Feminine Intimate Care Market Research, 2034

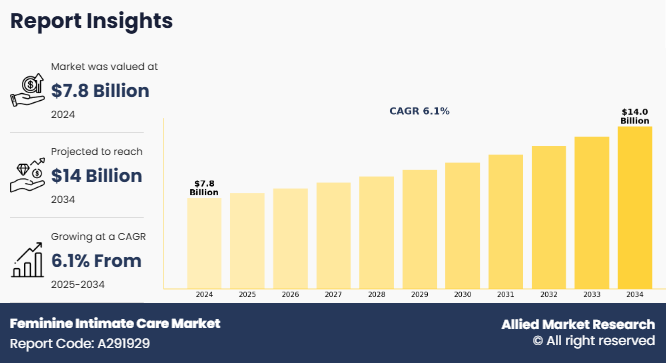

The global feminine intimate care market size was valued at $7.8 billion in 2024, and is projected to reach $14 billion by 2034, growing at a CAGR of 6.1% from 2025 to 2034. Feminine intimate care are products designed for the hygiene, comfort, and well-being of the intimate area. It includes cleansers, wipes, moisturizers, lubricants, deodorants, and anti-itch treatments formulated to maintain pH balance, prevent irritation, and support vaginal health. These products help with daily freshness, dryness relief, and discomfort associated with hormonal changes or infections. Dermatologist-tested and gynecologist-approved options offer safe and gentle care. With growing awareness, the market has expanded to include solutions tailored for different life stages, skin sensitivities, and personal preferences, ensuring better comfort and care.

MARKET DYNAMICS

Growth in intimate care wipes and on-the-go solutions has significantly boosted demand in the feminine intimate care market by addressing the need for convenience, hygiene, and discretion. Consumers increasingly choose portable products that support cleanliness throughout the day at work, during travel, or after exercise. Intimate wipes, designed to maintain pH balance and freshness, provide a quick cleansing option without requiring water. Brands such as Summer’s Eve, Rael, and The Honey Pot Company have expanded product lines with biodegradable and hypoallergenic options, further meeting the demand for skin-friendly and eco-conscious choices. Individually wrapped wipes and compact packaging have made feminine hygiene products more practical for daily use, increasing the adoption of feminine intimate care products across different lifestyles.

Moreover, on-the-go solutions such as cleansing foams, portable bidet sprays, and discreet menstrual care kits have strengthened demand by offering flexible hygiene options. Companies such as Cora and LOLA have introduced compact products made with natural ingredients, catering to consumers seeking gentle and chemical-free solutions. Retailers and online platforms have responded by offering multi-pack options and subscription services, ensuring steady availability to consumers. Thus, the shift toward convenience-driven hygiene products has made intimate care wipes and portable solutions essential in the feminine intimate care market, driving continued growth globally.

Even though the market has experienced rapid growth, certain challenges hinder the market expansion. For instance, the high cost of premium and organic feminine intimate care products limits market demand, particularly among price-sensitive consumers. Products formulated with natural ingredients, free from sulfates, parabens, and synthetic fragrances, often carry higher production costs, which are reflected in retail prices. Intimate washes, wipes, lubricants, and moisturizers made with plant-based extracts, probiotics, or CBD range from $10 to $30, while medicated ointments and anti-itch creams containing colloidal oatmeal or CBD can reach $25 to $40. Higher costs make it difficult for some consumers to purchase these products regularly, affecting overall market expansion. Consumers who prioritize affordability may hesitate to try new products, especially when budget constraints limit spending on personal care essentials.

Brands such as The Honey Pot, Rael, and Good Clean Love offer organic and plant-based formulations, however, their price points may limit accessibility for a wider audience. While growing awareness of natural and skin-friendly ingredients fuels demand for feminine intimate care products, affordability remains a challenging factor. In some regions, economic conditions and lower disposable incomes further restrict the adoption of premium options for feminine intimate care. In addition, the perception that natural formulations have similar effectiveness to standard products may lead consumers to question whether the higher cost is justified. As a result, some consumers may delay purchases or seek out more cost-effective alternatives, hindering the wider growth of the feminine intimate care market.

Furthermore, retail expansion in pharmacies and wellness stores is creating significant opportunities in the feminine intimate care market by increasing accessibility and consumer trust. Pharmacies serve as a reliable distribution channel where consumers can find dermatologist-recommended, gynecologist-approved, and medicated feminine care products. The growing presence of specialized wellness sections within pharmacies has allowed brands to position intimate washes, wipes, lubricants, and moisturizers as essential health and hygiene products. In addition, wellness stores focusing on natural and organic personal care solutions provide a dedicated space for premium and plant-based formulations, catering to health-conscious consumers seeking safe and effective alternatives.

