type

Tampons and Menstrual Cups segment is expected to grow at highest CAGR of 7.4% during the forecast period.

By distribution channel, the supermarket & hypermarket segment accounted for the highest market share in the global feminine hygiene products market in 2020. This is due to the heavy discounts and offers provided by the stores to the customers that help to boost the sales of feminine hygiene products through supermarket & hypermarkets stores across the globe, which notably contributes toward growth of the overall market. However, the online store segment is expected to be the fastest growing segment during the forecast period, in terms of value sales.

By Distribution Channel

Online Channels segment is expected to grow at highest CAGR of 8.3% during the forecast period.

By region, the feminine hygiene products market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for the highest market share in 2020. Rise in number of women populations in countries like India and China along with rising inclination of females towards maintaining personal hygiene has driven the sales of feminine hygiene products ultimately contributing toward growth of the overall market. However, North America is anticipated to be the fastest growing segment during the forecast period.

By Regions

North America dominates the market and is expected to grow at highest CAGR of 8.4% during the forecast period.

The key players operating in the global feminine hygiene products market focus on prominent strategies to overcome competition and maintain as well as improve the share worldwide.

Some of the major players in the global feminine hygiene products market analyzed in this report include Edgewell Personal Care Company, First Quality Enterprises, Incorporation, Hengan International Group Co. Limited, Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Procter & Gamble Company, Svenska Cellulosa Aktiebolaget (Essity Aktiebolag, Unicharm Corporation and Unilever plc.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the current feminine hygiene products market trends, estimations, and dynamics of the market for the period of 2021–2030 to identify prevailing market opportunities.

The key countries in four major regions have been mapped based on the market share.

- Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen the supplier–buyer network.

- In-depth analysis of the market segmentation assists to determine prevailing feminine hygiene products market opportunities.

- Major countries in each region have been mapped according to the revenue contribution to the global feminine hygiene products industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of market players.

- The report includes both regional as well as global the feminine hygiene products market analysis, key players, market segments, nature areas, and feminine hygiene products market growth strategies.

Feminine Hygiene Products Market Report Highlights

| Aspects | Details |

| By Nature |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

Analyst Review

Players operating in the feminine hygiene products market have adopted key developmental strategies such as product launch to fuel demand for feminine hygiene products in the market, in terms of value sales. In addition, they have also emphasized on continuous innovations in their products to maintain a strong foothold in the market and to boost feminine hygiene products demand globally. In addition, to cater to the rise in needs from the female consumers, manufacturers are continuously developing innovative feminine hygiene products in the market.

CXOs further added that rise in consciousness regarding maintaining personal hygiene among female consumers as well as working women population propels the growth of the feminine hygiene products market. The world feminine hygiene products market has witnessed a significant growth in the past few years. Asia-Pacific emerged as the largest market owing to higher penetration of sanitary pads in this region. Though menstrual hygiene is still a social taboo in Asia, personal hygiene awareness campaigns taken up by government agencies have contributed to increase in demand for sanitary products in this region.

Moreover, cosmetics & personal care products including feminine hygiene products have witnessed prominent adoption in the developing countries such as India, owing to rise in consumer awareness, increase in disposable income, and surge in need for feminine hygiene products. Furthermore, increase in penetration of various online portals globally and rise in number of offers or discounts attract large consumer base to purchase feminine hygiene products through online channels. Moreover, online sales channel has increased consumer reach, making it the key source of revenue for many companies.

However, health concerns due to ingredients used in conventional sanitary napkins is projected to hamper the growth of the feminine hygiene products market during the forecast period.

The global feminine hygiene products market was valued at $38.9 billion in 2020, and is projected to reach $68.7 billion by 2030, registering a CAGR of 6.1% from 2021 to 2030. Feminine hygiene products are type of personal care products, used majorly during menstruation. These products are also used to, remove unwanted hair, and others.

The CAGR of feminine hygiene products market is 6.1% from 2021 to 2030. Feminine hygiene products are used to maintain personal hygiene during menstruation, to clean vaginal discharge, remove unwanted hair, and keep internal body parts clean.

The sample report of feminine hygiene products market is available on request on the website of Allied Market Research. The similar reports are also available on the request on the website of Allied Market Research.

The forecast period in the feminine hygiene products market report is from 2020 to 2030. The increase in consumer awareness and literacy level for maintaining personal hygiene is a major factor that drives the growth of the female hygiene products market across the globe.

The top companies in the global feminine hygiene products market analyzed in this report include Edgewell Personal Care Company, First Quality Enterprises, Incorporation, Hengan International Group Co. Limited, Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Procter & Gamble Company, Svenska Cellulosa Aktiebolaget (Essity Aktiebolag, Unicharm Corporation and Unilever plc.

The feminine hygiene products market is categorized into nature, product type, distribution channel, and region. By nature, it is classified into disposable and reusable. By product type, it is divided into sanitary pads, tampons & menstrual cup, panty liners & shields, internal cleansers & sprays, and disposable razors & blades. By distribution channel, it is segregated into supermarkets/hypermarkets, pharmacy, and online stores. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, India, Australia & New Zealand, Japan, South Korea, ASEAN, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Argentina, and Rest of LAMEA).

U.S. was the highest revenue contributor in the feminine hygiene products market with $7,502.5 million in 2020, and is estimated to reach $16,520.8 Million by 2030, registering a CAGR of 8.3%. Germany was the highest revenue contributor in the feminine hygiene products market with $2,979.8 million in 2020, and is estimated to reach $4,398.4 Million by 2030, registering a CAGR of 4.0%.

The COVID-19 pandemic has not only hampered production facilities but also disrupted supply chains such as material suppliers and distributors of the feminine hygiene products market globally. In addition, owing to the COVID-19 pandemic, consumers are restraining themselves to go outside their homes and in crowded places such as supermarkets and specialty stores, which, in turn, has increased distribution of feminine hygiene products through online stores.

By region, Asia-Pacific will dominate the feminine hygiene products market by the end of 2030. Asia-Pacific is anticipated to experience a significant rise in feminine hygiene products, due to an increase in the number of working professionals who are ready to spend on these items that contribute to personal hygiene.

Loading Table Of Content...