Femtech Market Research, 2033

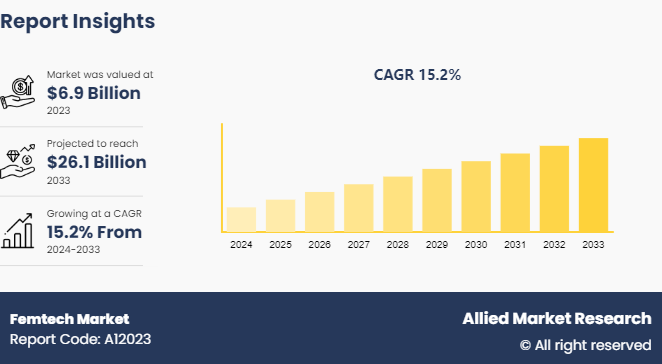

The global femtech market size was valued at $6.9 billion in 2023, and is projected to reach $26.1 billion by 2033, growing at a CAGR of 15.2% from 2024 to 2033.

Market Introduction and Definition

Femtech has emerged as a pivotal field encompassing various technological solutions catering to women's health concerns, spanning menstrual, reproductive, sexual, maternal, and menopausal health. In addition, it addresses conditions like osteoporosis and other health issues that impact women uniquely. This sector has evolved significantly, extending its focus beyond reproductive health to embrace a wider array of conditions such as autoimmune disorders, migraines, and cardiovascular ailments. Femtech plays a crucial role in enhancing healthcare delivery, empowering individuals with self-care tools, and tackling stigmatized health topics. Its importance lies in its ability to cater to conditions that affect women differently or disproportionately, ushering in a new era of personalized and inclusive healthcare solutions.

Key Takeaways

- The femtech market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major femtech industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

With the rise in digital healthcare tools, women are significantly more inclined to utilize digital healthcare tools, exhibiting a 75% higher likelihood compared to men. Particularly in the post-COVID-19 era, mobile applications have surged in popularity as effective aids in managing various symptoms associated with menstruation, fertility, and menopause. Women's healthcare is rapidly gaining precedence, and femtech emerges as a pivotal avenue to amalgamate capital and talent to bridge existing market gaps. A recent analysis from Citi Global Insights delves into the gender health gap, underscoring the role of femtech in leveraging digital technology to address health conditions predominantly affecting women. The burgeoning femtech market share owes its ascent to a confluence of factors including heightened awareness, technological innovations, increased investments, and a high demand for women's healthcare solutions.

In the femtech market share, the stigma associated with women's health and wellness matters can hinder the expansion and acceptance of products and services. Traditionally, women's health topics have been considered taboo, leading to a lack of open discussion. This poses a marketing challenge for femtech firms, especially when targeting older demographics who may be less inclined to engage in such conversations. Femtech enterprises must actively combat this stigma surrounding women's health concerns and raise awareness about the significance of their offerings through education and advocacy efforts.

The merging of wearable technology and women's health technology is paving the way for more accessible digital healthcare solutions tailored to women's needs. Equipped with an array of sensors and supported by AI algorithms, these devices enable real-time tracking and analysis of various health metrics. This capability empowers women to play a proactive role in their healthcare by predicting, preventing, and managing potential health issues.

Femtech wearables offer a wide range of health applications beyond fitness tracking. They include features like menstrual cycle monitoring, stress analysis, sleep tracking, and more. The user-friendly design and immediate feedback provided by these devices enhance the experience of managing one's health, making it more engaging and informative.

The Bellabeat Leaf exemplifies such wearable technology in Femtech. This smart jewelry piece is specifically designed for women's health tracking, covering areas such as physical activity, sleep patterns, stress levels, and menstrual cycles. Its adaptable design allows it to be worn as a necklace, bracelet, or clip, seamlessly blending fashion with health technology. These fcators are anticipated to boost femtech market opportunity.

Macro and Micro Economic Analysis Global Femtech Market

Investment in femtech startups has witnessed a significant uptick over the past decade, with the industry's worth reaching $28 billion in 2023. Although femtech companies constitute a small fraction of overall health investments, their value has steadily grown, buoyed by increasing awareness of women's health issues. In 2022, venture capital funding for femtech companies specializing in menstrual tracking, fertility services, maternal health support, gynecological devices, and menopause apps totaled $840 million, following a similarly successful year in 2021. Initially projected to surpass $103 billion by 2030, the femtech market's growth has encountered various challenges and impediments.

According to Sylvia Kang, Co-Founder and CEO at Mira, “70% of startups in the femtech sector are female founded. Despite this fact, male-founded femtech companies tend to raise much more capital. On an average, female-founded femtech startups have raised $4.6 million, compared to $9.2 million by male-owned companies.”

The industry's potential remains robust, with companies like Clue continuously raising funds to validate its impact. For instance, Clue announced a €7 million ($7.6 million) funding round in April 2023 and a €1.4 million ($1.5 million) crowdfunding round for users. Progyny, a New York-based startup offering fertility benefits for employers, went public in 2019 with a valuation exceeding $1 billion. Tia, another New York femtech company operating hybrid in-person and virtual women's health clinics, secured a $100 million series B funding round in 2021. Additionally, Maven Clinic, a virtual clinic specializing in women's and family health based in New York, announced a $90 million series E round in 2022 led by General Catalyst, a VC firm in Cambridge, Massachusetts. These success stories underscore the immense potential and growing prominence of the femtech industry in reshaping women's healthcare.