In addition, greater product visibility and availability in pharmacies and wellness stores contribute to the feminine intimate care market growth. In-store consultations, pharmacist recommendations, and promotional discounts encourage consumers to try new products with confidence. The shift toward holistic wellness has also led to an increase in demand for pH-balanced, probiotic-infused, and hormone-friendly formulations. As retailers continue to prioritize feminine intimate care, brands have the opportunity to expand their market presence and reach a wider audience seeking trusted and specialized care solutions.

SEGMENTAL OVERVIEW

The feminine intimate care market is segmented into product, distribution channel, and region. Based on product, the market is divided into intimate wipes, intimate lubricants, cleansing liquid, intimate wash gel, moisturizer, oils, and others. Based on distribution channel, the market is classified into online stores, and offline sales. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

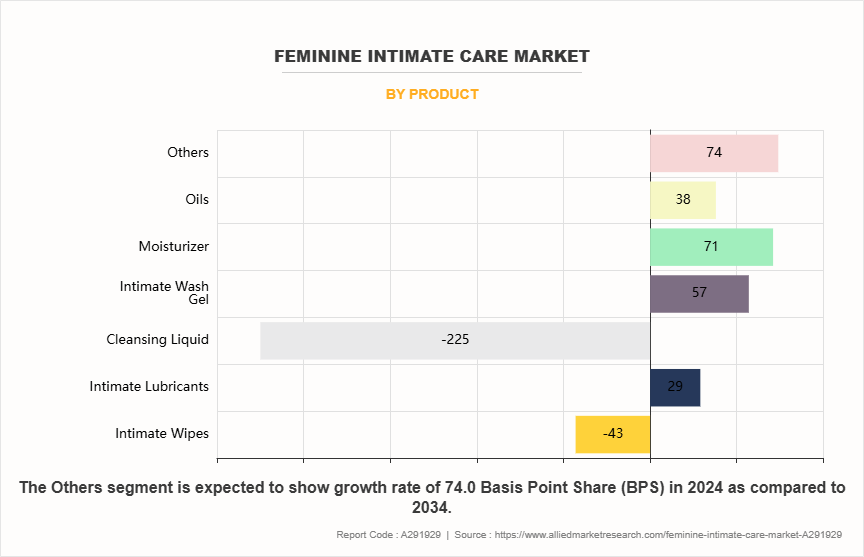

BY PRODUCT

By product, the cleansing liquid segment dominated the global feminine intimate care market in 2024 and is anticipated to maintain its dominance during the forecast period. Demand for feminine intimate cleansing liquids is high owing to increased awareness of intimate hygiene, a strong preference for mild, pH-balanced formulations, and rising concerns over infections and irritation. Consumers seek dermatologist-recommended and gynecologist-tested products with soothing ingredients such as aloe vera, chamomile, and lactic acid, which provide gentle cleansing without disturbing the natural vaginal flora. The shift toward daily hygiene routines, influenced by evolving lifestyle habits and rising disposable incomes, has further strengthened the demand for feminine intimate cleansing liquids. In addition, the preference for liquid formulations over bar soaps or wipes is driven by their ease of application, effective cleansing properties, and non-drying nature. Product innovations, including sulfate-free and plant-based formulas, cater to health-conscious consumers seeking safer alternatives free from harsh chemicals. Moreover, growing consumer inclination toward feminine intimate cleansing liquids addressing specific concerns such as sensitive skin and post-partum care further supports the growth of the cleansing liquid segment.

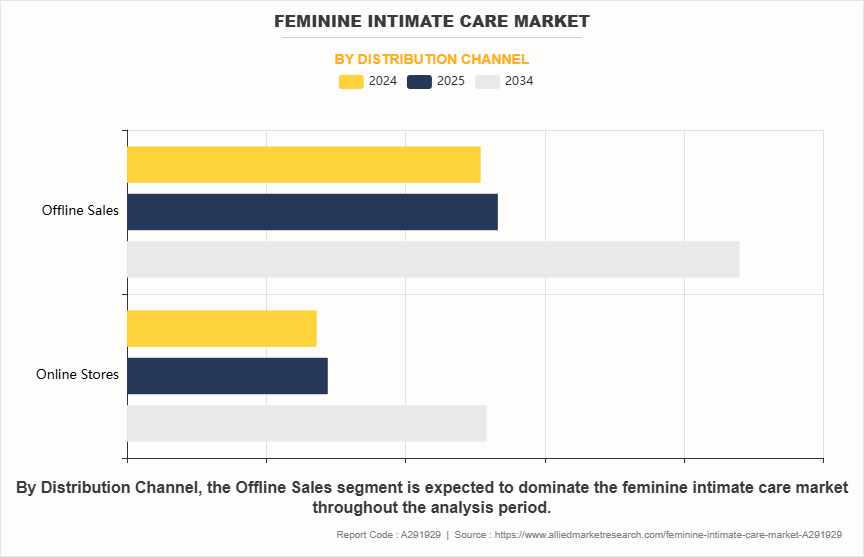

BY DISTRIBUTION CHANNEL

By distribution channel, the offline sales segment dominated the global feminine intimate care market in 2024 and is anticipated to maintain its dominance during the forecast period. Offline channels, including pharmacies, drug stores, supermarkets/hypermarkets, and specialty health and wellness stores, continue to be preferred by a large consumer base owing to the ability to physically assess product labels, ingredients, and packaging. Direct evaluation allows consumers to make informed choices, especially for personal care items such as feminine intimate care. Many consumers value the immediate availability of products, as it eliminates the waiting time associated with online delivery. In addition, shopping in-store offers reassurance and trust when purchasing intimate care products, as consumers can rely on physical inspection and in-person interactions with store staff.

The strong performance of offline sales is further supported by customer loyalty to established retail brands and the convenience of browsing and buying products on a single visit. In-store promotions and the opportunity to interact with knowledgeable staff help build consumer confidence and aid in decision-making. Thus, preference for physical stores remains dominant owing to the immediate product availability and assurance of product quality during the purchase process, driving segmental growth.

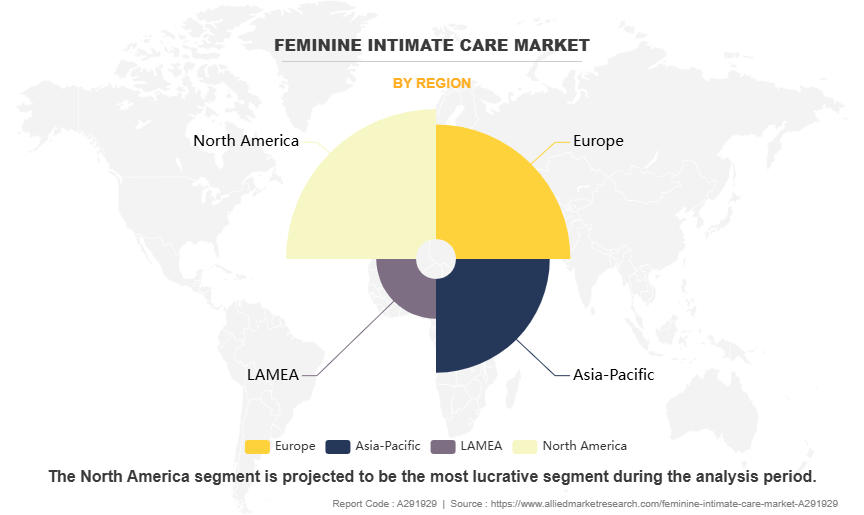

BY REGION

Region-wise, North America is anticipated to dominate the market with the largest feminine intimate care market share during the global feminine intimate care market forecast period. High consumer awareness related to intimate hygiene and a growing preference for products with natural and gentle ingredients have driven demand for feminine intimate care products in the region. Consumers in North America increasingly seek dermatologist-recommended and gynecologist-tested products, which has fueled demand for trusted brands. Established brand presence, such as Procter & Gamble’s Always, Kimberly-Clark’s Kotex, and Edgewell Personal Care’s Playtex, further strengthens market leadership. These brands have earned strong consumer trust through consistent quality and effective marketing strategies. Moreover, a rise in disposable incomes and an increased focus on personal care, driven by health-consciousness, contribute to a steady demand for feminine intimate care products. The region also benefits from a well-developed regulatory environment that ensures product safety and quality, creating further confidence in the market, leading to increased market share in the global feminine intimate care market.