Femtech Global VC Investment (Value in Million)

Femtech Global VC Investment | Value in Million |

2019 | 1100.0 |

2020 | 667.7 |

2021 | 2100.0 |

2022 | 1200.0 |

2023 | 882.5 |

Market Segmentation

The femtech market is segmented into type, application, end user, and region. On the basis of type, the market is divided into devices, software, and services. As per application, the market is segregated into pregnancy & nursing care, reproductive health, pelvic & uterine healthcare, general healthcare & wellness, and others. On the basis of end user, the market is bifurcated into direct to customer, hospitals, clinics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The femtech market growth in North America is experiencing robust growth, driven by several key factors. Improved healthcare infrastructure, heightened awareness regarding women's health issues, and greater female workforce participation are set to have a beneficial impact on the growth of the regional femtech market. Increased investments by femtech companies headquartered in North America will further propel market expansion in the region. Consequently, the growing prevalence of chronic ailments and the presence of key industry players are driving up the demand for femtech products and services in North America, positioning the region to hold a notable global femtech market size.

- In January 2024, Owlet, a company renowned for its smart infant monitoring technology, launched BabySat, a novel FDA-cleared pulse oximetry monitoring system designed for infants with particular health requirements. This development came shortly after the company had introduced the FDA-cleared Dream Sock, broadening its range of medical-grade, in-home monitoring devices.

- In November 2023, Clue, a company specializing in period tracking and reproductive health apps, partnered with ?URA, a smart ring technology company. This collaboration integrated Clue's menstrual health tracking features with ?URA's biometric sensing capabilities, with the goal of improving personal health management and advancing research in female health.

- In February 2024, a team of researchers from the University of Washington developed an innovative wearable device known as the Thermal Earring, capable of continuously tracking a user's earlobe temperature. This smart earring, designed to serve as both a stylish accessory and a health monitoring tool, demonstrated encouraging outcomes in a study involving six participants, particularly in the realm of reproductive health monitoring.

Competitive Landscape

The major players operating in the femtech market forecast include Clue, Glow, Natural Cycles USA Corp, Ava, Lola, Elvie, and Bloomlife.

Other players in femtech market includes NUVO Inc., HeraMED, Flo Health, Inc., iSono Health, Sera Prognostics, Athena Feminine Technologies, Nurokor Limited, and Canopie.

Recent Key Strategies and Developments

- On November 21, 2023, Movano Health began accepting orders for its recently unveiled Evie Ring, a cutting-edge smart ring meticulously crafted to cater to women's health needs. Positioned as a unique proposition within the wearable technology sector, the product was marketed with specialized health and fitness monitoring functionalities tailored exclusively for women.

- On November 10, 2023, Owlet, a leading provider of smart infant monitoring technology, achieved De Novo clearance from the U.S. Food and Drug Administration for its Dream Sock product. This milestone represented a notable advancement in infant care technology, with Dream Sock becoming the sole over-the-counter, medical-grade pulse oximeter tailored for infants.

Industry Trends

- On March 13, 2024, the smart ring manufacturer ?URA unveiled Pregnancy Insights, a novel feature crafted to offer expectant mothers extensive data-driven assistance during their pregnancy experience.

- On February 21, 2024, Samphire Neuroscience, a medtech startup, successfully secured a pre-seed funding round of $2.3 million for its innovative neurotechnology wearable, Nettle. Engineered to alleviate premenstrual syndrome (PMS) and menstrual pain, Nettle marked a noteworthy advancement in home-based neurostimulation therapy. Given that over 90% of women experience menstrual pain and PMS at some stage, the need for such solutions was evident.

- On January 9, 2024, Garmin unveiled its latest addition to the wearable technology lineup with the launch of the Lily 2 series. Tailored to address women's health requirements, these smartwatches boasted a sleek and customizable design. The Lily 2 and Lily 2 Classic variants sported metal watch cases and distinctive patterned lenses that revealed touchscreen displays.

Key Sources Referred

- TechTarget

- Empeek

- GoingVC

- The Institute for Gender and the Economy

- The State of FemTech _ Untitled Kingdom

- FemTech Analytics

- Theseus

- Gendereconomy.org

- WHO

- Asia-Pacific Economic Cooperation

- MaddyTalent

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the femtech market analysis from 2024 to 2033 to identify the prevailing femtech market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the femtech market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global femtech market trends, key players, market segments, application areas, and market growth strategies.

Femtech Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 26.1 Billion |

| Growth Rate | CAGR of 15.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 310 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ava, Elvie, Lola, Natural Cycles USA Corp, Flo Health, Inc., HeraMED, iSono Health, Clue, Glow Inc., Bloomlife |

Upcoming trends in the global Femtech market include increased investment in digital health solutions, personalized women's health products, expanded telehealth services, and a focus on reproductive health, menstrual care, and menopause management.

The leading application of the Femtech market is reproductive health, including fertility solutions, period tracking, and pregnancy care.

Asia-Pacific region is the largest regional market for Femtech.

The femtech market was valued at $6.9 billion in 2023 and is estimated to reach $26.1 Billion by 2033, exhibiting a CAGR of 15.2% from 2024 to 2033.

The major players operating in the femtech market include Clue, Glow, Natural Cycles USA Corp, Ava, Lola, Elvie, and Bloomlife.

Loading Table Of Content...