COMPETITION LANDSCAPE

The key players operating in the global feminine intimate care industry include Bayer AG, Corman S.p.A., Kimberley-Clark Corporation, Lil-Lets, Namyaa Care R G Biocosmetic Private Limited, Prestige Consumer Healthcare (Summer's Eve), Procter and Gamble, Sanofi, The Honey Pot Company, and Vagisil (Combe Incorporated). Several well-known and upcoming brands are vying for market dominance in the expanding feminine intimate care market in the region. Smaller niche firms are more well-known for catering to consumer demands and preferences in the global market. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

SOME KEY DEVELOPMENTS IN THE MARKET

- In July 2024, Summer's Eve, a brand of Prestige Consumer Healthcare Inc., launched the Wipe the Day campaign, featuring a 360-degree marketing strategy to highlight Ultimate odor protection products, intimate wellness, and proactive self-care through engaging creative content.

- In April 2024, the Honey Pot launched witch hazel intimate wash and wipes to expand their feminine care line, offering relief from hemorrhoid discomfort while supporting vaginal health.

- In May 2024, Summer's Eve launched the Ultimate odor protection line, addressing intimate hygiene taboos with gynecologist-tested products designed for long-lasting freshness, pH balance, and confidence, including daily refreshing spray, wash, and wipes.

Key Benefits For Stakeholders

- This feminine intimate care market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the feminine intimate care market analysis from 2024 to 2034 to identify the prevailing feminine intimate care market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the feminine intimate care market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global feminine intimate care market trends, key players, market segments, application areas, and market growth strategies.

Feminine Intimate Care Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 14 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Product |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Kimberly-Clark Corporation, Corman SpA, Bayer AG, Namyaa Care R G Biocosmetic Private Limited, Sanofi, The Honey Pot Company, LLC, Procter & Gamble, Prestige Consumer Healthcare (Summer's Eve), Combe Incorporated (Vagisil), Lil-lets |

Analyst Review

This section consists of the opinion of the top CXO in the feminine intimate care market. The global feminine intimate care market has been growing steadily as consumers become more aware of personal hygiene and seek specialized products for intimate wellness. Companies have developed a range of products, including wipes, lubricants, cleansing liquids, wash gels, oils, and moisturizers, with a focus on pH-balanced and dermatologically tested formulations, driving the market growth. Growing accessibility through both online and offline retail channels, particularly through e-commerce platforms, has contributed to increased product adoption across various consumer segments. In addition, changing social perceptions and greater openness regarding intimate care have created a more supportive environment for feminine intimate care market expansion.

Moreover, CXOs have highlighted that product innovation and diversification are key drivers of growth in this market. Companies are launching new formulations to address consumer preferences, including fragrance-free, organic, and plant-based options. CXOs believe that consumer education and transparency in marketing strategies are critical in building trust and encouraging informed purchasing decisions. Regulatory frameworks focusing on product safety and ingredient standards continue to influence market expansion, requiring companies to ensure compliance while maintaining high product quality. Emerging markets in Asia-Pacific and Latin America are expected to offer strong growth potential as purchasing power and awareness increase.

Furthermore, CXOs stated that sustainability has become a major focus, with companies investing in biodegradable packaging and sustainable ingredients to align with evolving consumer expectations. As demand rises for environmentally friendly and ethically sourced products, businesses that integrate sustainability into their product lines and operations are better positioned for long-term success. Companies that remain agile in responding to consumer needs and regulatory developments will be able to strengthen brand loyalty and maintain a competitive edge in the evolving market.

The global feminine intimate care market was valued at $7.8 billion in 2024, and is projected to reach $14 billion by 2034, growing at a CAGR of 6.1% from 2025 to 2034.

The forecast period in the feminine intimate care market report is 2025 to 2034.

The base year calculated in the feminine intimate care market report is 2024.

The top companies analyzed for global feminine intimate care market report are Bayer AG, Corman S.p.A., Kimberley-Clark Corporation, Lil-Lets, Namyaa Care R G Biocosmetic Private Limited, Prestige Consumer Healthcare (Summer's Eve), Procter and Gamble, Sanofi, The Honey Pot Company, and Vagisil (Combe Incorporated).

The cleansing liquid segment is the most influential segment in the feminine intimate care market report.

North America holds the maximum market share of the feminine intimate care market.

The company profile has been selected on the basis of key developments such as partnership, product launch, merger and acquisition.

The market value of the feminine intimate care market in 2024 was $7.8 billion.

Loading Table Of Content...

Loading Research Methodology...